One shock to rule them all

Marcus Nunes directs me to a new Brad DeLong post, discussing six big shocks that have hit the US economy since 2005. But I agree with Marcus, I only see one. First let’s look at DeLong’s six:

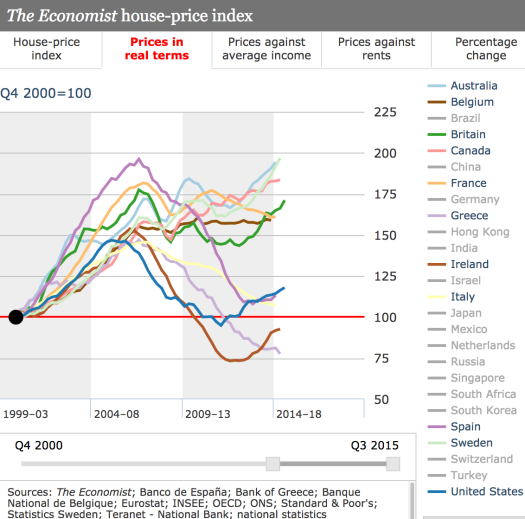

(1) The collapse of residential investment after the end of the mid-2000s housing bubble, in order of their size (-3.8% of potential GDP):

(2) The wave of austerity–mostly state-and-local, but considerable at the federal level as well–hitting government purchases (-3.0% of potential GDP):

(3) The collapse of business fixed investment in the aftermath of the financial crisis (-2.9% of potential GDP):

(4) The blockage of the credit channel that prevented there from being much significant bounce-back to normal in residential construction (-1.8% of potential GDP):

(5) The (closely-associated with (3)) collapse of exports as the effects of the financial crisis spread beyond U.S. borders (-1.8% of potential GDP):

And (6) on a different graph (since it is not one of the four salient components), and also closely-associated with (3), the adverse shock to consumption as it became clear first that there was going to be a deep and then a long downturn (-1.8% of potential GDP):

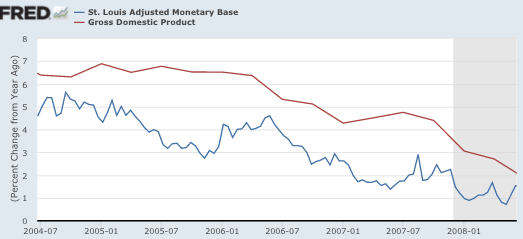

All I see is a big monetary shock; a tight money policy in 2008 that caused NGDP to fall during 2008-09 at the steepest rate since the 1930s.

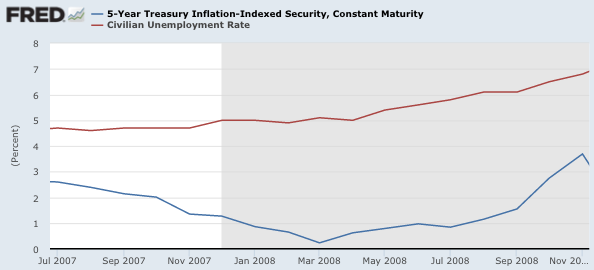

1. Residential construction fell more than in half between January 2006 and April 2008, but unemployment merely edged up from 4.7% to 5.0%, and the consensus view of economists was that 2009 would be an OK year. Yes, 2009 turned out not to be an OK year, but that wasn’t because of a housing collapse that economists were already well aware of, but rather because of a NGDP collapse that they did not predict, even in April 2008.

2. What austerity? Has government spending fallen as a share of GDP? Yes, it’s slowed relative to trend, as you’d expect in a economy that has slowed relative to trend. Sorry, but living within your means is not a “shock.”

3. Yes, investment is highly cyclical, and falls sharply in deep recessions caused by too little NGDP. It’s the effect of a shock.

4. OK, this is an independent shock, but we’ve already seen that housing is no big deal. With adequate NGDP growth the labor market would have been fine.

5. Yes, money was also tight in Europe and Japan.

6. Even DeLong admits the fall in consumption is an endogenous response to the deep recession.

Please don’t misinterpret this post. The world is very complex. The causes of the NGDP shock were very complex. Perhaps all six items mentioned by DeLong played some indirect role in monetary policy going off course. But the sooner we start thinking in terms of 2008-09 being a single shock, the sooner we’ll demand more from our central banks, and the sooner we’ll get better monetary policy.

Regardless of whether I am right or DeLong is right, it’s very much in America’s interest if the Fed believes that I am right.

PS. DeLong ends as follows:

And they say: given those six shocks and their magnitude, haven’t we done rather well at stabilizing the economy? Haven’t we certainly done much better than the BoJ, or the ECB, or the Bank of England?

And they are right: they have.

Since late 2008, the Federal Reserve has a lot to be proud of.

I’m not so sure of that. The US has faster population growth than Japan, and faster productivity growth than Britain, but haven’t their labor markets done much better, in the sense that employment population ratios are soaring to new highs, while ours languishes? (I’m relying on memory here due to a hectic holiday schedule, correct me if I’m wrong.)

But yes, much, much, much better than the brain dead ECB.

Merry Christmas, and check out my Econlog post.