Does monetary policy “cause” changes in NGDP?

Suppose that there are 6 ways the government could have prevented the 2008 financial crisis. One might be abolishing moral hazard (FDIC, TBTF, the GSEs, etc.) Another might have been to ban subprime mortgages made with taxpayer-insured funds. Another might have been higher capital requirements. Another might have been to require bankers to post personal bonds in case their bank failed (or needed to be bailed out), like on the old days. Another might have been NGDPLT. Etc., etc. In that case one might argue that failure to do one of those things “caused” the crisis. Of course there are many ways of thinking about causation, but I find policy counterfactuals to be one of the most useful ways of describing causation.

Before considering whether money causes NGDP, I like to consider some related questions.

1. I would argue that between 1879 and 1968 monetary policy “caused” the price of gold. For most of the period the price was fixed by the monetary policymakers. But even in 1933-34, when the price rose sharply, I’d argue it was “caused” by monetary policy, in the sense that the Fed was targeting the price of gold. In contrast, the Fed was not targeting the price of gold in recent years, so the increase was not caused by the Fed in any useful sense of the term ’cause.’

2. So if the Fed targeted gold prices from 1879-1968, does that mean other variables like the price level and NGDP were endogenous, and hence not caused by the Fed? It’s debatable whether they were completely endogenous, but let’s say they were. I’d still argue that the sharp decline in the price level and NGDP during 1929-33 was caused by the Fed. And that’s because I’d argue that gold price targeting was not a wise policy, and that a desirable counterfactual policy would have been to stabilize either the price level of NGDP during 1929-33. The Fed’s failure to do so caused the Depression.

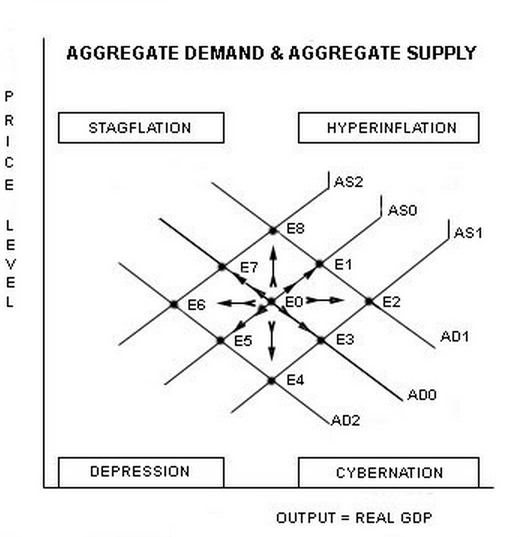

3. Now suppose the Fed is targeting inflation. In that case any change in RGDP growth will lead to an equal change in NGDP growth. Changes in NGDP will have nothing to do with monetary policy. Or at least it seems that way. But not necessarily. Suppose inflation is a bad target, because labor market instability (due to sticky nominal wages) and debt market instability (due to nominal debts) is much more closely related to NGDP fluctuations than to inflation fluctuations. In that case a central bank that is targeting prices could be said to have “caused” a deep recession by letting NGDP fall, even if it was hitting its inflation target perfectly, and RGDP was falling for other reasons. Of course it’s debatable as to whether its useful to consider the central bank to be to blame for the deeper recession, but it’s certainly not implausible, and indeed is the prediction of the standard AS/AD model used in econ textbooks. In the graph below when you are targeting P and there is a negative supply shock, then NGDP will fall. In that case you go to point E6, a deep recession. If you were targeting NGDP when this supply shock hit, you’d have a mild recession (E7) .

.

It’s certain fair game to blame the Fed for depressing AD in response to a negative supply shock, even if 100% of the fall in NGDP is “caused” by a fall in RGDP.

Nominal GDP growth is the sum of a real and a nominal variable; real GDP growth and inflation. And yet (paradoxically) NGDP growth is a 100% nominal variable, completely under the control of monetary policymakers. Whether it is useful to think in terms of NGDP fluctuations “causing” recessions depends on how you think the business cycle would be affected by a counterfactual policy of NGDPLT.

Similarly, changes in the nominal price of a gold (a 100% nominal variable) are the sum of a nominal and a real variable (inflation, and changes in the relative price of gold.) In 1933-34 it was useful to think of the rising price of gold at an indicator of easy money. More recently (in the early 2010s) it was not useful to think in terms of the rising price of gold as indicating an easy money policy. In 1933-34 the price of gold was used as a signaling device for the future path of monetary policy. That was not true in 2010-12. I’d like to use some of these ideas to analyze part of a Tyler Cowen post from a couple years back:

My worry is that some Market Monetarists speak of ngdp as if it is some block of stuff, handed down from on high (of course in the past our central banks have not been targeting ngdp). It’s as if ngdp determines the size of the room, and a carpenter is then asked to build a house within that room. If the room is too small, a large house cannot be built. Or, if you are not given enough clay, you cannot build a very large sculpture. Along these lines, if the growth path of ngdp is not robust enough, the economy cannot do well.

I get nervous at how ngdp lumps together real and nominal in one variable, and I get nervous at how the passive voice is applied to ngdp.

My framing is different. My framing is that the private sector can manufacture its own ngdp. It can do so by trade and it can do so by credit and of course velocity is endogenous to the available gains from trade. Most of the major central banks are, today, not obsessed with snuffing out recovery and increases in real output.

The value of money can be defined in terms gold, other currencies, all goods and services, and share of NGDP that can be bought with a dollar. These all involve an inverse relationship; 1/Pgold, or 1/price of foreign currency, or 1/price level, or 1/NGDP. Thus NGDP can be viewed as a single thing (one way of describing the value of money), or of course it can also be viewed as a composite (P and Y, or M and V). If someone is used to viewing policy in terms of money supply targeting, or price level targeting, then an NGDP discussion can seem odd—adding together two very different things. As I said, if you target P (or M) then NGDP will seem to fluctuate due to “non-monetary factors” like supply shocks (or V shocks.)

But that tells us nothing about whether it is useful to think in terms of NGDP being causal, i.e. whether NGDPLT is a useful policy counterfactual. So while Tyler’s argument is defensible, the average reader would probably assume that Tyler has spotted a logical error in the NGDP fanatics, which is actually not there. (In fairness, elsewhere he explicitly denies doing so.)

Go back to the opening analogy in this post. I favor eliminating moral hazard. But it wouldn’t be fair of me to accuse someone who favored higher capital requirements for banks as having ignored the real cause of banking crisis. At best I could argue my solution was more useful. Perhaps Tyler should have discussed which alternative monetary policy targets are the most useful. The commenter who sent me this post thought (probably wrongly) that Tyler was criticizing NGDPLT. I don’t see that. He was claiming it’s not the cure-all some of its proponents seem to think it is.

To say “ngdp is low,” or “ngdp is on a low growth path,” or “ngdp is below trend,” and so on “” be very careful! Those claims do not necessarily have causal force. Arguably they are simply repeating, in a new and somewhat different language, the point that the private sector has not seen fit to engage in more trade, credit creation, velocity acceleration, and so on. Formally speaking, the claims are not wrong, but I don’t find them useful as an explanation for why economic growth or recovery, at some point in time, is slow. It is one way of repeating or re-expressing the slowness of economic growth, albeit with some transforms applied to the vocabulary of variables.

This paragraph touches on both the “causality” and the “usefulness” perspectives I discussed earlier, but in what seems to me to be a somewhat unsatisfactory fashion. Start with the final two sentences. He’s saying that by 2012 enough time had gone by so that wages and prices should have adjusted. That’s an eminently plausible argument. The final sentence can be thought of as an alternative hypothesis. Say we are targeting P or M, and output is slowing for Great Stagnation reasons. In that case NGDP will also slow (or might slow in the M targeting case) and MMs like me might wrongly attribute the slowdown in RGDP to a slowdown in NGDP. And that’s certainly possible.

When Tyler wrote the post the most recent reported unemployment rate was 8.1%, for August 2012. Now it’s 5.9%. I believe the most useful explanation for that sharp fall is that NGDP has been rising faster than nominal wages in the US. Tyler says central banks were not trying to snuff out the recovery. But we do know that in 2011 the Fed was trying to speed up the recovery while the ECB was trying to reduce inflation by raising their target interest rate. And we know that NGDP in 2011-13 grew much more slowly in the eurozone than the US. And we know that unemployment rose sharply in the eurozone, while it fell sharply in the US. So while Tyler is right that movements in NGDP need not have any causal effect on RGDP, I believe that it just so happens that we live in a universe where it does have a causal effect, or at least that it is useful to talk in terms of causal effects from NGDP.

This matters when we consider sticky nominal wages. Sometimes it is suggested that the “inside workers” have frozen up or taken up so much ngdp with their sticky wage demands that the outsiders cannot find the ngdp to fuel their activities. It’s as if there is not enough ngdp to go around, just as there was not enough clay to make a sufficiently large sculpture.

Yes, workers and firms can behave in a way that overcomes any shortages of NGDP. Indeed Tyler and I agree that in the long run they WILL behave in a way that overcomes any shortage of NGDP. But these metaphors are expressed in a slightly misleading way. The average reader would have a great deal of trouble figuring out whether Tyler is expressing a new classical argument that nominal shocks don’t matter, and that real GDP is determined by real factors, or a NK/monetarist argument that nominal shocks matter in the short run but not the long run, and that September 2012 is now the long run, or the hybrid theory that nominal shocks might matter in the short run, but not if the short run NGDP changes are caused by real factors such as less aggregate supply. A close reading of his other posts shows he believes the nominal shocks matter in the short run, but many of the (skeptical) NGDP metaphors employed here are also applicable to the short run. Do they apply to a case where AS and AD are entangled?

So for instance, suppose a central bank is targeting inflation. Then suppose an adverse supply shock reduces RGDP by two percent in the short run, even in the best of circumstances (i.e. stable NGDP). But also suppose that NGDP falls with the supply shock (as Tyler correctly noted might happen.) My claim is that in that case RGDP would fall by more than 2%, perhaps 4%. What does Tyler believe? The metaphors he employs seem to suggest that he is skeptical of this claim, but elsewhere he argues that nominal shocks do matter in the short run, so falling NGDP should make the recession worse.

PS. Two years ago I did a post in response to this same Tyler Cowen post. I did this post without looking at my earlier post, and ended up with something very different. Maybe in two more years I’ll do a third.

PPS. I do agree with Tyler that framing effects are important. In microeconomics there is one dominant framing method, and hence you don’t see as many cases of microeconomists who are Nobel Prize winners call each other idiots as you do in macro, where different framing effects lead to almost a complete failure of communication.

PPPS. Election today? All I care about are the referenda. Both major parties have sharply declined in quality over the past 20 years. Both deserve to lose.

Tags:

4. November 2014 at 08:54

Scott,

I appreciate this post. Thank you.

Have you had a chance to digest Bill Gross’s comments? His argument is deflation is inevitable without deficit spending

“The real economy needs money printing, yes, but money spending more so, and that must come from the fiscal side – from the dreaded government side – where deficits are anathema and balanced budgets are increasingly in vogue. Until then, Grant’s deflation remains a growing possibility – not the kind that creates prosperity but the kind that’s the trouble for prosperity.”

https://www.janus.com/bill-gross-investment-outlook

Your and Krugman’s argument is that sufficient stimulus can produce escape velocity for an economy mired in a structural mess. The disagreement is on the nature of the stimulus. Gross is saying monetary stimulus is helpful but that fiscal stimulus is more real.

I believe Gross finds the right nut but he fails to crack it. The nut is a broken economy that needs to be restructured. Or, as Gross explains:

“Having created outstanding official and shadow banking credit of nearly $100 trillion with an average imbedded interest rate of 4% to 5%, the Fed presses must crank out new credit (nominal growth) of approximately the same 4% to 5% just to pay the interest rate tab.”

If Gross’s numbers are correct then 5% NGDP growth is insufficient to grow the economy. Unless or until, that is, the embedded costs of the economy are removed. But, as Summers argues, monetary stimulus has first effect of sustaining the status-quo and thus it delays reform.

Would you be willing to make explicit the requirement for structural reform in order for monetarism to have more than a temporary impact?

4. November 2014 at 09:16

With oil crashing, I believe the Fed should target 2% headline inflation just like they did in 2008. Five trillion QE tomorrow!!!

4. November 2014 at 09:54

Scott,

I like how you started out this post listing all of the possible things that might have “prevented” the Great Recession in addition to “Another might have been NGDPLT. Etc., etc..” I think you’ve identified many of the candidates and have apparently, with the etc., etc., acknowledged that there may be others.

It is not clear to me whether, in your view, “causation” and “prevention” are mirror images. In other words, if monetary policy could have “prevented” the recession, could you just as well have stated that monetary “caused” the recession? It appears this is the case due to your discussion of the “cause” of the Depression, and this is certainly what I gather from most of what I’ve read here about your views of the latest recession.

The technical details of your following argument aside, your view of “causation” and “prevention” seem rather (too) exclusive–in your discussion of these matters you seem to leave room for only one possible thing “causing” recessions and one possible thing “preventing” recessions, and perhaps, one possible thing getting us out of recessions. All of this, rather predictably, leads to NGDPLT.

Is the world and the economy that simple? Does your view of “causation” preclude the possibility that for any given recession there may be several “causes”? In the latter case, might one better refer to “contributing factors” (perhaps allowing also for major factors and minor factors), rather than merely “*the* cause”? Sorting out causation, much less accurately describing the phenomenon (or phenomena) is tricky business. Still, I often think that you are prone to overstating your cases, and in doing so you may unnecessarily get more critics than you really deserve. Many, including Vivian, might well agree that monetary policy may be *a* cause”, etc., but disagree that it is *the* cause.

4. November 2014 at 10:07

As I’ve asked before–here, and elsewhere–if the federal government had never insisted that home loans be made to people who probably couldn’t service them, caeteris paribus,(if, as prior to the 1990s, all home loans had been made to people who made 20% down payments and had traditional good credit reports)would there have been a financial crisis in the first place?

4. November 2014 at 10:10

movements in NGDP need not have any causal effect on RGDP

I don’t see how anyone can dispute that. Suppose the Fed targeted a 10% reduction in NGDP next year. Does anyone seriously think there could be no effect on RGDP?

Dan W — “deflation is inevitable without deficit spending” is a silly argument fron every angle . CBs can inflate whenever they decide to, and if government could allocate resources more effectively than markets we’d all have converted to Communism by now.

4. November 2014 at 10:13

My first thought on reading point #1 was (foolishly)… how on earth can monetary policy “cause” the price of gold? Gold is a real thing with a real value.

But in thinking more… of course the value of gold *expressed in dollars* depends both the real value of gold (which is not directly affected by monetary policy) and on the value of the dollar (which is wholly dependent on monetary policy). Targeting the dollar price of gold works not by manipulating the value of gold but by manipulating the value of the dollar.

4. November 2014 at 10:18

Dan, Big deficits prevent deflation? Obviously Bill Gross has never heard of a place called “Japan.”

Vivian, Not quite sure why you read the post that way. I repeatedly say there are multiple causes, and indeed the intro was designed to drive home that point. What did you think I was trying to accomplish with the intro?

Again, I’m a pragmatist, and I focus on the easiest way to prevent problems. The most reliable methods. For some problems that’s NGDPLT. For others it isn’t. NGDPLT is not the most reliable way to prevent financial crises, for instance. But it is the most reliable way to moderate the business cycle.

Yes, if X can prevent problem Y, then not doing X is a cause of problem Y. Of course it need not be the only cause.

Patrick, Good question.

4. November 2014 at 10:39

Scott,

It is not so much this post as my impression in general when you talk about the effects of monetary policy. They often are said to “cause” (without more) daily increases in stock prices, $4.5 trillion decreases in wealth, etc. without allowing that there may be more to it than monetary policy.

I specifically stated that I liked how you *began* the post. But, later there are several references to monetary “causation” in paras 1 and 2 of this post regarding the price of gold, as well as the statement that “The Fed’s failure to do so caused the Depression.”

If you think there were no other factors involved, fine (I generally take you at your word). If you think otherwise, I indeed misread those references in this post.

4. November 2014 at 11:00

Both major parties have sharply declined in quality over the past 20 years. Both deserve to lose.

Don’t we say that every 5 – 10 years? I remember in 1994, both parties deserve to lose and we had Gridlock! And the US economy had it greatest period during the post War the next six years. Sometimes I think the US does best when we think we are in the worst of times.

4. November 2014 at 11:01

Very good post Scott.

4. November 2014 at 11:02

Patrick,

I think this gets the causation backwards. Sure, public policy was procyclical, and probably made things worse on the margin.

But, the fact of the matter is that modern financial markets with nominal mortgage rates under 6% and returns on other inflation protected securities with predictable cash flows at 2% meant that home ownership was in a new context of more universal access.

Blaming subprime mortgage lenders or the GSEs for the housing boom is like blaming Napster for the decline in music sales. Sure, their fingerprints are all over the scene, but it was going to happen with or without them.

Believe me, if nominal long term rates are ever back at 10%, you won’t have to worry about ACORN lobbying for 3% down payment mortgages.

4. November 2014 at 12:11

Kevin, I don’t see any actual answer to my question there. Nor were mortgage loans under 6% unusual historically.

By coincidence Brad DeLong is also professing to be confused;

http://equitablegrowth.org/2014/11/04/morning-must-read-david-fiderer-review-fragile-design/

‘I don’t understand it. It just doesn’t seem to add up, arithmetically…’

Which comes after he admits that he hasn’t read the book he’s commenting on. Since he was part of the Clinton Administration that enabled the subprime lending, I doubt he ever will.

4. November 2014 at 12:53

Patrick,

There would still have been a housing boom, though maybe not quite as strong. And, whether there was a crisis or not was largely up to the Fed in 2008.

Wasn’t that Fiderer review awful? It would be nice if more people taking Fiderer’s position could somehow bring themselves to treating professionals with different opinions with some respect. It’s getting hard to tell the difference between them and crackpot conspiracists.

The last both real rates and inflation were this low was a long time ago.

http://research.stlouisfed.org/fred2/series/MORTG

Here is a graph of home ownership and Price-to-Rent ratios.

http://research.stlouisfed.org/fred2/graph/?g=PRI

I have been open to your position. There were a lot of ways that the push for low income home ownership was excessive and even difficult to fully account for.

But, looking at graphs like the one above, it’s hard for me to see a smoking gun. There is a distinct shift upward in home ownership in 1994-1995, when the CRA started to be used as a litmus test for bank expansions. But, home prices were surprisingly subdued throughout the 1990’s. Most of the gains in homeownership happened before the price gains of the 2000s. Those price gains, and the interest rate environment that was their source, provided plenty of ammunition for housing expansion to households whose income would have made homeownership difficult when mortgage rates were 8% or 9%.

CRA probably made things worse, but I don’t think it is necessary for the housing boom.

4. November 2014 at 13:15

Vivian, Clearly there were many factors behind the Great Depression. But i believe that monetary policy played a huge role in the initial contraction (1929-33). Obviously monetary policy causes the price of gold under the gold standard, I don’t think anyone denies that.

And it seems clear that if there is a massive change in equity values right after a 2:15 monetary policy announcement, the most plausible explanation is that the annoucement caused the change in equity prices. As far as I know that’s not controversial.

collin. Yes, we always complain, but take the Dems for instance. They clearly improved between 1974 and 1994, and then regressed between 1994 and 2014. In 1994 I was occasionally annoyed by the GOP, but I didn’t hold them in complete and utter contempt. So no, it’s not always the same.

4. November 2014 at 13:27

Such slander! Dems inproved 1974-2000 not 1994. Put social security back in that lockbox, I say.

😉

It all went sideways after that: psychological obsession with the ‘stolen’ 2000 election, extreme dissonance on national security after 9/11, and a new narrative that all the gains of the Clinton economy somehow only actually accrued to 1000 people.

If you won’t stand up for the 90s, and the democrats won’t either, who will???

It was a nice decade for me at least. And we stopped that Y2K right in its tracks like it was nothing!

4. November 2014 at 13:36

Prof. Sumner,

“Both major parties have sharply declined in quality over the past 20 years. Both deserve to lose.”

I thought you’re a utilitarian and don’t believe in “deserve.” 🙂

4. November 2014 at 13:39

Nick, Not sure who you were aiming that at–I was praising the 1990s.

4. November 2014 at 13:50

Patrick R. Sullivan,

You should familiarize yourself with Kevin Erdmann’s brilliant work at Idiosyncratic Whisk. I’d say the economics policies he favors are generally very very very very very similar to the ones you favor……

4. November 2014 at 14:09

Travis,

He visits. We are very close in overall stance, which can actually lead to more fruitful disagreements, I think. You should check out his blog at http://hisstoryisbunk.blogspot.com/ . He has some great stuff. In one of my recent favorites, he was talking about the myth that Ford raised wages in order to increase demand for his cars, and Patrick suggested that maybe Boeing should try that too.

4. November 2014 at 14:12

“I would argue that between 1879 and 1968 monetary policy “caused” the price of gold. For most of the period the price was fixed by the monetary policymakers.”

The point is, perhaps, incidental to the main intent of your post, Scott, but still I feel inclined to insist that it is misleading to treat the pre-1914 gold standard as an arrangement in which the price of gold was “fixed by policymakers.” A private bank (and most note-issuing banks, including even the Bank of England, were still such before 1914) that issues redeemable promises to pay gold isn’t “fixing” the price of gold any more than a cloakroom “fixes” the price of your coat by handing you a claim ticket in exchange for it. The difference matters a great deal, for so long as the gold standard was a matter of contracts under private law, banks couldn’t simply choose to dishonor it with impunity. They could either pay up or commit an act of bankruptcy. Devaluation–that is, deciding to “fix” a different gold price–wasn’t a real option. At was only after the disruptions of WWI that “the price of gold” (that is, its price in terms of paper currency) became, at first insensible (as Gibbon might say), a matter of public public policy and, eventually, the object of speculative attacks.

The U.S., Canada, Scotland, Sweden, Ireland, Australia, South Africa, Switzerland, and Italy, among other countries, didn’t even have public currency issuing authorities for all or most of the classical gold standard period.

4. November 2014 at 14:21

“he was talking about the myth that Ford raised wages in order to increase demand for his cars”

Do you have a link to that post?

4. November 2014 at 14:28

Philippe,

http://hisstoryisbunk.blogspot.com/2014/09/its-why-you-write-for-website-not.html

My memory was slightly off. He simply mentioned the analogy, but didn’t actually make a tongue-in-cheek suggestion.

4. November 2014 at 14:38

George, I’m afraid we’ll have to disagree on this. As I understand it the US government defined the dollar as 1/20.67 ounces of gold. That was a policy decision and it effectively fixed the price of gold. There was of course a huge silver debate during the 1890s, and hence devaluation of the dollar was certainly not unthinkable, and indeed was certainly an “option.”

4. November 2014 at 15:42

I am under the impression that hyperinflation and strong GDP growth are, in general, incompatible.

For example, when inflation really took off in Zimbabwe, after 1998, GDP fell. Thus, the World Bank shows GDP in Zimbabwe at $8.5 bn in 1997, falling to $4.4 bn in 2008. Meanwhile, inflation picked up from 48% in 1998 to 89,700,000,000,000,000,000,000% in mid 2008.

In Argentina, from 1980 to 1990, the Austral devalued by 20 million times (if I have done the math correctly) and GDP fell during this period by 11%.

Similarly, Argentina’s inflation rate in 2013 was estimated at 38.5% in The Economist, with 30% forecast for 2014. According to the IMF, Argentina eked out about 3% GDP growth in 2013, with recession forecast for 2014 and 2015.

I am not sure that I know of a historical example of really high inflation paired with high economic growth. But perhaps someone will show a counter-example.

4. November 2014 at 15:43

Excellent blogging. But for now it is simple, the Fed should print more money. Another good idea is QE in combination with tax cuts. I prefer cuts on FICA taxes, while the Fed buys Treasuries and stuffs them into the SS trust fund.

4. November 2014 at 16:13

improvement of admin trade authority seemingly more possible in R senate?

skilled worker visa boom more likely with party whose whiteness insiders trust, without as much union love?

4. November 2014 at 16:34

Scott, if I understand your answer to George, what you’re saying is if the US had gone back to a bimetallic standard in the late 1800s, the price of silver would then have been fixed. And the price of gold would not have changed but the value of gold would have decreased. Is this correct?

4. November 2014 at 19:22

@Gordon, Bimetalism wouldn’t have fixed the price of gold relative to silver, merely the official exchange rate. The market price of gold in terms of silver would have been significantly different, which was the entire problem. Among other things, if the Government agrees to exchange 16 ounces of Silver for one ounce of Gold, but the market ratio is 32 to one, I can take 16 ounces make the Government give me an ounce of gold, take that ounce of gold to the market and get 32 ounces of Silver, take that back to the Government to get two ounces of gold…you see where I’m going with this? I can drain the treasury of gold and stuff it with an amount of silver worth significantly less, and profit from it.

The market in this case, being the world market for gold and silver bullion. In the US, the people and not just the government would be forced to accept half as much silver in stead of gold as payment as they would normally ask for. Hence, Gresham’s law: silver (“bad money”) would drive gold (“good money”) out of the country.

If the government agreed to exchange and insisted that people accept, silver in stead of gold at a rate that happened to coincide with the market rate, not much would happen at all. Sort of like setting a price ceiling above the market clearing price, or a floor below it.

4. November 2014 at 21:21

Scott,

in a hypothetical perfectly competitive economy, with no market power, perfect information, flexible prices, rational expectations, etc, does ‘money’ have any real effects? Or is it just irrelevant?

4. November 2014 at 21:33

PPPS. Make an exception for Scott Walker please.

4. November 2014 at 23:47

Bizarre analysis:

“Kuroda’s Reagan Moment: A “Stay the Course” Plea”

http://blogs.wsj.com/economics/2014/11/05/kurodas-reagan-moment-a-stay-the-course-plea

5. November 2014 at 00:22

???????

“Morgan Stanley Turns Mega-Bear on Australia”

http://blogs.wsj.com/economics/2014/11/05/morgan-stanley-turns-mega-bear-on-australia

5. November 2014 at 04:35

Scott,

Fair enough. Sorry for any misunderstanding, I hope you can tell my remarks about the 90s were somewhat tongue in cheek. I just felt you gave the dems 5-6 years too little credit, implying improvement in the party trickled off as it retained power. To me, they were getting better and better and the drop off was sharp.

Dems really feel they ‘deserved’ to win the 2000 election, and I think they are right. Not about the procedures, though. That defeat was a real slap in the face from a public that had previously forgiven so much in the name of somewhat sensible economic governance.

5. November 2014 at 05:00

@Philippe-These sorts of assumptions prove too much. If people know exactly how to find a double coincidence of wants (ie they have perfect information about other’s preferences) what reason could they possibly have had to dispense with barter?

5. November 2014 at 06:13

CYBERNATION?!?!

Is digital deflation FINALLY a thing? Thank Jesus.

Patrick / Scott / Kevin,

No there would not be a housing boom.

I don’t think you guys think mechanistically about how 5% NGDPLT works in political practice:

1. Basically, ANY inflation now comes from bad govt. policy. Everybody knows NOW what the GDP will be, the new monthly buzz is WHAT % of the GDP came from inflation vs what % came from real growth.

2. The new chart everybody looks at over and over every month will show RGDP and inflation as two values that together add up to 5%.

TWO QUESTIONS will be asked:

1. How much of it was inflation?

2. Anytime inflation is over 2%, the question will be asked: WHO GOT THE REAL GROWTH PIE?

This gives us many awesome upsides:

1.ANY pay raise to public sector without corresponding productivity gains = inflation.

2. When in 2004 the economy started to push past 5%, the machine would have started to rachet up the price of money, and if the housing market didn’t stop growing, next month it would ratchet it up even further.

Now YES, if say the housing market took off, and the nation was SO EXCITED they demanding the public sector take big pay cuts to get some good deflation, that would have left room for the housing market to take more pie.

But any single .1% of GDP the housing market gets NEXT MONTH, has to come from SOMEWHERE.

And everyone will KNOW who lost their .1%

Thats what happens WHENEVER there is a hard cap – we know WHO got the pie, we become fixated on it.

5. November 2014 at 06:16

The point is NGDPLT would have kept the Dems in Congress from passing subprime laws, when they announced the idea, the NEW CBO would score the projected NGDPLT and show everybody who was going to not get pie, and riots would happen.

5. November 2014 at 07:11

Morgan,

You’re still thinking in liquidationist terms, in some respects. Services of all kinds can be deregulated, monetized and made real components of the free market so that they need not be lost to fiscal limits. That might generate far more growth than you imagine.

5. November 2014 at 07:29

Becky,

Deregulation reduces prices and increases production / consumption (Real Growth). (Compare this to pure digital deflation, where the price goes to zero, and consumption is infinite.)

But now deregulation is scored as a positive in our NEW CBO SCORE. Please close your eyes and imagine the news stories as each Democrat plan comes with a score clear list of private sector losers who will have to pay more for their loans, if the plan passes.

Right now there is a massive disconnect, people don’t KNOW “hey when govt. borrows money, my loans prices increase” they don’t KNOW “hey when public sector gets a raise, that’s not just taxes, that’s also inflation!”

Becky, there’s nothing liquidationist about this. NGDPLT in practice will force public sector to make productivity gains to get pay raises.

5. November 2014 at 07:48

Morgan, I agree with a lot of your details, but you’re begging the question. You presume that the housing boom was largely mis-allocation. My position is that the housing boom wasn’t such a mis-allocation.

Now, if you argue that ngdp targeting will lower equity risk premiums by removing one source of corporate cash flow risk, which would then shift savings from real estate back into equities, I can agree with that.

5. November 2014 at 10:14

Yeah… Scott and Kevin have gradually dragged me toward their viewpoint on the “housing bubble.”

Before, I believed the massive government intervention into the housing market created a bubble built on bad credit.

Now, I think the massive government intervention just created a lot of bad credit, which caused a crisis when the risk was exposed, and the subsequent fall in housing prices (much of which was localized to certain areas) is more accurately understood as a secondary effect of the credit collapse, particularly with respect to how the Fed handled the fall in NGDP.

5. November 2014 at 16:55

Steven, You can have fairly high inflation coincide with strong growth, but as you say extremely high inflation is almost always correlated with poor growth.

Gordon, See Andrew’s comment, which was my assumption (although it’s been a while since I studied bimetallism.)

Philippe, Mostly irrelevant, except for second order effects.

Nick, Yes, they deserved to win in 2000, and if we abolished the electoral college (as we should) they would have won.

Talldave, Just to be clear, I don’t blame the entire collapse on tight money. Housing peaked in early 2006, and tight money didn’t kick in until 2008.

5. November 2014 at 17:08

Kevin, I think there could be housing booms, but they’d come from something like GICYB where minimum wage disappears, and the unemployed are suddenly working on $120 rehab construction crews in poor neighborhoods, so that what used to be slum-like SFH can be owned by hedge funds and rented for $650 a month profitably.

Or that we end corporate taxes and switch to Land Value Tax to turn Malibu into Miami and end NIMBY forever.

I can name lots of things, but each is about fixing something that is currently being run in a horrible way.

To keep the math simple is we were allotted $720B in NGDP growth this year, let’s just say $60B a month:

It will change how we score and therefor discuss laws that enable subprime mortgages to pay increases for public sector, or fracking – bc each of these things either EATS up the $60B, or generates more production / consumption from the same $60B.

My wife has 6 sisters and brothers, and when the food hits the table in a big family, they have a different look in their eye, than kids from a small family.

The analogy isn’t perfect but NGDPLT takes us from being the people in a small family to the ones in a big one.

NOBODY EVER GETS A BIG PIECE bc nobody else was eating it.

5. November 2014 at 19:30

Scott-I should note that historically, prior to the movement of the Populists for a 16 to 1 ratio, Governments usually set the ratio much closer to the bullion market exchange rate. Since the ratio grew slowly over time the severity of the arbitrage opportunity created was usually initially limited. The effort of the Populists was something of an anomaly in trying to set an official exchange rate so very different from that on the world bullion market.

At any rate, I’ve always been utterly fascinated with that period of American history. Also I am an unabashed fan of Grover Cleveland.

Fun fact for those interested in campaign finance, and also a funny coincidence: in the election of 1896, when Bimetallist William Jennings Bryan, who called for an official exchange rate of 16 to 1 silver to gold, had a fundraising disadvantage to William McKinley of…16 to 1. Truly, God has a sense of humor.

6. November 2014 at 06:37

Andrew, That is ironic.

6. November 2014 at 16:52

The cause of NGDP is both nominal and real.

Goods must be traded in order for money to be paid. There must be those who sell goods and those who buy goods, and there must be those who sell money and those who buy money, in order for there to be NGDP.

A big problem arises when people divorce money and goods into two separate realms where causation is split: real causes real, nominal causes nominal, nominal causes real, and real causes nominal.

This ignores the subjective component that causes BOTH real and nominal.

It’s OK to think of real and nominal as separate concepts, because they are separate concepts, but what is not OK is to think of nominal effects as solely a function of nominal causes.

When a central bank targets price inflation, they are not the sole cause. The full cause is the central banker’s actions plus the actions of individuals in society.

It is dangerous to assert the central bank as dominant over everyone else for any particular “statistic”.

6. November 2014 at 17:24

“Bimetalism wouldn’t have fixed the price of gold relative to silver, merely the official exchange rate.” Yes, I didn’t express myself clearly so I know it would have meant an official exchange rate between the two metals. And from what I remember, Milton Friedman had put forth an argument showing that even if an arbitrage situation arose, it still would have been to the benefit of the U.S. economy. But what I really should have asked is whether the difference between Scott and George’s viewpoints on whether the price of gold was fixed in the 1800s is a matter of semantics. Would it be better to say a dollar could be exchanged for 1/20.67 ounces of gold and the exchange rate was fixed? And even if the exchange rate was fixed, the value of gold could change. I’m just trying to understand why they have the difference in viewpoints so as to test my own understanding of these things.

6. November 2014 at 17:35

Monetary policy causes the value of money to change. Under the gold standard, monetary policy caused the dollar to be valued at 1/20.67 ounces of gold. Monetary policy can also cause the value of the dollar to be 1/17 Trillionth of GDP. Or whatever value we want.

We have 100% control over the supply and the value of our currency so therefore we have 100% control over NGDP.

7. November 2014 at 00:40

@Morgan

“1. Basically, ANY inflation now comes from bad govt. policy. ”

Mostly yes, but inflation will also come via natural or man-made disasters (eg. large scale terrorism)

8. November 2014 at 11:12

“George, I’m afraid we’ll have to disagree on this. As I understand it the US government defined the dollar as 1/20.67 ounces of gold. That was a policy decision and it effectively fixed the price of gold. There was of course a huge silver debate during the 1890s, and hence devaluation of the dollar was certainly not unthinkable, and indeed was certainly an ‘option.'”

A change in official mint value of a metal isn’t “devaluation” as it is now usually understood: that term I took to refer to a change in the amount of metal returned for a paper promise to pay. The U.S. Mint could and did occasionally change the mint price of gold or silver. But that itself didn’t make a national or state bank’s promise to return a given amount of gold (or silver) to anyone surrendering its note for the purpose an instance of “price fixing.” The banks then were, unlike the Mint, not considered sovereign bodies that could alter at will the meanings assigned to monetary units.

8. November 2014 at 12:59

George, I see the difference as mostly a matter of degree. Obviously when the dollar was devalued in 1933 all sorts of private arrangements were also overturned. This sort of devaluation did not occur in the 1890s, but certainly could have. If you asked someone in 1929 they would have said it was “unthinkable” that the federal government would tear up private gold clauses–but 4 years later they did.

As I recall there were some greenbacks circulating during the “classical” gold standard and some national bank notes during the interwar gold standard.