13 Responses to “I’d like to know what this poll would have shown on February 1, 2009”

Leave a Reply

A slightly off-center perspective on monetary problems.

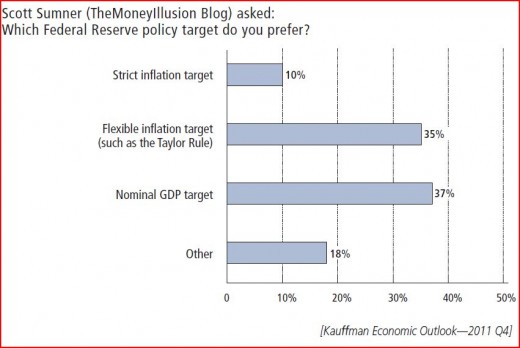

Here’s a poll conducted by the Kauffman Foundation:

BTW, I began blogging 2/2/09.

HT: JimP

Tags:

This entry was posted on November 02nd, 2011

and is filed under Monetary Policy, NGDP targeting.

You can follow any responses to this entry through the RSS 2.0 feed.

You can leave a response or Trackback from your own site.

13 Responses to “I’d like to know what this poll would have shown on February 1, 2009”

Leave a Reply

2. November 2011 at 18:47

Don’t get uppity. The bond market has a long time horizon, and has yet to make its move. It’s just starting to roll out its cannons…

http://www.businessweek.com/news/2011-11-02/goldman-idea-could-let-inflation-out-of-the-bottle-amity-shlaes.html

Reprinted in FT

Expect that NGDP targeting will be called insane, a recipe for hyperinflation, and destructive of the Fed’s hard-won credibility.

Oh, wait…

2. November 2011 at 18:53

Way to go Scott.

2. November 2011 at 19:39

StatsGuy, the BW article seems clearly wrongheaded to me, but there’s a real problem in that central banks’ credibility (and insulation from political concerns) is mostly invested in price indexes, so they are reluctant to publicly consider and announce a “radical” shift in priorities. We don’t even know how the market would react to that shift in the short-to-medium run, with Fed credibility potentially being impacted for some time.

Now that nominal income path targeting has achieved some popularity, I would like Scott to be clearer that a fairly good “middle road” between the two is available, in the form of price path targeting. There is no excuse at this point for failing to adopt a path-based rule (either prices or NGDP) and restore the path which was established before the late-2000s crisis.

2. November 2011 at 20:03

Too bad the Fed’s next step will probably be buying mortgage backed securities…

But do you think I’m being overoptimistic in thinking NGDP targeting will very likely be adopted in the next decade?

2. November 2011 at 20:12

Excellent results.

I am especially happy that only 10 percent wanted an inflation-only Fed target. Too bad you didn’t ask if we should also genuflect to gold each morning.

The Market Monetarists are winning the debate on monetary policy. Now, on to the Fed! Forward!

2. November 2011 at 20:43

I also wonder what the result would have been if they hadn’t said who was asking the question 🙂

2. November 2011 at 21:18

“Under NGDP targeting, it’s possible for the Fed to get a growth rate of 4.5 percent, of which 3.5 percentage points are inflation and only 1 percentage point real. That hardly accords with the spirit of the line in the Fed statute about increased production.”

LOL.

This is WHY the target will and must be under 4.5%. Prolly under 4%.

because THEN everyone’s brain goes to past historical performance.

At 3%, people are thinking, “well shit, we’ll have far less inflation!”

Winner, winner, chicken dinner!

At 4%, Democrats lose public employee unions – because giving public employees wage increases, raises NDGP, and since we even now run at 2.5-3% RGDP, we won’t accept higher rates as a consequence for accepting public employee unions.

In one hour having martinis I could get Amity on board with under 4% NGDP level targeted…. guaranteed.

2. November 2011 at 23:24

I went from fearing inflation to market monetarism within a few months of beginning to follow your blog back in 2009.

In fact, I’ve probably absorbed as much macroeconomics from your blog as I did from my econ major in college.

Well done, sir!

3. November 2011 at 07:05

Statsguy, Shlaes is not an economist, and certainly not a monetary economist. I liked her book on the Depression, but monetary econ isn’t her forte. She really shouldn’t be commenting on this issue, I doubt Taylor would agree with her argument that NGDP is an extremely bad target–it’s pretty close to the Taylor Rule.

Thanks Window Washer.

anon, I see your point, although the Fed doesn’t have an explicit inflation target, so they can still claim that they expect to hit roughly 2% inflation in average, but this tool also addresses the unemployment side of their mandate.

Cameron, I think it will become a bigger part of the policy process (a la the Bank of England) Don’t know if it will be explicitly adopted anywhere.

Thanks Ben.

Leigh, The question is; “Did my name add or subtract votes?”

Morgan, Who are you quoting?

John S. Thanks–maybe I should start charging tuition.

3. November 2011 at 09:31

Other.

IMO, it should be zero(0) private debt and zero(0) public debt (a zero debt target).

Whatever replaces the fed should have only liabilities and no assets.

4. November 2011 at 05:57

Some of the responses here are interesting:

http://blogs.reuters.com/felix-salmon/2011/11/(

4. November 2011 at 09:25

Looks like the link did not take – his article was posted today.

4. November 2011 at 18:03

Becky, Felix Salmon says Bernanke believes the Fed is out of ammunition? That’s news to me. I’d love to see the quotation.