22 Responses to “David vs. Goliath”

Leave a Reply

A slightly off-center perspective on monetary problems.

The computer models of the economy say don’t cut, indeed raise rates.

The markets say cut.

Mainstream economists say policy should be based on models.

Market monetarists say go with the markets.

. . .

The Fed cuts!

Tags:

This entry was posted on August 01st, 2019

and is filed under Uncategorized.

You can follow any responses to this entry through the RSS 2.0 feed.

You can leave a response or Trackback from your own site.

22 Responses to “David vs. Goliath”

Leave a Reply

1. August 2019 at 09:28

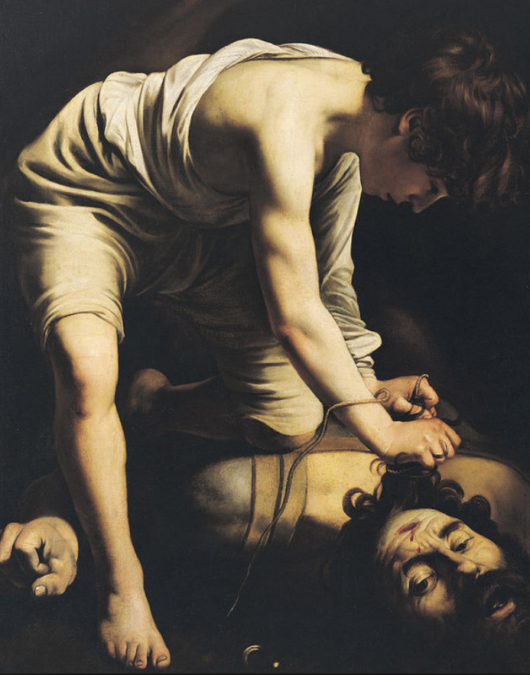

I’m not sure why you posted a great Caravaggio, but this type of “outside the cowpath” i approve.

1. August 2019 at 09:49

So Trump battles the Fed as to who can create the most turmoil—but when we watch Trump in his idiot mode, all I think of is this will be the democrats in their smart mode–assuming they win

1. August 2019 at 09:55

Thanks agrippa, Painting is my favorite art form–maybe I should post more examples. The problem is finding paintings that relate to an abstract area such as monetary theory.

Michael, So Trump is smarter than Obama? Okaaay . . .

1. August 2019 at 10:18

Isn’t everything based on rules on models at the end of the day? You need some kind model to explan things and some kind of rule to be able to react. Your golden rule seems to be: listen to the markets.

Was it not the advantage of the Keynesian explanation approaches (aka models), compared to the classical ones, that their models are not so rigid, but rather that they can react flexible to shocks? In this respect, your model seems to be an even better evolution of the Keynesian approach. Maybe you should sell it like this.

What’s in the picture? Rural America vs. urban America in 2016? Can David win twice? We will see it in 2020.

1. August 2019 at 10:22

What’s the point at which the Fed stops cutting even if economy falters because it knows any of its rate cuts will just be perceived by Trump as room for more tariffs?

1. August 2019 at 10:25

Models have also said that interest rates were going to mean-revert to significantly higher levels for the past ten years. Investing on that basis would have caused only pain.

1. August 2019 at 10:57

derek,

The Fed has to offset Trump, not the other way around. But maybe you’re right, we found a vicious circle, or a perpetuum mobile. But I think Scott said that the tariffs don’t have a big macroeconomic effect anyway (so far).

1. August 2019 at 11:15

Bond market recommenced its bellyaching today. Powell needs less Goldilocks, more Chuck Norris. Get out ahead of this thing.

1. August 2019 at 11:27

Derek, The Fed’s job is to hit its dual mandate, not play games with Trump.

John, All forecasts turn out “wrong”, ex post. Market forecasts will usually be less wrong than committee forecasts. Certainly that’s the case this year.

Also, you shouldn’t look at unconditional interest rate forecasts, rather those conditional on on-target inflation.

Brian, Agreed, but Trump’s not making their job any easier—pulling this stunt one day after the FOMC meeting and 6 weeks before the next meeting. This is why I’ve advocated the Fed adjust rates daily, to the nearest basis point.

1. August 2019 at 11:35

Scott,

Look I found a painting of your TDS:

https://no.wikipedia.org/wiki/Skrik

Okay, enough for today.

1. August 2019 at 12:17

good to hear you like painting. though there are probably less than two dozen known extant works, Da Vinci is almost always appropriate, say using “The Lady with Ermine” anytime trying to allude to a knowing smile or other facial expression.

1. August 2019 at 13:24

Agrippa, There’s also the issue of what looks good on the computer screen. I put some paintings in this post:

https://www.themoneyillusion.com/lost-in-america/

1. August 2019 at 15:26

Is this a sort of reverse rational expectations? The markets know more/are smarter than your models?

2. August 2019 at 06:28

Trump was right, Powell and the FOMC should have done more. The Fed seems to have tightened relative to market expectations, given the sell off in equities after Powell spoke along with 5yr inflation breakevens drifting down to 1.47%.

That being said, Trump’s badgering of Powell might well be forcing Powell to operate a tighter monetary policy than he otherwise would, to demonstrate independence.

What computer models say that rates should be hiked? Unemployment is historically low, but inflation is below the 2% target and 5yr breakevens show that the market expects the same for the foreseeable future. If you’re ostensibly targeting inflation, why not ease whenever 5yr breakevens slide below 1.75% and tighten whenever they rise above 2.25%?

I also like the idea of daily adjustments to monetary policy, so that a change can be made immediately if it appears there was a mistake (e.g. this week).

2. August 2019 at 06:42

Justin is right about daily adjustments. That single measure is really starting to look good right now, perhaps it would be the best way for the Fed to maintain independence and shake off excess political pressure.

2. August 2019 at 06:59

“Michael, So Trump is smarter than Obama? Okaaay . . .”

Trump was able to broker peace on Korean peninsula, Obama could not.

2. August 2019 at 07:10

Lorenzo

“Is this a sort of reverse rational expectations? The markets know more/are smarter than your models?”

Partial/speculative answer: the models are fairly uncoupled from other resource allocation decisions. Market predictions are coupled with all resource allocation decisions, through mechanisms such as arbitrage and capital allocation decisions by firms and individuals (as well as capital constraints). To a large extent, market-based decisions *have* to be consistent with a lot of micro-data, micro-predictions and micro-decisions.

From that point of view, the market predictions are much more “self-fulfilling” than model-based predictions.

2. August 2019 at 08:19

Lorenzo, You said:

“Is this a sort of reverse rational expectations? The markets know more/are smarter than your models?”

It’s not “reverse rational expectations”, that’s exactly what the rational expectations/EMH model calls for.

Justin, You said:

“Trump was right, Powell and the FOMC should have done more.”

People need to stop talking about Trump being “right”, when there is no reason to believe that Trump actually believes anything he says. Trump says the Fed should have an easy money policy when he’s President and a tight money policy when the Dems are in office. What would make that belief “right”? Is Trump “right” any time an easy money policy is appropriate when he’s in office, and any time a tight money policy is appropriate when the Dems are in office? Are broken clocks “right” twice a day? It is just absurd to talk about Trump being right, as if you are discussing the views of a macroeconomist who actually is trying to accomplish something more than getting re-elected.

Trump believes that interest rates represent the stance of monetary policy, so the entire premise of his policy views is wrong.

You asked:

“What computer models say that rates should be hiked?”

AFAIK, almost all the Taylor Rule type models call for a rate hike.

2. August 2019 at 09:57

Sorry Scott, I was poking the bear a little bit there with the Trump comment. 🙂

Gotcha, but don’t Taylor Rule models depend on assumptions which aren’t knowable in practice, like NAIRU (or the output gap) and the neutral real short term interest rate? For all we know NAIRU is 3.5% and the neutral real interest rate is 0%, so the model here might be forecasting a cut as well.

Are there any models which don’t use variables we can’t know with any certainty?

2. August 2019 at 12:38

Justin, Yes, you could construct Taylor Rule models that call for a rate cut, but I don’t think that actual models do call for a rate cut. That was my point. The Fed is following the market, not the actual models.

You say the equilibrium real rate might be 0%. But why do we now think that? Because of the markets, not the models.

2. August 2019 at 21:30

Nasty drop in Average Weekly Hours in the July jobs report. Drags down growth in Average Weekly Earnings. Not pretty for Trump.

https://fred.stlouisfed.org/graph/?graph_id=352824&rn=751

4. August 2019 at 10:35

https://thehill.com/homenews/news/428100-us-wages-salaries-rose-more-than-3-percent-in-2018-for-first-time-in-decade

US wages, salaries rose more than 3 percent for first time in decade