Demand vs. aggregate demand

The Black Death killed 1/3 of all the people in Europe. The demand for almost every single commodity probably fell, in the sense that demand curves shifted to the left. Supply curves also shifted to the left, and hence relative prices stayed about the same, on average. (In a supply and demand diagram, the “price” on the vertical axis is the relative price, the price relative to the overall CPI.)

And yet the Black Death probably had little or no impact on aggregate demand. How can that be? There were far fewer people, and the demand for virtually every single commodity fell. Why wouldn’t aggregate demand also fall?

Aggregate demand is a horrible term for the concept that economists use in macro 101. It has absolutely nothing to do with “demand” in the ordinary sense of the term. I wish it were called “nominal expenditure”. The “price” on the AS/AD diagram is the nominal price level, not the relative price of a single commodity.

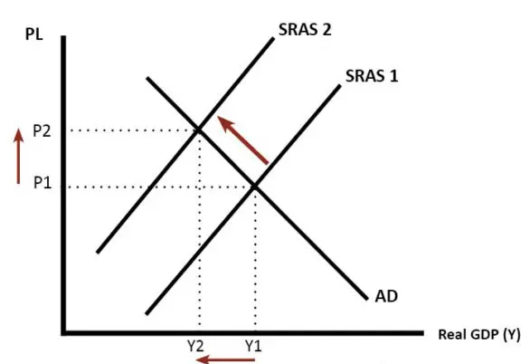

The Black Death did not kill money, so the (commodity) money supply was presumably unchanged. If might have reduced AD by reducing velocity, but I doubt it had much impact. We know that the Black Death increased the price level in Europe, and it’s likely that it reduced real GDP. The AD curve probably didn’t shift very much in response to this plague. Here’s what happened:

When average people think about macro, they tend to conflate “aggregate demand” and “quantity of goods and services purchased”. Even if there is no change in aggregate demand, the quantity of stuff that people buy at stores will tend to fall when AS falls (as in the figure above). But that’s a decline in equilibrium quantity; it’s not a decline in AD.

Monetary policy determines AD. The Economist recently had this to say:

In practice, the distinction between shocks to demand and those to supply is fuzzy. In a paper published in 2013 that revisited the era of stagflation, Alan Blinder of Princeton University and Jeremy Rudd of the Federal Reserve argue that supply alone cannot explain the soaring unemployment of the 1970s. In fact, they say, price increases had demand effects that mattered more. They raised uncertainty, reduced households’ disposable income and eroded the value of their savings.

Actually, aggregate demand (NGDP) in the US rose at about 11%/year from 1971-1981, due to easy money (despite 15% interest rates!) People were spending money like crazy. So the high unemployment was not primarily caused by a demand shortfall. In my view, the natural rate of unemployment rose during the 1970s. Spikes in unemployment in late 1974 and the spring of 1980 were caused by brief declines in AD (NGDP growth).

PS. Narayana Kocherlakota may not be right, but his recommendation is probably “less wrong” than doing nothing:

My benchmark forecast is that the U.S. economy will remain resilient to these forces. But there is a substantial risk that such a forecast could be wrong. One possible strategy is to wait until there actually is a slide in the economy before easing interest rates. But rates are still only a little above zero and so the Fed has few tools available to offset adverse shocks. In this situation, a basic precept of monetary policy is to keep the economy as healthy as possible in advance of downturns. As New York Federal Reserve Bank President John Williams explained in a speech last year, that means cutting interest rates in a pre-emptive fashion when threats to growth become more pronounced. Of course, it was exactly in response to the increase in global downside risks that the Fed cut interest rates by 75 basis points, or three-quarters of a percentage point, in 2019.

The Fed’s rate-setting Federal Open Market Committee holds its next meeting on March 17-18. I don’t think that the FOMC should wait that long to deal with this clear and pressing danger. I would urge an immediate cut of at least 25 basis points and arguably 50 basis points. That’s a cheap insurance policy for the economy that the Fed shouldn’t pass up.

Tags:

25. February 2020 at 08:51

That would be shocking if they did that——they will be yelled at for wasting ammunition—-but at least the traitor Trump will like it—-for the wrong reasons of course. Seriously—-when has the Fed last done something that surprising?

25. February 2020 at 09:09

In the PS, you say “may not be right”. Are you suggesting another course of action? Or just agreeing with Kocherlakota who says basically the same thing (that he has a benchmark forecast but it could be wrong)?

Thanks for the main post. It’s really helpful. I’ve always wondered why real wages rose after the Black Death. The usual explanation “well, fewer workers means higher wages” doesn’t make sense to me once we add in fewer consumers.

25. February 2020 at 09:27

bill, I would suggest that the productivity of the marginal worker increased after a large die-off, which is how wages could rise. If you had 10 farmhands, and now have 5, output per worker will rise in most cases, though overall output falls. And while there are fewer consumers locally in the hardest hit regions, the effect is not uniform. Non-perishable goods could still be transported to less hard-hit regions. If you pair that idea with increased per-worker productivity, you can imagine how wages would rise in decimated areas.

25. February 2020 at 09:49

Thanks Bob. That makes sense. I wonder if anyone has shown something like that empirically?

25. February 2020 at 10:29

Michael, Yes, they’d be accused of wasting ammo, but they’d actually be adding to their stack of ammo, as we both know.

Bill, See my newest post; rate cuts aren’t the main issue.

There have been economic studies of the Black Death, and I believe real wages did rise, as Bob suggests.

25. February 2020 at 11:05

Scott –

I wasn’t around during the 70’s and much of the 80’s. When you say that money was “easy” but interest rates were 15%, what do you mean? If I need a business loan to start my business, or expand an existing one, that is going to be really expensive for me to do then correct?

Secondly, my understanding is that AD depends much on market expectations, why were people “spending like crazy” when interest rates should lead them to expect they are in a recession?

25. February 2020 at 12:02

An interesting piece with extensive references for further research: https://eh.net/encyclopedia/the-economic-impact-of-the-black-death/

This one pushes back against the rising wage idea: https://ideas.repec.org/p/tor/tecipa/munro-04-04.html

25. February 2020 at 12:23

Derrick, If you were holding zero interest cash when you could earn 15% on a safe asset like T-bills, wouldn’t you quickly spend the money? Why hold on to cash when it’s rapidly losing value. But then the hot potato effect kicks in. If everyone tries to get rid of cash, and the supply of money doesn’t decrease, then aggregate demand can only go up.

Interest rates are the price of credit not money, they are the RENTAL COST cost of money. People were willing to borrow at 15% because inflation was rapidly reducing the real value of their debt.

Thanks Bob.

25. February 2020 at 13:29

Scott – thanks for your reply, I think I’m getting there, but I’m not making the leap you are.

“But then the hot potato effect kicks in. If everyone tries to get rid of cash, and the supply of money doesn’t decrease, then aggregate demand can only go up.”

What I take from this is that the velocity of money increases because returns to capital are very high, and inflation makes amortizing their debt easier.

What I don’t understand is this: from a consumer perspective, if my wages are rapidly draining from inflation and I want to spend right away versus save, won’t this put further pressure on wage inflation?

25. February 2020 at 13:47

It’s amazing how Sumner manages to cow his readers to submission (perhaps they fear being banned if they speak up?) Isn’t anybody going to challenge Sumner on his absurd claim that AS fell dramatically during the Black Death but AD remained about the same? What’s the basis for this? Sumner: “The AD curve probably didn’t shift very much in response to this plague.” (cite please? And why ‘probably’? Why hedge your bets in your un-sourced thought experiment?)

What? Why not say that AS and AD fell by the same amount? If you have one-third fewer people, AS will fall, but so will AD by one-third. Both curves will shift to the left, and depending on which curve shifts more, you’ll get lower quantity and higher prices. You have to look at history to determine what actually happened, which curve shifted more, and history says AS shifted more than AD. But presumably you could have a scenario where quantity fell and prices fell even more, if people stop consuming as much. You cannot do a ‘thought experiment’ and then announce, sua sponte, that AS fell dramatically but AD did not, as Sumner just did.

25. February 2020 at 15:06

Maybe that’s what we need? A new Black Death?

Think of the possibilities:

Climate crisis resolved. Pension funds relieved. Stock prices relaxed.

And lots of vacant housing in big cities. And less boomers who occupy all the top positions for decades and own all the wealth.

If one cannot change it, then one must try to see the upside. Don’t you think? Who would have thought that all these stupid self-help books are right for once?

25. February 2020 at 16:47

Scott, did you do undergraduate econ history? If not, dig out Carlo Cippolo and Harry Miskimin on the economic consequences of the Black Death – they were not as intuitive as they might seem

25. February 2020 at 18:24

Your assertion, “Monetary policy determines AD,“ prompts the question, What was monetary policy in fourteenth-century Europe?

25. February 2020 at 18:36

If a sharp, coronavirus-related economic recession hits, the Fed will be slow-footed and armed with pop-guns. The federal government’s automatic stabilizers will kick in after the fact.

There is a policy option that might be effective: A holiday on payroll taxes.

26. February 2020 at 10:03

Derrick, No, I am not assuming that velocity increases, I am assuming that the money supply increases.

Ray, You are making the mistake I mentioned in the post, conflating demand and quantity demanded.

Pyrmonter, No, I did not take econ history. But I recall reading that prices rose during the Black Death.

Philo, I believe that monetary policy was coin debasement, but I am not certain. It’s not my areas of expertise. Under commodity money systems, the output of silver/gold mines also matters.

26. February 2020 at 10:22

The 1971-1981 period involved two pretty obvious oil supply shocks. I believe our economy still had a higher % consumer spending than current Germany and it was on some level more energy intensive than the 2000s (rape with respect to oil). In fact CAFE regulations were a response to the oil shocks of the 1970s along with reducing oil in the electricity generation market.

26. February 2020 at 12:25

Sumner: “Ray, You are making the mistake I mentioned in the post, conflating demand and quantity demanded.” – I doubt it. You are I think assuming “sticky prices” so that AD does not shift much, in response to fewer people and less demand, but it’s not clear. Your heterodox view I’ve not seen in any textbook so it probably requires another post to make your point clearer. In any event, thanks for the reply, bye.

26. February 2020 at 18:46

Hang on just a second!

Aggregate demand IS NGDP.

When Thanos snaps his fingers and half the population disappears, NGDP falls by 1/2!

After an adjustment period, it may be the case that the unemployment rate stabilizes at near current levels, and prices for many goods are unchanged. Prices of some goods such as housing will surely crater.

But, this doesn’t mean that output is not 1/2 pre-snap levels.

27. February 2020 at 17:11

@Doug

Don’t you conflate “aggregate demand” and “quantity of goods and services” as well? I admit that I’m not following Scott completely either.

It’s hard to wrap your head around this. You always think you’ve just understood it, and then Scott comes back and says, “No, Dufus, it’s not like that at all.”

I could pull my hair out right now (if I wasn’t already bald).

28. February 2020 at 10:50

Ray, It’s fun to watch you make wild guesses and miss. No, nothing to do with sticky prices.

Doug, You said:

“When Thanos snaps his fingers and half the population disappears, NGDP falls by 1/2!”

Wait, does half the money supply also disappear? If not, wouldn’t people buy half as many real goods at twice the price? Or is your argument that V falls in half?

2. March 2020 at 10:25

@Ssumner – you should explain then, since a poster who’s a student of economics named Dismalist at MR seems to agree with me that it’s sticky wages / sticky prices. Please do a future followup post on this. In the meantime, enjoy the below.

JPMorgan’s top economist does not subscribe to Sumner’s “sticky wages/ sticky prices” thesis or whatever other point he’s making here re AD. If he did, the top economist would not say prices would fall. – RL

https://finance.yahoo.com/news/jpmorgans-feroli-on-why-the-coronavirus-wont-have-a-big-inflationary-effect-172951903.html

Wall Street is becoming more pessimistic about how the coronavirus outbreak will impact the global economy, but the one thing U.S. consumers are unlikely to experience is rising prices, according to JPMorgan Chase’s top economist. The supply chain disruptions that have slowed or completely halted the shipment of some goods from are huge, and growing more severe as the virus spreads across the world. However, JPMorgan’s Michael Feroli told Yahoo Finance that he doesn’t expect those bottlenecks to have a huge effect on domestic inflation — largely because of softer demand. “I think you’re going to have moves in both supply and demand…and the supply chain disruptions will be inflationary, but I think what you are also seeing is aggregate demand is being held back by so far weaker tourism activity,” Feroli told “On the Move” on Monday (3/2/20)