America’s industrial boom (what is it telling us?)

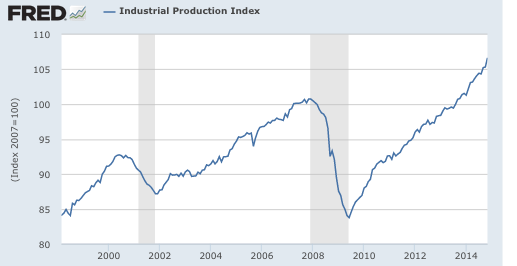

Over the past few years I’ve done a few posts on an underreported story, the fact that industrial production (IP) has been rising much faster than RGDP during the recovery. Early on I argued that this was evidence that a cyclical recovery was actually occurring, and that this refuted those who argued otherwise by pointing to the low LFPR. (It also suggests that tight money, not re-allocation out of housing, caused the recession.) Recently the industrial recovery has gained momentum, so much so that it can no longer be brushed aside. Before discussing what it means, consider that IP was up 1.3% in November, and is up nearly 6% since August 2013. By comparison IP only rose by a total of about 9% during the entire period from the 2000 peak to the 2007 peak. The level is still mediocre, but the momentum is undeniable. The new IP figures seem to confirm the strong November employment data; the economy is now recovering at a faster rate.

So what does the IP boom tell us? First let’s recall that IP includes mostly manufacturing, but also mining and utilities. I prefer the IP aggregate, because when people wring their hands about the loss of “muscular” jobs in manufacturing for men without a college education, it’s clear they are concerned about blue collar jobs in general, including coal mining, oil drilling, etc. In any case, the manufacturing data are quite similar.

So what does the IP boom tell us? First let’s recall that IP includes mostly manufacturing, but also mining and utilities. I prefer the IP aggregate, because when people wring their hands about the loss of “muscular” jobs in manufacturing for men without a college education, it’s clear they are concerned about blue collar jobs in general, including coal mining, oil drilling, etc. In any case, the manufacturing data are quite similar.

First some international comparisons. In the US, IP is up more that 73% in the past 25 years. In Japan it fell by 1.5%. Some of that is population, but not all. After all, Japan’s population is higher than it was 25 years ago, and America’s has risen by roughly 30%, not 73%. America industrializes as Japan de-industrializes. Germany reunified 25 years ago, which might affect the data, but their IP is up only about 30% since 1991. France is up only 9% in 25 years. (The 35-hour workweek?). Britain is similar to Japan, down by about 1%. (Falling North Sea oil output?) Italy is down 11.2% in 25 years. (Berlusconi spending too much time at orgies?) It’s the US that stands out as an industrial power, at least if the data is correct. (I suspect it is not—too much hedonics?)

So what’s wrong with American manufacturing? Jobs, jobs, and jobs. In recent decades we’ve been losing jobs at a rapid rate.

And why have we been losing jobs at a rapid rate? Some people point to imports from China. But the recent IP data suggests that’s not the problem. We are an industrial juggernaut. The problem is quite simple:

It’s the PRODUCTIVITY, stupid.

Agriculture went through this in the late 19th century and early 20th century. And now it’s manufacturing’s turn.

Update: US capacity utilization pushed above 80% in November, roughly the rate during the 2005-07 boom. We need more service sector jobs.

Update#2: I erred in saying the manufacturing numbers were similar. I was lulled by the fact that they have also been rising rapidly in the past year. But commenter allen pointed out that manufacturing has only just regained the 2007 peak, and that oil and gas output (part of mining) have grown much faster.

HT: am

Tags:

15. December 2014 at 08:56

http://www.tradingeconomics.com/united-states/capacity-utilization

The above link is on the FED Industrial Report and suggests capacity utilisation is returning to the historic average.

15. December 2014 at 09:00

The huge (and probably accelerating) dichotomy between the U.S. and other developed countries on this measure is very interesting. I wish I could find a regional breakdown on this. My perception is that the southern U.S. is extremely cost competitive compared to the rest of the developed world (including the northeastern U.S.). Labor regulations are far more flexible, as well.

15. December 2014 at 09:02

Very interesting!

When automation increases, offshore, low-wage producers lose to local producers, who have lower transport costs and faster time-to-market, and this is hurting export-oriented economies like Japan.

One can say that the Japanese car companies like Toyota are becoming more IP firms (like almost all corportations). In the past they exported physical cars. Now they export their knowledge by operating car factories within the US and the EU.

I suspect the difference between the US and the other large, high-wage economy, the EU, is due to population growth and disastrous Euro policy.

If corrected for population growth and the reunification, my hunch is that Germany would be on par with the US. And if EU NGDP had kept up with US NGDP, then Germany would even exceed the US, I suspect.

The other EU economies are mostly suffering from being in a currency and trade union with Germany and the low-wage eastern European economies.

Someone would need to the math.

15. December 2014 at 09:13

You lost me at “RGDP”… what’s that?

Seriously though, I wonder how “hedonic adjustments” might throw all this data off. I tried to inform myself on how it’s done here: (http://www.federalreserve.gov/releases/g17/IpNotes.htm) but it looks like it’ll take more than the 5 minutes I’m willing to give the topic.

15. December 2014 at 09:20

Outsourcing only slowed it down, “preserving” jobs by creating them in low labor cost areas. If it wasn’t for that, a lot of manufacturing would be in other rich countries or the American South, in plants with much more automation than they have now.

That said, it doesn’t make it any easier on the workers displaced, especially since the US makes so much of your financial security dependent on work, and the manufacturing jobs usually offered higher pay for workers without lots of college education than almost anything in the Service Sector.

15. December 2014 at 09:23

am, Thanks, I added an update.

Everyone, Note that much of the eurozone underperformance occurred during the 1990s, before the euro became a problem. I blame supply-side policies, although the recent dip is euro related.

15. December 2014 at 09:25

I suppose you’ve stopped reading PK, but I think he means market monetarism when he talks about the “confidence fairy”.

http://krugman.blogs.nytimes.com/2014/12/13/is-our-economic-commentators-learning/?module=BlogPost-Title&version=Blog Main&contentCollection=Opinion&action=Click&pgtype=Blogs®ion=B

We know PK never learns from his mistooks, like the economic meltdown following the 2013 austerity measures in the US.

15. December 2014 at 09:40

There would seem to be a relation between increased production, increased capacity leading to increased savings and finally new investment in labour and machines. But I don’t know anything about trigger points – maybe it is when increasing capacity becomes difficult to manage. However it would seem the boom will continue. Let’s hope so. It certainly suggests there is increased demand and growth to be seen in later figures – perhaps next year.

I am struck by your term industrial juggernaut.

15. December 2014 at 09:53

That’s exactly right. I remember at one point before 2008 looking at US steel production. It was similar to what it was in the late 1970’s but with 75% fewer workers. 5% per year productivity growth will crush job growth (in that sector).

15. December 2014 at 10:06

Euro Stoxx 50 fell 2.8% today.

Germany’s stock market (HDAX) fell 2.5% today.

15. December 2014 at 12:22

Industrial Production: Consumer Goods, however, is still pretty weak:

http://research.stlouisfed.org/fred2/series/IPCONGD

I agree with Sumner: “We need more service sector jobs”.

15. December 2014 at 13:32

How much of our industrial production is manufactured overseas and shipped here to be finalized?

15. December 2014 at 13:45

The graph looks great but you might want to dig into the numbers a bit. The oil and gas industry (aka fracking) has had outsized growth since 2007 and appears to skew the entire IP totals upward. Most other sectors have just now recovered.

http://www.federalreserve.gov/releases/g17/current/

15. December 2014 at 13:56

Charlie, None, it’s a value added index.

Allen, Thanks, I added an update to correct the post.

15. December 2014 at 15:06

Scott,

Just to echo to your point and to grossly over-simplify, when a manufacturer wants to increase production there are two choices: hire a 100 people in China or buy a machine in the U.S.

Manufacturing jobs are going away in the U.S. either way. Manufacturing productivity and output are going up.

15. December 2014 at 15:56

Excellent blogging.

I suspect the recent IP figs are helped by fracking and the “weak” dollar (which is going up, lately).

Puzzle: Economists always say manufacturing does not matter. Yet the USA is an industrial juggernaut and outperformed the other developed nations, with the exception of China…which has been industrializing.

Even yet, I suspect there are connections between living standards and industrial output…

15. December 2014 at 17:26

Benjamin Cole,

You said,

“Even yet, I suspect there are connections between living standards and industrial output…”

I think that depends on how you measure living standards and what consumers value.

15. December 2014 at 18:00

Benjamin Cole, you said:

“Puzzle: Economists always say manufacturing does not matter. Yet the USA is an industrial juggernaut and outperformed the other developed nations, with the exception of China…which has been industrializing.”

Economists don’t say manufacturing doesn’t matter. It IS helpful to be competitive in manufacturing. However, that does not mean that manufacturing jobs are inherently more productive than other types. I actually think you’re getting the causation backwards. Competitiveness in manufacturing can result from a country having more flexible labor markets and monetary policy than its peers, and those things DO lead to better living standards.

P.S. A note on China, just because this is a pet peeve of mine. Living standards in China certainly have improved since they opened up to foreign investment and trade, but they are still much lower than those of any developed country. It’s important to not mistake the stronger rate of growth for a superior model when China is coming from such a low base.

15. December 2014 at 19:25

As an example of manufacturing being neither necessary nor sufficient for widespread prosperity, compare Mexico with Chile. One has had a stagnant economy for over three decades, yet, is responsible for most of Latin America’s manufactured goods exports, the other is the most economically dynamic country in Latin America, yet, exports mostly copper products.

http://atlas.media.mit.edu/rankings/country/

15. December 2014 at 19:36

To add to my point about Industrial Production: Consumer Goods above, the stagnation is heavily concentrated in nondurable goods, which, in the past sixty years, only suffered sharp declines in 1973-5 and 2007-9.

15. December 2014 at 19:39

@Adam Platt

-Exactly. In the reign of the Emperor Hirohito, Japan was an economic miracle country sure to surpass the U.S. Now, not so much. Same for the Soviet Union, 1930-1977.

15. December 2014 at 20:31

Good post, though “tight money” is used as shorthand for what most people would call “financial crisis” but by design, since the author feels the latter was caused by the former. Nice pun where Berlusconi is mentioned in the previous sentence to the word “hedonic” (i.e., hedonic regression not hedonic orgy).

The Japan data point is a bit misleading since this chart: http://www.tradingeconomics.com/japan/industrial-production shows that Japan’s industrial production is *always* flat, even back in 1980, when Japan was destined to rule the world. It’s maybe the way industrial production is defined in Japan, and the fact Japanese auto makers have shifted production outside of Japan to counter protectionist measures (NUMMI in Fremont, CA was opened in 1984).

OT: I’d like to see Prof. Sumner’s take on today’s raising of interest rates by Russia, nearly doubling them, to “defend” the ruble. Good or bad? I know the answer is “bad” but I’d like to see the logic. Inflation is Russia is 7% this year, and Keynesians say anything less than 10% is OK, so the rise in rates by RU’s central bank was xorosho?

15. December 2014 at 20:39

@myself–I see the data for Japan Industrial Production in the link I gave is percentage year-over-year not a number, so scratch that thought on Japan’s data.

15. December 2014 at 21:27

I just read today’s NYTimes article about automation having reached the point that it will simply destroy jobs and not replace them. Is it just me or is Larry Summers consistently one of the most static-minded economists around?

“Lawrence H. Summers, the former Treasury secretary, recently said that he no longer believed that automation would always create new jobs. “This isn’t some hypothetical future possibility,” he said. “This is something that’s emerging before us right now.””

Every time I read anything by him, it’s some variation of “what’s happening right now must be a permanent trend, because it’s happening right now, and I can’t foresee anything different happening in the future than what’s happening right now”. The fact that all of the “non-employment trends” the author points to began with the recession of 2007-9 seems to not factor into their calculations at all.

Link here: http://www.nytimes.com/2014/12/16/upshot/as-robots-grow-smarter-american-workers-struggle-to-keep-up.html?hp&action=click&pgtype=Homepage&module=first-column-region®ion=top-news&WT.nav=top-news&_r=0&abt=0002&abg=0

15. December 2014 at 21:48

Adam,

Would that be way cool. Machines make and do everything we want. We just get to sit around and get to do whatever we want to do.

But seriously, we’re in an analogous situation to agriculture 170 years ago. Aren’t any farmers left but people figured out other things to do.

16. December 2014 at 01:25

Ray,

Damn it man, “tight money” and “financial crisis” are two different things.

You are a very ignorant man, and yet you have very firm opinions.

16. December 2014 at 01:29

Ray Lopez,

Inflation is Russia is 7% this year, and Keynesians say anything less than 10% is OK, so the rise in rates by RU’s central bank was xorosho?

Ask yourself this – what’s worse, paying more for your groceries or being unemployed ?

Have you considered turning on your brain before typing ?

16. December 2014 at 03:51

Hey Daniel rather than just calling Ray ignorant maybe you should let him know why, with a cash rate of near zero, money would be tight in the absence of a financial crisis.

After all, barring the 1930s and the 2000s, rate cuts have pretty much always been effective in generating recovery.

16. December 2014 at 04:18

Daniel:

“Ask yourself this – what’s worse, paying more for your groceries or being unemployed ?”

What’s better is being employed and paying less for groceries. And rent. And tuition. And clothing. And gasoline.

We are not forced to choose between higher prices or being unemployed.

Do you know what a false dichotomy is? Obviously not.

16. December 2014 at 04:42

sdfc,

You are very confused.

Major_Moron,

You are a moron.

16. December 2014 at 05:36

In the long run without basic agricultural and manufacturing, is the nature of work going to change. The first half of the century the work week greatly dropped for most workers (60 to 40 hours) and are in the midst of this drop again? Somehow I don’t think corporations will like this change, so something else might have to give.

Or will we see a long term movement back to single income families where people marry later and start having kids at 35, and one spouse drops out of the work force? I have seen this life cycle in our neighborhood. (Or if the family has a second income, it tends to be a part time school or retail job.)

16. December 2014 at 07:03

Collin, that theory is intuitive, but it is simply wrong. There is absolutely no sign of less worker hours in recent decades.

Check out this link: http://www.slate.com/blogs/moneybox/2013/01/15/the_myth_of_technological_unemployment.html

If you told a farmer in 1814 that in 2014 only 1% of Americans would be working in agriculture, he would probably assume the majority of us are unemployed, or at least severely underemployed. If you told a factory worker in 1914 that most manufacturing work would be automated or imported from countries with much cheaper labor, he would think the same thing. And yet even in the wake of a financial crisis and 6 years of overly tight monetary policy, we are surprisingly close to full employment. No matter how intuitive a theory is, at some point it has to actually show up in the facts to convince me.

16. December 2014 at 07:35

Russia is nearing collapse:

http://www.bloomberg.com/news/2014-12-15/russia-increases-key-interest-rate-to-17-to-stem-ruble-decline.html

16. December 2014 at 07:38

jj — It’s a real problem, living standards at the same “real” consumption level are clearly higher than 50 years ago. Plus, there’s a much higher consumption floor due to increases in government assistance and charity spending, so it’s hard to even measure living standards at some levels that existed 50 years ago.

16. December 2014 at 08:18

Good point, TallDave.

The perception that livings standards haven’t changed for X group in real terms since the 70s always struck me as strange. How can a GDP deflator account for the fact that a used car today is better than a new car 40 years ago? Or that the cheapest TV you can buy at Walmart today is immeasurably better than the most expensive you could buy then? Or that with the Internet, streaming services, etc… even a relatively poor person can consume a virtually infinite amount of information, entertainment, etc… that even the richest person 40 years ago couldn’t compete with?

16. December 2014 at 09:38

My hunch is that this is all energy. And with the recent drop in energy prices, this will be reversing itself next year.

16. December 2014 at 10:15

Blue collar jobs suck. I had one once, and it was boring and exhausting. If the Chinese want to work on an assembly line all day while I sit in a cubicle reading the MoneyIllusion, I say let ’em.

16. December 2014 at 10:55

Everyone, I haven’t followed Russia closely enough to comment on their monetary policy.

Regarding automation, it doesn’t directly destroy jobs. You can make a more complex argument that automation that leads to new jobs that certain people are not good at (i.e. low skilled men) PLUS welfare/disability, etc, might increase the structural rate of unemployment.

Doug, In the past year manufacturing output has also been rising fast, so it’s not just energy.

Kailer, I agree, I once had one too.

16. December 2014 at 12:19

Russia’s expected NGDP growth rate for 2015 must have surely been beyond acceptable before the rate hike. Note, though, that even in the first half of 2014, it was rising, though low by Russian standards.

“My hunch is that this is all energy.”

-Can’t be. Oil fell harder in 2008 and I don’t think other oil producers are in as severe a crisis.

16. December 2014 at 16:21

It seems to me, that with a population steady or declining, increasing manufacturing automation/productivity could reach a sort of equilibrium. Japan has some of the best automation technology and that fits their decreasing population profile. I can’t do it from where I am, but I think a graph of output/labor, US vs. Japan, would be revealing

17. December 2014 at 04:09

Daniel

sdfc,

You are very confused.

That is as pointless as your reply to Ray.

17. December 2014 at 05:52

Coming from somebody who equates “tight money” with “financial crisis” and “low interest rates” with “easy money”, I”ll take it as a compliment.

17. December 2014 at 20:26

@S. Sumner (and thanks for reading my stuff, it’s pretty good?)

Ray, I don’t think I’ve ever come across someone as totally without a sense of shame as you. It seems like you write things down without even thinking. A few days ago you implied I would be embarrassed by the fact that someone thought of NGDP targeting before me. Then I showed you that it’s widely known that NGDP targeting has been around for a long time, and that that person never even came up with it.

Creative people have no shame; high IQ marker. But your statement above does not contradict me. You simply showed you are not embarrassed, that’s all (which shows you have high IQ too). What might be more interesting is to put in your FAQ (I found it) the history of targeting NGDP, though it might be hard to find this history (ask your Chicago friends maybe).

From the FAQ…

The comment section is where you get to show me how useful ABCT really is, by making thought-provoking comments on the post. Until I finish my other projects, I won’t have much time to read anything.

LOL you are reading me; that’s pretty cool, see how much you can lern from reading an ‘idiot’? But since you like reading comments, you need to get a better blog program than WordPress. Look into “Simple Machines” forum software (http://www.simplemachines.org/). That way we can have threads that are more logically laid out. Since you are a Luddite, , get your IT people to set it up. Also you can moderate threads that add no value, like the ones by “Daniel” which end up simply calling names to people like Major Freedom, who is quite a knowledgeable poster, though you might not agree with everything MF says. MF? Just thought of an obscenity.

19. Isn’t the only solution to get rid of central banking? And then what? A gold standard does not stabilize the price level, as the real value of gold fluctuates like any other commodity. We had depressions under the gold standard. I think central banking is inevitable, but we do need to reform the system so that central bankers no longer try to out-guess the market. Monetary policy should be implemented by the market, using a futures targeting system. The market is best able to stabilize the price level, or NGDP.

Wow, quite a ‘everything and the kitchen sink’ reply. Where to start? Maybe that no monetary standard will stop depressions, and, as Friedman, Taylor, and now you, point out, having a ‘mechanical’ rule is better than a ‘discretionary’ rule. So indeed ‘targeting NGDP’ is better than arbitrary vague rules of the US Fed ‘dual mandate’ that include bailing out banks per se (and giving them interest for bailout monies received, which does nothing but fatten their bottom line and have them sit on the money, as you point out).

20. Aren’t you just a monetary crank trying to solve all the world’s problems by printing money? Yes, but like a broken clock the monetary cranks are right twice a century; 1933, and today. The other 98 years I am a Chicago-trained, libertarian, inflation-hawk. Twice a century I put on my Irving Fisher super-hero suit, and emerge from my deep underground bunker.

Well you have a sense of humor but I’m afraid nobody will take your targeting NGDP proposal seriously, though it does get a chapter in your friends Tyler Cowen et al. new forthcoming textbook. I hope I’m wrong since you have some good ideas and might be the heir to Friedman, Taylor and in a way, Keynes.

BTW you need to update your FAQ: “why is targeting price levels, or targeting a basket of commodities, not the same as targeting NGDP? Since in the 70s and 80s it’s more popular to do this than what you propose, and you don’t need a new futures market.

“Then you speculated that I had no FAQ section because I didn’t want to go on record with clear views. I told you I’ve had one from the beginning.

I don’t recall you saying you had a FAQ, but I found it, thanks. Again, “Simple Machines forum software” would help.

And now you say I am afraid to offer any opinions on Russia, immediately after I wrote a post offering the opinion that Russia should let its currency float!

No, that’s not how it happened, but let’s let it go. You actually said a few days ago: “ssumner December 2014 at 10:55 Everyone, I haven’t followed Russia closely enough to comment on their monetary policy.”

Next week I expect you to accuse me of refusing to get into blogging for fear I would lose debates with people like you. For now I’m having fun shooting down your silly arguments, but shooting ducks in a barrel gets boring after a while. You better raise the quality of your posts above the Major Freeman level if you don’t want to be ignored.

Yes, I did/do expect you to run away like both Mankiw and DeLong did who closed their blogs to me (notice I ‘flame’, not an accurate term, both left and right). But being boring is the kiss of death, so I must raise my game! Thanks for reading. And you should go back to reading Major Freedom, I think he’s quite good sometimes.

17. December 2014 at 22:17

Major Freedom, who is quite a knowledgeable poster

Either this guy is Major_Moron’s sock puppet, or he’s just as retarded himself (which is quite a feat).

18. December 2014 at 09:38

@Ray Lopez: “why is targeting price levels, or targeting a basket of commodities, not the same as targeting NGDP?”

Because NGDP=P*Q, whereas the price level just = P. So, the obvious difference is that NGDP includes the total amount of output, not just the price level. Or, to put it another way, velocity could drop (NGDP also = M*V), but the price level could remain unchanged, while total output plummets. Is this an aggregate demand recession, or not? NGDP targeting says yes, price level targeting says no.

19. December 2014 at 03:27

@Don Geddis–thanks, that was as I learned after posting, but it still remains that I posit price level targeting and targeting NGDP, as a practical matter, are highly correlated and likely to lead to the same thing. But that’s an empirical question not a theoretical question.

19. December 2014 at 03:55

Ray Lopez

Yo !

I already asked you a question – under your “price level targeting” regime, what would happen in case of a negative supply shock ?

And you admitted it would lead to a fall in nominal spending – and thus a rise in unemployment and a fall in output.

Now please explain why that would be desirable.

Can you answer a direct question, or is it too complicated for your puny shiny yellow metal worshipping brain ?

21. December 2014 at 05:30

@Daniel, the rude schoolboy: A negative supply shock is not bad, it allows the economy to reorient itself. Google Austrian economics, creative destruction, and so on. Keeping the economy comatose with Keynesian shock absorbers (to the extent they work, which they really don’t, but they do entrench big businesses) is like not allowing any wood to burn in a national forest: deadwood accumulates and eventually results in an even more destructive conflagration.

21. December 2014 at 07:11

I’m not interested in pseudo-science, thank you.

21. December 2014 at 07:15

Ray Lopez,

you don’t seem to know what ‘creative destruction’ means. It refers to a process of economic growth whereby new businesses, technologies, etc, replace old ones. A recession or depression is simply a period in which there is a reduction in overall economic activity and an increase in unemployment, representing an inefficient waste of resources (the hours of work lost can never be recovered) and suboptimal behaviour. What you’re advocating is really just destruction without the ‘creative’ bit.

21. December 2014 at 07:22

Philippe,

You haven’t been following our friend Ray. He’s part of the 1% – by inheritance, that is (that’s quoting from him, BTW)

And because he was lucky enough to be born in the right family, society should re-arrange itself so that he gets to extract rent. More precisely, a deflationary gold standard – so the pile of cash he inherited grows in value without him doing anything.

As for the chumps who’d suffer under such a regime (that is to say, most of society) ? Well, they’re a bunch of losers who should bow before him.

Because he’s a 1%-er and they’re not.

21. December 2014 at 08:22

Ray seems to enjoy telling people about his wealth and total contempt for most of humanity. I saw him making similar comments over at MR.

21. December 2014 at 11:42

Philippe, He needs to stop acting like a clown if he wants anyone to take him seriously. It seems like a lost cause at this point.

21. December 2014 at 12:41

Welp, what I said was responded to with more childish drivel, so it remains intellectually unchallenged.

I don’t want to be “taken seriously”. That is a goal for people who are frightened and have low self-esteem, who are in need of validation from their contemporaries. It is also a required goal in a socialist intellectual environment. Reason is rejected, any so intellectual debates become a game of underhanded ad hominem and prestige.

This is not a goal of true intellectuals. True intellectuals do not shy away from being laughed at, ridiculed, disliked, or called names.

Good arguments, no matter who makes them, should be taken seriously, and bad arguments, no matter who makes them, should not be taken seriously.

I don’t care if you have a Nobel Prize and have been cited numerous times by people all over the world. I don’t think some of what Hayek wrote was brilliant because of his Nobel, and I don’t think much of what Stiglitz wrote was flawed because of his Nobel.

Sumner presumes that his own goal for himself (to be validated and taken seriously), is the goal of everyone else.

Let the individual decide their own goals. Let peaceful cooperation reign supreme. Stop pretending that you are entitled to control other people’s persons or property. Start viewing other people, philosophically, according to their rational faculty, and start treating others, legally, by respecting their property rights acquired through peaceful homesteading and free trade.

Your desires for monetary socialism conflict with peaceful cooperation. They conflict with reason, and property rights.

Even if central banks start targeting NGDP around the world, you will have achieved nothing of value, because the only value is what the individual values for themselves, which NGDPLT destroys.

There is absolutely no rational reason why anyone should support, follow, encourage or sanction socialism in any of its forms, MM included. It is a goal that destroys. It is a goal that reasserts exploiter-victim society.

Why would I fight for one less act of violence per week as a goal, and ridicule any greater reductions in violence as impractical “ideology”? What if I then achieve the goal, and then start advocating for one more act of violence to be eliminated? Would my previous ridicule of the “ideologues” have been honest?

Why should I take your ridicule seriously? I am just communicating a goal that remains fuzzy and unclear to you baby steppers, but where your rational faculty will invariably lead you anyway. The choice is yours. I have made mine.

You who feel compelled to name call and ridicule are only revealing your own inner feelings of exasperation due to intellectual vacuity.

21. December 2014 at 12:42

Just for the record, I am not “Ray Lopez”.

21. December 2014 at 13:03

you’re not opposed to violence.

Lying again, I see.