Kevin Drum on Fed policy during 2008

Here’s Kevin Drum:

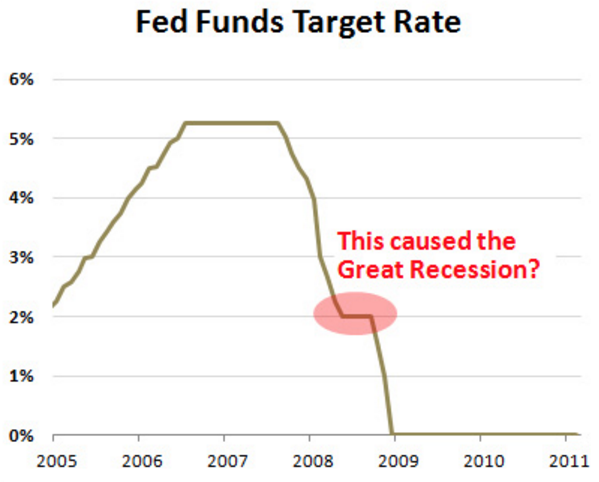

I think you can argue that the Fed should have responded sooner and more forcefully to the events of 2008, but the problem with Cruz’s theory is that it just doesn’t make sense. Take a look at the chart on the right, which shows the Fed Funds target rate during the period in question. In April 2008, the Fed lowered its target rate to 2 percent. Then it waited until October to lower it again.

So the idea here is that if the Fed had acted, say, three months earlier, that would have saved the world. This ascribes super powers to Fed open market policy that I don’t think even Scott Sumner would buy. Monetary policy should certainly have been looser in 2008, but holding US rates steady for a few months too long just isn’t enough to turn an ordinary recession into the biggest global financial meltdown in nearly a century.

Actually, according to New Keynesian (NK) economic theory (not my theory) it certainly could be enough. According to NK theory, when interest rates are positive the central bank controls the path of NGDP. Notice that interest rates were positive throughout 2008 (until mid-December.)

Also, according to NK theory, you can’t look at the path of the fed funds target to figure out the path of monetary policy. Ben Bernanke says you need to look at NGDP growth and inflation.

According to NK theory what really matters is the gap between the policy rate and the Wicksellian equilibrium rate. According to NK theory you’d expect the Wicksellian equilibrium rate to fall sharply in a housing crash/recession. And it did. According to NK theory that means Fed policy tightened sharply in 2008. According to Vasco Curdia (a distinguished NK economist who has published papers with Michael Woodford) the policy rate rose far above the Wicksellian equilibrium rate in 2008.

In other words, according to NK theory Kevin Drum is wrong; policy got a lot tighter. Now we can debate what the Fed might have accomplished with various counterfactual policies, but there is no doubt that the actual policy became extremely tight in the second half of 2008. Recall that in mid-year the Fed did not expect a severe recession, they thought the economy would grow between 2008 and 2009. So something unexpected went wrong in the second half of 2008, and we know from high frequency output data that the sharp deterioration of the crisis preceded the intensification of the financial crisis in October. Not for the first time, a crash in NGDP expectations led to a crash in asset prices, which led to the failure of highly leveraged banks.

Drum presents this graph:

and then wrongly assumes it tells us something useful, that it helps us to understand how policy played out in 2008. It does not. Yes, the rate cuts of April and October made policy less contractionary on those days than if rates had not been cut, but it doesn’t tell us anything about the overall stance of policy, and how that stance evolved over the course of 2008. As Frederic Mishkin says in his best-selling money textbook (and Ted Cruz agrees) for that you need to look at a wide range of asset prices.

Both the NK and MM models tell us that money got much tighter in the second half of 2008. Ironically, Ted Cruz seems more aware that fact than many of his critics.

PS. Notice that the Drum quote starts off, “I think you can argue. . .” Drum’s being too polite here. It’s like saying, “I think you can argue that the captain of the Titanic should have reduced the speed of the ship in the iceberg corridor.” Yeah, I’d say so.

PPS. On the other hand I wish more bloggers (including myself) were more polite, so no disrespect to Drum intended.

PPPS. Over at Econlog I link to a great Tim Fernholz article (on Ted Cruz) in Quartz.

Tags:

6. December 2015 at 11:57

Fun fact: I originally sold all the coal recovered from Titanic. He actually SPED UP bc the ship had a terrible coal fire and he didn’t want Titanic to land at noon when the press could get photos.

6. December 2015 at 12:21

The way I see it, the little plateau in interest rates wasn’t a problem in itself. It’s more about the fact that it signaled to the markets that the Fed didn’t have the willingness to sufficiently support the economy, that it would rather put people into unemployment and poverty than drop interest rates too far outside what it considered “normal”. This little pause and the fact that it took near apocalyptic market events to push the rates to zero, signaled to the markets that the Fed was going to stay too timid for a long time. This destroyed the investment, credit and job markets.

6. December 2015 at 12:48

Scott,

“Actually, according to New Keynesian (NK) economic theory (not my theory) it certainly could be enough. According to NK theory, when interest rates are positive the central bank controls the path of NGDP.”

No, in NK theory, the central bank can raise current NGDP relative to future NGDP to the extent the that zero lower bound does not bind. If the Wicksellian natural rate was negative at this time, as it was, the Fed could not have prevented _some_ contraction in output.

According to NK theory, could the recession have been less bad if rates were cut earlier? Probably, but this does not mean that tight money was the cause of the Great Recession.

“Both the NK and MM models tell us that money got much tighter in the second half of 2008.”

Only if you define the stance of monetary policy as the difference between the (unobservable) Wicksellian natural rate and the actual interest rate. Personally, the whole language of ‘tight’ and ‘loose’ monetary policy is useless because not only is there no set definition, all the definitions people give rely on some unobservable quantity. (e.g., the difference between the actual interest rate and the Wicksellian equilibrium rate or the difference between actual monetary base growth and the amount required to keep NGDP on target, which probably happens to be somewhere between ‘indeterminate’ and ‘infinity’).

“Also, according to NK theory, you can’t look at the path of the fed funds target to figure out the path of monetary policy.”

Again, ‘path of monetary policy’ is extremely vague and means nothing in particular to anyone (except you since you wrote it, I suppose). I guess technically, NK theory suggests that the interest rate is equivalent to what I would interpret the meaning of ‘path of monetary policy’ to be. A path of low interest rates (provided they eventually return to their normal level) implies a boom of NGDP over what it otherwise would be. In this way, the expected path of interest rates is more important than the current one in NK. Central banks can always use forward guidance, it’s just that none of them have been willing to allow inflation and output to overshoot its target for an extended period of time. Maybe central bankers have discount factors that are greater than one.

“a crash in NGDP expectations”

What does this have to do with anything? Somehow, people expecting NGDP to be lower in the future inherently means a recession? Japan’s NGDP seems to thoroughly contradict this hypothesis.

6. December 2015 at 12:49

In the CNBC debate, Cruz also argued that there was too much easy credit in the years before 2008.

The genesis of the debate was WSJ asking Cruz if he would let banks failure and depositors like grandma lose all their money in another banking crisis. I think WSJ was trying to get a zinger in for Cruz being too conservative, and not WS friendly enough.

Cruz’s answer:

– I wouldn’t let it get to that point

– Fannie and Freddie, government created too much easy credit

– grandma wouldn’t actually lose everything bc of the FDIC

Kasich tried to inject:

– Claimed his [Kasich’s] executive experience would enable needed executive decisions instead of ideological one’s [like Cruz].

– Kasich would decide “who could afford it” when deciding who would be allowed to fail (which elicited loud boos)

I believe Cruz also mentioned monetary policy, but this is all from memory. If I find a link will post it

6. December 2015 at 13:34

Scott:

In your view, what would have happened had the Fed cut interest rates to zero in Spring 2008?

6. December 2015 at 13:52

Sigh. My memory isn’t very good.

Cruz talked way too much about gold to make me comfortable. (Of course Romney defended gold too, a position you predicted he would abandon once elected) It looks like Fiorina is the one who blamed Fannie Mae and Freddie Mac.

http://thehill.com/policy/finance/259783-cruz-kasich-spar-on-bank-bailouts

6:35-8:45 Cruz is answering the bailout question

8:45-11:00 Sparring with Kasich over bailouts

4:35-6:35 Cruz talking about Washington cronyism.

6. December 2015 at 14:09

“Now we can debate what the Fed might have accomplished with various counterfactual policies, but there is no doubt that the actual policy became extremely tight in the second half of 2008.”

That is a contradictory statement. If the counterfactual is the free market, then there is little doubt that money was extremely loose, which is the primary reason for the prolonged economic slump. Needed corrections are not corrected when there is again a higher than market reinflation brought about by central bank OMOs. The very fact the Fed had to print so much money to make overall prices rise the way they did, is proof of this.

6. December 2015 at 14:15

Major.Freedom:

Can you explain how you compute the “free market” counterfactual?

6. December 2015 at 15:25

Jonathan:

The same way we do gold versus fiat. Logic and deduction constrained to the categories of action. It is what you presume as true in empiricism.

That the Fed exists at all is due to the fact that the state cannot acquire as much money via taxation and borrowing alone. To have access to an unlimited supply of money, paid for in real terms by others, cannot be and in a free market.

The Fed was not created so that the bankers and the state could spend and have control over less money than they otherwise would in a free market. It was created because of the constraints a free market imposed on their desire for exploitation of and power over others.

Entrepreneurs and individuals who respect each other’s property rights would not agree to earn paper that could be easily replicated and devalued. Money is meant as a medium of exchange, and part of that requires money to maintain its exchange value.

As a very rough estimate, we can ask what money would there be if today there was a free market in money? One estimate could be a digital currency based on precious metals, or one, or the other.

The trillions upon trillions of dollars in short term loans and OMOs by the Fed that took place since 1971, and largely accelerated during 2008-2009 to bail out the politically connected banks and military related firms and contractors, would almost certainly have been impossible to do to that extent in a free market.

Counterfactualism is less popular in economics as compared to temporal positivism, not because it is a lower quality or degraded form of research, but because it is more difficult to justify investments into economics research. The tens of thousands of essentially useless pages of output from the thousands of mediocre economists and their research assistants would be impossible if it weren’t for the wasted hours collecting data and running regressions, where certain “constants” are identified, only to again be supplanted by newer “constants.”

There has never been one constant akin to Planck’s constant, or Hubble’s constant, or the myriad of other constants in the realm of physics and chemistry, that has been discovered by any economist in the almost 70 years of “research” all over the world since the 1950s, which was when the method really took off (thanks to Milton Friedman). Not one. Zero. And yet economists keep mimicking the physical scientific method which is designed to find those constants. Why do they do that? Because if they didn’t, economics would be realized as a discipline akin to logic and mathematics, and the majority of economists would lose their jobs, their research grants rescinded, and the state would have to admit that the deductions in economics invariably, and not just probably, or only during certain circumstances, lead to a free market as the optimal process by which the greatest ends for the greatest number of people can be achieved.

6. December 2015 at 15:29

Prof. Sumner,

I’m just curious: is anyone capable of writing a more-informed review of your new book than David Glasner?

6. December 2015 at 15:51

Kevin Drum likes Fiscal Policy:

https://thefaintofheart.wordpress.com/2015/08/19/why-the-recovery-has-been-so-weak-an-extension/

6. December 2015 at 16:32

If it is true that the Fed was too tight in 2008, setting off glocal recession…then I think the Fed should err on the side of growth…run the economy a little too hot…print more money…

6. December 2015 at 18:44

Morgan, Interesting.

Benoit, I agree.

John, You said:

“No, in NK theory, the central bank can raise current NGDP relative to future NGDP to the extent the that zero lower bound does not bind. If the Wicksellian natural rate was negative at this time, as it was, the Fed could not have prevented _some_ contraction in output.”

That’s a different issue, which I addressed later in my post. My point is that according to NK theory, expected NGDP growth should be on target whenever rates are positive. If it’s not, then rates should be set somewhere else. But if you read Bernanke’s memoir it’s clear expected NGDP growth was far below target. Unfortunately, he never explains this discrepancy. At one point he even says he approved Bush’s fiscal stimulus in early 2008, which makes absolutely no sense given what he’s just been telling us about Fed monetary policy decisions.

You said:

“Only if you define the stance of monetary policy as the difference between the (unobservable) Wicksellian natural rate and the actual interest rate. Personally, the whole language of ‘tight’ and ‘loose’ monetary policy is useless because not only is there no set definition, all the definitions people give rely on some unobservable quantity. (e.g., the difference between the actual interest rate and the Wicksellian equilibrium rate or the difference between actual monetary base growth and the amount required to keep NGDP on target, which probably happens to be somewhere between ‘indeterminate’ and ‘infinity’).”

Many definitions are unclear, but not my proposed definition (NGDP futures prices relative to target.) I’d be happy if all economists agreed with you, and stopped talking about easy and tight money. If they did agree with you, then they’d stop saying that the MM explanation of the Great Recession cannot be right because money was “obviously” expansionary in 2008.

Yes, the Wicksellian rate may have turned negative in early 2008. But here’s where I disagree with the NK model. I believe an expansionary monetary policy can raise the Wicksellian equilibrium rate, and indeed could have raised it well above zero in 2008.

You said:

“I guess technically, NK theory suggests that the interest rate is equivalent to what I would interpret the meaning of ‘path of monetary policy’ to be. A path of low interest rates (provided they eventually return to their normal level) implies a boom of NGDP over what it otherwise would be.”

That’s not true of the NKs I’ve read. They seem to prefer the gap between the policy rate and the Wicksellian equilibrium rate. Isn’t that Woodford’s approach? And Svensson’s? And Curdia’s? Bernanke likes NGDP growth and inflation, and Mishkin likes other asset prices.

You said:

“What does this have to do with anything? Somehow, people expecting NGDP to be lower in the future inherently means a recession? Japan’s NGDP seems to thoroughly contradict this hypothesis.”

In a blog one doesn’t always have time to spell out everything in detail. I was assuming that people understood that I meant a crash in NGDP growth relative to trend, and/or relative to expectations. That causes a recession in either the US or Japan. Prior to 2008, Japan’s trend NGDP growth was 0%, while the US was 5%

Thanks Steve.

Jonathan, Hard to say, partly because it also matters what they did next (in mid and late-2008). It might have prevented a recession, or it might not have. In my view 2009 would have been a mediocre year at best regardless of what was done, but I think we could have prevented a severe recession.

You can probably tell I’m not a fan of using interest rates as a policy instrument.

Travis, I can’t think of anyone better off the top of my head. He’d be excellent. I suppose a number of people would be very well qualified. Ben Bernanke is another name that comes to mind (although I’d guess he would hate the book, as I added some Fed bashing regarding 2008-09 at the very last minute, after the book had been written.)

6. December 2015 at 18:48

The 2000s economy was clearly dysfunctional as the labor force participation rate never returned to the highs seen under Clinton even though the Boomers didn’t reach 65 until 2011. The only reason QE “worked” was because it coincided with the development of fracking. So why would have anybody wanted to “stimulate” a dysfunctional economy even if the technique worked? I guess I should be posting on a physics forum because one has to understand how energy can neither be created nor destroyed.

6. December 2015 at 18:59

@Everybody – notice how John Handley schools Sumner, then Sumner tries to get out of it. I too had a problem with Sumner’s saying ‘interest rates were negative’ in 2008 (they were not) until I read Handley’s reply and released Sumner is referring to the metaphysical, un-observable, ex post and hence unscientific ‘Wicksellian’ rate. And if you read the Fed minutes in the first Fed meeting after the Fall 2008 crash, you’ll see the Fed itself thought it was helping by cutting rates, and promised to cut again the next time they met in December, if needed (and they did). You’ll also note the Fed/government did not resort to either interest rates nor printing more high-powered money, but instead resorted to simply giving the banks money via bailouts and later, IOR (interest on reserves, a form of bank welfare). The analogy is that of a fighter in combat who has fancy ‘jujitsu’ combat skills (monetarism) yet when confronted with an enemy in actual close combat, resorts to their firearm (fiscal policy), which is tried and true. Money is neutral. Drum is right: monetarism doesn’t work (3.2%-13.2% out of 100%, that’s lame).

6. December 2015 at 19:08

@Gene Frenkle – nice observation. Also the inflation caused by the oil supply imbalance (you may know that a slight imbalance, such as even people ‘topping off’ their gas tanks as in the 1970s, can cause price spikes in the oil market) also was a reason the Fed (as they said so in their 2008 minutes, without mentioning oil by name) were actually afraid of inflation, and hence were not as aggressive in lowering rates. Further, your observation about labor force participation rates is very sound. In fact, as Tyler Cowen observed, the effect of the Great Recession was to get rid of Zero Marginal Productivity workers (i.e., workers who should never be working in the first place, think of grandma with a stroke or some lazy slacker). That this is a ‘bad thing’ boggles the mind. Yet Sumner thinks firing ZMP workers is something we should try and fix, even if GDP levels have now exceeded 2007 levels, and growth rates are back up to trend. Something about a metaphysical ‘potential GDP’, lol.

6. December 2015 at 20:08

Gene, labor force participation starts to fall off way before age 65. Labor markets, adjusted for age demographics, were very strong in 2005-2007.

6. December 2015 at 20:15

Yes; I thought of linking to the Quartz article in today’s assorted links at the Marginal Counterrevolution (link in my name) until I realized Sumner had already posted on it.

I must consider the Marginal Counterrevolution to be a great success. Due to my being in the same timezone as Cowen I largely have the same sleep and work schedule as him, permitting me to rapidly compose posts when he does.

Ray, is my background better now? Any links at the Counterrevolution you find interesting? Doing what Tyler does is really easy. And, no, I don’t plan to get any money from the endeavor, just a recognition of Tyler’s silliness and banality.

6. December 2015 at 20:41

Kevin, that might be the case going forward with the ACA but health insurance costs in the 2000s were out of control for people over 55 and no way were more people in that age group covered by union benefits and military benefits than in the 1990s. I was around people over 55 at that time and many had been downsized and they all wanted a job with BENEFITS and every one of them in the individual health insurance market was seeing their retirement savings being frittered away by premiums.

6. December 2015 at 21:44

@ E. Harding:

“Doing what Tyler does is really easy.” Maybe; but he does *so much* of it: *that’s* not easy (for an individual person, as opposed to a sizeable group)!

6. December 2015 at 22:36

Why labor and labor force participation rates are important is a mystery to me. To take an extreme example, echoing Keynes, in a Star Trek society robots do all the work and humans only have to work four days a week for a few hours, yet their standard of living is high. What is important is TFP (Total Factor Productivity), which comes from having a smarter workforce. Point of fact: Greeks work longer hours than Germans. Who is more advanced?

@E. Harding – get rid of the falling snowflakes, which change direction as your mouse moves. This is like using a spinning logo or using Comic Sans font. It’s not serious (even if your blog is not meant to be serious). You notice the gravity I assume when I post here. It’s not an accident (MF also is good with gravitas). As a member of Toastmasters International, I know how to command the attention of an audience. It’s not by being lightweight (not to say you shouldn’t use humor).

7. December 2015 at 01:29

“we know from high frequency output data that the sharp deterioration of the crisis preceded the intensification of the financial crisis in October”

Can you expand on this?

7. December 2015 at 04:03

Wow. That comment thread at Kevin Drum’s blogsite is scarily nasty. it makes RL, MF and EH seem helpful and polite.

7. December 2015 at 04:55

Take a look at the second graph on http://www.philipji.com/item/2015-09-06/a-fed-rate-hike-wont-have-adverse-results-for-now

It shows annual growth rate of a measure of money and suggests that the Fed should have started loosening somewhere towards the end of 2006 or beginning of 2007.

We are getting to that position again right now.

7. December 2015 at 06:01

@James Alexander – I found Kevin Drum’s commentators refreshingly honest. They were mostly left-wing, but they did not self-censor their posts, further, there was a variety of views not found here, where if you don’t toe the party line you risk the wrath of Khan.

7. December 2015 at 07:57

Alternative thread title : “Econ(?) blogger eyeballs some graph and concludes a bunch of people are wrong” -> meh

7. December 2015 at 07:58

“So the idea here is that if the Fed had acted, say, three months earlier, that would have saved the world. This ascribes super powers to Fed open market policy that I don’t think even Scott Sumner would buy”

I am interested in your response to this statement. I assume you believe that the Fed both caused the huge drop in NGDP in 2008 through too tight money, and then caused the recovery to take way too long as well, by a continuation of tight money in the years following 2008.

In other words the mistake of 2008 could have been relatively painlessly recovered from if an NGDP target had been adopted soon after.

Is that your view or do you think the mistake in 2008 condemmed us to the Great Recession, no matter what followed ?

7. December 2015 at 09:19

RL

Logically, why do you bother? Who pays you? The CIA, the KGB? The Goldbugs? Paul Krugman? Klingons? Of course not the last lot, they are logical. It’s a real mystery.

7. December 2015 at 11:29

Monetary policy acts with long and variable lags. I think if you’re looking to ascribe blame to the Fed for the 2008 crisis, you need to look much earlier – specifically at the high rates that prevailed in ’06-07. I think Greenspan intentionally set out to pierce the housing bubble…and succeeded beyond his wildest dreams.

7. December 2015 at 12:04

o. nate, some bubbles should be popped. Ty Warner was correct to pop the Beanie Baby bubble. Many people view the dot com boom as a bubble and Greenspan even used the term “irrational exuberance” to describe it, but some of those stocks have performed amazingly since 2000 and thus the “exuberance” was anything but irrational. A $10k investment in Amazon in 1997 would be worth over $1 million (not as good as investing in Apple in the early 2000s).

The Housing Bubble was irrational and I knew people that had no business investing in houses buying houses and their financial situation was undermined and their home prevented them from being mobile which is essential in the American economy.

7. December 2015 at 12:10

Which was more important: popping the bubble or fulfilling the Fed’s actual mandate of price stability and full employment? Even if you add the mandate of financial stability, it’s a valid question whether stability would have been better served by trying to engineer a soft landing. The real problem was that no one at the Fed seemed to understand just how fragile the financial system had become.

7. December 2015 at 12:30

Krugman got a new piece about Cruz and Yellen:

“Ted Cruz somewhat surprised Janet Yellen by accusing the Fed of causing the Great Recession by tightening monetary policy in 2008;”

http://krugman.blogs.nytimes.com/2015/12/07/the-passive-aggressive-monetary-two-step/

So what really *caused* the Great Depression (and Recession) according to Krugman? I find his argument against Friedman very weak.

Krugman acts like the monetarist answer (Friedman/Sumner) regarding the *cause* of the Great Depression (and Recession) appears way too late in the chain of causation but if you follow Krugman carefully you’ll find out that his *cause* (the Keynesian cause) appears at least as late (or even later) in the chain of causation.

7. December 2015 at 12:37

I don’t ascribe that kind of power to the Fed and remember the Fed needed Congessional action and taxpayer funds to save the economy. I am just saying if Greenspan and Bernanke believed the economy was dysfunctional why would they engage in actions that prolonged the dysfunction. Volcker had to deal with an energy crisis and he jacked up rates…and the oil profits searching for yield still wreaked havoc in Texas!?!

7. December 2015 at 14:57

Bankrupt U Bernanke stole more money, from more people, than anyone who ever lived (and that was before 2008).

Economists are ignorant. CBs pay for what they already own. This was the direct cause of stagflation. The payment of interest on excess reserve balances is even worse. The 1966 S&L credit crunch is the paradigm. If you don’t understand that you’re plain stupid.

7. December 2015 at 16:52

Gene, You said:

“The 2000s economy was clearly dysfunctional as the labor force participation rate never returned to the highs seen under Clinton even though the Boomers didn’t reach 65 until 2011.”

Demographics are way more complicated than this. Labor force participation from the 55-64 group is well below the 45-54 group. So boomers were affecting things well before 2011.

You said:

“The only reason QE “worked” was because it coincided with the development of fracking. So why would have anybody wanted to “stimulate” a dysfunctional economy even if the technique worked? I guess I should be posting on a physics forum because one has to understand how energy can neither be created nor destroyed.”

Yes, I prefer crackpots that post over on physics fora.

Ray, And why don’t you join him at the physics forum. I’m sure physicists would be fascinated by your theories of QM.

E. Harding, You said:

“just a recognition of Tyler’s silliness and banality.”

Careful, or you’ll end up as ridiculed as Ray.

SDOOO, Google the monthly RGDP and NGDP estimates of Macroeconomics Advisers, and you’ll see what I mean. The big crash was June to December 2008.

MFFA, Drum’s a good guy, and his views are very widespread.

Market, No, I think a rapid recovery was possible. But it’s definitely more difficult to do monetary policy when you’ve lost credibility. Better to not lose it in the first place.

O. Nate, I don’t believe in the long and variable lags theory.

Gene, You said:

“remember the Fed needed Congessional action and taxpayer funds to save the economy.”

Really? I guess I forgot that.

7. December 2015 at 17:08

Well it is pretty obvious that fracking for oil has been fueled by debt and that this happened during Bernanke’s Credit Easing, I am just saying Bernanke has something to hang his hat on.

Here is an article that has some numbers…but it is obvious.

“What is more disturbing is that a large portion of that junk debt (and a lot more that isn’t reported via the bank lending channel) is being issued to fund oil and gas exploration companies for the fracking of oil and natural gas. Shale debt has at least doubled over the last four years.”

http://davidstockmanscontracorner.com/qe-at-work-pouring-cheap-debt-into-the-shale-ponzi/

7. December 2015 at 17:23

ssumner, you are also ignoring the fact Boomers would have been healthier at 55 than previous generations along with being less likely to have health insurance through a union or military that would allow them to get out of the workforce.

7. December 2015 at 18:16

Special reader request: Sumner to blog on why he thinks labor force participation rate should be higher (if he so thinks). After all, it was lower in the 1970s. Should everybody be working in today’s robotic age? Echos of Keynes advice too.

8. December 2015 at 09:37

http://www.chicagobooth.edu/capideas/magazine/winter-2015/why-the-euro-is-a-good-idea-after-all by John H. Cochrane, read between the lines rips a huge hole in Sumnerism. Sample quote: “Microeconomics, macroeconomics, and politics interconnect. The case for separate currencies is to protect the economy from sticky wages, sticky prices, and sticky people. But none of these stickinesses are written in stone. A plausible answer to my question about the pre–New Deal US is that prices and wages were not sticky (whatever that means) before the era of regulation.”

In short, Sumner is essentially an “old school Keynesian” masquerading as a market monetarist. See Cochrane’s piece for details.

8. December 2015 at 09:37

Gene, This is a macro blog, I don’t care about fracking.

The fact that they are healthier than previous generations has no bearing on whether they are healthier than 45-54 years olds today.

Don’t think you can talk intelligently about demographics without having studied it. You are just throwing out useless facts from media stories. I’d suggest reading some of Kevin Erdmann’s posts on demographics if you want to be taken seriously. Right now you are in way over your head.

8. December 2015 at 09:39

Sumner:” I’d suggest reading some of Kevin Erdmann’s posts on demographics if you want to be taken seriously. ” – you mean the same Kevin Erdmann who says there was no housing bubble, that Kevin Erdmann? You cannot be serious.

8. December 2015 at 11:23

It is a fact Americans overwhelmingly get health insurance through their employers, how is that a “useless fact”? Just Google “job lock ACA” if you want to know how this dynamic plays out going forward.

I would argue the only way to understand the macro situation since 2001 is to know about the global oil and gas market and to “care about fracking”. I would say without a doubt that a macroeconomist must have knowledge of the oil market to understand the economy of the 1970s and 1980s. I would recommend Yergin’s “The Prize” but I honestly don’t think energy will be a big issue for at least the next 20 years.

8. December 2015 at 12:53

“I would argue the only way to understand the macro situation since 2001 is to know about the global oil and gas market and to “care about fracking”.”

Especially 2013-14?

Warren Mosler writes:

“First, I had been looking for 4% growth for 2013 and scaled back to 2% due to the tax increases and sequesters, and I thought it would continue to weaken until deficit spending increased.

Turns out there was an increase in private sector deficit spending/credit expansion on oil and gas exploration and production that offset the 2013 fiscal adjustments and further expanded in 2014 to further support GDP growth.

The increase in energy related deficit spending is now over due to the Saudi price cut, and unless deficit spending elsewhere accelerates seems to me GDP growth will quickly evaporate.”

http://econlog.econlib.org/archives/2015/01/the_keynesians.html

10. December 2015 at 10:10

I predicted a while back Ted Cruz will eventually shift his public statements to something like market monetarism if he wins the GOP nomination. He’s a very smart guy who is very good parsing at his way through these ideological minefields on the way to the right policy.

Good to see an MM critique of 2008 by Cruz, the Mark Steyn statement from his hearing the other day is also a must-read.

10. December 2015 at 17:34

Talldave, I don’t doubt that he’s smart, but he has almost no chance of becoming President. Even his fellow GOP senators don’t like him.

Remember Goldwater?

11. December 2015 at 15:16

He is serious, Ray. Scott does not believe in bubbles he says. However, he believes the house price crash was real and that there were reasons for it other than people not being able to pay their toxic loans. They argue that while many countries had “bubbles”, few had busts. That could be very true.

See, Scott, I can think outside the box. But, I think hot money went away where it wanted to go away. That caused the crash. Bernanke said hot money fueled the housing bubble. And surely it went somewhere. Why did they pick on just a few nations like Spain and the US?