Are the jobs gone forever?

In my previous post, I linked to a Tyler Cowen post that quoted Betsey Stevenson:

The problem is that old jobs are long gone for the vast majority of those who remain unemployed.

In a narrow technical sense that may be true. But according to Yahoo, this is also true:

More signs of labor shortages emerged, with employers scrambling to find qualified workers to fill positions and meet surging demand during the post-pandemic recovery. The Bureau of Labor Statistics reported that job openings soared to a record more than 9 million in April. And a separate new sentiment survey showed a record 48% of small businesses reported that they had unfilled job openings last month.

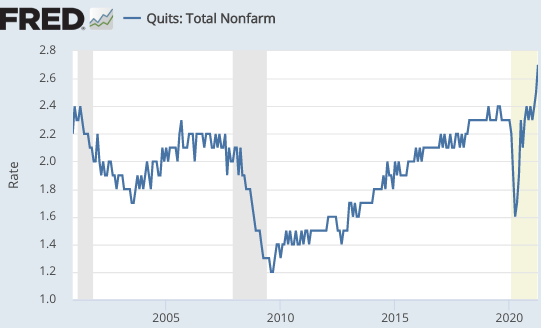

Meanwhile, the BLS says workers are suddenly quitting their jobs at record rates.

And yet unemployment is still 5.8%, far higher than in 2019. This is a really weird labor market.

PS. I wonder if the quit rate is linked to recent reports of some companies offering considerably higher wages? Workers may be shifting from one job to another. If so, the wage increases may spread.

PPS. Today, I’m even more skeptical of UBI than I was last year.

PPPS. I recently spoke with a college student who within the past 5 weeks received $3800 in stimulus checks. Summer job? Not this year.

Tags:

8. June 2021 at 10:07

For college kid and I bet you agree with this. Why would stimulus checks keep them from summer job. Instead of doubling down and working? Thats what I would have done in college. Even with 4k I’d still definitely value more summer money over just chilling for the summer. In my case I had study abroad coming up and every extra thousand meant another trip thru Europe I could schedule.

8. June 2021 at 10:31

Again, the reason people don’t want to work is clear:

https://safs.ca/issuescases/

The hatred and animosity towards “whites” and “white men” in particular, and western values more generally, is so ferocious that one would rather feign disability then spend their days with pseudo science quacks that analyze everything they’ve ever said through a dark age, dystopian, microscope; or attempt to brainwash them with “little red books” under the disguise of “anti-racist” and “anti-fascist” propaganda, as if censorship and placing people into groups is not fascist.

The latest victim is a Canadian professor who dared to say the obvious: that all lives matter. It’s like saying the grass is green, or the sky is blue, but apparently that is oblivious to the self righteous, Marxist, race baiters.

Here is a list of your drugged up fascists, calling themselves “anti-fascist”:

https://twitter.com/MrAndyNgo/status/1401747386863599619

Here is a racist black man who yells “chink”, over and over, towards a law abiding officer.

https://twitter.com/MrAndyNgo/status/1402116241163264000

What sane person would want to work under such stress? Who would want to subject themselves to such inhuman treatment, and punishment? Who would dare to speak truth to the mob?

Not many!

8. June 2021 at 11:03

@Rinat:

Finally a sane, reasonable comment here. You really know what you’re talking about, unlike SCCPott SCCPumner.

8. June 2021 at 12:10

I favor a Friedman style negative income tax.

8. June 2021 at 12:19

At least in engineering and science, if the college student wants a successful career once they leave college than they should be doing an internship or similar activity (paid or unpaid) in the summer.

One of the advantages of having family or other wealth as a college student is that you can prioritize this and accept internships based on interest/perks instead of on pay.

8. June 2021 at 12:27

Michael,

I agree that a negative income tax is a good idea. I think what is keeping unemployment high is the UI insurance, while the heating labor market is caused by high nominal gdp growth. If you get rid of UI insurance, and do a negative income tax, then you are going to get a very nice employment market.

8. June 2021 at 17:46

This fits with an intuition I’ve had about reasonable levels of UBI: it will fundamentally invert part of the lower end of the job market.

Highly unappealing jobs at the low end of the market will have to dramatically increase wages to attract workers, if the alternative is to have a reasonably acceptable standard of living while -not doing awful work-. (remember, the previous option was to have a job or risk abject poverty)

Or, in other words, low-end jobs that are “nicer” (e.g. sitting at a reception desk) will likely become FAR more in-demand (from the worker side) and may see wage decreases. On the other end, low-end jobs that are “worse” (e.g. serving, janitorial, manually intensive) will need to increase wages DRAMATICALLY for their wages to outweigh the “cost” of having to do terrible work.

It’s interesting to see job wage pricing approaching how appealing a job is, not how much a worker needs that job to survive.

8. June 2021 at 19:36

Rinat, Yes, a sudden surge in hatred of whites caused unemployment to surge from 3.5% at the beginning of 2020 to 14% by April 2020. That makes perfect sense.

Blue, I agree that it might force wages higher (and I’d add it might increase illegal immigration.) Of course the higher wages mean fewer jobs.

8. June 2021 at 22:29

@Blue, @Ssumner

If the UBI has that impact on lower end jobs, I would think that has significant knock on effects on gendered wage gaps. It would mean that men without much formal education or training would see wage increases, while similar women would see wage decreases. I don’t know if that would lead to more marriages or fewer men sitting at home playing video games. Maybe some progressives should talk to Mitt Romney about this.

Also, I think that this is the first recovery since the ACA markets and subsidies were implemented. I would assume that they are slowing down the recovery of jobs somewhat, though by how much I am not sure.

9. June 2021 at 04:50

Scott,

Won’t coupling a UBI of say, $800-1000/month with a wage subsidy that guarantees at least $12/hour help offset the work disincentive?

9. June 2021 at 05:38

Off-topic: Scott, this inflation reasoning scares me:

https://karlstack.substack.com/p/polymarket-prediction-will-inflation?r=ckvol&utm_campaign=post&utm_medium=web&utm_source=twitter

Can you assuage my fears? Please.

9. June 2021 at 06:55

From Todd S. (and Tyler C.’s) link:

“I simply don’t believe that the toothless Fed nor the rudderless Biden administration has the Volker-esque guts to deal with inflation should it continue to spiral out of control.”

Talk about high-quality analysis! If this guy was blogging on monetary issues all the time, why would anyone ever read this one?

9. June 2021 at 06:59

” I wonder if the quit rate is linked to recent reports of some companies offering considerably higher wages?”

Time to recycle those “stores at the mall aren’t letting their employees answer the phone” stories from the 1990’s. (Because the call might be from another store at the same mall….)

9. June 2021 at 07:57

‘ “G7 economies have the fiscal space to speed up their recoveries to not only reach pre-COVID levels of GDP but also to support a return to pre-pandemic growth paths,” Yellen said. “This is why we continue to urge a shift in our thinking from ‘let’s not withdraw support too early’ to ‘what more can we do now.'” ‘

https://www.reuters.com/business/yellen-says-she-urged-g7-keep-up-fiscal-support-recovery

9. June 2021 at 08:00

anon/portly, your points are well-taken.

I don’t mean this to be snarky; I am honestly asking: do you have refutations of the statistics in the post, rather than just the narratives? (I’m hoping you’re right)

9. June 2021 at 08:09

I also don’t understand the role of inflation expectations.

The first column is the actual change in PCE index over 5 years; the second column is inflation predicted for that period by the 5-year TIPS spread; the third column is the difference. (Sorry, the data didn’t copy well.)

The TIPS spread didn’t predict actual inflation very well at all. Is it supposed to? Couldn’t today’s predictions of the TIPS spread also be wrong?

I know I’m ignorant, but I am worried.

2007-12-01 Actual 5 year Inflation Inflation Predicted by TIPS 5 Actual minus Predicted

2008-01-01 11% 9% 2%

2008-02-01 11% 6% 5%

2008-03-01 11% 6% 5%

2008-04-01 11% 7% 4%

2008-05-01 11% 6% 5%

2008-06-01 11% 5% 7%

2008-07-01 11% 7% 5%

2008-08-01 11% 8% 4%

2008-09-01 11% 7% 5%

2008-10-01 11% 6% 5%

2008-11-01 11% 7% 4%

2008-12-01 11% 6% 4%

2009-01-01 10% 6% 5%

2009-02-01 10% 4% 6%

2009-03-01 10% 3% 8%

2009-04-01 10% 5% 5%

2009-05-01 10% 7% 3%

2009-06-01 10% 7% 3%

2009-07-01 10% 7% 3%

2009-08-01 10% 6% 4%

2009-09-01 10% 6% 4%

2009-10-01 10% 5% 5%

2009-11-01 10% 5% 6%

2009-12-01 10% 5% 5%

2010-01-01 10% 6% 4%

2010-02-01 10% 6% 4%

2010-03-01 10% 7% 3%

2010-04-01 10% 6% 3%

2010-05-01 9% 7% 3%

2010-06-01 9% 7% 2%

2010-07-01 9% 9% 1%

2010-08-01 9% 9% 0%

2010-09-01 9% 7% 2%

2010-10-01 9% 9% 0%

2010-11-01 9% 10% -1%

2010-12-01 9% 11% -2%

2011-01-01 9% 10% -1%

2011-02-01 9% 10% -2%

2011-03-01 9% 11% -2%

2011-04-01 9% 12% -3%

2011-05-01 9% 12% -3%

2011-06-01 8% 13% -4%

2011-07-01 9% 13% -4%

2011-08-01 9% 12% -3%

2011-09-01 8% 12% -4%

2011-10-01 8% 13% -5%

2011-11-01 9% 13% -4%

2011-12-01 9% 12% -3%

2012-01-01 8% 13% -5%

2012-02-01 8% 12% -4%

2012-03-01 8% 11% -2%

2012-04-01 8% 11% -3%

2012-05-01 8% 12% -4%

2012-06-01 8% 14% -6%

2012-07-01 8% 14% -5%

2012-08-01 8% 13% -4%

2012-09-01 8% 11% -3%

2012-10-01 8% 10% -2%

2012-11-01 8% 7% 1%

2012-12-01 8% 7% 1%

2013-01-01 8% 4% 3%

2013-02-01 8% 3% 5%

2013-03-01 8% 1% 7%

2013-04-01 8% 3% 5%

2013-05-01 8% 4% 4%

2013-06-01 8% 5% 3%

2013-07-01 8% 4% 3%

2013-08-01 8% 6% 2%

2013-09-01 8% 8% 0%

2013-10-01 8% 15% -7%

2013-11-01 8% 20% -12%

2013-12-01 8% 9% -1%

2014-01-01 8% 8% 0%

2014-02-01 8% 7% 2%

2014-03-01 8% 6% 2%

2014-04-01 8% 6% 3%

2014-05-01 8% 5% 3%

2014-06-01 8% 6% 2%

2014-07-01 8% 6% 2%

2014-08-01 8% 7% 2%

2014-09-01 8% 5% 3%

2014-10-01 8% 4% 4%

2014-11-01 8% 2% 5%

2014-12-01 8% 2% 6%

2015-01-01 8% 2% 6%

2015-02-01 8% 2% 6%

2015-03-01 8% 3% 5%

2015-04-01 8% 3% 5%

2015-05-01 8% 2% 6%

2015-06-01 8% 2% 6%

2015-07-01 8% 2% 6%

2015-08-01 8% 1% 8%

2015-09-01 8% 1% 8%

2015-10-01 8% -2% 10%

2015-11-01 8% -1% 9%

2015-12-01 8% 1% 7%

2016-01-01 8% 0% 8%

2016-02-01 8% 1% 7%

2016-03-01 8% 0% 9%

2016-04-01 8% -1% 9%

2016-05-01 8% -2% 10%

2016-06-01 8% -2% 10%

2016-07-01 8% -2% 11%

2016-08-01 8% -4% 12%

2016-09-01 8% -4% 12%

2016-10-01 8% -3% 11%

2016-11-01 8% -4% 12%

2016-12-01 8% -4% 12%

2017-01-01 8% -5% 12%

2017-02-01 8% -5% 13%

2017-03-01 8% -5% 13%

2017-04-01 8% -5% 13%

2017-05-01 8% -5% 13%

2017-06-01 8% -5% 13%

2017-07-01 8% -6% 13%

2017-08-01 8% -6% 14%

2017-09-01 8% -7% 15%

2017-10-01 8% -7% 15%

2017-11-01 8% -7% 15%

2017-12-01 8% -7% 15%

2018-01-01 8% -7% 15%

2018-02-01 8% -7% 15%

2018-03-01 8% -7% 15%

2018-04-01 8% -7% 15%

2018-05-01 8% -6% 14%

2018-06-01 8% -3% 11%

2018-07-01 8% -2% 11%

2018-08-01 8% -2% 10%

2018-09-01 8% -1% 9%

2018-10-01 8% -2% 10%

2018-11-01 8% -2% 10%

2018-12-01 8% 0% 9%

2019-01-01 8% 0% 9%

2019-02-01 8% -1% 10%

2019-03-01 8% -1% 9%

2019-04-01 8% -1% 9%

2019-05-01 8% -2% 10%

2019-06-01 8% -1% 10%

2019-07-01 8% -1% 10%

2019-08-01 9% -1% 10%

2019-09-01 9% 0% 8%

2019-10-01 9% 0% 8%

2019-11-01 9% 1% 8%

2019-12-01 9% 2% 7%

2020-01-01 9% 1% 8%

2020-02-01 9% 1% 8%

2020-03-01 9% 0% 8%

2020-04-01 8% -1% 9%

2020-05-01 8% -1% 9%

2020-06-01 8% 0% 8%

2020-07-01 9% 1% 8%

2020-08-01 9% 2% 7%

2020-09-01 9% 2% 7%

2020-10-01 9% 1% 8%

2020-11-01 9% 2% 7%

2020-12-01 9% 2% 7%

2021-01-01 9% 2% 7%

2021-02-01 9% 1% 8%

2021-03-01 9% 0% 9%

2021-04-01 10% -1% 11%

9. June 2021 at 08:21

Todd, There is some reason to worry about inflation, but I don’t find his post to be persuasive. He handles statistics in a pretty sloppy fashion.

9. June 2021 at 10:15

Can you / economists do some qualitative research and just ask? Is anyone asking?

9. June 2021 at 11:02

Todd, Matt Yglesias made a comment today on Twitter about how if you didn’t buy or rent a car this spring then you probably didn’t notice inflation that much. Granted, attempts to predict inflation through the rest of this year and into the next seem to be the focus of pundit/media frenzy. Like with the weird labor markets, we might have a clearer picture of a lot of things this September. For now, I appreciate that Scott is a voice of reason—like Krugman, Menzie Chinn, Dean Baker, and Bill McBride.

Or, maybe Trump’s reinstallment as President in August will stabilize everything.

9. June 2021 at 12:09

Maybe they are not working because whiteness is now considered a disease.

According to this published paper by Daniel Moss, white people should be sent to reeducation camps.

https://twitter.com/thejcoop/status/1402695511728082950?s=20

If I was threatened to be sent to reeducation camps because my skin color was white, I would not want to work either!!!

It’s good thing I’m brown.

9. June 2021 at 14:38

History shows that high inflation leads to high unemployment. Low inflation leads to low unemployment.

9. June 2021 at 14:40

Scott,

I had a question I was wondering if you could answer. Is there anything that an individual state within the US can do to boost or lower aggregate demand? For instance, the US is in a situation where the Federal Reserve is allowing aggregate demand to grow slower than average, is there something that an individual state like CA or TX can do to boost aggregate demand?

9. June 2021 at 16:52

Billy, I certainly hear lots of stories about people not wanting to go back to their old jobs because they make more on unemployment. But I don’t know how common that is.

Ankh, meet Rinat.

Anon, Maybe slightly, but nothing they could do that would be worth doing. They’d be far better off boosting aggregate supply.

9. June 2021 at 19:09

Scott, thanks for the feedback.

David S, Matt Y forgot: build something with lumber or hire low-wage workers or try to buy a house.

10. June 2021 at 00:37

” They’d be far better off boosting aggregate supply.”

Trying to boost A.S.? Pushing on a piece of string?

10. June 2021 at 06:07

Todd – I shared your fear. What helped me was going back to fundamentals. You can have a spike in inflation for a lot of reasons, but long-term, persistent, year-over-year inflation is only caused by a persistently loose monetary policy. I can easily believe that the Fed overshot and that we’ll have high inflation this year. I see no reason to believe that they have suddenly forgotten how to do there jobs and will make the same mistake again and again.

10. June 2021 at 07:23

@ssumner: Ankh and Rinat “meet” every time “they” look in the mirror.

10. June 2021 at 07:55

Mark Barbieri-

Do you think to engineer a soft landing (which Scott says has never happened in the US) the Fed has to be a little ahead of the game?

It seems that once a 5-10% inflation rate becomes entrenched in peoples expectations, the brakes would have to be applied too firmly for a soft landing.

10. June 2021 at 08:47

“Can you / economists do some qualitative research and just ask? Is anyone asking?”

Not on this ‘site’.

This is a religious site. It’s ‘I believe’!

10. June 2021 at 08:50

Scott “Of course the higher wages mean fewer jobs.”

Higher wages might mean more spending / economic activity which would lead to more jobs.

Both wages and number of jobs appear to be on a general long-term upward trend.

10. June 2021 at 09:39

Scott,

It is the 70s all over again – NAIRU is up and M is massively and then policy makers tells us that the increase in inflation has nothing to do with monetary policy. This is not 2008. This is 1975.

10. June 2021 at 14:06

Lars Christensenm

I usually agree with you, but not in this case. I think there can be some transitory high NGDP growth in the US, but that the last leg of the recovery will be disappointingly slow, with inflation averaging less than 3%. I reference the 5 year inflation breakeven numbers, for example.

I think the S&P 500 implicit annual NGDP growth forecast has mean NGDP growth at just over 4%, meaning real growth will be disappointingly weak, at less than 2%, with unemployment very slow to return to the pre-pandemic low, if at all.

I only speculate as to what might be hurting real growth expectations, but I suspect it’s some combination of tight money, some recent retirements becoming permanent, permanently lower trajectory of population growth, higher expected future taxes, inefficient capital spending via the expected infrastructure initiatives, and perhaps many other factors.

10. June 2021 at 14:13

I also want to point out that I generally expect average S&P 500 earnings growth and price appreciation to be equal, and in fact, since 1962, the difference on average is only 0.1%. However, there are short-run periods over which price appreciation dramatically leads earnings recovery after tight money episodes, such that lower discount rates lead to higher stock price appreciation, until current NGDP picks up enough to allow earnings growth to catch up. Hence, since 1982 or so, when you see large stock market gains much in excess of NGDP growth in the same year, it’s due to recovery from tight money. 2019 and 2020 were such years, as is the first half of this year, though the S&P 500 has been flat since markets concluded that inflation was getting near the Fed’s tolerance limit.

10. June 2021 at 14:17

Foosion, UBI doesn’t affect nominal spending in the long run; it affects the supply side.

Lars, Maybe, but what were 10-year bond yields in 1975? What are they today?

I’d add that the Hypermind prediction market is currently forecasting that NGDP growth will average 3.5% from 2019:Q4 to 2022:Q4. That sort of NGDP growth does not typically generate high inflation.

10. June 2021 at 15:03

Scott,

How seriously do you take that Hypermind prediction? You recently stated that you guessed that monetary policy was either about right or perhaps a bit loose.

Also, what do you think about short-run differential rates of S&P 500 earnings and price appreciation rates, in the context of the rates averaging the same over the long run. Do you agree that this can be good information concerning recent past and current stances of monetary policy?

11. June 2021 at 06:12

Scott, you ask Lars about the 10-year bond yields in 1975, which were around 8%. Is your point, in lay terms, that the market expected inflation in 1975 but doesn’t today?

Is your point about the Hypermind market that high inflation is not expected, so therefore it will not occur? Would that logic apply to TIPS spreads? Five-year TIPS spreads have had essentially no predictive correlation to actual inflation five years out.

Any chance of a post contrasting Lars Christensen’s understanding of our current situation with your own?

11. June 2021 at 06:27

The yield curve is telling. It’s a stealth contractionary policy (expectation of slower growth). It’s a yield curve (time to maturity) flattener (compressing spreads between sectors). Interest rate differentials, vs. other currencies (creating the forward pair), will fall the most in the outer sectors.

But: “Any CMT input points with negative yields will be reset to zero percent prior to use as inputs in the CMT derivation.”

11. June 2021 at 07:24

Michael, I view Hypermind as one useful data point, among others. Stocks also provide one piece of information, which is most useful when money is way too tight.

Todd, Yes, I think if we were facing high inflation then long term yields would be higher than 1.5%.

As for Hypermind, it does NOT mean that inflation will not occur, it means high inflation is unlikely.

11. June 2021 at 07:47

Scott, agreed that UBI would affect the supply side. I thought you were saying higher wages generally would decrease employment.

The market’s reaction to yesterday’s inflation announcement was rather calm, compared to most reporting and commentary that I’ve seen. Odd how that works.

11. June 2021 at 15:11

Scott, a sudden surge in hatred of white BLOOD CELLS might have caused unemployment to surge from 3.5% at the beginning of 2020 to 14% by April 2020. 😉

(I know Covid is not an immune-deficiency disease, it’s a joke)

12. June 2021 at 05:11

John Cochrane pointed to an interesting reason:

Re Tyler Goodspeed: ” If policymakers focus solely on massively raising aggregate demand without considering that, in the short-run at least, supply is inelastic, then even big wage gains in nominal terms are entirely eaten up by inflation. And if real wages are declining, then we shouldn’t be entirely surprised to see stagnant or declining labor force participation.”

“At least 23 states decided over the past week to prematurely cut off the sweetened aid, which provided an extra $300 a week on top of regular state unemployment benefits. The supplemental benefit is not slated to expire until Sept. 6, 2021.”

That denigrates the Philips curve, and perhaps even the non-accelerating inflation rate of unemployment, NAIRU, (the specific level of unemployment that is evident in an economy that does not cause inflation to increase).

12. June 2021 at 05:34

Neither gDp nor inflation is accurately measured. Causality is ignored. Not only are the rates of change specious, but so are the seasonal mal-adjustments.

“Annual CPI inflation is 5%, while 15-month (annualized) inflation is only 3%”

And the core price increases are not transitory, but permanent price increases. There is very little downward price flexibility in the economy. That means income inequality was just exacerbated (the uneven distribution of wealth, the income gap between the rich and the poor). That translates into higher rates of crime.

FAIT (Flexible Average Inflation Targeting) is FIAT (the 5-year/5-year forward horizon). N-gDp level targeting maximizes inflation while minimizing real output.

It is much more desirable to promote prosperity by inducing a smooth and continuous flow of monetary savings into real investment (putting savings back to work, and there are 16 trillion dollars of savings impounded in the banks), than to rely, as we have done c. 2008 (QE-forever), on a vast expansion of bank credit with accompanying inflation to stimulate production (or stagflation, high inflation, low economic growth).

The premise for N-gDp targeting (ignoring inflation): “April’s 4.2 percent year-over-year rise in prices, and the biggest 12-month rise since August 2008” is substantially different this time. R-gDp isn’t falling off a cliff.

The output gap was overfilled by government infusions creating wage-price disruptions.

12. June 2021 at 07:58

foosion, You said:

“I thought you were saying higher wages generally would decrease employment.”

That would be reasoning from a price change. 🙂

13. June 2021 at 06:56

“One reason inflation is so destructive is because some people benefit greatly while other people suffer; society is divided into winners and losers. The winners regard the good things that happen to them as the natural result of their own foresight, prudence, and initiative. They regard the bad things, the rise in the prices of the things they buy, as produced by forces outside their control” – Milton Friedman

13. June 2021 at 09:27

The temporary exclusion of reserves and Treasuries from the supplemental leverage ratio (specious Dodd Frank capital buffers on zero risk weighted assets), which ended March 31st has resulted in an expansion of the O/N RRP facilities use (banks and nonbanks avoiding negative rates of returns).

But the dollar for dollar decrease / offset in excess reserves does not reduce the supply of loan funds (as lending has shifted to the nonbanks, e.g., the MMMFs). This is driving interest rates even lower (producing negative yields). Thus, the stock vs. bonds barbell portfolio strategy favors stocks (the spread of risk allocations among asset classes).

Economists don’t know a debit from a credit. Economists are ignorant and arrogant. Banks are black holes. An increase in bank CDs adds nothing to GDP.

We are turning Japanese. And Japan’s CPI has been negative for the last 6 months.

13. June 2021 at 12:33

“The 2013 violent crime rate was 367.9 per 100,000 inhabitants, down 5.1 percent when compared with the 2012 violent crime rate.”

Who would have thunk it?

13. June 2021 at 12:40

How can someone call themselves an economist when all they know how to do is increase inflation rather than create new jobs? Using inflation to plug an output gap is counterproductive.

13. June 2021 at 15:47

Off topic: will your book that’s coming out in July be translated in French (or Italian)? Thanks.

14. June 2021 at 08:26

Pietro, I doubt it.

14. June 2021 at 13:32

Maybe by putting the idea out there it will magically happen:-).

In that same vein, it would be great if someone did a podcast series on the Midas Paradox, or some blogger could do a book club on it. Just compiling a wish list on my part.

15. June 2021 at 00:03

‘Someone’ is not optimistic?

“Last week the Bureau of Labor Statistics announced that in the year to May the US consumer price index rose by 5.0%. This unexpectedly high figure means that the consensus of a year ago has been quite wrong. Nevertheless, a new consensus – similarly relaxed and complacent – has emerged, that the current inflation upturn is transitory, due to “base effects and bottlenecks”. According to this new consensus US consumer inflation will be back to 2% or so by late next year and in 2023.

In a note accompanying this e-mail, we challenge the complacency, particularly in the American context. The heart of our argument is that the velocity of circulation of money has been artificially depressed by the Covid-19 pandemic, but a vast amount of evidence shows that in the long run money-holding preferences are stable. We assume – in our main projection – that M3 velocity will return in the USA by end-2022 to a level about 5% lower than that which prevailed in 2018 and 2019; we also assume that money growth from here will run at an annualised rate of 5% (i.e., about 0.4% a month).

The result is that nominal GDP in the final quarter of next year is about 30% above its value in the first quarter of 2021. If nominal GDP has to rise by 30% in a little more than 18 months, what does that mean for real output and inflation? As we say in the note, “the annual rate of US consumer inflation between now and end-2022 will typically run in the 5% – 10% band”. We could not in logic reach any other answer.

Time will tell. The test of competing theories is reaching a very interesting phase.”

https://mailchi.mp/928db1c48509/which-economic-thoughtcomes-out-best-from-the-last-decade-1336363?e=260ed9002a

Sell bonds?

15. June 2021 at 05:02

Is this the most interesting period in monetary policy in our lifetime? WSJ online above-the-fold headlines just from June 15:

U.S. Retail Spending Fell 1.3% in May

Producer Prices Rose Last Month

Lumber Prices Are Falling Fast, Turning Hoarders Into Sellers

Oil Hits Pandemic High

15. June 2021 at 08:29

Todd, It’s an interesting period, but more for the supply side of the economy than monetary policy. Inflation expectations are pretty well anchored at about 2%.

18. June 2021 at 07:14

I want to believe Scott. I also want to understand the why.

WHY do we think today’s inflation expectations, as demonstrated by the 5 and 10 year treasuries and by the 5 and 10 year TIPS spreads, are predictive of future inflation, while knowing that historically, 5 year TIPS spreads have not accurately predicted future inflation?

19. June 2021 at 14:21

Todd, Market forecasts of inflation are not perfect, but they are our least bad option. But if you prefer the consensus forecast of professional economists, that’s also about 2%.

The market, most economists, what else is there?