Just do it.

There are a wide variety of ways of thinking about monetary policy. In this post I’ll use some graphs to illustrate various policy options, with the goal of shedding light on some of the major debates of the past decade.

Let’s start with a shift from a zero percent target path for inflation to a 2% path. Let’s also assume that the Quantity Theory (QT) holds in the long run, in the sense that prices move in proportion to changes in the money supply, other things equal. But in the short run, money demand is negatively correlated with nominal interest rates. (Don’t worry if you don’t like the QT, this example will have anti-QT implications.)

Let’s assume that it is Japan that switches from a zero percent inflation path to a 2% inflation path. Also assume that the new path pushes nominal interest rates up from 0% to 2%. (I.e. assume a zero real rate of interest, for simplicity.) And finally, let’s assume that that demand for base money in Japan is 100% of GDP at zero interest rates and 10% of GDP at 2% nominal interest rates. (Not implausible assumptions, BTW.)

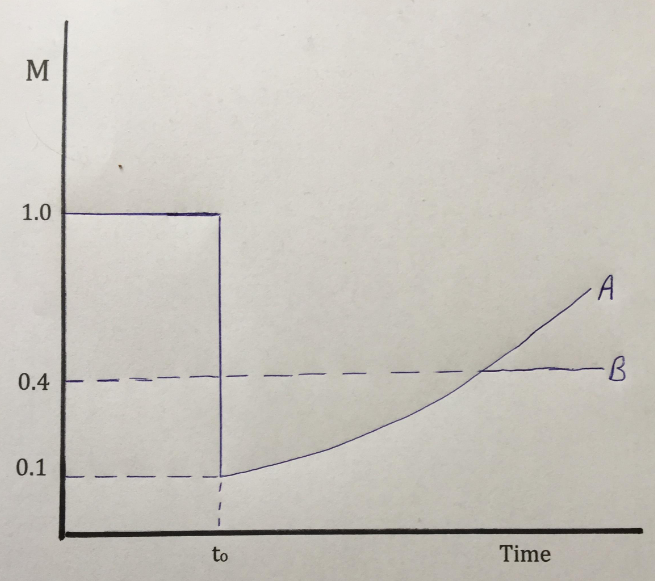

In the following graph, path A shows the path of the money supply that would push inflation from 0% to 2%, without any discontinuous change in the price level at the point where the policy change occurs.

Even though the money supply plunges by 90% at time=0, the price level does not show any immediate change. The Japanese suddenly prefer to hold much smaller cash balances, because the opportunity cost of holding base money has risen from zero to 2%/year.

Once money demand has fallen by 90%, it levels off. From that point forward, the BOJ must raise the money supply at 2%/year in order to generate 2% annual inflation. It takes 72 years for the price level to quadruple, but even then the money supply remains 60% below the level just before the change in policy.

So far I’m assuming that everything works smoothly. The policy change is credible, and is expected to persist forever. The Japanese attitude toward money changes immediately, to become more like the Australian attitude. Japanese salarymen suddenly start refusing overtime, and instead go home and put on shorts, throw a few shrimp on the backyard barbie, and make rude jokes about Sheilas.

That’s already a pretty heavy lift, but it gets much worse. Let’s suppose that the money supply follows path A for 72 years, and then is expected to level off (as in path B). What then?

In that case, everything changes even today, at time=0. The hypothesis that the BOJ could reduce the money supply by 90% and at the same time start on a path of 2% inflation is entirely dependent on the public believing that this new policy will last forever. If it lasts for “only” 72 years, the effect will be radically different.

Under path A, the price level is four times higher after 72 years. Under path B it is 60% lower than at time=0. That’s because path B leads to zero money growth and zero inflation in the long run. That means that 72 years from today, real money demand will be just as high as before the t=0 policy shift, and since the money supply is assumed to be 60% lower, the price level will also be 60% lower. The path of prices over that 72 year period will also be vastly different, but I’m not smart enough to show exactly how different.

The bottom line is that it’s dangerous to engage in money supply targeting. The path for the money supply that might achieve success with 100% credibility, could lead to total failure if it’s 100% credible for only 72 years, but not thereafter. (I believe Nick Rowe made this point earlier.)

Last year, the yen briefly appreciated on news that Prime Minister Abe might have to leave office due to a corruption scandal, and the next PM was not expected to push as hard for monetary stimulus. Now imagine a scenario where even committing to 72 years of monetary expansion is not enough!

Fortunately, Lars Svensson came up with a “foolproof” escape from a liquidity trap, which does not require any unreasonable credibility assumptions:

Why would this work? The argument proceeds in several steps, to be explained in detail below: (i) It is technically feasible for the central bank to devalue the currency and peg the exchange rate at a level corresponding to an initial real depreciation of the domestic currency relative to the steady state. (ii) If the central bank demonstrates that it both can and wants to hold the peg, the peg will be credible. That is, the private sector will expect the peg to hold in the future. (iii) When the peg is credible, the central bank has to raise the short nominal interest rate above the zero bound to a level corresponding to uncovered interest rate parity. Thus, the economy is formally out of the liquidity trap. In spite of the rise of the nominal interest rate, the long real rate falls, as we shall see. (iv) Since the initial real exchange rate corresponds to a real depreciation of the domestic currency relative to the steady state, the private sector must expect a real appreciation eventually. (v) Expected real appreciation of the currency implies, by real interest parity (2.15) and (2.16), that the long real interest rate is lower. (vi) Furthermore, given the particular crawling peg (3.4), a real appreciation of the domestic currency will arise only if domestic inflation exceeds the inflation target. Therefore, the private sector must expect inflation to eventually rise and even exceed the inflation target.

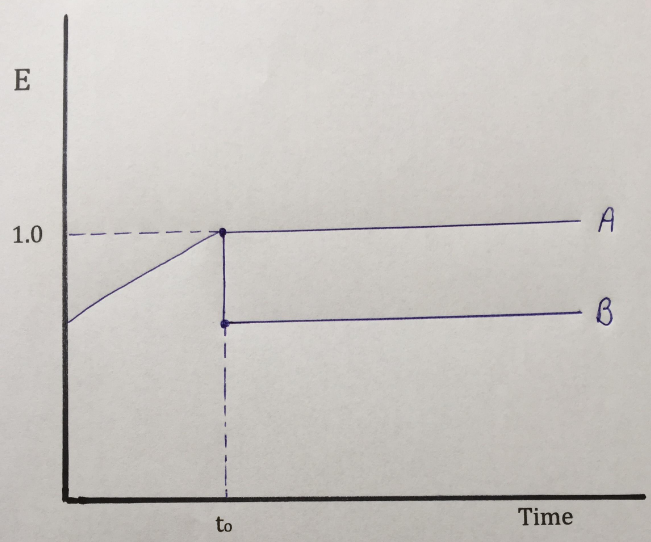

Let’s illustrate his intuition with a time series graph, showing the foreign exchange value of the Japanese yen (priced in US pennies):

Let’s assume the yen had been gradually appreciating before time=0, and then the yen were suddenly pegged to the dollar. During the period of yen appreciation, the Japanese inflation rate would be lower than in the US, on average. If the BOJ pegged the yen to the dollar, then the long run trend rate of inflation in Japan would be similar to the rate in the US. This is illustrated by path A.

Of course PPP does not always hold perfectly, and perhaps Japan needs a bit of “catch-up inflation.” After all, the Japanese economy was somewhat depressed after years of deflation at the time Svensson first developed his proposal in 2000. To make the policy even more “foolproof” you can do a one-time depreciation of the yen, and then peg the exchange rate to the dollar. That gives you a bit more inflation, and insures against a real depreciation in the yen exchange rate from exogenous factors.

It’s actually very likely that under this policy the money supply in Japan would look much like what I showed in the first graph above. But you can’t make the opposite argument. There is no reason to assume that adopting the money supply path shown in the first graph would lead to an exchange rate graph that looks even remotely like what we see in the second graph.

This is why QE by itself is a rather clumsy instrument. What a central bank actually needs to do is commit to do enough QE to hit some sort of price target (such as exchange rates or NGDP futures prices), and if they do so they might not have to do any QE at all (as in the first graph, where they actually reduce the money supply).

Exchange rate targeting has one important advantage over money supply targeting; the money supply is automatically adjusted to reflect the degree to which the public finds the policy target to be credible. If it’s not credible, you inject much more money than if it is credible. You inject enough money to keep exchange rates stable and on target, which is also enough money to accommodate the demand for money under the new policy regime.

Svensson’s proposal is an example of a NeoFisherian monetary policy, a more expansionary monetary policy that is associated with a rise in nominal interest rates, even in the very short run. Therefore it may be useful to use this graphical approach to compare the New Keynesian and NeoFisherian policy options.

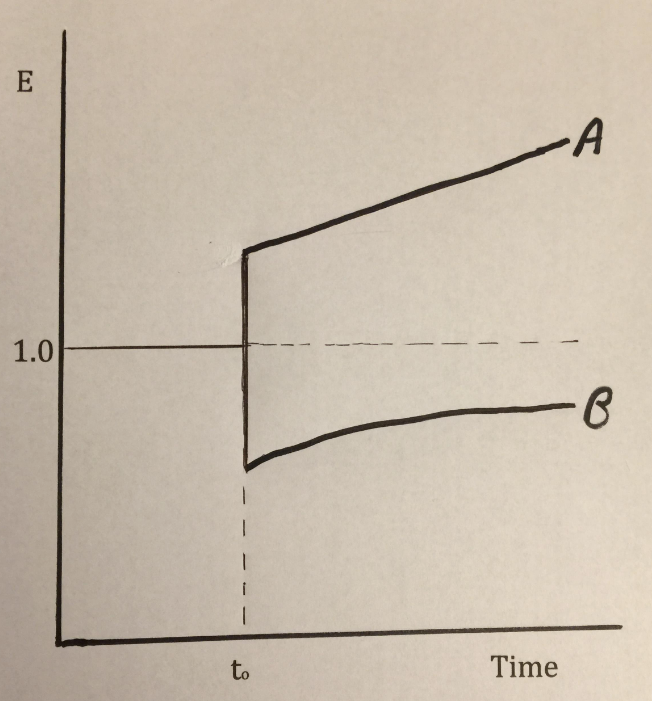

The next graph shows two possible paths for the exchange rate, two very different monetary policies. (Think of a country like Singapore, that uses the exchange rate as its monetary policy instrument.) And yet, as we will see, the change in nominal interest rates may well be identical in the two cases, even though one policy is highly expansionary while the other is highly contractionary.

Path A is a contractionary NeoFisherian monetary policy, sudden currency appreciation with a commitment for even more appreciation in the future. This is effectively what the Swiss National Bank did in January 2015. The franc appreciated and Swiss interest rates fell due to the Fisher effect. (Or the interest parity condition, if you prefer.)

Path B is an expansionary New Keynesian policy, currency depreciation with a commitment to gradually appreciate the currency only part way back to the original level. This is “Dornbusch overshooting”, and is effectively what the US did when it announced QE1 in March 2009. The dollar fell 6 cents against the euro on the day of the announcement.

Importantly, both monetary policies are “low interest rate policies”, even as one is highly expansionary and one is highly contractionary. That’s because both feature expected currency appreciation after the initial shock, and interest parity implies that this depresses domestic interest rates.

Some people are tempted to argue that the direct effect of low rates is always expansionary; while in the NeoFisherian case this effect is offset by currency appreciation. But that’s wrong, there is no direct effect of interest rates. Changes in market interest rates are always the effect of some more fundamental monetary operation, such as open market sales, discount loans, IOR, reserve requirements, forward guidance, etc. It’s hard, but you have to stop thinking about changing market interest rates as a policy, and instead think about market interest rates as the effect of various policies.

I hope these exercises are of more than academic interest. In my view, they help us to better understand that the sort of monetary regimes that are effective have several things in common:

First, they target a price, such as the price of gold, the price of foreign exchange, the price of CPI futures, the price of NGDP futures or some sort of complex mixture of asset prices that are believed to reflect NGDP expectations. (Hopefully not the stock market, which seems to be the current obsession of the Fed.)

Second, the policy does “whatever it takes” to hit the price target. This means that the market determines the needed level of concrete steps, which will depend on the policy’s credibility.

Third, less credible policies will require more concrete steps, and hence more controversial monetary policy actions. Ironically, a clear and strong “whatever it takes” approach will boost policy credibility, and therefore require less aggressive concrete steps than a more timid approach.

Lars Svensson understood these principles back in 2000. Here are the three steps in his foolproof policy (from the 2003 version of the model):

(1) Announce an upward-sloping price-level target path . . . for the domestic price level . . .

(2a) Announce that the currency will be devalued and that the exchange rate will be pegged to a crawling exchange-rate target . . . That is, the central bank makes a commitment to buy and sell unlimited amounts of foreign currency at the [targeted] exchange rate . . .

(3) Then, just do it.

Svensson seems to be a Nike shoe fan, while I prefer Yoda’s version:

Do. Or do not. There is no try.

Tags:

18. February 2019 at 13:10

Excellent post!

18. February 2019 at 14:14

I concur (with Iskander) and have nothing to add.

18. February 2019 at 16:16

It is interesting how often proponents of a successful monetary policy insist that it must have “credibility.”

That is, the public (globally?) must have faith in the central bank or at least believe that central banks resolution.

Thus a major feature of proposed successful monetary policy is firmly planted in macro behavioral finance or behavioral economics.

Should we teach behavioral economics alongside traditional macro economics? I concede, this feels but one step removed from mood rings and astrology, but over and over again we hear the need for the public to believe in a central bank’s credibility. Is that the call of the econo-shaman?

And yes, the current monetary policy setups of central banks with their interest-rate mechanisms, reverse repos, reserve requirements, and interrelations with commercial banks and the endogenous creation of money is enough to make anyone have more faith than reason.

I wonder if we even need a central-bank, but could dispense with the whole apparatus and move instead to money-financed fiscal programs.

18. February 2019 at 16:37

Add on: of course, there are always skeptics within in any public, and cynics who ascribe ulterior motives to any government agency. ( Whether such people are cynics or realists is often hard to determine.)

So when we posit that a central bank must have credibility, I assume that means it must have some level of credibility, since no government agency will ever be credible with the public universally.

Additionally, we will have members of political parties who will ascribe political motives to a central banks action at any time.

That reality raises an interesting question. Does the Federal Reserve have credibility today? Many members in the financial media constantly hammer the Federal Reserve for blowing asset bubbles. Others contend it manufactured the 2008 Great Recession.

Moreover, I would guess that 90% of the public doesn’t really know what is the Federal Reserve.

Is the present situation in the United States that the Federal Reserve does not have much credibility but inflation has been under control for decades?

What is this thing we call credibility? A gossamer of fantasy, the stuff dreams are made of.

18. February 2019 at 18:59

Add on, add on (apols):

Re “Federal Reserve Credibility”

1, Okay, let us posit that 90% of US population does not know what is the Fed. They charge what the market will bear for goods and services. They do not contemplate Fed credibility (a happier bunch, I suspect).

2. Okay, so 10% of the population does know what is the Fed, and has an opinion whether the Fed is too tight or too loose or has credibility. (Yes, this estimate seems high).

3. This 10% strikes me as extremely opinionated, ranging from Fisherians, to Neo-Fisherians, to gold-bugs to MMT’ers to anti-inflationistas to Market Monetarists and so on. How many suits are in a haberdashery? That’s the how many monetary positions you have.

So, is the Fed seeking “credibility” with this 10% of the population?

It makes no sense to seek credibility with the 90% who do not know who is Jerome Powell.

Or, is the Fed seeking a “balance point.” That is, the Fed must be perceived by roughly half of the “financial literati” as too loose (for the next 72 years, or in perpetuity) and roughly half as too tight?

This idea of “public expectations” and :”Fed credibility” seems to be on the edge of…well, macroeconomic voodoo.

18. February 2019 at 22:33

Scott,

I question your dismissal of targeting stock prices for the purpose of conducting monetary policy. While obviously inferior to your NGDP futures guardrails idea, or perhaps targeting an index of liquid asset prices, I think it’s possible that focusing on stocks and trying to level target NGDP is superior to the Fed’s current regime.

The particular idea I have is that the degree of nominal shock can be thought of as raising the discount rate in a discounted earnings formula for, say, S&P 500 index levels. So, a shock like we had at the end of last year would add about 1% to the discount rate, lowering the S&P 500 price level by about 20%. The discount rate is imputed, given pre-shock earnings and price quote.

Fortunately, it turns out the math here is very simple. An effective doubling of the discount rate, such as we had during the Great Recession, leads to a 50% drop in the S&P 500 index(and halving the discount rate would double the index). Or, during the Great Depression, an effective nearly ~800% increase in the discount rate leads to a drop in stock index of over 80%.

Another indicator that might be of use is the VIX. Especially if the VIX relaxes as real interest rates are lowered, it’s a good indicator of expectations of stable policy moving forward. If markets trust the Fed not to engage in stagflation policy, then brief periods of high NGDP growth won’t bring expectations of sudden tightening.

Problems with this approach are not trivial. Ceteris isn’t always paribus with stock prices. Factors other than changes in NGDP expectations can move stocks. A recent example was the tax reform bill Trump signed into law. How does one tease out the macro and micro effects? Comparing earnings growth with what one would expect from economic growth can help, but it means depending on lagged data. This can’t always be a 100% forward-looking approach.

That said, the present regime is not only flawed because it involves inflation targeting, but also because it doesn’t depend enough on forward-looking data. The above approach would be more forward-looking than the present approach, but less so than your guardrails idea.

That said, better still probably to develop an index of liquid asset prices.

18. February 2019 at 22:35

I forgot to mention that focusing on stock earnings is also potentially problematic, due to inconsistencies in the way they’re reported. It’s not a perfect metric.

18. February 2019 at 22:43

Another idea, which would benefit bank customers in general, would be to legislate the requirement of those conducting electronic monetary transactions to transmit their final transaction data to the end counter-party within a single calendar day, if not require reporting to be virtually instantaneous. No more ACH transactions taking 1-3 business days. No more merchants having days or weeks to report transactions.

Then, have all final transactions reported to the Fed at the end of each day. That would allow for much more timely and precise estimates of NGDP. This is similar to the way you foresaw monetary policy being conducted in the future in a recent Econlog post.

And of course, it would mean that bank customers would no longer have to keep check registers to avoid overdrawing their bank accounts. The stated current balance would be accurate.

It’s hard to imagine that the short-run costs of technology upgrades needed would come anywhere close to outweighing the benefits, especially in the context of being able to more precisely level-target NGDP.

19. February 2019 at 01:53

OT but in the ballpark: BoJ ex deputy says “money financed fiscal programs” necessary….

(Headline a bit off, but….)

“BOJ urged to boost fiscal spending to reignite the economy

TUE, FEB 19, 2019 – 5:50 AM

Tokyo

JAPAN must ramp up fiscal spending with debt bank-rolled by the central bank, the Bank of Japan’s former deputy governor Kikuo Iwata said, a controversial proposal that highlights the BOJ’s challenge as it tries to reignite an economy after years of sub-par growth.

Mr Iwata, an architect of the BOJ’s massive bond-buying programme dubbed “quantitative and qualitative easing” (QQE), warned that inflation will miss the central bank’s 2 per cent target without stronger measures to boost consumption.

He said there are few tools left to ease monetary policy further as cutting already ultra-low interest rates could push some financial institutions into bankruptcy.

That means Japan must lean on fiscal policy by ditching this year’s scheduled sales tax hike and committing to boost government spending permanently with money printed by the BOJ, he said.”

—30—

This idea of financial institutions going bankrupt keeps popping up at zero-bound, and negative interest rates.

19. February 2019 at 08:48

Thanks Iskander and Lorenzo.

Michael, I’ve often wondered why we don’t have better real time estimates of NGDP in this era of big data. Unfortunately, I don’t understand big data well enough to have an answer. You’d think it would be possible.

Stocks do have SOME info on NGDP, but the data is pretty noisy.

Ben, You said:

“He said there are few tools left to ease monetary policy further as cutting already ultra-low interest rates could push some financial institutions into bankruptcy.”

LOL. Low rates mean money is easy?

19. February 2019 at 11:46

In theory, a little inflation un-sticks sticky prices. The stuck price (or wage) will not increase as much as the general price level, bring the real price (wage into line).

But, Japan has been under-performing for 30 years. An entire generation has passed. It is time to abandon “sticky prices” as the cause for Japan’s stagnation.

You touch on something else. If the central bank inconsistent, it creates uncertainty, and this uncertainty can cause growth to fall short of potential.

19. February 2019 at 12:23

“After all, the Japanese economy was somewhat depressed after years of deflation at the time Svensson first developed his proposal in 2000.”

Japan’s inflation rate was briefly under 0% in 1995/1996, a bit in 1998 and then in 1999 but each episode was at around -0.5%. Why is using the CPI the wrong measurement for inflaton/deflation?

19. February 2019 at 13:06

FYI, Argentina is undergoing a monetary experiment. After a balance of payments crisis last year, it’s now implementing money supply targeting with IMF support. Any thoughts on this from the market monetarist perspective?

https://www.imf.org/external/np/loi/2018/arg/101718.pdf

19. February 2019 at 13:08

What is happening up until T0? Is that the policy adjustment time, and how long?

19. February 2019 at 14:55

Doug, You said:

“It is time to abandon “sticky prices” as the cause for Japan’s stagnation.”

I agree. I abandoned that long ago. But sticky prices were still an issue in 2000.

Lucas, I haven’t followed that closely. I doubt they are actually targeting M.

Matthew, Yes, time=0 is when the policy adjusts. Before that I am assuming a zero percent trend in inflation, or an appreciating exchange rate in the case of Japan.

19. February 2019 at 15:58

Yeah, the new monetary policy will keep the base frozen until June. The central bank can only expand by seasonal adjustments or modest FX purchases (unsterilized) if the ARS appreciates beyond a pre-announced threshold.

It has stabilized the currency, interest rates have come down (from a high of 72% at the beginning of the new policy to the current 44% on 7-day CB notes) but inflation has not fallen nearly as much (6,5% m/m on the peak of the crisis to 2,9% m/m on January)

https://www.bloomberg.com/amp/news/articles/2018-10-01/argentina-tries-to-leave-hell-behind-with-new-monetary-policy

19. February 2019 at 21:28

Scott,

Not surprised that you are unable to answer my question.

19. February 2019 at 23:50

Scott,

The reason slow ACH transactions still exist is literally due to a cartel that most banks support for two reasons:

1. Using the Fed’s newer electronic clearing system is slightly more expensive.

2. Many banks are still heavily dependent on revenue from overdraft and returned payment fees, some of which exist because people underestimate how long electronic deposits will take.

Also, to speed up debit card transaction processing would require many merchants to upgrade their POS systems such that they report out daily, instead of once-per-week or even less frequently. Perhaps you’ve noticed that it’s not uncommon for some of your debit or credit card purchases to take a week or longer to be deducted from your account. This also leads to mistakes with bank accounts that increase overdrafts and related fees.

And while we’re talking about problems with payment processing, let’s not forget about the high fees the Visa/MasterCard monopoly charges, or the even higher fees Amex charges.

Why are we still using cards at all? Some countries largely moved on from cards years ago.

I promise you, banks and firms like Visa fear increased competition from deregulation far more than they do additional regulation. We need massive deregulation of the financial services industry in general, including the investment industry.

19. February 2019 at 23:57

On level-targeting NGDP through stock indexes and signals like the VIX, it might be possible to do so in a way that represents a net improvement in monetary policy over the current approach, though further research is needed. Maybe I’ll research and think about the idea more, as time allows.

Yes, stock prices are noisy, but there are ways to potentially boost the signal-to-noise ratio.

20. February 2019 at 03:04

If you don’t stick to a target, it doesn’t matter what target you choose. That’s the biggest problem with the Fed right now, not the choice of target.

Agree stock market pricing is noisy, but big moves can tell you if policy is way on or off.

Private forecasters/investors look at live satellite data to see the number of cars in Walmart parking lots. The Fed doesn’t need an NGDP futures market to do a better job predicting growth and inflation. There are plenty of tools out there, but why would you expect an institution as incompetent as the Fed to use anything but tools that are half a century old.

Japan’s problem is not monetary policy. It’s a confiscatory tax regime and excessive regulation.

Interest rates don’t drive yen velocity. Tax rates drive it.

BoJ is already using a currency peg, they just don’t know it.

20. February 2019 at 08:45

Todd, I’m not sure what you are asking. I have no objection to using the CPI as a measure of inflation. Are you saying that Japan did not experience deflation? What’s your point?

Lucas. Money supply targeting is a bad long run policy, but it might be helpful for a limited period of time in a high inflation economy like Argentina.

Michael, Agree on the need for deregulation of the payments industry.

dtoh, I strongly disagree about yen velocity. Interest rates are the overwhelmingly most important fact. When nominal rates fall to zero, velocity falls sharply.

The reason is simple. If you can get 5% interest in a T-bill, you’d have to be insane to hold massive quantities of zero interest reserves. When Japanese interest rates were positive, yen velocity was far higher. But yes, high taxes also reduce velocity.

The Fed is currently pretty close to hitting its dual mandate, so I’m not worried on that score.

As for a currency peg; if it’s there, the markets also don’t know it. They expect yen appreciation.

20. February 2019 at 09:20

Scott,

You had written that Japan had experienced “years of deflation” before 2000 but if using the CPI, Japan had very mild deflation of -0.1% in 1995 and then -0.3% in 1999. (Average inflation for those years) That isn’t years of inflation before 2000.

You also wrote: “Japanese salarymen suddenly start refusing overtime, and instead go home and put on shorts, throw a few shrimp on the backyard barbie…”

But a Japanese salaryman is, as the name suggests, an employee who receives a salary, not an hourly wage, so he can’t really refuse to work overtime.

20. February 2019 at 14:19

https://phys.org/news/2019-02-central-ideas-economics.html

20. February 2019 at 15:59

Todd, If you look at the GDP deflator, you’ll see decades of persistent deflation. So what’s your point? Even the index that you cherry pick shows a couple years of deflation.

The comment on salarymen was a joke.

20. February 2019 at 19:38

Scott,

Your memory is slipping. I didn’t cherry pick anything. You just said yesterday that you had no problem using the CPI and today you do, so I’m a cherry picker?

A small amount of deflation in 1995 and then in 1999 is not “years of deflation.”

20. February 2019 at 19:40

Scot,

Your salaryman example was to make a point and not a joke.

20. February 2019 at 22:53

When are you going to mock AOC Scott?She seems like a left wing Trump 😂🤣😏!

21. February 2019 at 04:40

Ben, You said:

“He said there are few tools left to ease monetary policy further as cutting already ultra-low interest rates could push some financial institutions into bankruptcy.”

LOL. Low rates mean money is easy?

—30—

Yes, the media keeps saying the Bank of Japan has an “ultra” easy money policy and “low” rates etc.

But media misnomers do not obscure the fact: The ex-BoJ deputy is calling for money-financed fiscal programs in Japan, as has Ben Bernanke and our own George Selgin.

There does seem to be concerns among bankers and financial-industry types that when rates go flat, profits evaporate. Negative rates might drive depositors out of money-market funds and also cause disintermediation in the financial system. The problem is, we need bankers to make loans (endogenous creation of money).

BTW, the latest is the ECB will not raise rates in 2010, nor reduce its balance sheet, but a recession is possible anyway. There are already negative interest rates in parts of Europe (Germany, Swiss). But fiscal stimulus is out, as most nations never recovered from 2008 and big deficits then.

What a mess.

Really? How long will central banks flog the lagging horses of QE and nominally low rates? They have whipped those horses pretty hard in Japan and Europe.

How long will the macroeconomic profession genuflect to taboos and not embrace money-financed fiscal programs?

Dudes, there is a way out of perma-stagnation.

How long central banks have any credibility, if perma-recession is the norm?

21. February 2019 at 04:49

Scott,

If you include reserves, yes then velocity changes with interest rates because. If you’re talking about cash held by the non-banking, then no they don’t have much impact. Is Mrs. Watanabe going to risk jail time and have 50% of her money confiscated by the National Tax Authority so she can earn an extra 150 basis points. No way!

21. February 2019 at 04:58

Scott,

You said, “The Fed is pretty close to hitting its dual mandate.”

Yes, and on roughly half of the days in the year my dog accurately predicts whether the stock market will go up or down by either marking an oak tree first or a maple tree first.

21. February 2019 at 07:07

It is perhaps not out of the question that we could automatically make the monetary base adjust daily to statistically significant, seasonally adjusted changes in final sales.

22. February 2019 at 11:51

Todd, I said I had no problem with someone pointing to the CPI and I have no problem with someone pointing to the GDP deflator either. I’ve said 1000 times in this blog that all inflation estimates are arbitrary, it’s a made up number.

And the salaryman example was obviously a joke—get serious!

Edward, AOC is 100 times better than Trump, despite her wacky economic views.

dtoh, I did my Phd dissertation of currency velocity, and I assure you it’s positively correlated with nominal interest rates.

So on the days when your dog is correct, do you accuse your dog of being incorrect? Or do you only accuse him of being wrong when he’s wrong?