Is inflation re-accelerating?

I don’t know. But the possibility is greater than I would have wished to see.

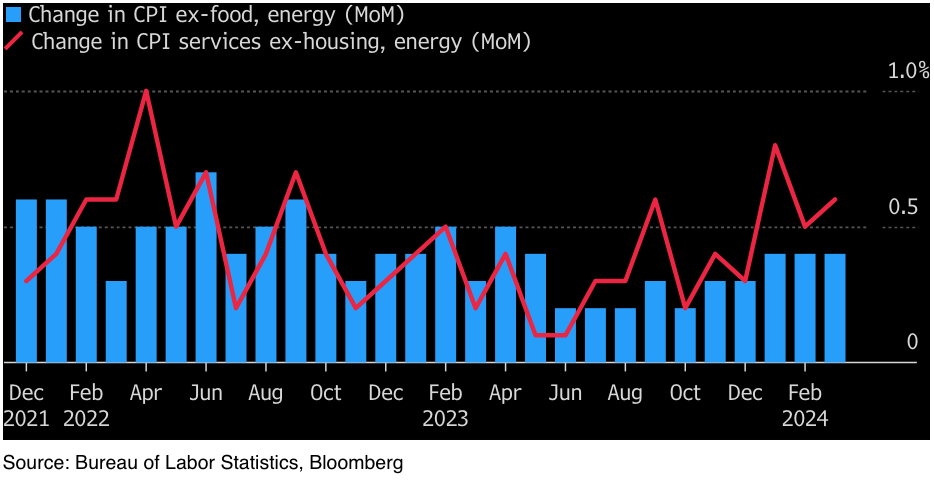

Inflation data is often noisy and unreliable, for a wide variety of reasons. Wage inflation is the most meaningful for monetary policy. Among all of the various price indices, the service sector inflation ex-housing and energy is probably the most closely tied to wages. Wages aren’t closely linked to housing or gasoline prices, but they are fairly closely linked to the price of haircuts, fast food, and medical care. And while this series is pretty noisy (red line), it does seem to be trending up since last May and June, when the monthly rate bottomed out at only 0.1% Here’s Bloomberg:

The most recent reading is 0.6%, and the most recent three month average is even higher than 0.6%.

Again, this data is erratic, and it may well slow again going forward. But as I’ve been saying ad nauseam over the past few years, it’s not at all clear that the Fed has adopted a tight money policy. Money is still too loose. I expect 2024:Q1 NGDP to be “hot”. In other words:

Wake me when the tight money starts.

Update: Jason Furman has an interesting thread.

Tags:

10. April 2024 at 12:29

https://twitter.com/JamesOKeefeIII/status/1778157381907513802

The narrative from monetarists exposed as a lie.

Welcome to the real world.

10. April 2024 at 15:06

if only….

sumner explained how he knows this:

“Among all of the various price indices, the service sector inflation ex-housing and energy is probably the most closely tied to wages. Wages aren’t closely linked to housing or gasoline prices, but they are fairly closely linked to the price of haircuts, fast food, and medical care.”

economists, especially those of the manque cadre, are one level below three-card monty shills.

10. April 2024 at 16:47

The release of the S&P 500 earnings last week revealed that the Q4 NGDP growth minus the concurrent S&P 500 earnings ticked up, with the best estimates for Q1 having it at a similar level. And, of course, NGDP is still above trend, with the inflation breakevens creeping higher above the Fed’s target.

So, I’m convinced that monetary policy has loosened over the past 2 quarters and hence the Fed needs to delay rate cuts, at the very least, if not cancel some of them entirely.

10. April 2024 at 20:35

It seems like they should hike, but being an election year they won’t

But then do they want to hike in the early term of a presidency?

They have dug themselves into a hole.

11. April 2024 at 06:00

It’s no happenstance. The FED’s accounting is wrong. Draining the O/N RRP injected new money and new reserves into the payment’s system. The money stock can never be properly managed by any attempt to control the cost of credit.

11. April 2024 at 07:20

Bobster, That’s what interregnums are for. 🙂

11. April 2024 at 12:55

It boggles my mind that there are still people claiming this is supply-side and that tightening monetary policy is not a good idea.

1Q 2024 NGDP is going to come in way too hot.

They should absolutely hike, in my opinion.

11. April 2024 at 14:48

Major Freedom is back? I might start reading this blog again. And in other news, years ago Scott dissed beavers, calling them evil. Well, this video just dropped on YouTube and showed beavers in their true light, as climate heroes. Shows how little our host knows. – RL

This Beaver Dam is So Huge, You Can See It from Space | Climate Heroes Terra Mater

11. April 2024 at 14:57

There have now been 12 boom/busts in real-estate in the U.S. since WWII. The busts have all been triggered by a flawed monetary policy, a flawed correction for a loose monetary policy.

Powell hasn’t yet to drain money flows enough, the volume of money times its transactions rate of turnover. And he’s likely not to succeed in dropping housing prices.

Core CPI came in at 4.4% annualized. Secular stagnation has been swapped for stagflation, or business stagnation accompanied by inflation.

11. April 2024 at 15:02

SS: “The [boom/busts in real-estate] busts have all been triggered by a flawed monetary policy, a flawed correction for a loose monetary policy.” – seriously? Scott believes the Fed can “steer” the economy? That thinking literally fell out of fashion in the 1960s Or is this some sort of shorthand for something less ridiculous? I’m afraid it’s the former; I’m back to not reading this blog. Bye.

11. April 2024 at 15:13

March PPI up 2.1% on year.

11. April 2024 at 15:30

It’s very easy to steer the economy as the 1966 Interest Rate Adjustment Act demonstrated.

11. April 2024 at 15:39

Monetarism has never been tried. Paul Volcker’s version of monetarism (along with credit controls: the Emergency Credit Controls program of March 14, 1980), was limited to Feb, Mar, & Apr of 1980.

Even with the intro of the DIDMCA of March 31st 1980, total legal reserves increased at a 17% annual rate of change (before FRB-STL’s Dr. Richard Anderson’s “reconstruction”), and M1a exploded at a 20% annual rate (until 1980 years’-end).

11. April 2024 at 15:48

And so now Ray thinks I changed my name to “Spencer”.

Senility?

11. April 2024 at 15:53

Powell as Chairman is not a monetarist.

#1 “there was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time”

#2 “Inflation is not a problem for this time as near as I can figure. Right now, M2 [money supply] does not really have important implications. It is something we have to unlearn.”

#3 “the correlation between different aggregates [like] M2 and inflation is just very, very low”.

12. April 2024 at 08:01

Powell will be remembered as just another Arthur Burns. I heard he even smokes a pipe these days. Probably filled with weed.