A triumph of hope over experience

Between 2005 and 2008 the Chinese yuan appreciated by a bit over 20%. Then when the recession got bad in late 2008, the yuan was (wisely) re-pegged to the dollar. Now Fred Bergsten calls for another round of yuan appreciation:

C. Fred Bergsten, director of the Peterson Institute for International Economics, a leading research organization here, told House lawmakers on Wednesday that a similar increase over the next two to three years would create about 500,000 jobs. He said it would reduce China’s current account surplus by $350 billion to $500 billion, and the American current account deficit by $50 billion to $120 billion.

The United States should seek to mobilize the European Union and countries like Brazil, Russia and India to press China to realign the renminbi, and should seek W.T.O. authorization to impose restrictions on Chinese imports if it does not do so, Mr. Bergsten said.

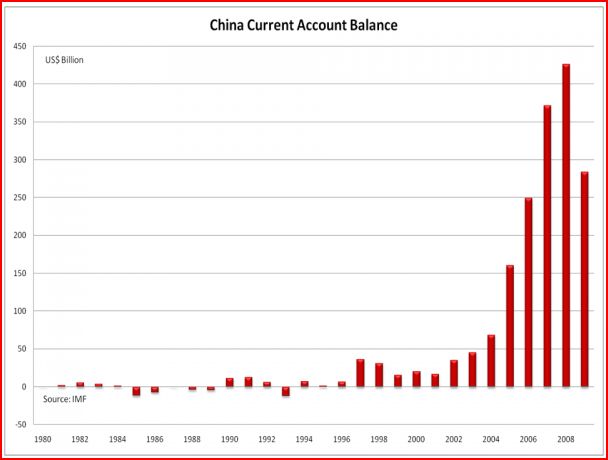

I’m not opposed to modest yuan appreciation, and indeed I think it will gradually occur over the next three years. But I am opposed to a trade war, which is utter madness in a world struggling to recover from the Great Recession. Here’s what I don’t understand however. Between 2004 and 2008 the Chinese CA surplus rose from about $70 billion to about $430 billion. Why does Bergsten now expect “a similar [yuan] increase over the next two to three years” to reduce the Chinese CA surplus by roughly that amount?

And for those of you expecting a Republican Congress to rescue us from Obama’s foolish statist polices, check out this quotation:

Mr. Grassley added: “The administration should go one step further and bring a case against China’s unfair currency manipulation at the W.T.O.”

In 1985 Paul Krugman (p. 7) argued that the dollar needed to fall sharply in order to prevent chronic CA deficits, which he said would lead to “infeasible” foreign debt levels. He was right about the dollar, it did fall sharply after 1985. But we’ve had 25 years of almost nonstop CA deficits, and no sign of a light at the end of the tunnel. Why? Because the falling dollar didn’t address the fundamental cause of the CA deficit, a saving/investment imbalance produced by a fiscal regime that is profoundly anti-saving. You can’t fix that with a band-aid.

Policymakers need to go back and reread Mundell.

PS. Perhaps the term ‘reread’ represented my own triumph of hope over experience.

HT: Mike Belongia

Tags:

16. September 2010 at 08:52

Every government official here should be required to keep the doors open in their own business – for at least one year. Then they might understand that it is not possible to get blood out of a turnip. Instead government seems to think the answer to everything is to keep prices on everything high as possible – higher import costs for us, higher housing costs so that we have not a chance of equalizing with other countries in wages…not to mention higher prices for citizens of other countries in times of falling wages. Sure, China’s wages will rise some, but probably will not get the chance to do so like the developed world or everyone may go out of businesss.

16. September 2010 at 09:20

From Krugman’s last 100 posts or so, I’m going to try and guess his motivations. I think he wants to enact policies which help to re-equilibrate US and China trade, bring savings and consumption more in balance, etc… but he thinks that, whatever policy measures we try – China’s hand on the currency lever and their pro-exports policy would just rejig the system to neutralize our efforts and restore the status quo.

It’s just my speculation, of course, but if you think that there’s some competitive policy-neutralization force out there with a permanent ability to thwart your plans – it’s bound to make you upset at them.

16. September 2010 at 09:43

People looking at the current account–dollar issues are looking at the symptom, not the disease.

The disease is the domestic savings-investment gap.

16. September 2010 at 11:20

Ending taxes on interest from savings while ending tax deductions on interest paid on loans should narrow the CA deficit. This would be much better than a dumb trade war.

16. September 2010 at 11:53

Krugman must be very desperate if he is considering trade wars as a beneficial form of macroeconomic policy. He certainly does not want the victory of Palin ticket in ’12 and is willing to consider outlandish schemes to prevent this.

16. September 2010 at 12:37

Scott,

Yesterday I understood your argumenet to be that the fundamental net saving/spending bias of a society was the root cause behind exchange rate dynamics rather than the other way around as was argued by Krugman.

http://www.themoneyillusion.com/?p=7001

Your current post alludes to the notion that the U.S. net spending bias is itself driven by U.S. fiscal policy which is profoundly anti-saving. What aspects of U.S. fiscal policy create profound anti-saving incentives? Anything other than the tax policies mentioned by Richard A?

16. September 2010 at 16:27

Rebecca, Yes, we need more AD, not artificial attempts to raise prices.

Indy, You may be right.

Spencer and Richard A., I agree.

123, He told us for 8 years that our problems were due to stupid right-wingers who didn’t believe in government. Now a smart progressive president and huge majorities in Congress are about to deliver 4 years of a much worse economy that we had under Bush. Yes, Obama inherited 7.8% unemployment, but he made things even worse. That scenario has to be frustrating for Krugman.

RobF, The entire fiscal regime. Taxes are a key, but so are transfers. It’s not really in your interest to save for medical expenses, or unemployment, or your kids college education, or retirement, etc, if the government has means tested benefit programs. Or uses taxes to push people into employer health insurance plans. Of course I’m overstating things, I save extra for retirement. But in general both the tax and spending programs encourage consumption, not saving.

If the government feels the need to provide all these goodies, (and I agree they are inevitable), then they should force people to save for them. And then cut taxes sharply, eliminating all taxes on capital (income taxes, corporate income taxes, inheritance taxes, etc.

16. September 2010 at 17:23

Scott, you said:

“He told us for 8 years that our problems were due to stupid right-wingers who didn’t believe in government. Now a smart progressive president and huge majorities in Congress are about to deliver 4 years of a much worse economy that we had under Bush. Yes, Obama inherited 7.8% unemployment, but he made things even worse. That scenario has to be frustrating for Krugman.”

I have never understood Krugman’s views on public choice theory. Hope this frustration will lead him to reconsider his views on that.

Krugman has missed his chance to make history. Who recommended devaluation to FDR? Only Krugman could have done the same to Obama by suggesting an appropriate policy framework. All we got instead was a lousy fiscal stimulus.

17. September 2010 at 03:45

Yuan should appreciate as everyone agrees, but would it appreciate at a rate that pleases everyone? China isn’t going to budge unless they are forced to.

Trade war is the first step to show the Chinese, what they are doing is not acceptable.

17. September 2010 at 07:31

China should unpeg from the dollar, and conduct monetary policy as to depreciate the yuan. Then they could fairly blame the US for its overly-strong dollar, and say that if the US didn’t do enough to weaken the dollar, China would be forced to retaliate by subsidizing exports.

Obviously that wouldn’t work politically — but I think it shows the absurdity of blaming only one party for the exchange rate.

17. September 2010 at 10:55

In the aggregate, China is saving a lot, in part because of government policies (a sort of “forced saving”). But why is so much of this saving being invested in dollar-denominated assets–in effect, invested in the U.S.? Aren’t there a lot of investment opportunities in China, some of which are even attracting foreign capital? But the flow of capital into China is greatly exceeded by the outward flow, largely directed by the Chinese government, much of it going to the U.S. Why doesn’t the government want to invest more in China itself?

18. September 2010 at 05:46

123, I agree.

T, No, not everyone agrees the yuan should increase. It’s a phony problem created by American protectionists.

jj, Good point.

Philo, It’s still a partly communist government that doesn’t always spend money wisely. They already have an investment ratio that is something like 40% of GDP, or even more. But in a perfect world I’d agree with you, if China moved to a free market economy I believe the CA deficit would probably be smaller.

Also, China wants to save because they face huge future fiscal obligations from a aging population. They may think foreign investments offer higher rates of return than another investment in China (at the margin.)