John Roberts on monetary reform

David Beckworth has a new podcast where he interviews John Roberts, who spent 36 years at the Federal Reserve Board as a macroeconomist. At one point in the interview he was asked about how the Fed should tweak its policy regime in the next review period (which is scheduled for 2024):

Roberts: So I think in that statement of longer-run goals, that constitutional document, I would keep, for the reasons I was just saying, the shortfalls language on maximum employment. But I’m not sure I would keep the shortfalls language on the average inflation targeting. My reasoning is that, if you think about it, that puts an upward bias to inflation. When they adopted that, it seemed like it was a good idea to have an upward bias on inflation, because their concern was getting stuck in a low inflation world because of the low interest rates. Today, it doesn’t look like we have a problem with inflation never being able to be high. It looks like that’s perfectly possible. So I don’t think, from today’s perspective, they need that asymmetry in the constitutional document anymore.

Roberts: And then in terms of if they ever do hit the lower bound again, what statement language they should use… So I think in retrospect, it looks like having those two criteria for liftoff, both the maximum employment and the price level-related one, led to monetary policy being too loose for too long. So a really simple change in my view would be to change the “and” in that conditionality to an “or.” So you would say then that, “We will keep the federal funds rate at the effective lower bound until either we’ve achieved maximum employment or some kind of average inflation targeting criterion has been reached.” So that would’ve stood them in good stead this last time around, because by the middle of 2021, they had already made up the shortfall in prices. So that promise would not have gotten in the way this last time. And it would’ve stood them in good stead in the previous cycle where it took a long time to get to maximum employment and inflation kept undershooting. So it would work for each of the last two cycles. Who knows? Maybe some other thing will come up that would make it not work in the future, but at least, it would have worked, I think, in the last couple of times. So the tweak there would simply be to change “and” to “or.”

Given his career path, I imagine that Roberts has much more insight than I do into where policy is headed. While these are his own views, I suspect the final decision will be not too dissimilar to his proposal. After all, the Fed knows they erred in allowing inflation to get too high, and thus the obvious place to adjust FAIT is in making it symmetrical, at least for inflation.

It’s unfortunate that the Fed is probably unwilling to adopt NGDP level targeting. I suspect they believe that their mandate forces them to target inflation and employment, but that is not the case. The mandate is the goal of policy; if the Fed believes (as I do) that NGDPLT is the best way to achieve that goal, then NGDPLT is fully consistent with the dual mandate.

The change from “and” to “or” does make the employment part of the regime less bad, but there’s still room for mischief. And it’s a mistake to make any promises about the path of interest rates, including a promise not to raise rates until some threshold for inflation or employment is met. To see why, consider Roberts’ explanation of what went wrong in 2021:

So they said that they would keep the funds rate at zero until the unemployment rate reached their estimate of maximum employment. They didn’t spell that out, but that could well have been, say, 3.5% unemployment because that’s where they were pre-COVID and that was not inflationary.

He’s probably right about the 3.5%, but of course that’s a terrible way to do policy. During the 1970s and early 1980s, the unemployment rate was far about 3.5% and yet we had a severe inflation problem. The Phillips Curve is not a reliable guide for policymakers.

Again, the Fed needs to stabilize NGDP growth along a level path. All policies that lead to highly unstable NGDP will fail to stabilize the macroeconomy.

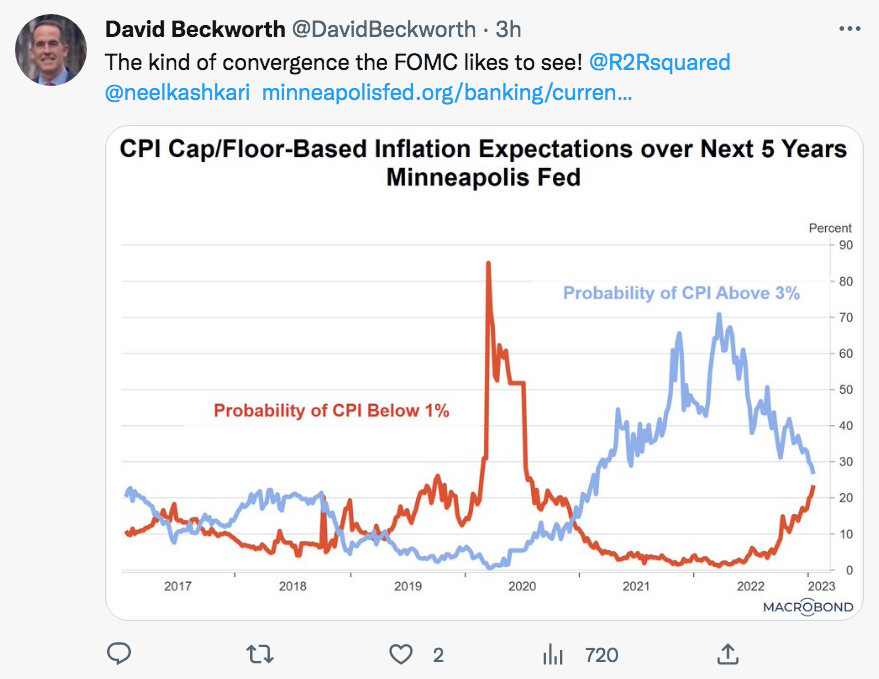

PS. This David Beckworth tweet caught my eye:

I mostly agree, but would delete the phrase “kind of”. The Fed wants to see convergence, but the kind of convergence they’d like to see is down below 10% chance of each type of overshoot, not roughly 25% chance of each.

PPS. In a new article I wrote for the National Review, I point out that low and stable NGDP growth is a necessary and sufficient condition for the Fed to achieve its policy goals:

The Fed does not currently target nominal spending. But as a practical matter, the Fed cannot achieve its goal of low inflation and high employment without stable nominal-spending growth. Whenever spending growth is far below 4 percent, unemployment will rise sharply. Whenever it is far above 4 percent, inflation will rise. Because spending growth is the sum of inflation and real GDP growth, it is the best single indicator of the Fed’s performance.

A policy target of 4 percent spending growth is much more credible and transparent than a vague policy aimed at 2 percent inflation and high employment. How should high employment be defined? The Fed doesn’t tell us. How does it balance the goals of avoiding high inflation and encouraging high employment? The Fed doesn’t tell us. What does it do if it misses a policy goal? Again, the Fed doesn’t tell us.

Read the whole thing.

PPPS. New new NGDP figures show 7.3% growth over the past four quarters, which is far too high. I warned you all back in early 2022 not to assume that just because the Fed had embarked on a series of rate increases they were tightening monetary policy. Interest rates are not monetary policy. Money was extremely loose in 2022.

When will we ever learn?

Tags:

27. January 2023 at 14:58

Where do you get your ngdp (estimate) numbers from?

The BEA does not make it easy to find unadjusted numbers.

27. January 2023 at 15:10

Here:

https://fred.stlouisfed.org/series/GDP

27. January 2023 at 15:45

Will there be a hyper market contest for 2023?

27. January 2023 at 16:29

Didn’t the M2 measure of the money supply stop growing and even shrink in 2022? That’s not indicative of tight money?

27. January 2023 at 17:08

John, I doubt it.

msgkings, It’s a very weak indicator—NGDP growth is far better.

28. January 2023 at 01:11

Sorry to hear that you might be ditching the Hypermind contest. I made 115 Euros on the 2022 bet—and I would have made more if I had adjusted my range targets downward in November.

If I were making a bet right now for 2023 I would put my floor for NGDP growth at 4.5% and my ceiling at 6%.

28. January 2023 at 09:43

David, I’d be happy in 4.5% turned out to be correct. If it’s 6%, the Fed’s going to face a lot of criticism.

28. January 2023 at 10:15

People confuse stock with flow. Economics is about the rate-of-change in the flow-of-funds. It is not about absolutes. Thus, to say that the stock of M2 slowed or declined is sheer ipsedixitism.

29. January 2023 at 04:41

It’s funny, but maybe instead of targeting NGDP, we should target GDP. Kidding of course, but marketing does matter.

When I saw Tim C’s question, I was wondering what he was thinking since everyone knows where to find GDP. But it was not a dumb question.

Why put the “N” in front of GDP? I understand why—-to not confuse it with RGDP. Still—-we live in a democracy—-people need the simplest description—-and by people I mean politicians.

And Fed employees.

29. January 2023 at 04:50

P.S. There are many odd ways that impact perception——as Kahneman and Tversky have shown.

29. January 2023 at 07:43

10/1/2020 ,,,,, 6.6

01/1/2021 ,,,,, 11.7

04/1/2021 ,,,,, 13.8

07/1/2021 ,,,,, 9.0

10/1/2021 ,,,,, 14.3

01/1/2022 ,,,,, 6.6

04/1/2022 ,,,,, 8.5

07/1/2022 ,,,,, 7.7

10/1/2022 ,,,,, 6.5

Greater than 2 years of overshooting. It’s an historic monetary blunder. It’s no happenstance that inflation is entrenched.

29. January 2023 at 08:28

The thing is that you can stop the madness anytime you want. You just execute a Greenspan “Black Monday”.

Monetary flows (volume X’s velocity), fell from 16 in AUG, to 4 in NOV (See G.6 release – debit and demand deposit turnover). [ Δ, not Δ Δ ]

Conterminously (3 months prior to the crash), the rate-of-change in RRs (the proxy for R-gDp), was surgically sharp, decelerating faster than in any prior period since the series was first published in January 1918. The proxy declined from 11 in JUL to (-)4 in OCT. [ Δ, not Δ Δ ]

That’s all it takes – the fortitude to instill discipline on the markets.

29. January 2023 at 11:19

It is very annoying that NGDP is not properly reported. I screwed up my (second-to-)last Hypermind edit because I had just read the Reuters’ wire that non-real GDP growth in 2022 had been 9.2%. Thankfully I quickly noticed Table 1.1.5 or whatever and corrected myself. I don’t think it made a big difference on my score either way, however.

Very unfortunate there won’t be another NGDP contest – my 343 euro winnings from this last contest will cover a decent amount of books this year!

On a non-personal level, I felt the results were better this year than last? Annoyingly, I think one needs to gate who can answer the question, as so many people last year had no idea what the question was even asking.

31. January 2023 at 07:00

Retsif Levi, of MIT, calls for “immediate suspension” of all covid mRNA vaccines.

This, along with Abdullah Alabdulgader and McCullough, two eminent cardiologists, along with one of the world’s leading virologists, Malone, should put the nail in the coffin.

So will Sumner now finally apologize to those he called “anti vaxxers” and “morons” and “conspiracy theorists” for pointing to obvious research and data between 2020 and 2023?”

You should apologize immediately to those you banned.

And then you should look in the mirror, before you call anyone else a “moron.” Because there is only one moron on this blog; and it’s the guy writing it. You have a difficul time reaching good, well thought out conclusions, because you don’t read very often. As we know, you watch a lot of old movies and Bucks games.

Your sources are therefore limited; you just parrot CNN and whatever the CDC or the state provides you, and then like a religious zealot call it gospel. It’s another reminder that you should talk about things you know; like economics, and take a back seat when it comes to important things like medicine or physics, or anything that doesn’t have to do with the very narrow field of Monetary economics.

Unbelievable.

31. January 2023 at 23:52

Scott,

The Fed might argue like this:

the NGDP of 7.3 percent is a historic figure, i.e. it partially is due to much lower rates (and QE) in the first half of 2022. Further it seems a lot of forward indicators are decelerating (CPI expectations, energy, etc…). Thus we prefer to “wait and see”…

What would you answer to this argument, i.e. why is “wait and see” not the right course of action? Appreciate your thoughts…

1. February 2023 at 08:47

viennacapitalist, That might be true today, but this post was discussing 2022, and policy was clearly too expansionary last year.