Cash and T-bills are not close substitutes

Tyler Cowen Alex Tabarrok recently linked to an interview of Eugene Fama. His discussion of the EMH is brilliant, as you’d expect. He’s right about “bubbles”. But Alex chooses to quote from his discussion of monetary policy, which is almost completely inaccurate:

It’s not just the Fed, around the globe central banks are flooding the system with liquidity like never before. Is this a reason for concern?

Frankly, I think this is just posturing. Actually, the central banks don’t do anything real. They are issuing one form of debt to buy another form of debt. If you are an old Modigliani–Miller person the way I am, you think that’s a neutral activity: You’re issuing short-term debt to buy long-term debt or vice-versa. That’s not something that should have any real effects.

Then again, the financial markets sure seem to love it. At least it looks like that the S&P 500 is moving upwards in tandem with the expansion of the Fed’s balance sheet.

Every day we hear a story about the movement of stock prices. But the story is different each day. So basically, these stories are made up after the fact. But when we look at it systematically, we don’t see a big effect of Fed actions on real activity or on stock prices or on anything else. That’s why I use to say that the business of central banks is like pornography: In essence, it’s just entertainment and it doesn’t have any real effects.

Let’s consider the applicability of Modigliani–Miller to monetary policy. Is it true that the Fed was just swapping one liability for another similar government liability, which should not have much impact on relative prices?

Conventional economists might try to disprove Fama by pointing to the fact that the Fed can use OMOs to control interest rates. But here I’d agree with Fama; their control of rates is greatly exaggerated. Unfortunately, he’s still wrong about OMOs not having much effect.

Fama’s been making this argument for a long time, well before the zero bound situation arose. So let’s go back to 2007, when the monetary base was 98% composed of currency. At the time, one-month T-bills yielded 5% and currency yielded 0%. How can yields have been so different on two assets that are supposedly close substitutes?

[Update: In the comment section, John Cochrane says Fama is speaking to the post-2008 period, so the preceding paragraph may be in error. The sentence beginning “Actually” kind of sounded like he was making a general proposition about central banks in various times and places. The central banks of India? Turkey?]

And how many times in your life have you stood in a checkout line at a store behind someone trying to pay for purchases with T-bills? Zero? Same here.

So both common sense experience and market prices confirm that currency and T-bills are not at all close substitutes. Don’t like 2007? In 1981, T-bills yielded 15% while cash yielded 0%. In Switzerland, cash yields more that government bonds. How does M-M explain that fact?

Currency is more like “paper gold”, an asset with idiosyncratic uses that are almost unrelated to our financial system. Most currency is used for small transactions and tax evasion, areas in which T-bills are useless.

So Fama’s basic approach is wrong. Now it’s true that modern interest bearing bank reserves are much closer substitutes for T-bills than is currency. And it’s useful to think about how to model this. But you need a general model that applies to both bank reserves and currency. The M-M theorem is not a useful starting point, even in the world of 2020.

Fama’s also wrong about market responses to Fed announcements. Fed announcements often have a powerful effect on financial markets within seconds of the announcement. The odds of this being random are far less than 1 divided by the number of atoms in the universe. Perhaps Fama hasn’t studied this area.

To be sure, there are plenty of problems with empirical work on the impact of monetary policy, especially its longer run impact on the macroeconomy. Economists have done a poor job of addressing the identification problem, and this may partly explain Fama’s skepticism. But there’s no doubt that the Fed has a huge impact on asset prices; anyone that follows the markets closely knows this.

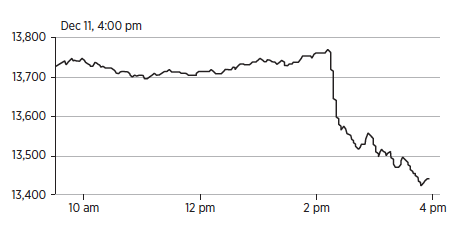

In one respect it is like pornography; I know it when I see it. Here’s the impact on the Dow of the unexpectedly contractionary Fed announcement of December 11, 2007, which occurred at 2:15pm:

That’s more disgusting than any picture of a naked lady.

There are dozens of similar examples. Modigliani–Miller has no implications for monetary economics.

Here’s why my dispute with Fama is so ironic. Who convinced me to look at monetary policy this way? Fama did! Once I understood the EMH, I realized that other macroeconomists were doing things all wrong. The way to do macro is to look at the immediate impact of policy surprises on asset prices. I quickly saw that economists were grossly underestimating the impact of policy shocks like December 11, 2007, which triggered the Great Recession.

So I’ve used Fama’s EMH model for monetary economics, and ended up as far away from Fama as it is possible to be.

Tags:

17. October 2020 at 11:55

Fama seems to believe that markets are so efficient that all price movements are random and there is no conclusions that can be drawn from particular movements. He also seems to be dismissive of the ability to draw conclusions about changes in means since returns are so volatile. I understand that markets are more efficient than most market participants, economists, and laypeople believe, but that’s no reason for him to stick his head in the sand. Also, it’s 2020, there’s no defense for rejecting the fact that monetary policy has real effects in the short run.

17. October 2020 at 12:19

Great post.

17. October 2020 at 13:14

What was the unexpectedly contractionary statement on Dec 11 2007 and why did it have no effect on the TIPS inflation expectations?

10-year 5-year

2007-12-10 2.26 2.14

2007-12-11 2.25 2.10

2007-12-12 2.27 2.15

17. October 2020 at 17:05

Fama is referring to the world we have lived in for 10+ years, interest on excess reserves that pay the treasury rate (or more), and $2-5 trillion of excess reserves, not $10 billion. Yes, the MM theorem was not true when money did not pay interest and bonds paid 5%. That’s not our world, has not been for 10 years, and won’t be anytime in the near future.

17. October 2020 at 18:38

Thomas, I recall that was definitely contractionary–a disappointingly small rate cut. I don’t know why the TIPS response was so small.

John, Thanks for commenting. I added a correction, but in the Fama quote the sentence beginning “Actually” made it seem like a proposition that applies to all central banks. Even with IOR, money is neutral in the long run. Double the base (permanent and exogenous) and you’ll eventually double the price level. That’s unless base money and bonds are perfect substitutes, in which case bonds are money. But financial markets say they are not perfect substitutes, which is why asset prices respond to QE news.

Peter Ireland has a good paper on this topic.

I agree that we are unlikely to drop IOR in the near future. Not sure why the Fed is so opposed to a (non-IOR) system where everyone agrees they can control inflation via OMOs.

17. October 2020 at 18:45

Absurd post. Of course the Fed has an effect, as measured by seconds, minutes or hours. Sure money is non-neutral, as measured by day traders in seconds, minutes, or hours. But longer than a day or two, money is neutral. So MM is right. Money is largely non-neutral, and nearly a century of monetary policy has confirmed that the Fed follows, not leads, the market. Even our host denies that the Fed had much of an effect on the stock market or the economy with its massive and unexpected March 2020 announcement.

17. October 2020 at 18:46

Ray, MM says it’s non-neutral. Double M and you don’t double P.

17. October 2020 at 21:38

Leading and prominent lights in macroeconomics often disagree, and sometimes on the fundamentals, and sometimes diametrically so.

But no one in macroeconomics is ever wrong. (We should advise woke-ists, with their aversion to logic, empirical observation, scientific reasoning and deduction, to go into the refuge of macroeconomics.)

If you are wrong for 40 years in row (Paul Volcker and Martin Feldstein, on the direction of inflation and interest rates) there are always ponderous variations of the retort, “Just you wait.”

As much as I admired Milton Friedman, his “long and variable lags” was a gigantic intellectual refuge. By such a standard, a minor increase in inflation after 30 years qualifies “as long and variable.”

Friedman further nuanced his statement by acceding that an economy operating below capacity would have a longer run to the inevitable inflation. Since we do not know what is full capacity, and we are rarely even near what we think is full capacity….

How fares the wayward earnest laymen, a-wandering the econoscape in the fog?

By the lights of this blog, even people who win Nobel Prizes in economics are wrong on the fundamentals….those economic lighthouses direct ships into the econo-shoals

18. October 2020 at 01:27

‘If “full employment” is anything under 5% unemployment and “price stability” is core inflation below the Fed’s 2% target rate then the Fed has achieved its dual mandate a whopping 3.5% of the time since 1957 when core inflation was first tracked. Yes, you read that right. THREE POINT FIVE PERCENT OF THE TIME.* That means the Fed has failed to simultaneously achieve both its mandates 96.5% of the time. I wouldn’t call that failure. I’d say they’re not even trying. And maybe they’re not?’

https://www.pragcap.com/feds-dual-mandate-bull-sht/

18. October 2020 at 01:36

“Examining the relationship between 3-month and 10-year benchmark rates and nominal GDP growth over half a century in four of the five largest economies we find that interest rates follow GDP growth and are consistently positively correlated with growth. If policy-makers really aimed at setting rates consistent with a recovery, they would need to raise them. We conclude that conventional monetary policy as operated by central banks for the past half-century is fundamentally flawed. Policy-makers had better focus on the quantity variables that cause growth.

Reconsidering Monetary Policy: An Empirical Examination of the Relationship Between Interest Rates and Nominal GDP Growth in the U.S., U.K., Germany and Japan”

https://www.sciencedirect.com/science/article/pii/S0921800916307510

18. October 2020 at 03:58

Postkey,

“Examining the relationship between 3-month and 10-year benchmark rates and nominal GDP growth over half a century in four of the five largest economies we find that interest rates follow GDP growth and are consistently positively correlated with growth. If policy-makers really aimed at setting rates consistent with a recovery, they would need to raise them.”

That’s very similar to what Scott has said if it means “The Fed needs to raise NGDP growth to raise interest rates,” but it’s a bad case of inferring causation form correlation if it means “The Fed needs to raise interest rates to achieve a recovery.”

From the rest of the abstract, it looks like they mean the former, which is good.

18. October 2020 at 06:19

re: “I agree that we are unlikely to drop IOR in the near future. Not sure why the Fed is so opposed to a (non-IOR) system where everyone agrees they can control inflation via OMOs.”

The IOR functions like REG Q CEILINGS for exclusively the DFIs. Raise the rate relative to short-term money market rates, and disintermediation of the nonbanks occurs. The 1966 Savings and Loan credit crunch is the antecedent and paradigm. The Sept. 2019 spike in rates is prima facie evidence.

This is as stupid as it gets. Induce nonbank disintermediation then the supply of loan-funds decreases. This destroys money velocity. It destroys the savings-investment process.

There’s a huge difference between money products and savings’ products, between credit creators and credit transmitters. Lending by the banks is inflationary. Lending by the nonbanks is non-inflationary (other things equal).

From the standpoint of the system, banks don’t lend deposits. Money is either created and destroyed by banks. Savings are activated or deactivated by the nonbanks.

The only way to activate monetary savings is for their owners, saver-holders, to spend/invest either directly or indirectly outside of the banking system.

18. October 2020 at 06:22

Fama/French were properly critiqued when they added “value” and “small cap” stocks to his EMH theory as an “after the fact” proof that EMH was still valid. The critique was undeniably accurate as it was ‘in sample” and there was no evidence of it being predictive.

The Equity investment world has now become one of dozens, perhaps hundreds of “factors”. But Fama French now have a five factor model—AQR has a 6 factor model. I think factors are fine. But if any one factor were to consistently outperform the market (which for some reason is defined as stocks, even as Pubic Debt is at least 50% larger)—-which they believed Value did, I think we have an EMH problem. Or, if certain subsets of factor combinations did then we also have an EMH problem.

But this has yet to be shown. Active managers who can outperform should be able to demonstrate it by timing factors, or stocks. The evidence leans heavily toward an inability to do this. But while Fama/French may have added value by identifying factors, and thus in theory “explaining more of the market’s returns” it’s relevance in importance is analogous to a first derivative of the original,EMH.

My biggest critique of these creative very smart guys beginning with Markowitz was their unwillingness to factor in debt into their investment models——which is surprising.

(M&M did in corporate finance and taxes). So it’s not surprising to me Fama’s view of monetary policy is not exactly his sweet spot.

Your point, while obvious once you said it, that money is like “old” gold and “almost unrelated to our financial system” was very informative and alters how I view policy. And I agree the Fed makes markets move instantly through surprises. 1 over atoms may be a bit much——maybe 1 over molecules is closer. And your notion of “surprises” generally is clearly true—-interesting you got that idea from EMH.

18. October 2020 at 06:26

Capital is not homogeneous. Mal-investment (“impacts resource allocation”), stems from the fact that adding indiscriminate and infinite money products (QE-Forever), decreases the real-rate of interest and has a negative economic multiplier.

Whereas the activation and discharge of $15 trillion of finite and real-investment targeted savings products (near money substitutes), increases the real-rate of interest, produces higher and firmer nominal rates, and has a positive economic multiplier

18. October 2020 at 06:35

re: “The evidence leans heavily toward an inability to do this.”

That’s crazy talk. Money flows, volume times transactions’ velocity, bottomed in October 2002 with stocks. Money flows bottomed in March 2008 with stocks. It’s the same since WWII. Every recession, except Covid-19, since WWII was the FED’s fault.

Some people don’t know a credit from a debit, money from mud pie.

18. October 2020 at 06:39

correction, should have been March 2009. It’s always the same. You measure money flows by rates-of-change, from bank debits to deposit accounts. This is grade school stuff.

18. October 2020 at 06:46

I have had this tendency to believe Treasury ownership by the Fed is offset by excess reserves——which is also not cash——just a t-bill substitute for banks. Also, shortage of bank capital has not been a restriction to lending——we have no shortage of Tier 1 capital in the system. Capital determines lending capacity and money creation, not reserves—-particularly if we have a liquid fed Funds and repo market when needed. We saw that go away in 2007-2008. So I assume that is why Fed buys Treasuries during Covid destruction. How wrong is that statement?

18. October 2020 at 07:08

http://fmwww.bc.edu/ec-p/wp772.pdf

18. October 2020 at 08:56

Why is the fact that price (yield) differ between T-bills and currency relevant? Thinking about the M&M context, there is no reason to expect that the yield on corporate bonds and stocks will be identical, but the M&M theorem still shows that these two funding mechanisms are close substitutes.

18. October 2020 at 09:28

Cove77, Thanks for the link.

Max, Isn’t it more accurate to claim that MM “assumes” (not “shows”) the two are close substitutes? In any case, I suspect that bonds and stocks are far closer substitutes than cash and T-bills.

In 1981, cash yielded zero and one month T-bills yielded 15%. You never see that sort of vast gap in expected risk adjusted return for stocks and bonds from the same company. Or am I missing something.

Cash is not priced as an “investment” asset like stocks and bonds. People hold cash for radically different reasons from why they hold stocks and bonds.

18. October 2020 at 10:50

The payment of interest on IBDDs turned otherwise non-earning assets into earning assets (emasculating the trading desk’s open market power).

Whereas the DFI’s would have always purchased short-term securities, temporarily pending a longer term more profitable disposition of their legal lending capacity (thereby expanding the money stock), as they always did between 1942 and 2008, thereby remaining fully “lent up”, today the funds remain largely idled (little reserve velocity).

18. October 2020 at 10:52

Banks don’t loan out deposits. The saved components, essentially non-M1 components are frozen, an unrecognized leakage in Keynesian economics.

The business cycle simply represents an increasing volume or percentage of bank deposits being saved. The FED then tries to offset the decline in velocity by injecting an increasing volume of new money. So, at the end of the cycle we get FOMC schizophrenia: Do I stop because inflation is increasing? Or do I go because R-gDp is falling?).

The GFC’s “Minsky Moment” was another prime example. Prices peaked in July 2008 – which was reported with a lag on Aug 14, 2008 – when the government announced that the annual inflation rate surged to 5.6% in July – the highest point in 17 years.

If the FED pursues a rather restrictive monetary policy, e.g., QT, interest rates tend to rise.

This places a damper on the creation of new money but, paradoxically drives existing money (savings) out of circulation into frozen deposits (un-used and un-spent, lost to both consumption and investment). In a twinkling, the economy begins to suffer.

It’s stock vs. flow. As Dr. Philip George says; ““When interest rates go up, flows into savings and time deposits increase” ( the ratio of M1 to the sum of 12 months savings ).

18. October 2020 at 11:02

You can’t even finish reading that crap. Re: “the Federal Reserve’s “monetarist experiment” of 1979 through 1982”

That wasn’t monetarism. In 1980, Paul Volcker, Past chairman of the Board of Governors of the Federal Reserve System, appeared before the House Domestic Monetary Policy Subcommittee. In response to a question as to why the Fed had supplied an excessive volume of legal reserves to the member banks in the third quarter 1980 (annual rate of increase 13.2%), Volcker’s defense was that there are two types of legal reserves: 1) borrowed (reserves obtained by the banks through the Federal Reserve Bank discount windows), and 2) non-borrowed (reserves supplied the banking system consequent to open market purchases).

Volcker advised the congressmen to watch the non-borrowed reserves — “Watch what we do on our own initiative.” The Chairman further added — “Relatively large borrowing (by the banks from the Fed) exerts a lot of restraint.”

This is of course, economic nonsense. One dollar of borrowed reserves provides the same legal-economic base for the expansion of money as one dollar of non-borrowed reserves. The fact that advances had to be repaid in 15 days was immaterial. A new advance can be obtained, or the borrowing bank replaced by other borrowing banks. The importance of controlling borrowed reserves was indicated by the fact that at times nearly 100% of all legal reserves were borrowed.

18. October 2020 at 11:23

re: “Recently, however, Goodfriend (2002), Ennis and Weinberg (2007), and Keister, Martin, and McAndrews (2008) have all suggested that to some extent, even this last remaining role for a measure of money in the monetary policymaking process can vanish when the central bank pays interest on reserves.”

Tripe. Nothing has changed > 100 + years. The FOMC’s monetary policy objectives should be formulated in terms of desired rates-of-change, roc’s, in monetary flows, volume times transaction’s velocity, relative to roc’s in the real-output of final goods and services -> R-gDp.

Roc’s in N-gDp, or nominal P*Y, can serve as a proxy figure for roc’s in all physical transactions P*T in American Yale Professor Irving Fisher’s truistic: “equation of exchange”. Roc’s in R-gDp have to be used, of course, as a policy standard.

We knew this already. In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7 year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal” Its 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

The only tool, credit control device, at the disposal of the monetary authority in a free capitalistic system through which the volume of money can be properly controlled is legal reserves. The FED will obviously, some time in the future, decades from now, lose control of the money stock.

18. October 2020 at 11:34

re: ” banks that typically lend reserves find that the benefit of doing so has declined”

As savings are increasingly bottled up in the payment’s system, AD will fall. As AD falls the volume of bankable opportunities falls with it.

Just think. The U.S. Golden Era in Capitalism was 2/3 financed by velocity, activating savings products. Today, it takes more than a dollar of money products just to finance a dollar of GDP.

That is there are more and more leakages in the circular flow of income.

19. October 2020 at 06:28

As I said in 2009:

T-bills are settled upon maturity, or are liquidated at a discount.

IOeR’s compete with money market “paper” (as contrasted to the capital market). The financial instruments traded in the money market include Treasury bills, commercial paper, bankers acceptances, certificates of deposit, repurchase agreements (repos), municipal notes, federal funds, short-lived mortgage and asset-backed securities & Euro-Dollar CDs (liabilities of a non-U.S. banks operating on narrower regulatory margins).

The money market is differentiated by its position on the yield curve (i.e., short-term borrowing & lending with original maturities from one year or less). Domestic liquidity funding is customarily benchmarked by the London interbank market LIBOR indexes & foreign exchange swaps.

In turn, money market paper funds the capital market (earning assets greater than 1 year). Non-bank financial intermediaries in the capital market include hedge funds, SIVs, conduits, money funds, pension funds, selective mutual funds, hedge funds, sovereign wealth funds, insurance companies, banks , foundations, universities, & individuals as well etc.

IOeR’s invert the short-end of the yield curve. They reduce the spread, or net interest rate margin between borrowing short & lending long (between the weighted-average interest earned on loans, securities, and other interest-earning assets, & the weighted-average interest paid on deposits and other interest-bearing liabilities). A flatter yield curve and/or lower rates shrink bank profit margins (reduce profits on new loans and new investments).

IOeR’s sport a “floating”, remuneration rate (currently consonant with the 1 year “Daily Treasury Yield Curve Rate”). Interest is paid on the Deposit-Taking Financial Institution’s (DFIs) IBDDs balances averaged over the reserve maintenance period (7 or 15 days, depending upon the institution), & credited 15 days after the close of the respective maintenance period (unlike overnight FFs or repos).

I.e., the BOG’s policy rate “floats” (like an adjustable rate mortgage), via a series of either, cascading, or stair-stepping, interest rate-pegs. I.e., as with ARMs, a “note is periodically adjusted based on a variety of indices”. Similarly, “Among the most common indices (for ARMs), are the rates on 1-year constant-maturity Treasury (CMT) securities”.

19. October 2020 at 07:21

The Japanese save more, keep more of their savings in the payment’s system, and remunerate IBDDs.

Long-Term Government Bond Yields: 10-year: Main (Including Benchmark) for Japan (IRLTLT01JPM156N)

https://fred.stlouisfed.org/series/IRLTLT01JPM156N

Case closed.

19. October 2020 at 15:28

I am confused. Can’t these things be very close substitutes? I use my Visa tied to my treasury money market brokerage sweep to buy some stuff at Wal Mart. Money is transferred to Wal Mart, my treasury sweep debited, Wal Mart takes cash and buys t bills.

19. October 2020 at 15:33

Matthew, Yes, right now reserves and T-bills are close substitutes. But “cash” means actual paper money.

19. October 2020 at 17:36

Thanks for the detailed response!

When was the last time you paid for anything with actual cash? When I stand in line to pay at the grocery store I pay with apple pay or a credit card. That is linked to an (in principle) interest-bearing account which is now backed pretty much by (in principle) interest-bearing reserves. So yes, I pay with T bills! Or mortgage-backed securities. The trillions of reserves, which is what Fama is after, have nothing to do with transactions cash.

John Cochrane

20. October 2020 at 09:39

John, It’s great to have your comments.

I think you are still paying with reserves in that case, the T-bills are just backing for the account. Is that right?

The question is not how often I pay with cash, it’s how big is the aggregate demand for cash, and how does the use of cash differ from other assets. Cash demand is huge, and getting bigger! So let’s say that in the modern world cash is primarily used for illicit activities. In that case cash has a very distinctive demand. That’s why savers back in 1981 held billions in $100 bills despite 15% yields on one month T-bills. The advantages of anonymity offset the interest foregone.

I agree that bank reserves are currently close substitutes for T-bills, but that’s a choice of the Fed. And as long as they are not perfect substitutes, the long run money neutrality propositions continue to hold (if you exogenously and permanently double the base then NGDP will double in the long run.) If the Fed chooses to make reserves and T-bills into perfect substitutes, then you control the price level by controlling the total of base money and T-bills. I think that’s a foolish system—it divides responsibility for hitting the 2% inflation target between the Fed and the Treasury—but it’s a feasible system.

Overall, the fact that financial markets continue to respond strongly to QE news (See Joe Gagnon’s research) convinces me that we still are not in the perfect substitute world.

Just to be clear, I favor using the base as an instrument, not a target. Base velocity is highly unstable near the zero bound, and thus the Fed should adjust the base as needed until markets forecast on-target inflation. (Perhaps peg the TIPS spread at 2%, for instance.)

You and I discussed this a long time ago, I think you agree the Fed could peg a CPI futures contract sort of as they used to peg gold prices.

21. October 2020 at 00:44

Scott, I can do essentially the same with cash. Visa inserted to bank machine debits a treasury money market. I take cash to Wal Mart to buy stuff, and they deposit to their account.

21. October 2020 at 01:00

Sorry, part of my post was cut off. I still struggle with the difference. Our modern electronic payment system, immense supply of government debt and liquid products that hold things like t bills seem to blur the lines for me. May be worthy of a post debating this. Why has cash held by the public increased during Covid? Is it because people are taking their government issued unemployment visa to the bank machine to get cash?

21. October 2020 at 01:36

As I have been reading up on all things cash, I came across this OMG blog post which is interesting:

Cashing In: How to Make Negative Interest Rates Work

https://blogs.imf.org/2019/02/05/cashing-in-how-to-make-negative-interest-rates-work/

21. October 2020 at 08:30

That should be IMF blog post above. Mobile spell check.

21. October 2020 at 10:28

Matthew, The demand for cash is overwhelming as a store of value. There are no close substitutes for this role, as it is anonymous. People hold cash as a store of value even when T-bills yield 15% risk free. What does that tell you?

22. October 2020 at 09:20

Where are the scientists? The money stock was not altered (redefining interbank demand deposits), to compensate for the changes in deposit classifications when the DIDMCA of March 31st 1980 turned 38,000 financial intermediaries into 38,000 commercial banks (gave the Savings and Loan Associations, the Mutual Savings Banks, and Credit Unions the legal authority to offer demand drafts). However, Dr. Richard Anderson erroneously immediately changed total reserves to match the legislation.

And the money stock was not adjusted when Goldman Sachs, Morgan Stanley, American Express, CIT Group and GMAC (now Ally Financial) successfully converted to bank holding companies “in order to gain access to liquidity and funding”.

Is it no happenstance that we know less and less about money? M1 is overstated. And without money turnover, injecting new money is like “pushing on a string”. I.e., the FED erroneously discontinued publishing money velocity in September 1996.

22. October 2020 at 10:11

re: “The demand for cash is overwhelming as a store of value”

Then why does the rate of change, AD, in money flows not change with an increase in cash?

22. October 2020 at 10:16

re: “I use my Visa tied to my treasury money market brokerage sweep to buy some stuff at Wal Mart.”

Exceptionalism economics. Nothing changed in the 16 years since the FED introduced new transaction deposits. There is no new era yet.

22. October 2020 at 10:25

re: “if you exogenously and permanently double the base then NGDP will double in the long run”

There is no such correlation. We now have multiple reserve banking.

It makes you wonder how interbank demand deposits are currently classified?

The thrifts correspondent balances were always much larger than required to meet their complicit reserves (pass thru arrangements) which exercised no constraint on money creation.

22. October 2020 at 10:46

Unlike Treasury issuance, because the belligerent bifurcation (the mis-aligned distribution of sales and purchases of debt by the FRB-NY’s trading desk and its customers/counter-parties is largely unpredictable, so too now is the volume and rate of expansion in the money stock.

FOMC policy has now been capriciously undermined – by turning non-earning excess reserve balances into bank earning assets. The FED has emasculated its “open market power”.

This is in direct contrast to targeting: *RPDs* (reserves for private nonbank deposits), and by using non-borrowed reserves as its operating method (predating Paul Volcker’s October 6, 1979 pronouncement on the *Saturday before Columbus Day*), as Paul Meek’s (FRB-NY assistant V.P. of OMOs and Treasury issues), described in his 3rd edition of “Open Market Operations” published in 1974.

This adds up to an obdurate apparatus that the Fed cannot monitor, much less control, even on a month-to-month basis. What the net expansion of the money stock will be, as a consequence of any given addition or subtraction in Federal Reserve Bank credit, nobody can forecast until long after the fact. And the whole process is now initiated by the member banks, via proffered bankable opportunities, not by the monetary authorities.

22. October 2020 at 10:54

re: “Without cash, depositors would have to pay the negative interest rate to keep their money with the bank, making consumption and investment more attractive. This would jolt lending, boost demand, and stimulate the economy.”

Exactly the opposite would happen. Economic activity would grind to a halt. As Dr. Philip George says: “The velocity of money is a function of interest rates”

22. October 2020 at 12:28

The neutrality or non-neutrality of money is a copout. It’s about the non-neutrality of credit. Money products are inflationary. Savings products are non-inflationary.

22. October 2020 at 12:45

Why do you think stocks fell in Sept 2015 and oil bottomed in early 2016:

01/1/2015 ,,,,, 0.05 0.20

02/1/2015 ,,,,, 0.07 0.19

03/1/2015 ,,,,, 0.07 0.19

04/1/2015 ,,,,, 0.07 0.21

05/1/2015 ,,,,, 0.07 0.18

06/1/2015 ,,,,, 0.07 0.19

07/1/2015 ,,,,, 0.06 0.20

08/1/2015 ,,,,, 0.06 0.18 China devalues Yuan

09/1/2015 ,,,,, 0.01 0.15

10/1/2015 ,,,,, 0.02 0.16

11/1/2015 ,,,,, 0.03 0.13

12/1/2015 ,,,,, 0.04 0.16

01/1/2016 ,,,,, 0.02 0.14 Oil bottoms

02/1/2016 ,,,,, 0.04 0.12

28. October 2020 at 02:28

[…] Two papers that influenced my view of banking in general and central banking in particular were Bank Funds Management in an Efficient Market, by Fischer Black, and Banking in the Theory of Finance, by Fama. Both take seriously the modern theory of financial markets that begins with Modigliani-Miller. One could see smoke coming out of Scott Sumner’s ears even before he responded.* […]

28. October 2020 at 02:33

[…] Two papers that influenced my view of banking in general and central banking in particular were Bank Funds Management in an Efficient Market, by Fischer Black, and Banking in the Theory of Finance, by Fama. Both take seriously the modern theory of financial markets that begins with Modigliani-Miller. One could see smoke coming out of Scott Sumner’s ears even before he responded.* […]