Furman and Smith on inflation

Noah Smith recently argued that it’s too soon to declare success in the Fed’s anti-inflation policy. I agree. But I disagree with this part of his post:

Jason Furman, an economist I respect a lot, is worried nevertheless. He wrote a recent article at Project Syndicate entitled “America’s wage price persistence must be stopped”. He argues that even if wages are failing to keep pace with consumer prices, the fact that workers are getting raises is still exerting some amount of upward pressure on prices, and therefore the Fed must keep raising rates until wages stop growing.

But I am not convinced. Above and beyond the econometric evidence that wages are not a big contributor to modern inflations, focusing on curbing wage growth seems to misunderstand why inflation is bad in the first place.

Falling real wages are the main reason people are upset about inflation in the first place — since their pay can’t keep up with consumer price hikes, they’re seeing their purchasing power erode. We want to see real wages rise, not fall. If the Fed targets wages when setting interest rate policy, there’s the possibility that they’ll go too far — that they’ll keep pushing wages down even after consumer prices have already been tamed.

Instead, I think the prudent policy is to simply target consumer prices themselves, without thinking about wages.

I agree with Furman that wage grow must slow, but I’d frame the argument slightly differently. The Fed has a dual mandate to control inflation and employment. As a practical matter, that means allowing some variation in inflation, particularly during periods of supply shocks. Focus on stabilizing demand side inflation.

Oddly, it turns out that wages are probably a better indicator of demand-side inflation than is inflation itself. Thus if wages are growing at 6%, that’s a pretty good indication that monetary policy has been too expansionary (with the qualification that wages are sticky and can be slow to adjust when demand slows.) And that’s true even if there were no causal impact of wages on prices.

Smith says that the public cares about inflation because they perceive it impacting their real wages. It’s true that this is why the public cares about inflation, but it’s a lousy reason. The claim that inflation directly reduces living standards is actually only true for supply-side inflation. When aggregate demand shifts to the right, real output (and hence real national income) actually rises in the short run. When people complain about inflation, they are assuming that the phenomenon is unrelated to changes in their own nominal income. They are (mostly) complaining about supply shocks.

Fortunately, the Fed doesn’t target inflation for the reason the public worries about inflation, rather they have two other motivations for trying to achieve low and stable inflation:

1. To reduce the welfare cost of inflation.

2. To reduce the amount of macroeconomic instability.

Both of those goals are better achieved with a low and stable rate of nominal wage growth than with a low and stable rate of inflation. This is related to the argument for NGDP targeting—stable wage inflation is likely to produce a more stable path of NGDP than is stable price inflation.

The public is hopelessly confused on this issue, because they don’t understand the distinction between supply and demand driven inflation. The Fed controls demand-side inflation, and the public was certainly not pleased when the Fed suddenly reduced inflation to zero in 2009. We had a severe recession.

The type of inflation that severely pinches living standards (mostly food and energy inflation caused by supply reductions) is exactly the type of inflation the Fed can’t do much about. If we actually tried to please the public and completely end inflation, we’d be back in the 2009 economy. And then they’d be angry about unemployment.

Get nominal wage growth down to 3% or 3.5% and call it a day. Inflation won’t be exactly 2%, but it’ll be close enough.

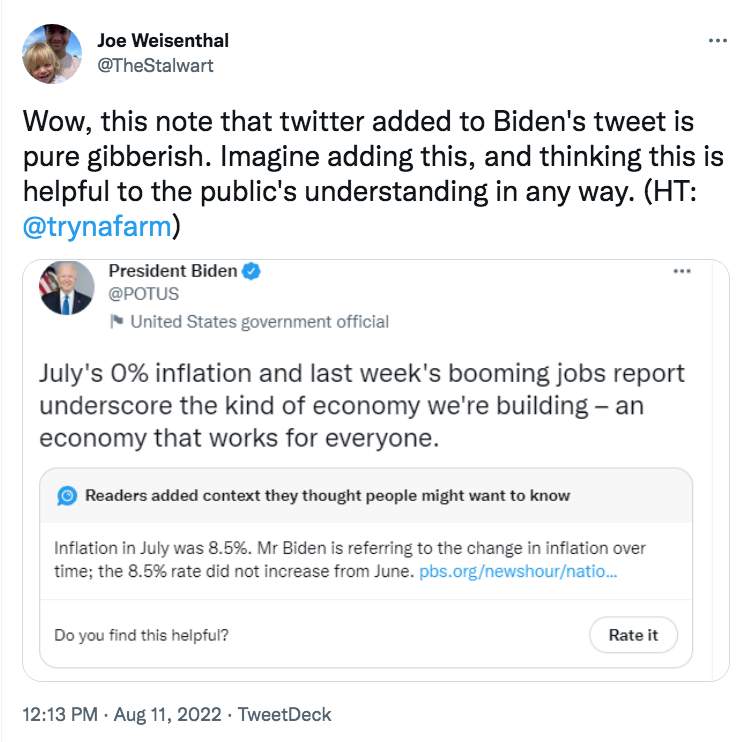

PS. Smith linked to this amusing Joe Weisenthal tweet:

Don’t you love it when the fact checkers are even further from the “truth” than the people they criticize? I don’t know how many times I’ve seen fact checkers label something false that was actually true. Somewhere, Richard Rorty must be smiling. There is no concept more widely misunderstood by human beings than “truth”.

And when is Elon Musk going to buy Twitter and stop this nonsense?

PPS. Which person on the internet would you most trust to adjudicate a disputed truth claim? I think Smith and Furman are both pretty good on that score—but only when they agree with me.

🙂

Tags:

12. August 2022 at 17:06

Wages are not growing at 6%.

Surely you can understand the difference between nominal and real. When is the last time real wages actually increased in the United States? You’d have to go back to the 80’s, before all the outsourcing, massive unrestrained immigration, and printing loads of funny money (imagine that).

And in regards to who should arbitrate online disputes: the answer is nobody. What kind of Orwellian world are you trying to create?

Fact checkers are tools of the THE PARTY, and if they can get enough dimwits to believe that fact checkers are always correct, then they can implement their totalitarian state.

You are so behind the curve on this, because we’ve been battling this in courts for nearly a decade. You do realize that people are demonetized on YouTube and other platforms because they disagree with the states fact checkers? You do realize how totalitarian these agencies and MNC’s have become, right?

You are supporting all the wrong people, simply because these people share your hatred of Trump, but someday they will come for you. Some crazed IRS agent used as a neo-gestapo will show up at your door, or some FBI agent will descend upon your home because the establishment considers NOMINAL GDP targeting a national security threat.

They will make up stories about you, propagate them 24/7, and then they will have their fact checkers tell everyone those stories are true.

Oh, but you will file Defamation/slander lawsuits, I hear you say. Nope. Assuming you can even identify the person who wrote it, the judge will throw it out because you have to prove that the persons intent was malicious.

12. August 2022 at 17:21

“I don’t know how many times I’ve seen fact checkers label something false that was actually true?”

According to Richard Rorty’s self-contradictory thesis, there is no such thing as ‘actually’ true. So your reference to ‘actual’ truth contradicts not only Rorty, but there is no basis in the dialectic faith to ground even that claim in any ‘actual’ truth.

If most people believe the Earth is flat, as did most people at some distant past, the world according to Rorty was flat.

“There is no concept more widely misunderstood by human beings than “truth”.”

And your chosen logic structurally obfuscates truth by design, where everyone else, or ‘most people’, are oblivious to truth as it is while you have special insight that you can’t even explain without recourse to circular logic of DEFINING truth as ‘truth is defined as what is said as truth’.

“Don’t you love it when the fact checkers are even further from the “truth” than the people they criticize?”

Why do you keep putting the word truth in quotes as if even using the word carries a fundamental flaw (which itself is a claim to truth)?

“Which person on the internet would you most trust to adjudicate a disputed truth claim?”

Everyone should trust themselves, and everyone should all see themselves as extending from the same singular unified source code. Humans are not God, as much as some WANT others to see them as.

https://i.imgur.com/87SJ8s5.jpg

Trump storing highly sensitive classified documents at Mar-a-Lago presented such an urgent national security risk that the FBI waited two days for the start of the weekly news cycle to carry out the raid. lol

12. August 2022 at 18:16

Sara, You said:

“Wages are not growing at 6%.

Surely you can understand the difference between nominal and real.”

LOL, you actually thought I was referring to real wages? Seriously? You thought I was advocating the Fed target real wage growth?

You and George make quite a team.

12. August 2022 at 22:36

Real factor income is up for most people both in the last year and the last quarter.

I’m sure the FBI will start investigating NGDP any day now.. 🙄

13. August 2022 at 05:59

1. To reduce the welfare cost of inflation.

2. To reduce the amount of macroeconomic instability.

============

1. It is not clear that the social welfare cost of inflation (e.g., current rates or lower) is very high. Do you disagree? If so, please explain.

2. Would a somewhat high (e.g., current rates or lower) but stable rate of inflation cause much macroeconomic instability?

You seem to be saying that what’s important is real output while the public is too focused on nominal amounts. If so, isn’t the public allowed to like higher nominal wages and derive value from that? Does the statement that the Fed can’t do much about supply side inflation suggest the Fed can’t do much about real variables?

13. August 2022 at 06:13

Nominal vs. real? Housing prices used to be included in the CPI. Powell increased the Gini coefficient to the highest level in 50 years.

13. August 2022 at 07:12

Bernanke demonstrated how to control housing prices. Banks are not intermediaries.

https://fred.stlouisfed.org/series/csushpinsa

Unless you understand that all monetary savings originate in the payment’s system, you don’t understand money and central banking. It’s the difference between the system vs. an individual bank. If there was only one bank, then the bank would be paying for the deposits that it already owns (and that’s how to look at the system, macro-economics).

13. August 2022 at 08:15

foosion, You asked:

“Does the statement that the Fed can’t do much about supply side inflation suggest the Fed can’t do much about real variables?”

The Fed can make real output more unstable with bad monetary policies.

I’ve posted extensively on the optimal inflation rate. No one knows exactly what it is, but I’m content with something close to 2%

13. August 2022 at 09:38

Reserve Bank credit didn’t peak until April 2022.

https://fred.stlouisfed.org/series/RSBKCRNS

13. August 2022 at 12:04

I’m just waiting for Sumner to lambast Pelosi’s son for failing to publicly disclose his 22M investment in a Chinese tech startup (criminal offense). But are we surprised Sumner ignores that form of corruption?

1. He also has investments in China.

2. He supports the corrupt party establishment and the CCP.

So we’ll get more posts about how terrible Trump is, and more nonsensical Marxist, doublethink and newspeak arguments about why a recession is not really a recession but we won’t hear a peep about the corruption of Biden, Pelosi, McConnel, and the thugs of the establishment. Keep in mind that Sumner has never questioned the definition of a recession in over a decade of writing on this blog, until it became politically expedient a few months ago.

Btw, I highly recommend watching Ted Cruz’s analysis of the banana republic raid on Trumps estate: Cruz goes through the history of how the DOJ negotiates with past presidents over historical documents (very common) and how those documents are generally turned over. The DOJ also asked Obama, Clinton, Bush, Carter, and Ford for their documents, but nobody was raided or prosecuted.

Of course, the delusional Trump haters will do anything to “get him”, including the current attorney general who was a self proclaimed Marxist in the 1970’s. Some delusional trump haters have even called for his execution.

What can we say, other than these people are mentally sick! Let’s hope someone in that administration stops this nonsense, before the country ends up in a civil war.

13. August 2022 at 16:35

Scott, not sure who as worse commenters, you or Marginal Revolution!

13. August 2022 at 17:26

Professor Sumner,

As sneering and rude as Sara’s question was re: nominal wages, it does bring up a question for me that may be dumb. To the extent that wage growth has lagged non-wage inflations over a given period so that goods have become relatively more expensive for the average person, is there any reason to believe that there should be sim “catch-up” wage inflation owed to make up for the loss in living standards? I’m referencing more the case where the goods inflation has been demand driven – I realize there is no reason to expect any catch up for supply shocks, and that any cost of living normalization in that example should come from prices declining.

I’m not sure what kind of demand side intervention would cause the price of goods to rise independently of wages. Maybe some sort of distributional effect from a broad fiscal stimulus/subsidy that is not offset by the Fed?

Separately, very much appreciate your continued posts. I’ve been a long time lurker for years since I was a junior taking macro in college, and your view on the 2008 crisis especially was always very refreshing.

13. August 2022 at 17:35

Ricardo, Yes, Pelosi’s support for the CCP is one of America’s major problems. That’s why she went to Taiwan. Do I need to blog on that even more often?

JMCSF, When I read commenters like Ricardo and George, I sometimes wonder if they are left wingers impersonating Trumpists to discredit Trumpism. They are that dumb.

Kevin, Wages can lag behind due to stickiness. But (as you imply) catchup only occurs for the demand side part of inflation, not supply side inflation.

14. August 2022 at 01:40

Kaboom

https://www.thegatewaypundit.com/2022/08/exclusive-national-archives-media-caught-lie-claim-obama-didnt-keep-classified-docs-evidence-shows-obama-absolutely-no-way-prove-didnt/

We know Obama kept classified documents when he left the White House because the NSC wouldn’t fulfill a request to turn over Susan Rice’s unmasking documents that were moved to Obama’s library.

The fact that they could not be easily obtained indicates they were classified.

The fact they were moved to Obama’s “library” and based on the above, indicates that the National Archives withheld information under their control during the Trump years which was likely a crime.

14. August 2022 at 02:06

The site owner is displaying narcissistic psychopath patterns of engagement.

“Sara, You said:”

“Wages are not growing at 6%.”

“Surely you can understand the difference between nominal and real.”

“LOL, you actually thought I was referring to real wages? Seriously? You thought I was advocating the Fed target real wage growth?”

“You and George make quite a team.”

Look at these smears about what is allegedly in anyone else’s head but the site owner’s own warped dialectic.

By what reason does Sara’s comment have to even be ‘interpreted’ as limited to what must be a description of site owner’s mind as if that is the ultimate datum from which all statements are judged true or false?

Why should “Wages are not growing at 6%” be judged as correct or incorrect by being limited to a description of the site owner’s mind?

Writing ‘seriously?’ as if it is a flaw to see a definition of “wage growth” that is not the site owener’s?

It is true that wages are not growing at 6%, and one does not have to be ‘incorrectly describing site owner’s own mind’ AS IF THAT IS EVEN THE ULTIMATE STANDARD IN THE FIRST PLACE.

If dollars to wages are rising 6%, but dollars paid for consumer prices are rising 9.1%, it is LOGICALLY SOUND to write “Wages are not growing at 6%”. It is NOT an ‘INCORRECT DESCRIPTION OF SITE OWNER’S MIND’ because the statement isn’t a description of the site owner’s mind in the first place! It is Sara’s own thoughts as a description of the reality of wages as it makes the most sense to Sara, and to everyone else who also understands it is a true statement.

Dialectic projection then comes next, ‘truth is what is said (by me) to be truth of what is said, if you can’t align your mind with mine, you’re the problem’.

N.a.r.c.i.s.s.i.s.t

Wages falling 3.1% is a true statement with CPI 9.1% and dollars to wages 6%.

Wages rising 6% is ALSO true, from a definition that lacks the information that makes ‘wages are not growing at 6%’ a true statement.

14. August 2022 at 03:07

I do legitimately think there is a good chance that George and other commentators are left-wing trolls trying to roll-play their idea of dumb right-wing trolls.

14. August 2022 at 04:10

Its possible, but when you go to actual right wing blogs you see the same stuff and it is supported by all of the other right wingers. Come to think of it you could pretty easily cut and paste this stuff so maybe it is is true.

Steve

14. August 2022 at 05:17

“who to trust to adjudicate a truth claim”

Great question of course. No one is my answer. Primarily because most issues are not straight forward demonstrable facts. Pretend Obama’s house was hit with a search warrant and they found a host of boxes with some sheets labeled top secret. Would I automatically believe he was doing something illegal beyond some technicality? Of course not. I would believe nothing—-my bias would be it was political as I believe the same with Trump. Why? Because other than our own biases there is no way we can determine what any of these issues are. Impossible.

All one need do is the classic example of reading about something you are involved with in an article in the press. My experience——which were a handful——was they always had it wrong. To adjudicate the truth one needs to many facts.

Let’s go “simpler”. How many articles have we read about professors being canceled? Maybe too many. But there are almost 4000 accredited colleges in the US. How many of these have a serious issue with cancel culture? I have no idea. For any one single event most facts are not that disputed. But the question in our country is really about the size of the problem of cancel culture. Who can possibly know that?

This does not mean everything is a lie or we may as well read nothing (although I find doing that is useful—-wait a month—-the stories change but the narrative or theme is usually the same.

There are many writers whose OPINIONS I trust are honest opinions. Dozens on right and left. But on “facts”? Who knows. However most issues of facts are not that important. It is the direction of various policies that matter most.

For example, we have had a breakout on Federal spending in excess of tax receipts. Since I believe federal spending (put side transfer payments as a separate category) is an economic drag on society, I believe this is very bad policy. But it is based on a theory. Who has ever written studies that deficit spending is a negative ROI? That is accepted as a fact? I would love to see it.

14. August 2022 at 07:28

https://www.redvoicemedia.com/2022/08/new-yorks-voter-matrix-an-alternate-structure-within-voter-rolls/

Kaboom

14. August 2022 at 07:32

Tacticus: Your latest post is an excuse for you to deflect from the information.

14. August 2022 at 07:48

One expert said he saw this occur in the Middle East. He said the purpose was to “control elections. I never expected to see it in America.”

Sometimes, you run into something so out of place that you have to ask yourself, how did that get there? A boat in the desert, A fossilized battery, crop circles, and now, New York’s voter rolls.

New York Citizens Audit (NYCA) is an all volunteer group of individuals who have been studying the 2020 General Election since last August. After a year’s worth of effort, they have made some impressive findings. They have discovered hundreds of thousands of cloned voter records, examples of identity theft, discrepancies between official vote counts, over a hundred thousand registered voters without an address, and more.

Today, an NYCA representative appeared on True the Vote’s “vital strategy session,” “The Pit,” and dropped something truly strange:

====There is a pattern embedded in the identification numbers assigned to voters.====

How did it get there, and why?

The pattern, dubbed “The Voter Matrix” by NYCA, creates an alternate structure within the voter rolls. The details are complicated but the effect is simple: It makes nefarious manipulation of records possible.

The criminal syndicate’s database has been decoded.

14. August 2022 at 07:56

George, Redvoicemedia? Well, why didn’t you say so!!

14. August 2022 at 08:08

The rate-of-change in long-term money flows, for M2 (mud pie), is c. 20%. The roc in DDs (means-of-payment money), for long-term money flows (proxy for inflation), is 123%.

We don’t have a valid velocity figure since the G.6 release was discontinued. But, historically, such an increase in the primary money supply has led to an acceleration in the transactions’ velocity of money, Vt.

According to:

https://research.stlouisfed.org/publications/research-news/putting-inflation-in-context

Noteworthy: “As the economy and prices recovered, the price increases in March and April 2021 were magnified because of the declines seen in March and April 2020.”

“When you and I studied economics a million years ago M2 and monetary aggregates seemed to have a relationship to economic growth,” Powell said, referring to one main measure of the money in public hands. “Right now … M2 … does not really have important implications. It is something we have to unlearn I guess.”

Powell obviously flunked money and central banking. Nothing’s changed in > 100 years.

14. August 2022 at 10:06

Sumner you have a breathtakingly lazy mind, lol. It’s your dialectic faith messing up your cognition again.

IT’S SOURCED BY A FOIA DISCLOSURE, ALL OPEN SOURCE. It is a reference to information that was disclosed yesterday in Phoenix, AZ, by NYCA.

ANYONE COULD HAVE REPORTED THE SAME INFORMATION FROM SOURCE.

What happens when you can’t attack the message? Attack the messenger!

Truths and Falsehoods are not truths or falsehoods based on the background of the author(s).

How about actually THINKING?

14. August 2022 at 10:48

Commercial bank credit is growing at a 10% y-o-y rate (not easy).

“With outstanding volume still increasing and the Federal Reserve withdrawing as the principal buyer, non-Fed investors will have to

significantly increase their holdings. The orange diamonds in Chart 4 show the maximum share of SOMA-eligible securities held by each investor type since 2000—a realized benchmark for their maximum balance sheet absorption capacity—along with their shares in 2017 and 2022”

https://www.kansascityfed.org/Root/documents/8877/EconomicBulletin22SenguptaSmith0711.pdf

14. August 2022 at 10:50

correction: Commercial bank credit is growing at a 10% y-o-y rate (not tight).

14. August 2022 at 11:10

Imagine someone asked me

“George, where can I learn more about market monetarism?”

And I provided them with the link

wwww.themoneyillusion.com

And then after one minute, I hear the reply:

“The information you provided me I can correctly conclude is false, because Sumner is a ‘leftist'”

By Sumner’s lazy minded logic, he would have to agree his own writings are false, because the background of the author was mentioned and that is sufficient grounds to concluding the information is false.

Self-contradictions abound in the dialectic faith insane asylum.

14. August 2022 at 11:35

These are feds, lol.

https://www.azfamily.com/2022/08/14/armed-trump-supporters-hold-protest-outside-fbi-phoenix-offices-saturday/

14. August 2022 at 15:13

“Don’t you love it when the fact checkers are even further from the “truth” than the people they criticize? I don’t know how many times I’ve seen fact checkers label something false that was actually true.”

The problem with most of the fact checkers that I’ve read, is they don’t limit themselves to only checking facts. If they stuck to exact words (like the famous Brady Bunch episode) they could actually provide a useful service. But they engage in scope creep, such as deciding whether something that is true is misleading – or even worse interpreting the significance of something. There is a place for commentary of course, just don’t call it fact checking.

Fact checking President Biden’s statement is simple. It is undeniably true. He said that for the month of July, inflation was 0%. That simply means for that month, the price index did not increase. The fact that prices increased by 8.5% in the previous 11 months is notable, but does not contradict his statement. Whether that one month figure should be interpreted as significant is a matter of interpretation.

The closest example I can think of is if a person weighed exactly 100 pounds on Aug 1, 2021, then 108.5 pounds on July 1, 2022, then 108.5 pounds on August 1, 2022. If that person said “My weight increase was 0% in July”, they wouldn’t be lying. If someone pointed out they had still gained 8.5% over the past year, that would also be true, but would not make the first statement a lie. The significance of the annual or monthly weight gain is a matter of interpretation, not fact.

What I find most strange about this is I remember learning the difference between fact and opinion in the first grade. Determining whether something is a fact or opinion should be the first step for fact checkers.

14. August 2022 at 18:33

7 images of digital proof NY State voter rolls contain a program to hide (or so they thought) Unique IDs for phantom votes, non-existent votes, COMPLETELY SEVERED FROM POLLING STATIONS, VOTING MACHINES AND BALLOT BOXES.

The ‘keyholders’ determined the outcome of every election in NY.

https://freeimage.host/i/gdjQLP

https://freeimage.host/i/gdjDEF

https://freeimage.host/i/gdjtB1

https://freeimage.host/i/gdjbrg

https://freeimage.host/i/gdjp2a

https://freeimage.host/i/gdjyYJ

https://freeimage.host/i/gdw9kv

14. August 2022 at 20:49

George and Sarah are propaganda trolls. Remember Major Freedom lol. He was one too.

14. August 2022 at 23:52

One of the biggest problems with neo-keynesian economics is the focus on inflation instead of wages. The neo-keynesian Phillips curve is a little bit of a joke. Totally agree that nominal wages are a much better indicator for nominal demand, which is precisely why a nominal wage level target would be an alternative option to nominal GDP level targeting – both are better than inflation targeting.

14. August 2022 at 23:53

One of the biggest problems with neo-keynesian economics is the focus on inflation instead of wages. The neo-keynesian Phillips curve is a little bit of a joke. Totally agree that nominal wages are a much better indicator for nominal demand, which is precisely why a nominal wage level target would be an alternative option to nominal GDP level targeting – both are better than inflation targeting.

15. August 2022 at 04:34

Makes sense: “The gap between gdi and gdp (officially known as “the statistical discrepancy”) is typically about 1%. Since late 2020, however, the discrepancy has been much larger. In the first quarter of this year America’s gdi was fully 3.5% larger than its gdp.”

15. August 2022 at 05:22

Student is PROJECTING their own propaganda trolling, lol, since I am not a ‘propaganda troll’.

When your operating system is logically structured to manage all information as ‘propaganda’, that’s all you can SEE outside yourself.

https://twitter.com/Yolo304741/status/1558888961925324802

15. August 2022 at 05:51

https://twitter.com/ScottAdamsSays/status/1559169950551400451

(For reference, I did not believe A SINGLE ONE of these propaganda psyops, because the entire time I was digging and closely observing the sources of the statements made, and the evidence)

Hey Student, you arrogantly flatter yourself as a ‘propaganda’ expert, enough to smear me as intentionally pushing it, how many of these hoaxes did your groundless ‘dialectic faith’ operating system ‘detect’?

https://i.imgur.com/wr3jzIm.png

Garbage in, garbage out.

15. August 2022 at 05:52

https://twitter.com/ScottAdamsSays/status/1559169950551400451

Which ‘propaganda experts’ fell for these hoaxes?

15. August 2022 at 06:14

When you run the economic engine in reverse, it ultimately breaks, causing first stagflation, then depression.

The transition from the great inflation (the monetization of time deposits) to secular stagnation was due to the DIDMCA of March 31st, 1980.

The error is that banks aren’t intermediaries. All monetary savings originate inside the payment’s system, a shift from DDs to TDs.

Paradoxically, the DIDMCA was in part enacted because of the decline in the ratio of member banks (65%) to nonmember banks and an anticipated decoupling of the money multiplier (where interest rate targeting wouldn’t work?).

15. August 2022 at 11:26

The “end-game” is near. Treasury to do “buybacks”. Operation twist in reverse.

15. August 2022 at 14:36

End game is indeed near.

Massive bombshell news released today. Digital forensics FTW.

US elections data: passwords to machines, RFID codes of the election machines, schematics to the buildings where polls were, information on all the poll workers, WAS TRANSMITTED ONTO CCP CONTROLLED SERVERS IN CHINA.

And the CCP law is that all information coming into China, BECOMES THE PROPERTY OF THE CCP.

You read it here, remember this moment, remember this day.

15. August 2022 at 17:10

What the public cares about are real interest rates. It seems fairly obvious that real interest rates remaining negative for any extended period of time is basically a perversion of everything and results in a warped economy. I think the Fed also understands that negative real interest rates are not justified except in truly existential crises like world wars, hence the effort of some FOMC members to elevate Covid in interviews to make it seem like a legitimate excuse for driving real interest rates so negative. It’s unfortunate because it seems people are coming to realize that this is simply the “new normal”, ie a state of perpetual “crisis” where normalcy and the blue-sky associated with it is actively eschewed by the powerful. I think this will probably be an asterisk to the growth targeting theory, that if maintaining your growth target requires pushing real interest rates below zero then it is probably better to just let gdp fall rather than trying to stay the course. But like the young Icarus it seems that our policymakers are too tempted to resist the allure of the “growth trajectory”.

15. August 2022 at 19:10

Julius, Good points.

Jeff, Have you ever thought of reading the post before commenting?

16. August 2022 at 06:58

Jeff learning really quick on this site that being an independent thinker who is just posting information on how he sees the world, as a gift, an offer, of that information at no cost, to be either accepted or not, free flow or ideas, where he made no offensive comments at all, where it is UNKNOWN whether he read zero or all of the post before commenting, only Jeff knows that, he is met with vicious smears and slanders of wrongdoing from the site owner, as if he ‘insulted’ the site owner’s narcissistic mind for daring to post anything that might in the slightest way differ from the site owner’s mind. How dare anyone post information not in a lock step personality cult!

It’s as if the site owner is imagining his own vicious dialectic back and forth in his own mind as an empirical ‘reflection’ of the patterns in the minds of posters who are only posting their ideas about the world. How dare Jeff write what he thinks about interest rates and the economy! It’s not identical with the site owner’s thoughts! How rude. How offensive!

(Site owner can’t say anything written above is “false”, because according to the site owner truth is merely ‘what people can get away with thinking and saying is truth’, lol, no objective grounding)

16. August 2022 at 07:06

“Trumpistas” are in a “personality cult” because it is offensive and rude that they are not consistent with the site owner’s desired personality cult with himself as cult leader.

Personality cults are logically structured where one person’s thoughts and ideas are to DRIVE APPROVED COMMUNICATIONS of others who are ‘members’ of that personality cult, whereby communications OUTSIDE those approved narrative boundaries are to be squashed/attacked/smeared.

Julius ‘made good points’ because the statements are in exact lock step with the site owner’s personality cult.

Jeff was smeared and slandered because his statements are not in exact lock step with the site owner’s personality cult.

Go back and read Jeff’s innocent post, and then the site owner’s ‘reaction’ post. Who is seeking to implement a personality cult again?

16. August 2022 at 10:42

“he is met with vicious smears and slanders of wrongdoing from the site owner”

🙂

16. August 2022 at 11:15

Hey I did read the post! I was responding the claim about what the public actually cares about. If inflation is 6% but you can get 7% in a passbook savings account, as was the case through a lot of the 70s & 80s, people are going to be a lot more Ok with that than 9% inflation and 0% on savings. Those situations are not comparable. Talking as if all people care about is wages is ridiculous—an absurdly reductive way of treating the massive diversity of financial situations in the US. There is simply a huge gap between what our political leaders want to spend and what our they are willing to levy in taxes, and the Fed and economists have said it is OK to make up for this by robbing Peter to pay Paul, even when there is no pressing crisis, just complacency and entitlement from the politically influential Pauls. So what if it creates jobs? Fed policy added tons of fuel to the crypto dumpster fire, creating jobs in the crypto “industry” and transferring huge amounts of wealth to scammers, but what was the point? It happened largely because average people (correctly) hoped to avoid the massive loss of purchasing power associated with holding USD and us gov-backed securities, and (maybe correctly but often not) were lured in by crypto’s promise of solving this. It seems that is a natural consequence of persistently negative real interest rates—people “invest” in all sorts of things they dont really want which creates lots of distortions and make-work activity.

16. August 2022 at 11:28

“Hey I did read the post!”

Well then sorry for what George calls the vicious smears and slanders!

Seriously, I don’t agree with your comment. Check out my book “The Money Illusion” if you want a different perspective. To begin with, low interest rates are not an easy money policy.

16. August 2022 at 12:17

https://truthsocial.com/@InevitableET/posts/108833000816748376

I legit feel for this guy. I’d bet there are a LOT of Democrats out there who feel the same way but they don’t speak their minds because the left is one gigantic personality cult, with the dialectic faith in ‘the current thing’ rabble roused by their propaganda arm msm, as their true North, and how dare you should you speak out against the current thing, whatever it is:

https://twitter.com/ScottAdamsSays/status/1559175256408895488

You talk against the ‘current thing’ narrative and you’re smeared and slandered as a Russian agent, or a Putin puppet, or a “trumpista”, or a nazi.

(How in the world can Nancy Pelosi LEGALLY accumulate a net worth of $114 million, AND THAT’S JUST WHAT IS PUBLICALLY DISCLOSED, on a lifetime congressional salary of $140k per year? “PAY TO PLAY” and corruption, that’s how!). Now you know why Pelosi is so LOUD about how Trump is so bad. It’s not about Trump’s ‘corruption’, it’s so that you don’t find out about THEIR corruption.

16. August 2022 at 15:11

After deep review, and ‘testing’, I believe Sumner has the best theory on monetary policy in the world.

Yes, y’all read that right.

Call me a troll, call me a personality cultist, but nobody asked me the right questions, not that I am saying I deserved any. But I walked into a snake pit, and yet in that snake pit I see NGDP as the best target for any monopoly claiming to be responsible for the ‘right’ monetary environment.

By best, I mean the least worst out of all ‘fiat’ monetary regimes.

Aggregate nominal demand, the total quantity of spending that occurs over time, should be the main target because recessions and depressions, employment/unemployment, are most tightly correlated with total spending.

It is indeed stupid for aggregate spending to be collapsing, like it did 2008-2009, and to be blind to that and call monetary policy ‘loose’ just because interest rates are ‘low’ or this or that compared to some past point in time. Who gives a shit what interest rates are when COMPANY REVENUES are collapsing and when NOMINAL WAGES are collapsing?

Interest rate manipulation is a TOOL that central banks use, it shouldn’t be a ‘target’ at the expense of NGDP.

And ‘price level’ is asinine. How can you have a UNIVERSAL MEASURE if all you have are individual prices on heterogeneous PHYSICAL objects (goods) or specific services? If t shirts cost $25 and bread costs $5.00, WTF is the ‘price level’ in that economy?

Aggregate spending on the other hand is just the sum total of all payments for everything. That metric IS computable, it’s ‘solvable’ without the cringe ‘hedonic adjustments’ that corruptocrats fudge to produce desired politically expedient outcomes.

I am not here to ‘troll’, I am here because I wouldn’t waste my time on some worthless Keynesian blog of morons. I’m here because ideas are and should be the main concern.

16. August 2022 at 18:57

Prices at Walmart have risen 21% since 2019, and nominal wages have risen about 15%.

That doesn’t sound like prosperity to me.

And the new “inflation reduction act” is quite puzzling. I don’t remember my professor telling the class that printing a trillion dollars would reduce inflation. I must have been asleep during that presentation.

And for the love of god, please just vote republican. At least, until these woke morons are removed from office. Keep taking red pills until AOC is back at the bar, making drinks, where she should be , and/or until Pelosi and the other corrupt octogenarians are gone. I was hoping she would just keep over, but that old woman is as close as you can get to the devil. I wouldn’t be surprised if she was around another twenty years. Her visage, her insider trading, her plastic surgery is disgusting — this woman has the audacity to call China a “great democracy”. She is as drunk on power as anything that has ever walked the halls of congress. I mean, for christ sake just get these people out and then we can talk about the blue pill again.

https://www.zerohedge.com/news/2022-08-16/walmart-grocery-prices-increased-215-between-july-2019-and-july-2022

16. August 2022 at 19:04

Johannes, If you plan to lie, at least make your lies slightly plausible.

16. August 2022 at 22:52

Just wanted to pop in today and annoy Scott again. His favorite Trump hater, Liz “mega corrupt” Cheney has been booted — and hopefully for good.

Your establishment thugs are getting slapped around Scott. Huge win for Trump. Huge win for liberty!

16. August 2022 at 23:00

Link on Marginal Revolution to a wild article about what Argentinians have to do with their money. Since the government has effectively abdicated responsibility for stable monetary policy, people rely on foreign cash–USD and crypto. While I’m still deeply skeptical of crypto I respect that people have to seek out alternatives.

The lesson I’m drawing is that modern humans will always tend to gravitate towards the most stable money types—no matter the format of that money.

In other news, if China has a recession how will that impact our inflation and growth trends? Potentially, it helps us because the stuff we buy from China will get cheaper. For the record, I don’t want any country except Russia to have a recession.

17. August 2022 at 03:29

https://cognitivecarbon.substack.com/p/mongodb-what-is-it-and-how-did-it

17. August 2022 at 03:30

https://uncoverdc.com/2022/08/16/ny-citizens-audit-finds-hidden-infrastructure-in-voter-rolls/

17. August 2022 at 03:55

https://rumble.com/v1g3dd1-ny-citizens-audit-presents-the-spiral-algorithm-in-ny-voter-rolls.html

17. August 2022 at 07:33

A lot of econ professors are like Sumner. It’s their classroom, they make up the tests, they grade the answers (judging rightly or wrongly according to their beliefs).

17. August 2022 at 09:04

The trend in inflation is down (however unacceptable), based on the roc in DDs. But M2/Gross Domestic Product (potential AD) is still too high:

https://fred.stlouisfed.org/graph/?g=eTtE

Stagflation is the most probable outcome.

http://www.shadowstats.com/alternate_data/inflation-charts

” The CPI on the Alternate Data Series tab here reflects the CPI as if it were calculated using the methodologies in place in 1980.”

17. August 2022 at 09:48

https://rumble.com/v1g3dd1-ny-citizens-audit-presents-the-spiral-algorithm-in-ny-voter-rolls.html

“Spiral” algorithm uncovered in NY voter roll database, which was also discovered to be on a CCP server.

1 hour and 50 minutes.

The Great Awakening cannot be stopped.

17. August 2022 at 09:58

“Which person on the internet would you most trust to adjudicate a disputed truth claim?”

It depends on the subject. For general, relatively accessible questions, probably Tyler Cowen. For extremely specialized questions, one would probably need the world’s leading expert or a consensus of leading experts. If they are not known or available, then Tyler Cowen again.

17. August 2022 at 11:26

N-gDp is still too high:

2020-07-01 38.7

2020-10-01 6.6

2021-01-01 10.9

2021-04-01 13.4

2021-07-01 8.4

2021-10-01 14.5

2022-01-01 6.6

2022-04-01 7.8

17. August 2022 at 12:01

Christian List:

“Which person on the internet would you most trust to adjudicate a disputed truth claim?”

By Sumner’s logic the answer is Sumner, lol.

The self-contradictory psychological projection ‘Rorty’ logic is that everybody else would have trouble with what ‘truth’ really means, everybody else would misuse ‘truth’, everybody else would fall prey to one form of cognitive bias or another, everybody else is deterministically constrained to the specific ‘paradigm’ or ‘temporal current thing’ methodology to get to truth, everybody else is OBJECTIVELY DIVIDED from objective truth, and all these asserted truths presented as OBJECTIVE truths ABOUT the language and meaning of truth, we’re supposed to gloss over and not pay attention to, and just ‘trust’ that there is an escape hatch for Sumner who transcends all these deterministic boundaries THAT HIS OWN LOGIC SPEWS OUT, where without any explanation whatsoever he can magically ‘see’ the true truth that is denied to the rest of humanity.

The most succinct definition of a leftist is a liar who wants power.

17. August 2022 at 13:34

I am old, but because I have a modern grandson, I have become exposed to the ‘gamer’ scene.

In the ‘gamer’ scene, there is a typology of players called ‘try hards’.

See the threading from “George” above for an example of this kind of unsportsmanlike and rude behavioral manifestation.

https://www.wordnik.com/words/try-hard

17. August 2022 at 13:40

You gotta wonder how sophisticated/unsophisticated George is, however…For example…has he generated sock puppets here to reply to?

17. August 2022 at 13:51

Ricardo, You say the GOP has become a personality cult? I’m truly shocked. I never saw that coming.

Christian, Good choice.

17. August 2022 at 15:51

Sumner PROJECTING his own ‘personality cult’ logic necessary in the dialectic faith that has caused all communist personality cult regimes from Lenin to Stalin to Mao to Pol Pot to Un?

This question: “Which person on the internet would you most trust to adjudicate a disputed truth claim?”

is a call to settle whose personality should drive a personality cult, because the TRUE answer for ANYONE on who to trust the most….IS THEMSELVES.

17. August 2022 at 15:59

You know how I know Sumner is a personality cult wannabe, while Trump is not?

Trump just ENDORSED A DEMOCRAT.

https://truthsocial.com/@realDonaldTrump/posts/108840495517174073

The ONLY way Sumner can prove he is not a personality cultist, is to endorse and support a Republican, which he’ll never do because HE is the cultist, lol

17. August 2022 at 16:14

How in the world did Liz Cheney accumulate $36 million in just 6 years as a politician?

All the yahoos who called for auditing Trump’s tax returns, a billionaire who gave it all up to become a politician who gave his entire salary away to charity, are completely silent on auditing those who became millionaires AFTER being elected, like Pelosi, Waters, Warner, etc, etc, etc.

Oh haha, Trump just ENDORSED ANOTHER DEMOCRAT, this time Dan Goldman,

https://truthsocial.com/@realDonaldTrump/posts/108840459246343661

18. August 2022 at 08:14

Given an injection of new money, it takes 24 months for inflation to recede from its initial impact (provided the FED doesn’t “cave in”).

Given that the roc in real output is 10 months, a deceleration in money flows impacts R-gDp more so than inflation. That’s how you get a recession. It’s just math.

18. August 2022 at 09:49

Link: “HOUSING IS THE BUSINESS CYCLE” Edward E. Leamer

https://www.nber.org/system/files/working_papers/w13428/w13428.pdf

Problem is, like the GFC, a deceleration in new residential housing exacerbates the existing housing shortage. So existing sale prices are given new support.

“Even before the pandemic, in 2019, the U.S. was short 3.8 million homes — both places to rent and places to own”.

The economy is being run in reverse. Lending/investing by the Reserve and commercial banks is inflationary (increases the volume and turnover of new money). Whereas lending/investing by the nonbanks is noninflationary, other things equal (results in the activation of existing money).

The 1966 Interest Rate Adjustment Act is prima facie evidence.

18. August 2022 at 11:03

https://www.thegatewaypundit.com/2022/08/prominent-podcaster-sam-harris-admits-conspiracy-prevent-trump-presidency-warranted-not-cared-hunter-hid-corpses-children/

18. August 2022 at 13:26

H.R.4616 – Adjustable Interest Rate (LIBOR) Act of 2021

https://www.congress.gov/bill/117th-congress/house-bill/4616/text

Maybe partially responsible for the $’s rise, as the E-$ market contracts.

U.S. Dollar Index (DXY)

Last Updated: Aug 18, 2022 at 5:15 p.m. EDT

107.50

0.92 0.86%

PREVIOUS CLOSE

106.57

19. August 2022 at 08:50

re: “wages are probably a better indicator of demand-side inflation than is inflation itself”

That may be true in the past, but not the future. Wouldn’t wages be considered a supply-side problem if there are not enough workers?

The unemployment rate is always going to be “too low”. See: “The Great Demographic Reversal” by Charles Goodhart and Manoj Pradhan.

19. August 2022 at 09:07

Excellent read:

https://www.liberalcurrents.com/a-realist-defense-of-legislative-supremacy/

“ A Realist Defense of Legislative Supremacy” by (Neoliberal) Adam Gurri

19. August 2022 at 09:09

That essay above reminded me of this essay attacking Bill Barr’s enthusiastic support for executive supremacy (as opposed to legislative supremacy):

https://slate.com/news-and-politics/2019/11/barr-speech-federalist-society-impeachment.html

19. August 2022 at 11:40

NAHB: “Rising mortgage rates, high inflation, low existing inventory and elevated home prices contributed to housing affordability falling to its lowest point since the Great Recession in the second quarter of 2022.”

The misallocation and maldistribution of credit is due to bad policies. QE in conjunction with the payment of interest on interbank demand deposits artificially depresses real interest rates (artificially boosting asset prices). It also takes increasing infusions of Reserve Bank credit to generate the same inflation adjusted dollar amounts of gDp.

It’s no happenstance. The banks are custodians of stagnant money. Unless bank-held savings are expeditiously activated, put back to work in the circular flow of income, a dampening economic impact is generated (secular stagnation). It’s stock vs. flow. All bank-held savings have a zero payment’s velocity. Banks aren’t intermediaries. Banks, as a system, don’t lend deposits. Deposits are the result of lending. An increase in bank-held savings shrinks gDp.

20. August 2022 at 05:17

https://i.imgur.com/0cb9VGl.jpg

20. August 2022 at 05:32

Having said that I think Barr is a coward. Even a DC court called him out. The memo Barr hid from public disclosure shows Trump did not ‘obstruct justice’.

20. August 2022 at 05:44

https://i.imgur.com/15z7Bf9.jpg

https://i.imgur.com/0AeNb9b.jpg

Communist WEF suggests we need to start thinking in terms of “mental wealth” and “mental capital.”

They’re seeking to turn people’s minds into commodities.

Karl Marx believed communist utopia would occur after EVERYTHING is turned into a commodity, maximum privitisation (with global ‘elite’ as owners) is the goal, and FAITH IN A DIALECTIC OF NATURE to magically turn maximum depravity into maximum ‘freedom’ without any human input is the logic.

How’d that turn out in USSR? Maoist China? Pol Pot Cambodia?

https://i.imgur.com/5erdQKD.jpg

They broke millennials on purpose.

20. August 2022 at 06:07

For the first time in my life, there is not a single elected Bush, Cheney, Obama, Clinton or McCain in office.

YES!

20. August 2022 at 06:17

Senate Majority Leader Chuck Schumer openly threatened President Trump for defending the American people against their corrupt intelligence agencies with the statement:

“Let me tell you, you take on the intelligence community, they have six ways from Sunday at getting back at you…So even for a practical, supposedly hard-nosed businessman, he’s being really dumb to do this”

—a threat quickly followed by the entire American intelligence establishment unleashing an army of “Trump Destroyers” to bring President Trump down—the main one being CIA operative Peter Strzok, who still to this day is said to have been an FBI official, but whose true facts about reveal:

There is no evidence that Peter Strzok ever worked or served in any FBI field office…Nor is there any evidence that Strzok attended the FBI academy in Quantico, Virginia…There is no evidence Strzok ever graduated from Quantico…Strzok’s history shows that he left the Army and was immediately assigned to the White House to personally work for President Bill Clinton and his wife Hillary Clinton.

Was Trump keeping declassified documents (that as Chief Executive he has constitutional authority to declassify) at Mar-A-Lago proving the truth about CIA operative Peter Strzok, and that’s why the FBI raided his home? The FBI UNIT that launched “Operation Crossfire Hurricane” to falsely smear Trump as ‘colluding with Russia’ (before Mueller report exonerated him of that false charge) was the SAME FBI UNIT that raided his home. Coincidence? We know the judge who signed the warrant is an Obama donor who used to be a defense lawyer for Epstein’s child rape accomplices. Coincidence?

20. August 2022 at 07:07

If you look at Danerics Elliott Wave analysis, you’ll see that we just completed wave 2 (after the Grand Super Cycle). So, look forward to limit down days (wave 3).

20. August 2022 at 09:33

Outside money vs. inside money. Commercial bank credit continues to increase at an increasing rate of change. The last bottom in the 10mo roc was on 2/3/2021 15171.18 @ 0.020. The last bottom in the 24mo roc was on 1/13/2021 15075.43 @ 0.145.

Today the 10mo roc is @ 8/10/2022 = 0.073. Today the 24mo roc is @ 8/10/2022 17325.32 = 0.161

The FED is not tight. The FOMC’s proviso “bank credit proxy” used to be included in the FOMC’s directive during the Sept 66 – Sept 69 period.

“1966 A new measure, the bank credit proxy, was developed during the year in order to get current information about the operating guide more frequently. This measure infers changes in member bank loans and investments (assets) from changes in member hank deposits (liabilities). Deposit data are available weekly on a daily average basis, whereas bank credit data are available less frequently.”

Today, back credit (asset growth) is published more frequently.

20. August 2022 at 10:42

I’ve been watching the big shift in the Hispanic vote and there is definitely some Higher prices + wage pressure from illegals in both FL and TX. This is probably true with a decent amount of low-skilled whites as well.

But with Hispanics I’d still put the bulk of it on culture, Latin-X and gender stuff has pushed them over the edge, they no longer report themselves as “Hispanic” they ALL call themselves “White” now.

Hispanics in the fastest growing states are the fastest growing population and they are majority GOP voters.

Scott, I was hoping the raid wouldn’t such a flameout, that Dems seemed more serious, bc I wanted Trump to decide he’d trade not running for POTUS to be Speaker of House 2023-24. It doesn’t look like I will be so lucky.

My 4D conspiracy theory is the flipside of yours, I think the smart Dems want Trump as the candidate.

21. August 2022 at 05:49

The problem is that the FED’s Ph.Ds. in economics don’t know money from liquid assets. Banks are not intermediaries.

Take the Depository Institutions Deregulation and Monetary Control Act of 1980 history.

Depository Institutions Deregulation and Monetary Control Act of 1980 | Federal Reserve History

It says: “So, banks and other traditional types of depository institutions were at a severe disadvantage in attracting deposits compared with less-regulated competitors, such as money market mutual funds.”

And: “Other depository institutions, such as savings and loans and credit unions, whose deposits are also part of the money supply, were not subject to the Fed’s reserve requirements.”

Neither is true. Both the MMMFs and “other depository institutions” are customers of the DFIs.

21. August 2022 at 10:33

MMT shows that the natural rate of interest is zero. Interest rate setting is an artificial intervention in the market that tries to centrally plan the quantity of domestic credit.

Like all central planning, it fails. The people running the regime aren’t clever enough, or responsive enough.Y

22. August 2022 at 05:19

Shot:

https://www.nytimes.com/2022/08/19/technology/tiktok-browser-tracking.html

Chaser:

https://www.thegatewaypundit.com/2022/08/exclusive-joe-biden-enlists-china-owned-tiktok-partner-federal-voting-assistance-program-2022-midterm-elections/

22. August 2022 at 06:10

https://www.politico.com/magazine/story/2017/05/07/presidential-libraries-are-a-scam-could-obama-change-that-215109/

One method to discern what the radical left is guilty of themselves, is to see what they criticize their ‘opponents’ of allegedly doing.

The Obama Presidential Library (PL) is unlike all past libraries: Deliberately firewalled from the federal government.

Why? TO HIDE INFORMATION ON CRIMINAL, TREASONOUS ACTIVITIES of course.

Obama’s PL is still devoid of any digitization as promised, almost 5 years after he left office.

33 million documents STILL BEHIND INFORMATION FIREWALL.

“Most transparent admin ever” was constantly parroted by the useful idiots.

The same FBI unit that launched the false, phony ‘Russia collusion’ smear of Trump with the ‘Operation CrossFire Hurricane’ narrative is the SAME FBI unit that raided the home of Trump. Coincidence? The same ‘magistrate’ judge that signed off on the search warrant is the same person who was defense counsel for Jeffrey Epstein’s child rape accomplices. Coincidence?

Meanwhile ‘useful idiots’ are foaming at the mouth SUPPORTING the gestapo FBI unit. Why? TDS.

22. August 2022 at 06:13

The Ph.Ds. in economics don’t know a debit from a credit.

AD = M*Vt

See: Toward a More Meaningful Statistical Concept of the Money Supply

Leland J. Pritchard

The Journal of Finance

Vol. 9, No. 1 (Mar., 1954), pp. 41-48 (8 pages)

Mutual Savings Bank deposits were misclassified.

“that savings deposits in mutual savings banks have the “store of purchasing power” quality of money, and have approximately the same relationships to the means-of-payment money supply as do time deposits in commercial banks or deposits in the postal savings system”

After the DIDMCA, the correspondent balances of the S&Ls and CUs were misclassified. And large time deposits are excluded.

Economists don’t know money from mud pie.

Why do you think the money stock is no longer considered important?

“Over recent decades, however, the relationships between various measures of the money supply and variables such as GDP growth and inflation in the United States have been quite unstable. As a result, the importance of the money supply as a guide for the conduct of monetary policy in the United States has diminished over time.”

https://www.federalreserve.gov/faqs/money_12845.htm

Dan Thornton is correct. “Money Supply and Inflation: Where’s the Proof?” WSJ July 21, 2022

The decoupling started after the DIDMCA. See: See: New Measures Used to Gauge Money supply WSJ 6/28/83. Neither William Barnett nor Paul Spindt, nor the St. Louis Fed’s technical staff in 2008 got it right:

“Although the evidence is mixed, the MSI (monetary services index), overall suggest that monetary policy *WAS ACCOMMODATIVE* before the financial crisis when judged in terms of liquidity”

And income velocity is a contrived figure. Friedman: “as income velocity that cannot but impress anyone who works extensively with monetary data” (Friedman, 1956, p. 21).

Or (WSJ, Sept. 1, 1983)

Friedman bastardized the equation of exchange that he had printed on his car license plate. The transactions’ velocity of money has sometimes moved in the opposite direction as income velocity, as in 1974-1975 or 1978.

re: “the ‘mystery of the missing money’ (Goldfeld et al., 1976).

The transactions velocity of money was a statistical stepchild. I.e., virtually all the demand drafts that were drawn on DFIs, the CUs, S&Ls, etc., cleared through DDs – except those drawn on MSBs, interbank & the U.S. government. That is all “new payment methods” clear through transactions’ deposits.

Vt, the transactions’ velocity of circulation, is an “independent” exogenous force acting on prices.

The G.6 release fell to President Bill Clinton’s “Paperwork Reduction Act of 1995”: From the Federal Register: “The usefulness of the FR 2573 data in understanding the behavior of the monetary aggregates has diminished in recent years as the distinction between transaction accounts and savings accounts has become increasingly blurred”.

The G.6 was discontinued at the same time it was needed (to reflect asset inflation). Bank debits reflect both new & existing residential & commercial real-estate sales/purchases. As such the housing boom/bust would have stuck out like a sore thumb.

And we knew this already:

In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7 year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal”

its 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

22. August 2022 at 06:28

The reason for the disconnect in money was the end of the “monetization of time deposits” (the gradual un-gating of savings deposits climaxed in 1981).

As Dr. Philip George says in his “The Riddle of Money Finally Solved”:

“For nearly a century the progress of macroeconomics has been stalled by a single error, an error so silly that generations to come will scarcely believe that it could have persisted for as long as it has done.”

In “The General Theory of Employment, Interest and Money”, John Maynard Keynes’ opus “, pg. 81 (New York: Harcourt, Brace and Co.), gives the impression that a commercial bank is an intermediary type of financial institution (non-bank), serving to join the saver with the borrower when he states that it is an “optical illusion” to assume that “a depositor & his bank can somehow contrive between them to perform an operation by which savings can disappear into the banking system so that they are lost to investment, or, contrariwise, that the banking system can make it possible for investment to occur, to which no savings corresponds.”

In almost every instance in which Keynes wrote the term bank in the General Theory, it is necessary to substitute the term non-bank in order to make his statement correct, viz., the Gurley-Shaw thesis, the DIDMCA of March 31st, 1980, which directly caused the S&L crisis, the remuneration of interbank demand deposits.

22. August 2022 at 06:33

The disconnect was predicted.

See: “Should Commercial Banks Accept Savings Deposits?” Conference on Savings and Residential Financing 1961 Proceedings, United States Savings and loan league, Chicago, 1961, 42, 43.

“Profit or Loss from Time Deposit Banking”, Banking and Monetary Studies, Comptroller of the Currency, United States Treasury Department, Irwin, 1963, pp. 369-386

Princeton Professor Dr. Lester V. Chandler, Ph.D., Economics Yale, theoretical explanation was: 1961 – “that monetary policy has as an objective a certain level of spending for gDp, and that a growth in time (savings) deposits involves a decrease in the demand for money balances, and that this shift will be reflected in an offsetting increase in the velocity of demand deposits, DDs.”

Thus, the saturation of DD Vt (end game) according to Corwin D. Edwards, professor of economics. [Edwards attended Oxford University in England on a Rhodes scholarship and earned a doctorate in economics at Cornell University. He spent a year teaching at Cambridge University in England in 1932. He taught at New York University in 1954, the Chicago School from 1955-1963, the University of Virginia, and the University of Oregon from 1963-1971.]

Edwards: “It seems to be quite obvious that over time the “demand for money” cannot continue to shift to the left as people buildup their savings deposits; if it did, the time would come when there would be no demand for money at all”

Chandler’s conjecture was correct from 1961 up until 1981. The S-Curve” hybrid dynamic damage (sigmoid function) in money velocity, was completed by the first half of 1981.

Professor emeritus Leland James Pritchard (Ph.D., Chicago Economics 1933, M.S. Statistics) never minced his words, and in May 1980 pontificated that:

“The Depository Institutions Monetary Control Act will have a pronounced effect in reducing money velocity”.

22. August 2022 at 06:42

I earlier suggested the hypothesis (based on walking around observations) that some of the wage growth is a systemic adjustment (triggered in part by Covid) whereby lower wage earners are gaining relative to higher wage earners.

Take a look at the data from the Atlanta Fed and select “College Degree” and “Paid Hourly”

https://www.atlantafed.org/chcs/wage-growth-tracker

At the margin (new hires), the delta is probably significantly higher.

22. August 2022 at 08:08

dtoh, Yes, lower paid workers have gotten bigger raises, but that doesn’t cause higher overall wage growth. We still have excessive demand.

22. August 2022 at 08:49

There’s a difference between outside money and inside money.

https://fedguy.com/fed-balance-sheet-faqs/#comment-29227

This is the current path of DDs:

01/1/2022 ,,,,, 1.887

02/1/2022 ,,,,, 1.951

03/1/2022 ,,,,, 2.082

04/1/2022 ,,,,, 1.660

05/1/2022 ,,,,, 1.403

06/1/2022 ,,,,, 1.327

07/1/2022 ,,,,, 1.256

08/1/2022 ,,,,, 1.234

09/1/2022 ,,,,, 1.243

10/1/2022 ,,,,, 1.157

11/1/2022 ,,,,, 1.142

12/1/2022 ,,,,, 0.907

01/1/2023 ,,,,, 0.579

02/1/2023 ,,,,, 0.573

03/1/2023 ,,,,, 0.515

Based on the distributed lag effect of money flows, the volume and velocity of money, long-term money flows (means-of-payment money) are decelerating (proxy for inflation).

22. August 2022 at 12:49

BLS: “From July 2021 to July 2022, real average hourly earnings decreased 2.7 percent, seasonally adjusted. The change in real average hourly earnings combined with a decrease of 0.9 percent in the average workweek resulted in a 3.5-percent decrease in real average weekly earnings over this period.”

Just like in the Great Depression, payrolls must be sufficient to buy the goods and services produced – at the asked prices.

23. August 2022 at 13:12

Scott,

I’m not sure it’s all that helpful to characterize inflation as an either or phenomena (either excessive demand OR inadequate supply.) There can be some of both, it’s not necessarily consistent across all factors of production, and it can be caused by either movements along the curves or shifts of the curves.

It’s a multi-variable problem and I think it’s helpful to our understanding of the problem to try to understand each of the variables.

Given that wage increases are particularly high for low wage workers and given that the LFPR has not recovered, I’m inclined to believe that a shift in the supply curve for certain sectors of the labor market is a partial (and perhaps significant) cause of the current inflation.

23. August 2022 at 13:19

@Spencer

> Just like in the Great Depression, payrolls must be sufficient to buy the goods and services produced – at the asked prices.

Or there must be an increase in business investment, or consumer credit, etc., etc.

And also, while average real wages have declined, you have to look at the distribution of that decline. If the decline is concentrated in high wage workers who have a high marginal propensity to spend and lower wage workers have seen real wage increases, then it is certainly theoretically possible for consumer spending (in real terms) to be increasing even while average real earnings are decreasing.

23. August 2022 at 13:22

@Spencer

Correction..

“who have a high marginal propensity to spend” should read..

“who have a high marginal propensity to save”

24. August 2022 at 09:05

dtoh, You said: “I’m not sure it’s all that helpful to characterize inflation as an either or phenomena (either excessive demand OR inadequate supply.) There can be some of both”

I’ve devoted much of my career to making exactly that point.

This inflation involves some of each. Low wage pay increases are partly a sectoral issues, the overall rise in all wages is almost all excessive AD.

24. August 2022 at 16:32

Scott,

“the overall rise in all wages is almost all excessive AD.”

So how does that comport with the low LFPR number. Maybe I’m not correctly understanding what you mean by excessive AD. Excessive relative to the pre-Covid labor market or excessive relative to the current decreased supply of labor? And if the latter, is it better to characterize it as excessive demand or to characterize it as inadequate supply?