An even greater moderation?

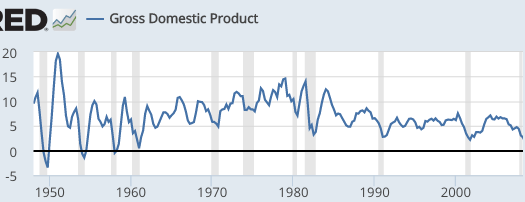

After 1985 there was a definite moderation in NGDP (and RGDP) instability:

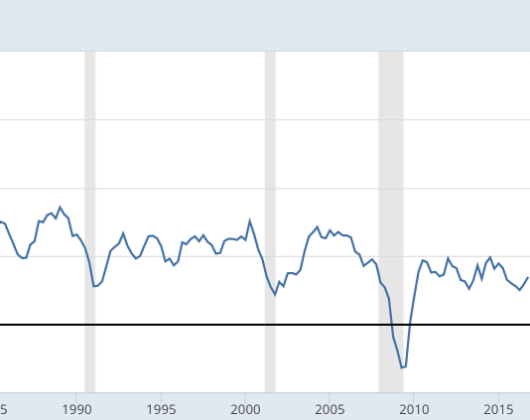

But this period of stability ended in 2008:

I am going to go out on a limb and predict that we are now entering a new Great Moderation, even more stable than the 1985-2007 period. Let’s start with what we know.

I am going to go out on a limb and predict that we are now entering a new Great Moderation, even more stable than the 1985-2007 period. Let’s start with what we know.

We are only a few months away from being eight years unto the expansion. This 8-year period will likely be the second most stable in all of American history, outdone only by the 10 years of stability from 1991 to early 2001. As you can see from the second graph (YoY data), the recent stability of NGDP growth is about the same as during the 1990s, albeit averaging somewhat below 5%, rather than somewhat above 5%.

So why do I think we are entering an even greater moderation? Seven reasons, none of which I expect people will find all that persuasive:

1. No excesses yet. I think it’s likely that this expansion will exceed the 10-year expansion of the 1990s. We only need two more years to do so, and I don’t see any signs of the sort of excess that often occurs before recessions. Not saying a recession cannot happen within two years (they tend to be unforecastable) just that it seems much less than a 50/50 proposition.

2. Supply-side reforms. I think it’s likely that there will be some sort of tax reforms, as well as deregulation, which will tend to slightly boost the supply-side of the economy. I don’t expect the sort of dramatic effects that true believers predict (a new long run RGDP trend of 3% to 3.5%) but I do see a small improvement as likely. Recessions are often preceded by adverse AS movements, which create inflation, leading to Fed tightening. In addition, an adverse supply shock tends to lower the Wicksellian equilibrium interest rate, which leads to unintentional Fed tightening when the Fed believes a given rate setting to be more expansionary than it actually is. (See 2008, for instance.) But since Trump took office, it seems like the Wicksellian equilibrium rate has risen slightly. This also gives the Fed more room to operate, relative to the zero bound.

3. Spotlight on the Fed. This one is hard to quantify, but I feel it’s important. I became radicalized in late 2008 because I saw that pundits were totally ignoring the drop in NGDP growth expectations, and basically giving the Fed a free pass. Kevin Erdmann directed me to an absurd WSJ editorial from right after Lehman failed, which captures the mood of that period:

These columns have been tough on the Federal Reserve in recent years, so it’s only fair to praise the central bank when it does the right thing. And that’s what it did yesterday by holding the federal funds rate stable at 2%, despite the turmoil in the financial markets and enormous Wall Street pressure to reduce rates further.

Face palm. Yes, and Boston firemen took a brave stand against smoking in bed, by refusing to douse a house fire sweeping through East Boston tenements. Hardly anyone was criticizing the Fed’s tight money policy in 2008. David Beckworth noticed that interest on reserves was a potential mistake, but even that program was mostly ignored.

Now the blogosphere and academic economists are paying far more attention to NGDP growth than in the past. I am watching it like a hawk, and unlike in late 2008 I have a big mouthpiece to scream through if I see the Fed making the same mistake again. I can’t even imagine the Fed letting growth expectations slip as they did after Lehman, without putting up a fight.

4. Learning from mistakes. I am not saying the Fed has adopted NGDP targeting—they haven’t. Rather I’m saying the Fed is increasingly aware that they cannot allow highly erratic moves in NGDP growth. The Fed learned from the mistakes of the Great Depression. They learned from the mistakes of the Great Inflation. They didn’t learn as much as I would like from the Great Recession, but surely they learned something.

5. QE works, and negative IOR hasn’t even been tried. Some might worry that although the Fed would wish to keep NGDP growth fairly stable, they lack the tools to offset “shocks” when we are near the zero bound. But the Fed did succeed in fully offsetting the fiscal tightening of 2013, even though we were at the zero bound. When the next shock hits we probably will not be at the zero bound, giving the Fed even more “ammo”.

6. Yellen is a cautious dove. Janet Yellen understands that the best way to prevent a recession is to prevent the sort of excessive rise in AD that often leads to a recession (as tight money is then used to bring inflation back down.) The Fed’s caution produced a substandard recovery, but it also means the expansion is likely to be longer than normal.

7. No financial crisis on the horizon. Although the Fed can offset shocks like the 2013 fiscal tightening, they still may not have learned how to do monetary policy in a major financial crisis. And forthcoming GOP banking deregulation probably makes another financial crisis more likely, unless the GOP deals with the underlying moral hazard problem (and I fear they won’t.) But this is partially offset by the fact that major financial crises are pretty rare, and the banks were burned so badly by 2008 that they are likely to be more cautious in even a deregulated environment. I do think we’ll eventually have another financial crisis unless we adopt the sort of system the Canadians have (and even theirs is not perfect), but these major crises are rare events. There is less than a 20% chance of one occurring in the next 2 decades.

Conclusion: By the year 2040 we will be more than 3 decades past the Great Recession. I may not live long enough to see if this prediction comes true, but I’m going on record predicting only one US recession between now and 2040. A thirty-year span with only one recession would be unprecedented, and even Greater Moderation. The Aussies have done it, why can’t we?

So cheer up MMs of the world, we are winning.

And if I am wrong and you lose lots of money in the stock market, which was invested based on my prediction? Then you are welcome to spit on my grave in 2040.

Update:

From Peter in the comment section:

Hi Dr. Sumner,

I was able to ask Loretta Mester, the Cleveland Fed President, what she thought of NGDPLT, and thought you might be interested in her response. Overall she was cautiously positive on the idea.

She started her answer by saying that she thought Inflation Targeting was probably good enough for stabilizing the economy, and that the inflation target has worked pretty well thus far. But, she said she saw the benefits of NGDPLT (and price level targeting) over IT, and mentioned that it would have been particularly effective in stabilizing the economy during the Great Recession. She was hesitant to endorse switching to NGDPLT in the very near future because they only just adopted the explicit 2% inflation target, and she worried that switching to another target so quickly would be too discretionary, and would damage the Feds credibility. As a result, she wanted to keep the inflation target for now, but felt that NGDPLT and PLT where promising directions to move in the future.

Hopefully Barnard puts the video from the talk up soon, so you can hear her answer for yourself. But, I think you can add her to the list of fed officials who are at least mildly supportive of NGDPLT.

http://bwog.com/2017/03/03/barnard-power-talk-with-loretta-mester-gets-economical-real-quick/

I actually think that’s a very reasonable answer. From the beginning, I’ve understood that a sudden switch to NGDPLT would create a bit of a credibility problem for the Fed, as it only recently adopted the 2% inflation target (formally.) I’m pleased that Fed people see how that policy might have done better during the Great Recession, which leads me to believe they might incorporate a bit on NGDP thinking in there response to the next crisis, if only informally.

Update#2: From commenter MFFA:

About that comment from Peter

I once asked the exact same question to professor Kashyap (who’s just been appointed to an advisory role to the BoE) from the University of Chicago Booth school of Business and got almost exactly the same answer. So let’s not be too hasty in our desire to move to NGDPLT, we need to move at the right pace

Tags:

4. March 2017 at 08:18

I agree. I was predicting this several years back, mostly based on #3, #4, and some of #7.

Trump has made the probability of a more sanguine next 8 years higher as well, due to how he manages expectations. He doesn’t make foolish bearish statements about the economy like most the rest of our economic leaders do. On the contrary, the only information he offers is how much better and brighter the future will be and how much better each of the new developments for the economy makes the economy.

4. March 2017 at 08:20

Can’t quite read the inscription on the headstone but it looks :

Level Targeting R.I.P.

4. March 2017 at 08:22

Steve F. Yeah I agree. He kind of reminds me of Herbert Hoover, who kept telling the public that “prosperity was just around the corner”, hence boosting confidence.

James, There is no bigger fan of level targeting than me, and unlike other people, I actually know what the concept means. Returning to the pre-2008 trend line today would not represent “level targeting”.

4. March 2017 at 08:25

Monetary stability would certainly be the good news, because the underlying fundamentals of this moderation – if it should turn out to be so – are quite different from the last. Instead of more input and more output for GDP measure (cost reduction via good deflation), it tends to be the same amount of output with less input required to achieve same. And there’s less money to go around, when the bad inflation of service product subtracts the output potential of product with “built in” good deflation. That’s a problem in terms of what any government hopes to tap for fiscal policy, to say the least. Governments seem keen on capturing more revenue from what is already efficient and contains less profit, instead of the less efficient services which are today’s most profit oriented enterprise.

4. March 2017 at 08:28

Scott, notice that the statements are coupled with productive action. The case can be made that Trump is viewed as having a great deal of credibility on the economy; whereas Hoover did not.

4. March 2017 at 08:38

All set for the longest depression on record!

https://thefaintofheart.wordpress.com/2015/05/15/the-depressions-great-moderation/

4. March 2017 at 09:36

I like all points. I think you might have missed one factor though, point 8: demographics. Maybe this “great moderation” is mostly because of demographics. What about that?

And why called it “great moderation” in the first place? Why not call it “Great Stagnation” like TC did?

4. March 2017 at 10:15

I’m still concerned about their use of IOR. Can you explain why they keep choosing to use IOR instead of letting the balance sheet decrease? Gradually or quickly. Also, how would you define a “major crisis”? 20% chance in the next 20 years seems low to me but maybe your definition of crisis has a higher threshold.

4. March 2017 at 11:12

Steve, Hoover was just as active as Trump, and 100 times more competent. Hoover was probably the most competent man ever to serve as President. The point is that Presidential rhetoric is useless.

Christian, I’m afraid you are confused; the Great Moderation has nothing to do with the Great Stagnation, they are unrelated concepts. One occurred before 2008 and the other after 2008.

Bill. I agree that IOR is a bad idea, and the balance sheet should shrink. By major crisis I mean like 2008 and 1931-33; those are pretty rare events. We’ve had two in American history. Banks are cautious right now, meaning I think we are a ways away from the next huge crisis.

4. March 2017 at 11:27

Shorter Scott Sumner (S3): “This time is different”.

The Great Moderation turned out to be false. Total Factor Productivity has been declining for the USA since the 1960s, hence the fewer “big swings” as Big Government has made working redundant. As for Sumner’s love of Australia, a country of a mere 25M or so people, it’s an outlier. You can say the same about Singapore, Canada, Panama (has never had a financial crisis) or any small sample.

Trivia: what happened in 1985? Why not ask what happened in 1989? Or 1969? Ask your pop music friends.

4. March 2017 at 11:54

“Hoover was probably the most competent man ever to serve as President.”

-That’s not what I can infer from your book. Hoover generally believed the same doctrines as Trump, including on protectionism and foreign policy (though he was slightly less Jacksonian). Both were seen as mildly big-spending Republicans for their time who won on anti-foreign-religion bigotry. What’s the difference?

“One occurred before 2008 and the other after 2008.”

-Sumner, I’m afraid you are confused. One occurred after 1973, the other after 1982.

4. March 2017 at 13:34

A typo oh my gosh. I meant your “greater moderation” obviously. Why not call it great stagnation like TC does?

4. March 2017 at 13:58

Hi Dr. Sumner,

I was able to ask Loretta Mester, the Cleveland Fed President, what she thought of NGDPLT, and thought you might be interested in her response. Overall she was cautiously positive on the idea.

She started her answer by saying that she thought Inflation Targeting was probably good enough for stabilizing the economy, and that the inflation target has worked pretty well thus far. But, she said she saw the benefits of NGDPLT (and price level targeting) over IT, and mentioned that it would have been particularly effective in stabilizing the economy during the Great Recession. She was hesitant to endorse switching to NGDPLT in the very near future because they only just adopted the explicit 2% inflation target, and she worried that switching to another target so quickly would be too discretionary, and would damage the Feds credibility. As a result, she wanted to keep the inflation target for now, but felt that NGDPLT and PLT where promising directions to move in the future.

Hopefully Barnard puts the video from the talk up soon, so you can hear her answer for yourself. But, I think you can add her to the list of fed officials who are at least mildly supportive of NGDPLT.

http://bwog.com/2017/03/03/barnard-power-talk-with-loretta-mester-gets-economical-real-quick/

4. March 2017 at 14:08

I still say it’s demographics and simple mathematical reasons: During the Great Depression and WW2 the world economy has declined by a lot, so of course a smaller gdp has bigger votalities than a bigger one. Was this considered when making the graph?

4. March 2017 at 14:24

Harding, He was very competent but had the wrong ideology. Those are two different things.

Christian. Because moderation has nothing to do with stagnation, they are totally unrelated concepts.

Peter, Thanks, check out the post update I added.

4. March 2017 at 15:29

About that comment from Peter

I once asked the exact same question to professor Kashyap (who’s just been appointed to an advisory role to the BoE) from the University of Chicago Booth school of Business and got almost exactly the same answer. So let’s not be too hasty in our desire to move to NGDPLT, we need to move at the right pace 🙂

4. March 2017 at 16:22

Remunerating IBDDs destroys savings velocity. Thus it lowers aggregate demand. Yeah, “stabilized” at progressively lower levels. Big deal. So the stock market then goes to the moon. TINA as incentivized by tax policy. Another bubble long-term. The latter half of 2017 would be a good period to try N-gDp targeting. Inflation will accelerate in 2017 when R-gDp decelerates in the last half. But inflation will subside in 2018.

4. March 2017 at 17:04

Well…have to say Marcus Nunes is correct, the US economy could have been 10 percent higher through the recovery…

Now, we are seeing commercial and industrial loan volume, and also real estate loan volume flat lining. Commercial property values have flatlined since August.

The endogenous versus exogenous money supply argument may never be settled, but suffice it to say the Fed may be inadvertently tightening much more than it thinks.

Also David Beckworth points out that 70% of global central banking is essentially default to the Fed.

Lastly, the Fed will be loath to reverse course, and its 2% IT is a noose. Why not 2.5%?

4. March 2017 at 17:23

Monetary policy objectives should be in terms of money flows, volume X’s velocity. Similar to the “bank credit proxy” proviso which used to be included in the FOMC’s directive during Sept 66 – Sept 69: “consisting of daily average member bank deposits subject to reserve requirements”.

Similar to 1938 study entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal” – It’s 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45 year hiatus, this research paper was declassified” on March 23, 1983.

6 examples:

My comments the day stocks topped:

(1) “the stock market should be topping & in the process of a downtrend (i.e., without further stimulus).”

« Last Edit: Jul 21, 2011, 8:32pm by flow5 »

(2) Or maybe how I denigrated Nassim Nicholas Taleb’s “Black Swan” theory 6 months in advance and within one day:

To: anderson@stls.frb.org

Subject: As the economy will shortly change, I wanted to show this to you again – forecast:

Date: Wed, 24 Mar 2010 17:22:50 -0500

Dr. Anderson:

It’s my discovery. Contrary to economic theory and Nobel Laureate Milton Friedman, monetary lags are not “long & variable”. The lags for monetary flows (MVt), i.e., the proxies for (1) real-growth, and for (2) inflation indices, are historically, always, fixed in length.

Assuming no quick countervailing stimulus:

2010

jan….. 0.54…. 0.25 top

feb….. 0.50…. 0.10

mar…. 0.54…. 0.08

apr….. 0.46…. 0.09 top

may…. 0.41…. 0.01 stocks fall

Should see shortly. Stock market makes a double top in Jan & Apr. Then real-output falls from (9) to (1) from Apr to May. Recent history indicates that this will be a marked, short, one month drop, in rate-of-change for real-output (-8). So stocks follow the economy down.

And:

flow5 Message #10 – 05/03/10 07:30 PM

The markets usually turn (pivot) on May 5th (+ or – 1 day).

I.e., the May 6th “flash crash”, viz., the second-largest intraday point swing (difference between intraday high and intraday low) up to that point, at 1,010.14 points.

(3) Like the Treasuries’ conclusion: “Diminishing market depth and a surge in volatility were both on display Oct. 15, when Treasuries experienced the biggest yield fluctuations in a quarter century in the absence of any concrete news. The swings were so unusual that officials from the New York Fed met the next day to TRY AND FIGURE OUT WHAT ACTUALLY HAPPENED”

From: Spencer (@hotmail.com)

Sent: Thu 9/18/14 12:42 PM

To: FRBoard-publicaffairs@frb.gov (frboard-publicaffairs@frb.gov)

Dr. Yellen:

Rates-of-change (roc’s) in money flows (our “means-of-payment” money times its transactions rate-of-turnover) approximate roc’s in gDp (proxy for all transactions in Irving Fisher’s “equation of exchange”).

The roc in M*Vt (proxy for real-output), falls 8 percentage points in 2 weeks. This is set up exactly like the 5/6/2010 flash crash (which I predicted 6 months in advance and within 1 day).

(4) Some people think Feb 27, 2007 started across the ocean. “On Feb. 28, Bernanke told the House Budget Committee he could see no single factor that caused the market’s pullback a day earlier”.

In fact, it was home grown. It was the seventh biggest one-day point drop ever for the Dow. On a percentage basis, the Dow lost about 3.3 percent – its biggest one-day percentage loss since March 2003.

flow5 (2/26/07; 14:34:35MT – usagold.com msg#: 152672)

Suckers Rally. If gold doesn’t fall, then there’s a new paradigm

(5) POSTED: Dec 13 2007 06:55 PM |

The Commerce Department said retail sales in Oct 2007 increased by 1.2% over Oct 2006, & up a huge 6.3% from Nov 2006.

10/1/2007,,,,,,,-0.47,,,,,,, -0.22 * temporary bottom

11/1/2007,,,,,,, 0.14,,,,,,, -0.18

12/1/2007,,,,,,, 0.44,,,,,,,-0.23

1/1/2008,,,,,,, 0.59,,,,,,, 0.06

2/1/2008,,,,,,, 0.45,,,,,,, 0.10

3/1/2008,,,,,,, 0.06,,,,,,, 0.04

4/1/2008,,,,,,, 0.04,,,,,,, 0.02

5/1/2008,,,,,,, 0.09,,,,,,, 0.04

6/1/2008,,,,,,, 0.20,,,,,,, 0.05

7/1/2008,,,,,,, 0.32,,,,,,, 0.10

8/1/2008,,,,,,, 0.15,,,,,,, 0.05

9/1/2008,,,,,,, 0.00,,,,,,, 0.13

10/1/2008,,,,,,, -0.20,,,,,,, 0.10 * possible recession

11/1/2008,,,,,,, -0.10,,,,,,, 0.00 * possible recession

12/1/2008,,,,,,, 0.10,,,,,,, -0.06 * possible recession

Trajectory as predicted:

BERNANKE SHOULD HAVE SEEN THIS COMING. IN DEC. 2007 I COULD.

(6) The rate-of-change in the proxy for real-gdp (monetary flows MVt) peaks in July. The rate change in the proxy for inflation (monetary flows MVt) peaks in July. Therefore it should be obvious: interest rates peak in July.

Because interest rates top in July, the exchange value of the dollar should resume it’s decline. A very good time to buy gold!

The “Holy Grail” has no disclaimer.

posted by flow5 at 7:50 AM on 06/29/07

4. March 2017 at 18:28

20% chance of a major crisis over the next 20 years is too low. We’ve had two in the last 90 years whereas 20% in 20 years is roughly one in a hundred years, no? I agree that the banks are more cautious now, but we’re just 8 years from the last crisis. 28 years from that crisis is a long time for forgetting. I’d gladly make a friendly wager at 4 to 1 odds that we’ll have a crisis before the end of 2037. I like those odds.

4. March 2017 at 21:14

Inevitable, inexorable, unpunctual.

5. March 2017 at 05:16

Just taught myself something. There’s no permanent policy rule or target that is always appropriate. The Fed should target N-gDp in the last half of 2017.

5. March 2017 at 08:35

MFFA, Thanks, I added an update.

Bill, OK, friendly wager.

6. March 2017 at 16:35

How much of that is real, how much the precision of measurement? http://eml.berkeley.edu/~cromer/Reprints/Spurious%20Volatility.pdf

7. March 2017 at 14:48

Pyrmonter, That doesn’t really apply to data from after WWII.