I’ve finally got Keynesians talking about NGDP

For years I’ve been complaining that Keynesians look to real GDP growth rates as an indicator of the effectiveness of fiscal policy. I’d say that’s the data they cite 99% of the time. But it’s not the right statistic, as it reflects both supply and demand shocks. Ideally you want a measure of changes in aggregate demand or total spending, i.e. NGDP. (Did Zimbabwe have an AD problem?) Eventually I gave up and started playing their game, reporting actual RGDP numbers against the numbers the Keynesians were predicting.

But perhaps too soon. Ramesh Ponnuru sent me a Twitter comment from Mike Konczal:

But hasn’t NGDP growth collapsed?

That’s a smart move. But in fact it has not collapsed. NGDP grew 3.8% in 2012 and is growing at 3.55% so far in 2013. Down a quarter point. I don’t know if the Philly Fed GDPplus also comes out in nominal terms, but I’d guess they’d show an even closer alignment, as the acceleration of RGDP growth in 2013 is even greater for their estimate than for the official numbers.

PS. The real/nominal distinction is more important in Britain, where inflation is unusually high. I’ve never seen a Keynesian cite NGDP data for Britain. (It’s not very impressive good, but it’s less awful than RGDP, indicating some supply-side problems.)

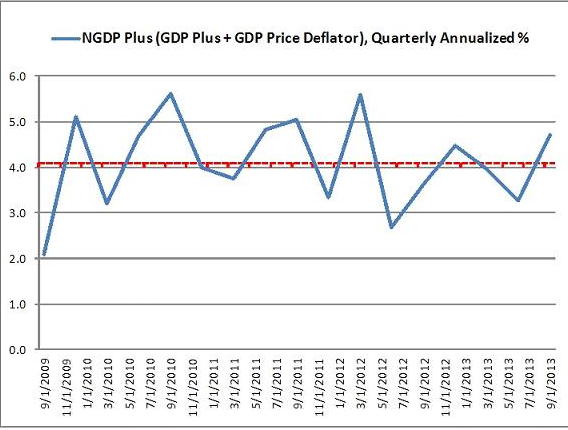

Update: Michael Darda sent me this graph with GDPplus + the change in the GDP deflator. The average NGDP growth rate during the recovery has been 4.1%. Eyeballing the data it looks like NGDP growth was about 4.1% in 2012 and 4.0% so far in 2013. Someone let me know if I am wrong.

Basil Halperin pointed out that NGDI growth seems stable, although we lack the latest figures.

Tags:

8. November 2013 at 10:15

It’s also not true if you look at NGDI: https://pbs.twimg.com/media/BYkSCKlCMAApHB4.png

8. November 2013 at 10:30

Ah, I wondered who got James Tobin talking about NGDP. Well done.

8. November 2013 at 10:54

Thanks Basil.

Kevin, Sorry to break the news, but James Tobin hasn’t been talking about anything for more than a decade.

New title:

I’ve finally got Keyneisans talking about NGDP . . . again.

8. November 2013 at 11:19

No sure why people looking at fiscal policy ignore NGDP as government spending is an important part of the formula.

8. November 2013 at 11:40

Lots of good blogging…Market Monetarism gaining adherents…but can or will an independent public agency—the Fed—change? Ossification is storied and hoary glory in such marbled halls…

8. November 2013 at 12:34

Pimco tweet gave me an idea.

What if the entire Fed BOG announced all their 75% of their personal wealth is in assets that assume inflation will be 1.9%-2.1% the following quarter.

Not just tying their pay to performance, but taking their wealth and saying, TRUST US, there is no possible way we’re going to let this thing go either way off target on purpose.

8. November 2013 at 13:10

Morgan,

That is an AWESOME idea!!

8. November 2013 at 13:13

Morgan,

Why not just pay them based on their ability to hit whatever targets they set for themselves….

I hate the idea of anyone demanding what someone else must do with their personal property.

8. November 2013 at 16:10

BC, their pay is a blip.

The point is we need the markets to EXPECT and then be rewarded for expecting us to hit the target.

but the more they expect it, the easier it is to do.

I’m not demanding it, the alternative would have to be a payday that feels like lottery winnings.

8. November 2013 at 16:35

Morgan– Richard Fisher went supershort (leveraged) the market a few years back…a public disclosue…actually Fisher’s short called a market bottom…I am inclined in some extent to agree with you…independent public agencies are probably a bad idea….I would link Fed staff pay to real growth too…

8. November 2013 at 20:47

“But it’s not the right statistic, as it reflects both supply and demand shocks. Ideally you want a measure of changes in aggregate demand or total spending, i.e. NGDP.”

This is clearly wrong, because if you focus on NGDP, then you would conclude that the economy is doing fine if NGDP grew modestly, even though real output might have collapsed.

Standards of living are connected to real goods, not how many dollars are floating around.

8. November 2013 at 20:56

But can you get them to stop talking about finance?

Ben Bernanke, The Crisis as a Classic Financial Panic: http://www.federalreserve.gov/newsevents/speech/bernanke20131108a.htm

9. November 2013 at 00:51

Why?

9. November 2013 at 09:43

” NGDP grew 3.8% in 2012 and is growing at 3.55% so far in 2013. Down a quarter point. I don’t know if the Philly Fed GDPplus also comes out in nominal terms, but I’d guess they’d show an even closer alignment, as the acceleration of RGDP growth in 2013 is even greater for their estimate than for the official numbers.”

However, that’s the problem. NGDP heas been stable for 4 years, beginning with 2010. Yet you yourself admit that the economy is far from optimum. So there’s still plenty of room for fiscal stimulus. You can argue that the Fed could and should do more, they’re not doing it. I’m not opposed to them doing more and would prefer that they did. Still as they aren’t it’s not surprising or unreasonable that many are calling for more fiscal stimulus.

One thing you have said many times is that what’s important is for NGDP to move along a trend once a target has been selected. If I understand you right you think it’s not that important whether the Fed targets 5.5%, 4.5%, 3.5, 2.5%… what counts is just to be stable.

That we’ve had NGDP growth basically in this range of the high 3s or low 4s for a few years suggests that it does matter how high or low the target it. We’d be in much better shape is the trend had bee 1 or 2 percent higher over the last 4 years.

9. November 2013 at 10:23

“One thing you have said many times is that what’s important is for NGDP to move along a trend once a target has been selected. If I understand you right you think it’s not that important whether the Fed targets 5.5%, 4.5%, 3.5, 2.5%… what counts is just to be stable. ”

I’m surprised that a long time commenter like you would make that error. Scott has said many times that you need level targeting, meaning having NGDP growth of 3 or 4% with no catch up to the previous trend is not stable. We were going along at 5% per year, then had a 4% drop putting us 9% below trend. Now we’re even further behind, something like 13% below trend.

Eventually the economy will adjust to the new trend, and it probably has partially done so, but to claim dropping 13% below trend and falling only slightly more behind every year is “stable” is certainly not correct.

9. November 2013 at 10:37

Negation as reco?veries go 3.8% is pretty poor as I’m sure you’ll agree. If we want catch up then why not do fiscal stimulus? Why do the sequester? It seems that the Fed has chosen as it’s own target 3.8%.

Scott is holding up 3.55% and saying “Eureka! I was right and the Keynesians were wrong!”

With this much admitted catch up to do why do the sequester? He has also when pressed by Morgan Warstler suggested that maybe it’s ok to have less than full catch up. Like Morgan-if I read him right-would be happy to lock in 3.% NGDP in perpetuity. So I don’t see how Keynesianism can be vanquished as we’re 13% below trend.

9. November 2013 at 12:10

Mike – “If we want catch up then why not do fiscal stimulus? Why do the sequester? It seems that the Fed has chosen as it’s own target 3.8%. ”

If you are correct that the Fed has chosen a target of 3.8% then why on Earth would you try to do fiscal stimulus? If you are right, then no matter how much stimulus we do, the Fed will not allow more than 3.8% nominal growth. If we eliminated all taxes and doubled federal spending and the Fed only allowed 3.8% growth what good would that do?

As for not doing the full catch up, that’s because there has certainly been some adjustment of the economy to lower NGDP. I don’t know by how much, but Krugman says Fed research suggests we’ve lost 7% of of output permanently.

http://www.nytimes.com/2013/11/08/opinion/krugman-the-mutilated-economy.html

So I would assume if we make up 6% or so that would be enough. So we could target NGDP growth of 8% for two years and then 5% forever after that.

9. November 2013 at 13:38

If you are correct that the Fed has chosen a target of 3.8% then why on Earth would you try to do fiscal stimulus

That’s the sort of question only a cold-hearted Republican would ask.

9. November 2013 at 13:50

Daniel,

That’s good news for cold-hearted Republicans; bad news for the rigour of everyone else’s thinking.

9. November 2013 at 16:42

Mike, You said;

“However, that’s the problem. NGDP heas been stable for 4 years, beginning with 2010. Yet you yourself admit that the economy is far from optimum. So there’s still plenty of room for fiscal stimulus. You can argue that the Fed could and should do more, they’re not doing it. I’m not opposed to them doing more and would prefer that they did. Still as they aren’t it’s not surprising or unreasonable that many are calling for more fiscal stimulus.”

I have a article on monetary offset in the right margin of this blog. It seems to me you don’t know what it is. Read the article.

9. November 2013 at 18:40

The Monetary offset problem is a problem of stubborn public policy, not economics.

Fiscal stimulus would work if the Fed would promise to let it work

Just as NGDPLT targeting needs Public policy changes for it to have a shot.

It Does not make any sense to say NGDPLT targeting does not work in Econ terms because the FED won’t let it. But that is just what the monetary offset argument says about Fiscal stim.

The Monetary offset argument is a Political objection disguised as an economic argument.

10. November 2013 at 10:51

Daniel:

“That’s the sort of question only a cold-hearted Republican would ask.”

Which cold hearted Republicans? The ones who might have issues with pointing guns at innocent people, or the ones who agree with the Democrats?

10. November 2013 at 13:43

Geoff,

You’re a broken record.

10. November 2013 at 15:39

Daniel:

You don’t dislike broken records, or else you would not be a frequent visitor of this blog, nor would you write what you continue to write 🙂

11. November 2013 at 06:21

Bill, Just the opposite, monetary offset occurs when the central bank is properly doing its job.