Good news on inflation

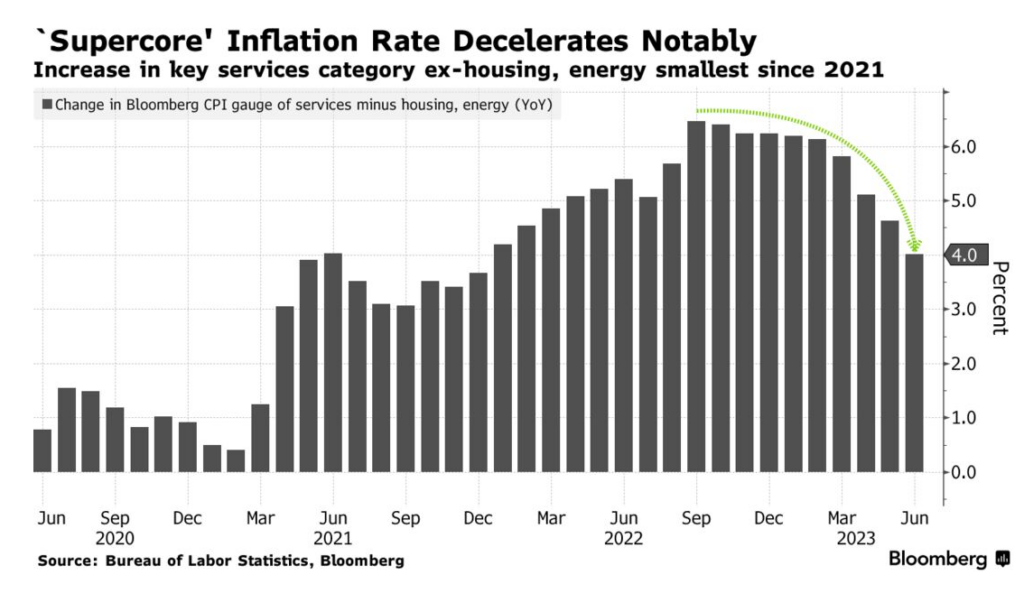

We still have a loooong way to go, but today’s report contains good news. Not so much the fall in annual headline inflation to 3% (which was due to base effects), rather the fall in non-housing services inflation:

The inflation that really matters is wage inflation. Unfortunately, it’s hard to get good data on wage inflation. The Atlanta Fed says it’s running 6.1%, and the BLS says 4.4%. “Supercore” inflation is the part of inflation that is most closely tied to wages, so its recent decline is a good sign.

But don’t become too optimistic; the next few reports may be worse.

Tags:

12. July 2023 at 10:39

Professor,

Wouldn’t it be ‘biased’ to focus on metrics that measure hourly wage inflation as opposed to total payroll growth?

Total payroll growth which we can directly from the monthly employment report would be a much closer metric to NGDP growth rather than hourly no?

12. July 2023 at 10:55

@Rafael – you’re stuck in the past. In the old days, when Sumner was a student, NGDP was indeed linearly related to employment. Nowadays, less so. Simple example: suppose a machine produces everything humans can produce today but twice as much output for the same energy and monetary inputs. NGDP would double but employment would be zero. And with the Singularity approaching that machine will soon not be science fiction (or if TFP increases).

OT, I admire Sumner for being flexible in his thought: a post ago he was railing about high inflation and today he’s partly conceded he was wrong.

12. July 2023 at 11:43

@Ray

that machine would increase real gdp, not nominal gdp.

12. July 2023 at 11:49

Rafael, Good question. NGDP is affected by both nominal hourly wages and hours worked. It’s much easier to bring down hours worked than hourly wages. So evidence that nominal hourly wage growth is slowing is much more supportive of a soft landing than evidence that hours worked are slowing.

Ray, LOL, you packed a lot of ignorance into one post.

12. July 2023 at 12:02

With the Fed focused on inflation, is there a level of the 5 year breakevens they should target?

12. July 2023 at 12:39

@Rafael, @ssumner – such ignorance on display, and this is YOUR field. NGDP = RGDP + inflation. So increasing either or both of RGDP or inflation will increase NGDP. It’s an accounting identity. Remember that phrase, professor? An economist once savaged you in this very same comments section over your worshiping an identity.

12. July 2023 at 12:44

For you math nerds, NGDP = (1+r)RGDP where r=inflation but my point still is valid. Let’s see how SS moves the goalposts by not answering the question. No doubt he’s try and link inflation to RGDP but that still doesn’t address the comment.

12. July 2023 at 16:06

The Inflation Bogeyman is in retreat!

12. July 2023 at 18:41

Bill, I wouldn’t say they should target the TIPS spread, but they should pay attention to it.

Ray, “NGDP = RGDP + inflation”

LOL

12. July 2023 at 19:44

@SS: “Ray, “NGDP = RGDP + inflation LOL” – I corrected it in my followup post. It’s NGDP = RGDP + r*RGDP where r = inflation What part of that identity do you have a problem with? Since you seem to have a thing about identities.

13. July 2023 at 04:29

@Ray last comment on this thread.

The new machine would halve the price level essentially, since money isn’t changing, keeping NGDP constant.

More production is deflationary

13. July 2023 at 05:17

In the last 5 days, DXY has fallen from 103.13 to 100.2. For inflation to make any additional gains, it will take years of tight money.

13. July 2023 at 05:54

Why is it so unambiguously good that wage growth has slowed down? Can part of this just be labor re-taking a greater share of profits vs. capital? Unless we are going to see some outright deflation, it definitely seems like wages have some catching up to do to keep pace with the 2021-22 inflation.

13. July 2023 at 08:36

I have a basic question: If inflation was, say 9% in 2020 and 9% in 2021, and then comes down to 3% in 2022 and stays at 3% for the next couple years, then all of the increase from 2020 and 2021 becomes “stuck”, right? I keep hearing people talk about the good news that inflation is tempering, but doesn’t this ignore all the inflation that happened over the past couple years? That isn’t undone unless you have a commensurate period of deflation, right? So we’re just forever stuck with these high prices unless wages increase?

13. July 2023 at 08:42

Bernanke drained legal reserves for 29 contiguous months before R-gDp dropped below zero. Powell will have to tighten money policy for a longer period of time in order to correct his policy mistake.

13. July 2023 at 08:49

Derek, High real wage growth is good, high nominal wage growth is destabilizing.

Biff, Sure, that would be bad. Fortunately nothing like that happened. Wages grow at roughly the rate of prices over a multiyear period.

13. July 2023 at 10:43

When the first set of numbers dropped a few days ago Yglesias immediately advocated another rate hike. I think he’s right, because even though at this point it probably doesn’t impact inflation trends, it helps the Fed look tough and gives just another few points of maneuvering room when the next thing goes sideways.

Also, not that Scott cares, but Noah Smith classifies him as mainstream. He posted grades for groups that made predictions about inflation.

13. July 2023 at 12:49

How do you know the decline in the super core isn’t due to the base effect? Are you assuming so, because it is presumably less volatile?

13. July 2023 at 21:44

David, Link for Noah Smith’s post?

Travis, I’m not certain on the base effect, but service inflation is generally less volatile.

14. July 2023 at 03:13

On his Substack:

https://www.noahpinion.blog/p/grading-the-economic-schools-of-thought?utm_source=profile&utm_medium=reader2

Reference to you is buried in the comments–which indicates how much time I waste on the Internet.

14. July 2023 at 07:43

David, Interesting. I didn’t see it, but I’ll take your word for it. Who else does he view as mainstream?

14. July 2023 at 10:37

Noah identifies Powell as operating in a mainstream fashion. You’re the only market monetarist who gets named in the comments (are there enough vocal advocates of MM/NGDPLT to fill your powder room?)

Noah updated his post to discuss the special case of Larry Summers, who was advocating the need for far more economic pain than what we’ve been experiencing. Will Larry turn out to be as wrong as the Team Transitory folks?

14. July 2023 at 13:13

@Rafael: “@Ray last comment on this thread. The new machine would halve the price level essentially, since money isn’t changing, keeping NGDP constant. More production is deflationary”

Last WORD on this thread: thanks for the correction, unlike SS I acknowledge my mistakes, but in fact it all depends on the PES (Price elasticity of Aggregate Supply). I can see a world, unless it’s a fixed money supply like gold, where fiat money is increased to keep unit prices per quantity as a constant, so indeed you would get 2*NGDP with the fictional “machine” in the OP. In fact long term I’ve found that money supply increases with increasing GDP, as people like a stable “unit of account”. But in general, prices are deflationary with increased productivity, as you say, as with the “Long Depression” of the late 1800s showed.

15. July 2023 at 07:40

My conundrum is that:

– inflation was caused by an unoffset supply shock and an unoffset fiscal eruption

– supply shock mostly over (supply up)

– fiscal shock ebbing (demand down)

– Fed probably less loose than before (rates+QT) (demand down)

– some workers unretiring (supply up)

– millions of migrants entered the country and looked for a job (supply up)

– inflation down

– output up

– unemployment flat

I feel like I’m missing a lot.

15. July 2023 at 08:01

Larry, I think you are making things too complicated. Just focus on NGDP and the impact of monetary policy becomes obvious.

16. July 2023 at 10:17

@ssumner

Scott,

“Wages grow at roughly the rate of prices over a multiyear period.”

They do? I thought I’ve read multiple stories about how wages have not kept pace with prices since like the 60’s or something like that. Thinking about my own situation, I think the inflation rate for 2021 and 2022 was 7% and 6.5%, respectively. My job didn’t give me a 7% and 6.5% raise those years and they’re never going to. They just do a default 3% cost-of-living increase every year regardless of the actual inflation rate. So how am I ever going to get that 4% and 3.5% back? Your saying prices will eventually go back down, and thats how I would make up that lost 4% and 3.5%?

16. July 2023 at 10:56

Biff, I’d say 90% of articles on real wages are garbage. I recall the 1960s, and real wages are far higher today.

Also, ignore the CPI, the PCE is a better index.