Alternative Approaches to Monetary Policy

That’s the title of my new book, which can be found for free at this link:

Alternative Approaches to Monetary Policy

A few comments:

1. This is just a rough draft, although it has gone through the editorial process, so I hope there are relatively few typos. I will revise the book after receiving feedback, and the revised book will eventually come out as a “first edition.” That version will also be available online for free, or in paper for a modest price.

2. You can think of this book as addressing the question of how to identify monetary policy. In my view, a big failure of the profession has been the widespread assumption that the Fed adopted an easy money policy in 2008 and a tight money policy in 2022. Both claims are false, indeed exactly the opposite is true. That’s bad!! And that’s what motivates me to keep harping on this issue.

3. These false beliefs about monetary policy have important consequences; they contribute to bad policy decisions.

I’ll have lots more to say about the book in the future. I hope the final version is much better than the current version.

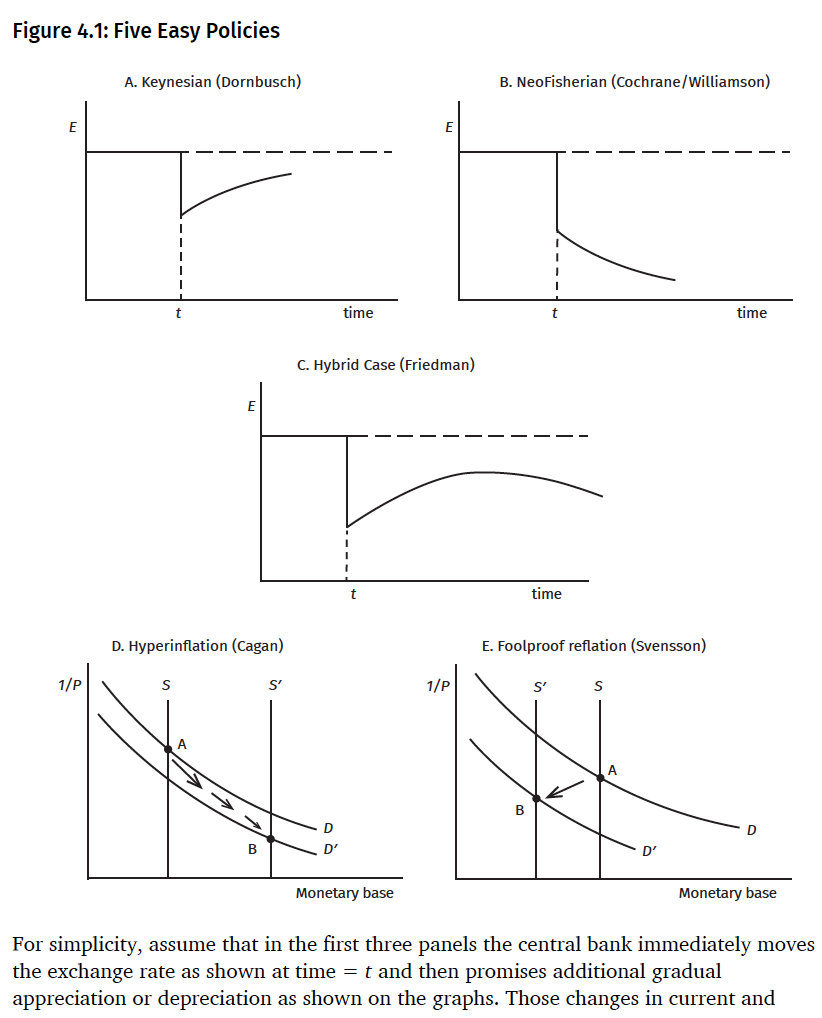

The following graphs from page 101 illustrate some of my views on the relationship between the stance of monetary policy, exchange rates (E), interest rates, and the monetary base.

Tags:

28. March 2023 at 17:43

Nice! I took the rough draft for a test drive, skipping through to different random chapters to sample the content, and learned something new at each stop. That doesn’t happen when I read Econ textbooks, and I think that’s because the ideas you’re presenting are communicated very clearly, without excessive jargon or clutter. I very much appreciate the historical examples for providing context in the few sections I scanned in this first look.

If possible, having the figures presented closer to the parts of the text where you discuss them would be helpful, but I realize that’s at the mercy of your print setter. All in all, I’ll look forward to the final product.

29. March 2023 at 02:08

Oh dear?

No ‘BAU’?

‘Most’ ‘economic thinking’ is ‘short run’ and ‘redundant’? ‘It’ ignores the ‘supply side’? ‘Growth’ {and ‘civilisation’} depends upon ‘cheap’ F.F. – those so called ‘halcyon days’ are ‘over’. ?

“The crisis now unfolding, however, is entirely different to the 1970s in one crucial respect… The 1970s crisis was largely artificial. When all is said and done, the oil shock was nothing more than the emerging OPEC cartel asserting its newfound leverage following the peak of continental US oil production. There was no shortage of oil any more than the three-day-week had been caused by coal shortages. What they did, perhaps, give us a glimpse of was what might happen in the event that our economies depleted our fossil fuel reserves before we had found a more versatile and energy-dense alternative. . . . That system has been on the life-support of quantitative easing and near zero interest rates ever since. Indeed, so perilous a state has the system been in since 2008, it was essential that the people who claim to be our leaders avoid doing anything so foolish as to lockdown the economy or launch an undeclared economic war on one of the world’s biggest commodity exporters . . . And this is why the crisis we are beginning to experience will make the 1970s look like a golden age of peace and tranquility. . . . The sad reality though, is that our leaders – at least within the western empire – have bought into a vision of the future which cannot work without some new and yet-to-be-discovered high-density energy source (which rules out all of the so-called green technologies whose main purpose is to concentrate relatively weak and diffuse energy sources). . . . Even as we struggle to reimagine the 1970s in an attempt to understand the current situation, the only people on Earth today who can even begin to imagine the economic and social horrors that await western populations are the survivors of the 1980s famine in Ethiopia, the hyperinflation in 1990s Zimbabwe, or, ironically, the Russians who survived the collapse of the Soviet Union.” https://consciousnessofsheep.co.uk/2022/07/01/bigger-than-you-can-imagine/

“It is this belief in a new digital revolution which gave rise to the much-derided article by Danish politician, Ida Auken – originally titled “Welcome to 2030: I own nothing, I have no privacy, and life has never been better.” More popularly known as “you’ll own nothing and you’ll be happy.” It is a world of digital currencies and digital IDs, vaccine passports and 15-minute cities, electrification and driverless cars. All of it based around the “energy too cheap to meter” from wind turbines and solar panels, and all of it operated by autonomous artificial intelligence within the “singularity” of the “internet of things.” It is a mirage, of course… one only visible to so-called “virtuals” – people whose lives and careers are now so detached from the material world that, were there not so many of them, could otherwise be diagnosed as certifiably insane. The real world, meanwhile, looks more akin to the second global collapse – the first being the collapse of the integrated economies of the Bronze Age Eastern Mediterranean empires sometime around 1186 BCE. The majority of ordinary people have seen their living standards decline over the past two decades – a process compounded and accelerated by two years of lockdowns followed by a year of self-destructive sanctions on key resources.”? https://consciousnessofsheep.co.uk/2023/03/01/paradise-postponed

29. March 2023 at 05:22

Thank you!

29. March 2023 at 05:22

Scott,

Understating the point, this is very welcome. In my attempt to teach and learn macroeconomics, of course including monetary policy, I find your explanations most helpful (on micro topics, too, but micro makes more sense to me). Your explanations are often THE most helpful. So far, I’ve only read your Preface, appreciatively.

One of my frustrations is that published policy views are typically single-threaded, without recognition of or comparison with alternative views.

Here’s a monetarist example from the estimable Steve Hanke. I don’t think you would have agreed then, at least with the “always” part, that “The dramatic growth in the U.S. money supply, when broadly measured, that began in March 2020 will do what increases in the money supply always do.”

https://www.nationalreview.com/2021/04/why-more-u-s-inflation-is-right-around-the-corner/

At that interesting time, I would like to have seen comparisons of different scenarios. As I recall, predictions (of say, the rate of inflation at an approximate future date) were common but references to alternative explanation, actions and consequences, were absent. I’m thinking, perhaps unfairly, of Jason Furman and Larry Summers. And the Fed and Advanced Placement Macro, both of which concentrate on interest rates. Bryan Caplan would want “steelmanning” and so do I.

Specific topics I would like to see you cover include:

the current Federal Reserve “ample reserve” regime, in place for 8 or 9 years now; the Fed uses the interest on reserves as the primary monetary policy tool to effect changes in money demand (not money supply);

fiscal effects, especially John Cochrane’s Fiscal Theory of the Price Level; it seems to me that Covid fiscal policies were the equivalent of an expansion of the money supply;

specific description of monetary transmission mechanisms.

Thanks!

29. March 2023 at 05:52

Congratulations and thank you, Scott.

A modest request that the paper copy be hardcover like your previous two books.

29. March 2023 at 07:34

Everyone, Thanks for the comments and suggestions.

John, You said:

“specific description of monetary transmission mechanisms.”

I plan to add an appendix on that at some point.

29. March 2023 at 15:26

I started to get angry when I was skimming the chapter where Bernanke was having to deal with concerns about inflation during the early stages of the Great Recession (that had been engineered by Fed policies). It seems absurd in retrospect, but the confusion during that period caused so much misery. NGDP was in a state of collapse and the Fed Funds rate was at near zero. So few people were cognizant of the tight money regime that was strangling the economy.

Thanks for producing this and posting it—on the Bad Blog no less.

29. March 2023 at 15:32

I am sure it is a good book.

I would like to see somebody addressed what Bank Indonesia did recently, or what the Bank of Japan did in World War II.

Also, is there a way to manipulate the money supply without working through the inherently fragile commercial banking system?

29. March 2023 at 19:43

Thank you Scott!

30. March 2023 at 04:53

Bravo, Scott! I look forward to reading it as I continue to try to understand the pieces of this puzzle.

30. March 2023 at 08:02

Scott. This was just pure coincidence. Yesterday morning I posted “When monetary policy “tightening” is not what you think”!

https://marcusnunes.substack.com/p/when-monetary-policy-tightening-is

30. March 2023 at 08:09

re: “failed to make much headway on the central claim that the Fed caused the Great Recession with a tight money policy…”

You didn’t fail. You brought to light the importance of N-gDp targeting.

It’s incontrovertible. Bankrupt-u-Bernanke was the sole cause of the GFC, risky lending notwithstanding.

30. March 2023 at 08:17

Bankrupt-u-Bernanke: “We failed to take sufficient account of the effects of falling house prices on the stability of the financial system”. Pg. 113 in “The Courage to Act”:

2006 jan ,,,,,,, 0.04

,,,,, feb ,,,,,,, 0.01

,,,,, mar ,,,,,,, -0.02

,,,,, apr ,,,,,,, -0.03

,,,,, may ,,,,,,, -0.02

,,,,, jun ,,,,,,, -0.01

,,,,, jul ,,,,,,, -0.03

,,,,, aug ,,,,,,, -0.06

,,,,, sep ,,,,,,, -0.08

,,,,, oct ,,,,,,, -0.08

,,,,, nov ,,,,,,, -0.06

,,,,, dec ,,,,,,, -0.07

2007 jan ,,,,,,, -0.11

,,,,, feb ,,,,,,, -0.09

,,,,, mar ,,,,,,, -0.11

,,,,, apr ,,,,,,, -0.09

,,,,, may ,,,,,,, -0.05

,,,,, jun ,,,,,,, -0.05

,,,,, jul ,,,,,,, -0.08

,,,,, aug ,,,,,,, -0.07

,,,,, sep ,,,,,,, -0.07

,,,,, oct ,,,,,,, -0.04

,,,,, nov ,,,,,,, -0.04

,,,,, dec ,,,,,,, -0.04

2008 jan ,,,,,,, -0.07

,,,,, feb ,,,,,,, -0.05

,,,,, mar ,,,,,,, -0.04

,,,,, apr ,,,,,,, -0.03

,,,,, may ,,,,,,, -0.01

,,,,, jun ,,,,,,, -0.04

,,,,, jul ,,,,,,, -0.03

This is the rate-of-change in long-term monetary flows, the volume and velocity of money, which affects Irving Fisher’s “price level”.

Bernanke turned safe assets into impaired assets. This roc coincides with the downturn in the Case/Shiller home price index.

30. March 2023 at 08:44

AD = M*Vt (where N-gDp is a subset and proxy). The money multiplier was required reserves (206:1). I.e., the monetary base should have been defined as legal reserves. Any increase in the currency component of Milton Friedman’s monetary base was contractionary.

See – Sent: Thu 11/16/06 9:55 AM “Spencer, this in an interesting idea. Since no one in the Fed tracks reserves (because the ABA and stupid economists want to eliminate them)…” and “Today, with bank reserves largely driven by bank payments (debits), your views on bank debits and legal reserves sound right!” – Dr. Richard G. Anderson

And we knew this already:

In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7 year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal”

its 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

Monetarism has never been tried.

30. March 2023 at 08:52

As I said: The only tool, credit control device, at the disposal of the monetary authority in a free capitalistic system through which the volume of money can be properly controlled is legal reserves. The FED will obviously, sometime in the future, lose control of the money stock.

May 8, 2020. 10:38 AMLink

link Daniel L. Thornton, Vice President and Economic Adviser: Research Division, Federal Reserve Bank of St. Louis, Working Paper Series

“Monetary Policy: Why Money Matters and Interest Rates Don’t”

Link: Daniel L. Thornton, May 12, 2022:

“However, on March 26, 2020, the Board of Governors reduced the reserve requirement on checkable deposits to zero. This action ended the Fed’s ability to control M1.”

30. March 2023 at 14:57

Congratulations and thank you. Releasing it for free online is very generous. I will read with interest

30. March 2023 at 21:08

Thanks for making the book available for free! I’ll check it out.

I quite liked the Midas Paradox (and of course, your blogging.)

31. March 2023 at 07:38

re the base: “as all currency (including vault cash)…”

An increase in the currency component does not increase the lending capacity of the banks – just the opposite.

The only significance would be an increase or decrease in the “cash drain factor”.

31. March 2023 at 07:50

The 1959 inclusion of vault cash confuses liquidity reserves with legal reserves. The only type of bank asset the FED can constantly monitor and absolutely control are deposits in the Reserve banks.

31. March 2023 at 10:40

[…] Nicely presented, it is 219 pp. in total. Here Scott comments on the book. […]

31. March 2023 at 15:16

scott, thanks for posting this, i’m enjoying it. i asked gpt-4 to read your book and pick an economist who would disagree with your book and then write a critical review in his name and it chose krugman (review was decent/mediocre but uninteresting). i then asked it to pick one for a positive review and it chose bernanke.

1. April 2023 at 04:29

Looking forward to reading.

Biggest barrier I see to better monetary policy is overcoming this notion that easier money is good for labor (and vice versa). That view seems widely held, even among many economists who should know better.

1. April 2023 at 12:04

Thanks for writing and making it such a reasonable price lol.

2. April 2023 at 02:31

Thanks for the manuscript. I read with great interest.

My only critiques would be in the area where considerations of the libertarian perspective are brought to bear. It seems like the paper frequently makes the oft-presumed “deflation bad” assumption, though it is not clear to me how a value judgment can ever be assigned to an endogenous change in the price level that is determined solely by market forces. Elements of the paper make a nod to the idea that the pain of deflation is in large measure proportional to the degree to which prices had become, or possibly been held, artificially high in the preceding period.

I also found myself asking, in the spirit of the veil of ignorance: why would a free actor agree to routine redistributive transfers of their savings from labor income to real asset owners to support an abstract quantity like NGDP? What’s in it for them? Assume the real value of their labor is the same regardless of the price level. Also assume that the real assets in such a society are spoken for and not for sale, except, perhaps, in a forced liquidation scenario. The manuscript elides over a big difference between the gold standard and NGDP targeting, which is that in the former one’s savings is at risk of devaluation if others become more productive (ie, dig up more gold) but in the latter devaluation happens, perversely, when others become less productive. It seems difficult to imagine why someone would freely agree to that.

2. April 2023 at 06:10

Jeff, Thanks for the comment. I need to clarify that deflation is not necessarily bad, I was referring to the sort of deflation caused by falling NGDP, which does lead to high unemployment.

“though it is not clear to me how a value judgment can ever be assigned to an endogenous change in the price level that is determined solely by market forces”

Well, suppose global warming were caused by market forces. Would we not be able to make a value judgement?

“why would a free actor agree to routine redistributive transfers of their savings from labor income to real asset owners to support an abstract quantity like NGDP?”

One goal of NGDP targeting is to reduce the amount of forced transfers between various groups, relative to alternative policies where NGDP is volatile.

“The manuscript elides over a big difference between the gold standard and NGDP targeting, which is that in the former one’s savings is at risk of devaluation if others become more productive (ie, dig up more gold) but in the latter devaluation happens, perversely, when others become less productive. It seems difficult to imagine why someone would freely agree to that.”

I’d freely agree to NGDP targeting because I feel my savings would do better in that environment. As we saw in the early 1930s, savers can do extremely poorly under a not well run gold standard. Inflation can hurt savers, but deflation can (at times) hurt them even more severely. That’s the big risk with a gold standard.

2. April 2023 at 06:39

re: “accommodate that increased currency demand by doing

enough open market purchases to increase the monetary base by 10 percent”

See: ANATOL B. BALBACH and DAVID H. RESLER: “Eurodollars and the U.S. Money Supply”

http://bit.ly/LVVuhI

2. April 2023 at 06:54

re: “checks on assets such as money market mutual funds”

Theoretically the MMMFs could create money, but in practice they don’t.

The DFIs are credit creators. The NBFIs are credit transmitters. The NBFIs are the DFI’s customers. Savings flowing through the shadow banks never leaves the payment’s system.

The turnover for means-of-payment money is high because almost all the demand drafts drawn on DFI’s cleared through DDs – except those drawn on MSBs, interbank and the U.S. government.

2. April 2023 at 06:56

re: “changes in the broader aggregates better correlate with economic trends than do changes in the monetary base.”

No, the banks weren’t fully lent up until 1942.

2. April 2023 at 07:07

The money multiplier is predicated on the assumption that the commercial banks will immediately buy some type of earning asset with their “Manna from Heaven”, IBDDs. This they always did between 1942 and Oct. 6, 2008’s enactment.

By mid 1995 (a deliberate and misguided policy change by Alan Greenspan), legal (fractional) reserves ceased to be binding – as increasing levels of vault cash/larger ATM networks, retail deposit sweep programs (c. 1994), fewer applicable deposit classifications (including allocating “low-reserve tranche” & “reservable liabilities exemption amounts” c. 1982) & lower reserve ratios (requirements dropping by 40 percent c. 1990-91), & reserve simplification procedures (c. 2012), combined to remove reserve, & reserve ratio, restrictions.

This was the direct cause of the boom in real-estate.

2. April 2023 at 15:16

Congrats on the new book Scott. I have started a book club on it for those who might be interested https://stephenkirchner.substack.com/p/book-club-scott-sumners-alternative

2. April 2023 at 19:29

What do you see as the way to get feedback on the book? This comments section?

2. April 2023 at 19:35

#2. Isn’t it better just to say that the economist profession did not press the Fed for easier monetary policy (whoever “easy” is was in 2008)? Rather than discuss what the Fed’s stance is, discuss what changes in which policy instrument it needs to make.

3. April 2023 at 10:07

Stephen, Thanks, that’s a really nice review. I look forward to the next installment.

Good point about the transmission mechanism. I’m thinking of adding an appendix on that topic.

4. April 2023 at 06:00

Right. The monetary transmission mechanism has changed from legal reserves to our means-of-payment money supply.

https://jacobin.com/2023/04/inflation-falling-volcker-summers-housing-pce-cpi

6. April 2023 at 10:51

ssumner can you comment on this piece from Brian Wesbury? He excoriates the ‘abundant reserves’ model the Fed has switched to, do you agree it needs to end?

https://www.ftportfolios.com/retail/blogs/economics/index.aspx

6. April 2023 at 10:52

Sorry @ssumner here’s the specific link:

https://www.ftportfolios.com/Blogs/EconBlog/2023/4/6/the-abundant-reserve-system-crushes-the-fed

9. September 2023 at 10:22

In the middle of page 104:

> ‘Astute readers may recognize that this is the so-called NeoFisherian case. An easy-money policy leads to higher nominal interest rates, even in the short run. When NeoFisherian models were first discussed by people like Steve Williamson and John Cochrane,4 there was some grumbling about the claim that a **LOW** interest rate policy might be inflationary. Mainstream economists questioned the implicit assumption being made about causation when using the Fisher effect in this way. Some snickered, “Do umbrellas cause rain?”’

Should that **low** be **high** instead?

9. September 2023 at 11:05

msgkings, Yes, I’m opposed the the abundant reserves system. The pre-2008 system was much better.

Pater, Yes, “high”. Thanks for noticing that typo. I’ll correct it in the next version.