China has a pathetically small infrastructure

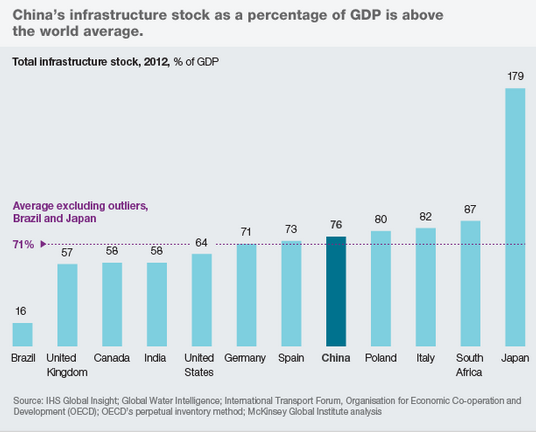

But that’s mostly because it’s a pathetically poor country. Here’s is China’s infrastructure as a share of GDP:

China’s infrastructure as a share of GDP is fairly normal, but because its GDP per capita is so much lower than developed countries, it’s stock of infrastructure per capita is also far lower. The real outlier is Japan, which did an orgy of infrastructure spending to boost AD, even as its central bank pursued a deflationary monetary policy, and ended up with lots of bridges to nowhere, and falling NGDP.

Yes, there is some infrastructure in the wrong place; Ordos, or the Binhai area of Tianjin. But for the most part it’s where it should be:

1. The subways are under the huge, densely populated cities, where they should be.

2. The high speed rail mostly connects big cities.

3. The larger ports and airports are mostly near the bigger cities.

4. The motorways mostly connect highly populated areas in eastern China.

5. The housing is mostly being built in the cities that are receiving massive rural to urban migration.

And remember, if China ever becomes developed it will need far more housing, subways, airports, roads, rail, water systems, power, etc, etc, than it has now.

China’s in a sweet spot where the inefficient SOEs don’t do all that bad—building big things. As it moves to a more modern high tech/service/consumer-oriented economy it will need to reform, or else get stuck with lower living standards than other developed countries.

But for today, the biggest problem is not China investing too much in big projects, rather it’s the slowness with which they move away from the SOE model, combined with a set of policies that strongly discriminate against people in rural areas.

PS. Matt Yglesias has a blog post that shows overcrowding on Beijing subway line 13. I’d guess that (other than Michael Pettis) I’m probably the only western blogger who’s ridden that line (it’s not in a tourist area, and not underground.) I’ve been through the Xizhimen station and seen the huge lines. Beijing has gone from almost no subway system when I visited in the 1990s to one of the world’s longest subway systems, and it’s still way too small. If you don’t believe me check out Matt’s video. Oddly, the system seems to get more crowded each time they add new lines. I suppose that’s a sort of “network effect;” as the system becomes more complete, more people rely on it.

Tags:

24. July 2013 at 15:42

“The real outlier is Japan, which did an orgy of infrastructure spending to boost AD, even as its central bank pursued a deflationary monetary policy, and ended up with lots of bridges to nowhere, and falling NGDP.”

Prices can fall rapidly in a non-inflationary monetary system. Humans adapt and learn. There is no objective law of the universe that prevents individuals from reducing prices intertemporally, by choice.

24. July 2013 at 18:03

China’s infrastructure stock may be typical as a share of GDP, but its investment rate is extraordinary. Which is more important – the stock, or the flow? You mentioned Michael Pettis. He blogged about this issue last month… a good read.

Coincidentally, most bubbles could be described as “network effects”. Positive feedbacks are unstable, and this is a problem with public transportation. It becomes less useful as it becomes less used; service is cut, conditions deteriorate, crime rates rise. On the other hand, no one ever complained about an empty highway.

Positive feedbacks are at the heart of the China story. It’s one thing to say that SOEs and rural policy are the problem, another thing to reform them without creating tidal waves.

24. July 2013 at 18:11

Geoff, Boring observation which has nothing to do with this post, or even my offhand comment about Japan. Do you approve of the fiscal stimulus? Please try to keep up.

Andre, I mostly agree with Pettis about what needs to be done, I think he also has problems with the SOEs and the rural policies.

It may be the case that with better policies the flow of investment is lower, I’m not sure. But even with optimal policies China would have very high investment rates, and thus I don’t see overinvestment as the big problem. The big problems are poorly run SOEs, weak property rights and the one child policy. The property rights thing relates to issues ranging from pollution to rural discrimination.

24. July 2013 at 18:28

[…] Regarding claims that China is overbuilt: […]

24. July 2013 at 19:11

No wonder Brazilians are so angry.

25. July 2013 at 01:55

I had to google what SOE means, top candidate seems to be “State-Owned Enterprise”. Even if there were some other good competitors like “School of Education” or “State of Environment” that may make sense in Chinese context. So much for american obsession by acronyms.

.

Anyways as for Ordos – I think it gets too much attention without being put into context. The truth is that developing world goes through urbanization on scale that is unimaginable by stagnating western countries. In next 40 years it is expected the urban population will double. That means adding 1,5 million urban dwellers every week.

Yes, this means that if developing countries have enough resources they need to build new city the size of Dallas every week for upcoming decades. Having failures like Ordos here and there is bound to happen – and if you ask me it is preferred to unending sprawl of slums around other major cities that we see today.

25. July 2013 at 06:21

JV, Good comment.

25. July 2013 at 07:27

From the scary sentences department: “Japan also once tried to adopt Western-style industrial capitalism without consensual government.”

26. July 2013 at 09:36

When estimating things, people are used to thinking of lines instead of more complex functions, and that leads to a whole lot of trouble in modern decision making, both in government and corporate settings. Utility functions are not linear with respect to cost.

Most mid sized American cities just build the wrong kind of public transportation: Enough for it to be expensive, but not enough to be popular, and becoming self sustaining.

The same kind of problem is found when investing in some form of media: ROI goes lower and lower until you reach a certain threshold, at which point it shoots upwards towards a plateau. Further investment doesn’t provide much more revenue, and the function heads downward again. Plotted on a graph, the worst possible outcome is extremely close to the best outcomes, so the price of undershooting is very high.

Therefore, along with comparing infrastructure costs, we have to look at types of infrastructure, to try to guess how much of that infrastructure cost is downright wasteful, either because it is unnecessary, or because it’s not enough to be useful.

8. August 2013 at 06:34

[…] than 200% of GDP. And of course the Japanese government massively misallocated resources into a historically unprecedented set of infrastructure boondoggles, which dwarf anything going on in China. And despite all of that, NGDP in Japan is lower than 20 […]