Bubbles don’t exist: Example #761

Since I began blogging in early 2009, I’ve cited one example after another of how “bubble” claims were completely meaningless and worthless, the sign of sloppy reasoning. (Akin to “rolling recessions”, or “long and variable lags”, or “greedflation”)

The tech bubble of 1999? Nope, prices were rational. A housing bubble in 2006? Nope, prices were rational. Bitcoin a bubble at $30? Today, the price is near $30,000!

With low interest rates after 2010, bubble claims began to reach frenzied proportions. One of my favorites was that “artificially low interest rates” (a sign of sloppy reasoning right up there with greedflation) had created a housing bubble. With the end of the low interest rate environment, surely that bubble was about to pop!

Nevermind . . .

You can go onto twitter and read all about how high interest rates are tight money, how the economy blows one bubble after another, how fiscal policy drives aggregate demand, how corporate greed drives up prices, how we are experiencing a rolling recession, how those “long and variable lags” will eventually kick in, and how “industrial policies” help the economy.

Or you can stay here, a blog that takes economic theory seriously. The EMH, rational expectations, monetary dominance, long and variable leads, free markets work, statism sucks.

MEGA!

(Make economics great again.)

PS. Some people cite the tulip thing, which is still disputed. In any case, when you have to go back to the 1600s to find an example . . .

Tags:

11. August 2023 at 08:25

What about the Japanese housing bubble? Seems like an obvious example.

11. August 2023 at 09:45

What did you think of Reis’ description of what a bubble is?

11. August 2023 at 12:56

Arilindo, Of what? Something that went up and down? If that’s your definition of bubbles, then no one would dispute that bubbles exist.

Danny, This quote?

“Reis: And then what you end up with is, because I don’t know that you don’t know that I don’t know of when exactly this is going to end, we’re all allowed to have this diversity of what economists like to call higher beliefs, and we end up with a bubble surviving until it finally hits the point where there’s enough of us selling, and then all of us end up selling at once. And so I think it’s this concept which many people have linked to John Maynard Keynes and his famous beauty context he talked about where, it’s not so much about whether we’re trying to figure out, David, whether this asset has a bubble or not, it’s really about how we’re trying to figure out when are we going to sell. We may all agree that there’s a bubble there, but it’s rather, is it going to crash in December, November, October, or September?”

I think the beauty contest metaphor is exactly backwards. I look for investments that other people think are ugly, but are actually beautiful. Those are undervalued.

In any case, it’s bad that Reis cites tech stocks during 1998-2000 as a bubble, when in retrospect they were not. The huge returns on the winners justify the ex post overvaluation of the losers—no one at the time knew which ones would end up dominating the global economy.

11. August 2023 at 13:35

Professor,

What would be your definition of a bubble?

11. August 2023 at 15:16

Scott, when I am defending your position, I usually begin by asking what a person means by “bubble.” They usually respond by saying the asset is overvalued (relative to some fundamental). But further interrogation reveals that’s not really what they mean. Instead, they mean something like “in the near future the price of the asset will fall fairly dramatically.” Which makes sense given the bubble analogy – at some point it will pop.

So despite what they claim, the real reason folks believe a bubble exists is not actually based on value of the asset right now (relative to some purported fundamental), but instead what they expect the value of the asset to be in the near future. You can get them to admit this by asking whether they would call it a bubble even assuming the asset keeps going up in value forever.

If the existence of a bubble is predicated on some impending drop in value, then it begs the question, what will cause the drop in value? If the cause of the drop is new information, then that’s consistent with EMH and doesn’t really prove the asset was overvalued prior to the discovery of the new information.

On the other hand, if it’s something like “everybody suddenly realizes the asset was overvalued,” then the person has committed a logical contradiction. If the reason the asset was overvalued is because its value fell, the reason its value fell can’t be because people realized it was overvalued.

A sudden and dramatic fall in asset value is simply insufficient by itself to justify that, in the past, an asset was overvalued.

11. August 2023 at 15:36

To hell with bubbles. I want someone to tell me about a reverse bubble (in advance, or as it is happening).

12. August 2023 at 06:34

Speculators don’t call bubbles, they call inflection points. They could care less if it was a bubble, they just want to be on the right side of the market.

But the so-called “dot.com” bubble was indeed a bubble. Alan Greenspan made it so. In anticipation of a Y2K computer date catastrophe, Greenspan injected an abnormal volume of excess legal reserves into the banking system. That distortion made it a bubble. Speculators knew that it would be “washed out”.

12. August 2023 at 06:47

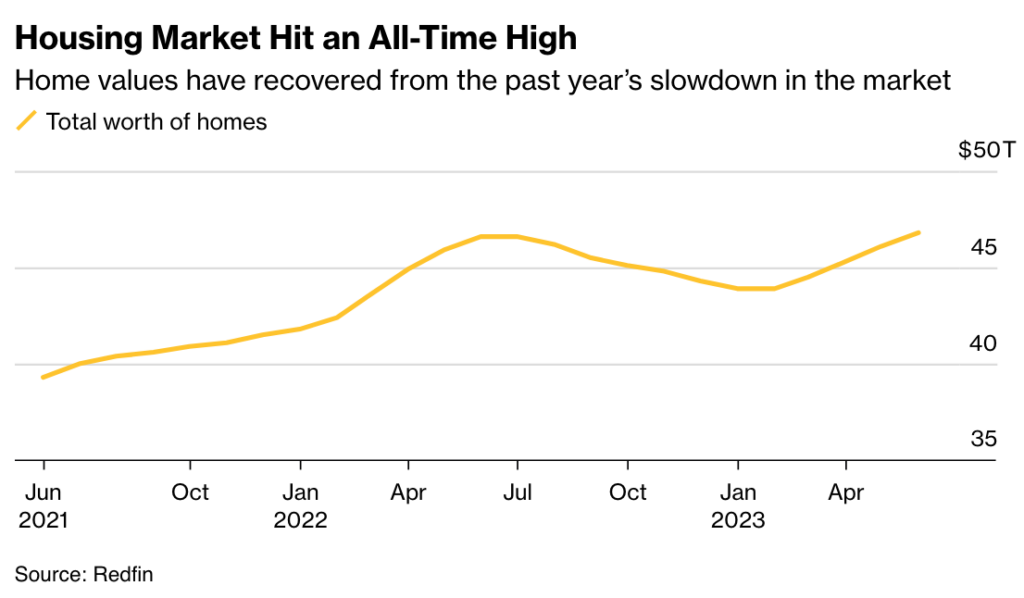

re: Housing hit an all-time high

Bernanke forced an absolute decline in money flows, the volume and velocity of money, to cause the GFC. Powell has not driven money flows lower after C-19. Money flows are still rising.

And the CRB commodity index is rising:

https://tradingeconomics.com/commodity/crb

12. August 2023 at 07:06

re: “long and variable lags”

“At the Dec. 27–29, 1971, American Economic Association meetings, Milton Friedman (1972) presented a revision of his prior work on the lag in effect of monetary policy (e.g. Friedman 1961). His new conclusion was that ‘monetary changes take much longer to affect prices than to affect output’; estimates of the money growth/CPI inflation relationship gave ‘the highest correlation… [with] money leading twenty months for M1, and twenty-three months for M2’ (p. 15)”

The pundits use one rate-of-change metric to dissect inflation based on their preferred definition of money. And it is invariably y-o-y. And Divisia Aggregates and TMS measures are negative. Both approaches are wrong in the determination of a recession (as Milton Friedman originally described).

Atlanta’s gdpnow Latest estimate: 4.1 percent — August 08, 2023

Short-term money flows are trending up. Long-term money flows are trending down.

12. August 2023 at 07:27

Economists don’t understand money and central banking. Contrary to the Keynesian economists who dominate the FED’s research staff, banks aren’t intermediaries.

It’s virtually impossible for the Central Bank or the DFIs to engage in any type of activity involving non-bank customers without an alteration in the money stock. I.e., deposits are the result of lending and not the other way around.

There is a one-for-one correspondence between demand and time deposits (as loans = deposits). As time deposits are depleted, demand deposits grow dollar-for-dollar.

That’s what is propelling the economy, dis-savings, the conversion of time to demand deposits. I.e., the demand for money is falling, velocity rising. The proportion of TDs to DDs has fallen by 18% since C-19. And the turnover ratio for DDs is much higher than TDs.

12. August 2023 at 10:00

Rafael, An asset that is likely to do poorly going forward, or where shorting the asset is expected to yield very high returns. An asset that is obviously overpriced.

12. August 2023 at 13:38

Wouldn’t Chinese housing be a bubble? I think that for a number of years that it has been clear that the NPV of purchasing a condo has been negative, given how low rents are compared to prices, a shrinking population, high vacancy rates, high prospect for a slowdown in growth, etc.

12. August 2023 at 14:19

“I look for investments that other people think are ugly, but are actually beautiful. Those are undervalued.” I don’t even *try*, because for me it is too hard to know when one of these is “actually beautiful.” Virtually always I lack not just knowledge, but even a small net inclination-to-believe–to believe, that is, that such-and-such investment is more valuable than the market is pricing it. But the dream lives: maybe someday I will have usable inside information!

Meanwhile, I am staying with The Money Illusion; keep up the good fight!

12. August 2023 at 17:10

Here are some bubbles–no good way to short some of them unfortunately:

-Jaylen Brown. I don’t even follow basketball but I’m scratching my head over his 5 year contract.

-Ron DeSantis as a presidential candidate from 2022 through early 2023. If you invested in that you are now feeling buyer’s remorse.

-Trump Steaks

-The South Sea Company. Although, can we make a useful distinction between outright fraud and overly optimistic business ventures? Isaac Newton got caught up in that one.

-WeWork–even without the pandemic.

-Twitter when Musk bought it.

-Organized Religion. Be careful shorting this because you may find yourself getting burned at a stake by other shareholders.

12. August 2023 at 18:01

I’ll stay here. Thank you for the blog Scott. I’ve been reading since the beginning in 2009. As a person who went to grad school for economics I really appreciate all the serious and scholarly approach. But yet it’s still accessible to the non-economist. You’ve made a huge contribution to the econ blogosphere. (And to macroeconomic theory as well) Bravo Prof. Sumner.

Oh, didn’t Earl Thompson write a paper way back about how “Tulipmania” prices were actually the result of a rational response by the buyers and sellers in the tulip market. Funny how the people who see bubbles in all these markets never make money from these “brilliant” observations. Should be easy, right?

13. August 2023 at 04:35

Lending/investing by the banks is inflationary (increases the volume and turnover of new money). Lending/investing by the nonbanks is noninflationary (results in the turnover of existing money), other things equal.

See ZeroHedge’s double counting:

https://www.zerohedge.com/markets/large-bank-loan-volumes-slump-despite-fed-reporting-massive-deposit-inflows

“The divergence between money-market fund assets and bank deposits remains extreme…”

I.e., the transaction’s velocity of money has increased. As Dr. Philip George puts it: “Changes in velocity have nothing to do with the speed at which money moves from hand to hand but are entirely the result of movements between demand deposits and other kinds of deposits”.

“Extreme” is no bubble.

13. August 2023 at 20:33

I had read somewhere that a group of chinese business men were going into rural locations in vietnam and triggering tulip style bubbles on some locally produced commodity for fun. I had no way of verifying the facts and it could certainly be part of a general anti china bias, but it struck me as perfectly plausible. So bubbles of this kind are a possible sociological phenomena, but i agree it is not a helpful framework for assessing market prices in any size as the psychic element is dwarfed by financial incentives.

13. August 2023 at 21:09

Lizard, They were saying it’s a bubble back in 2000. How’d those forecasts work out? Sure, there will be ups and downs in housing prices, that’s how markets work.

15. August 2023 at 23:55

Just looking at prices is not enough to define a bubble, you would need some fundamental reference,i.e. to some sort of expectation which is what bubble pundits typically do (hard to do for Bitcoin, though).

I am sypmpathetic to Minskian stability/unstability defintions and find it very useful for understanding the phenomena at hand. Unstable financial relationships (bubbles) are those that need rapidly improving fundamentals (outside of historial experiance or logic) to make sense. If that is the case, you can reasonably call it a bubble (once in a while the rapidly improving fundamentals even might come to pass)…

for instance here in central Europe there defintitely has been a real estate bubble. People were buying real estate barely able to service the debt at record low interest rates (2 percent at times). Naturally, now that rates have normalized they cannot even pay interest, let alone principal – I would call that a bubble,

I do not know to what extent this has been the case in the US housing market, additional date would be required – a price chart is meaningless without context

17. August 2023 at 14:57

My own definition of a bubble would be a class of investments where buying and holding the investment is predicted to have a negative NPV, but people still buy enough of the asset to drive up the price. If the only reason an investment looks like it will have a positive return is because the price of asset is predicted to rise, and not because of the predicted NPV of the other cash flows, that is a bubble. So I do think that when people talk about a bubble, they aren’t just talking nonsense. They are communicating their belief about the predicted NPV of the cash flows from buying an asset versus its current price.

In the case of Chinese housing, calling it a bubble is akin to saying that the NPV of the cash flows that come from buying and holding a house are negative. People weren’t buying houses because they thought they would make money being landlords, or that they would save money versus renting, they were buying houses in the belief that the value of the house would continue to rise indefinitely without any change in the expected value of the cash flows that come from owning the house.

21. August 2023 at 15:21

I don’t understand how this argument makes sense.

If I understood correctly, your point is that Bitcoin at $30 was not a bubble because it’s now higher, but by that logic, bubbles only exist in the infinitesimal point in time of their last peak before they collapse, since any point prior the price was higher.

It’s also curious you chose BTC as the asset in question, when we’ve seen NFTs go from >$1M to literal pennies.

21. August 2023 at 16:00

Lizard, If you keep calling an asset a bubble for a long enough period of time, eventually you will see the price action confirm your forecast. I don’t dispute that point.

But “bubble” is not a useful concept. It doesn’t help investors make wise decisions.

Xavi, Check this out:

https://www.econlib.org/99-lead-balloons/

22. August 2023 at 08:37

Scott, I think you can have bubbles in markets that are extremely inefficient, where there are extreme limits to arbitrage and no short selling.

Stocks and bitcoin are not examples of these markets.

22. August 2023 at 15:31

Hi Scott,

I actually found this post through that article, trying to find more clarity.

I find your thought experiment very unconvincing, Tyler just needs to *short* the bubbles to put your 10-fold return to shame.

I also find the claims of “rational prices” to be very unconvincing. Assume an asset X experimented a real bubble. Go back to it’s early history, define it’s class as one that includes surviving companies. If you do this late enough, you can pretty much always “prove” the prices were “rational”.

Not knowing which companies will be the winners is a lousy justification for price increases in companies that changed their name to “.com” with no other changes, or for investors buying *the wrong* $ZOOM during the pandemic.

There’s something that ties together all this examples though (and most of the ones people claim to experience bubbles), and that’s that I would not classify those markets as particularly efficient, e.g. shorting the housing market or BTC is *hard*, and it involves outsized counterparty risks, it’s not surprising that they trend upwards.

29. August 2023 at 09:57

Scott, Have not visited your website for some time. Better than ever!