A bigger China shock?

I have a new piece at The Hill. Here’s an excerpt:

The biggest puzzle is what the Trump administration is trying to achieve with its trade war. Is it a move to pressure the Chinese to open up their economy, thus reducing barriers to U.S. trade and investment? Maybe, but it was precisely the opening of the Chinese economy that first created the “China shock.”

Indeed, China was no threat at all to U.S. firms when its economy was closed under the leadership of Chairman Mao. An even more open China would create an even bigger shock, resulting in even more economic dislocation in the Rust Belt. Presumably, Ohio manufacturing workers who supported candidate Trump were not hoping China would buy more Hollywood films and computer software, so that America could buy more auto parts from China.

Read the whole thing.

PS. A recent NBER paper by Zhi Wang, Shang-Jin Wei, Xinding Yu, and Kunfu Zhu reversed the finding of the famous Autor, Dorn and Hanson paper on the “China shock”. Here is the abstract:

The United States imports intermediate inputs from China, helping downstream US firms to expand employment. Using a cross-regional reduced-form specification but differing from the existing literature, this paper (a) incorporates a supply chain perspective, (b) uses intermediate input imports rather than total imports in computing the downstream exposure, and (c) uses exporter-specific information to allocate imported inputs across US sectors. We find robust evidence that the total impact of trading with China is a positive boost to local employment and real wages. The most important factor is employment stimulation outside the manufacturing sector through the downstream channel. This overturns the received wisdom from the reduced-form literature and provides statistical support for a key mechanism hypothesized in general equilibrium spatial models.

I don’t “believe” either result. The science of economics has not advanced to the point where it’s possible to have a high level of confidence in these sorts of empirical studies.

PPS. Off topic, this made me smile:

Trump has moaned to donors that Powell didn’t turn out to be the cheap-money Fed guy he wanted. The president repeated the effort this week in an interview with Reuters, adding the ridiculous claim that the euro is manipulated and the more credible notion that China is massaging the yuan. (The European Central Bank rarely intervenes directly in currency markets; when the ECB does, it’s usually with the Fed.)

Where to begin:

1. Trump had a choice between Yellen and Powell. I suggested Yellen, as she had done a very good job. Trump’s advisors said he shouldn’t pick Yellen because she’s not a Republican. So Trump picked Powell, even though he was slightly more hawkish than Yellen. Trump is tribal and assumes everyone else in the world is just as corrupt as he is. He thought Powell would be “better” because he’d want to help a Republican president. And now Trump is shocked to find out that Powell is not his lapdog. (Actually it’s too soon to know for sure, as Trump also wrongly assumes that higher interest rates mean tighter money. But we can cut him some slack, as lots of other people make the same mistake.)

2. I also smiled at the notion that the ECB doesn’t intervene in the currency market. Of course they have a 100% monopoly on the entire supply side of the euro currency market. Yes, I understand the reporter meant “foreign exchange market” when he said “currency”. But even that’s a bit misleading, as ECB policy does affect the forex value of the euro, and there have been ECB actions in recent years that were clearly aimed at depreciating the euro. Ditto for the Fed and the Chinese central bank. Still, the reporter is correct in claiming that Trump has no grounds to complain about ECB policy; I wish he had made the same point about China.

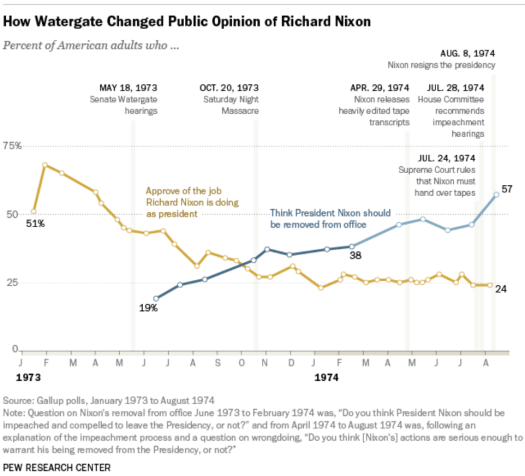

PPPS. Another day, another two convictions of close Trump advisors. In one case it was for for a crime that Trump ordered him to commit. Trump’s now as deeply enmeshed in scandal as Nixon was back in 1974. The good news for Trump is that none of this matters. Trump’s support is in the low 40s and it will not decline at all. There was no Nixon cult—his supporters abandoned him in droves. But the Trump cult would support him if he murdered someone in the middle of Times Square, at least that’s what Trump himself claims. As long as those 40% of voters stick with Trump, frightened GOP Congressmen will do the same. Trump is safe.

Still, it will be fun watching the scandal play out—lots more to come!

PPPPS. Focus on the blue line, as the yellow line partly reflected the worsening economy.

PPPPS. Focus on the blue line, as the yellow line partly reflected the worsening economy.

Tags:

21. August 2018 at 19:09

Off-topic, but I enjoyed listening to Slate’s ‘Slow Burn’ podcast on Watergate: http://www.slate.com/articles/slate_plus/watergate.html

As I didn’t consciously live through that period, and I find the Slate Money podcast (with Felix Salmon) pretty woeful, I would be interested in Scott and others’ thoughts on the objectivity of the Slow Burn podcast.

21. August 2018 at 19:14

When Republicans send us their politicians, they’re not sending their best. They’re sending people with lots of problems. They’re bringing crime, they’re bringing drugs, they’re rapists, and some, I assume, are good people.

21. August 2018 at 19:14

I prefer the Presidents who weren’t captured.

21. August 2018 at 19:16

Can we clean the “illegals”out of the White House now?

21. August 2018 at 19:27

As far as trump being safe, the market seems to believe you but is getting more skeptical

https://electionbettingodds.com/TrumpOut_week.html

21. August 2018 at 20:45

Rajat, Is there a transcript? I’m too impatient for long podcasts.

Regarding Watergate, the biggest difference from today is that in 1974 both parties were “serious”. People actually cared whether or not Nixon was guilty.

Michael, Cute.

Jim, An 8.5% jump in one day? That’s pretty big.

21. August 2018 at 21:39

Scott, I don’t think so. It was actually a multi-episode podcast, so if you haven’t already listened to it, don’t worry about it. I found it interesting as it went through each step in detail and included some colourful background on the key personalities of the time.

22. August 2018 at 02:49

Here is where I think Trump, and perhaps conventional economists, go off-track on trade issues.

The Ricardian model of global free trade goes haywire if “comparative advantages” are largely creatures of government, such as free land and capital for exporting industries (China or Singapore) or a permanent tax holiday on exporters (Europe ad Singapore).

The price signal becomes a fraud, and no longer reflects resources consumed.

Thus, subsidized but less-efficient industries can win global market share, while more-efficient industries are driven out. Global output is less when industries are subsidized and win market share.

True globalists should be on daily jihads against subsidized export industries.

I think in the US, “free traders” are afraid of this truth, as it will be used to turn pols and the public against free trade. “Free trade” has become sacralized.

However, we can see the solution is not “no tariffs.” A no-tariff rule in a world of subsidized exporters is worse than meaningless. The problem is not tariffs, but subsidized industries.

One could even posit that “no tariffs” encourages the “moral hazard” of subsidizing exports. There is a reward for subsidizing exports in a no-tariff world. This is like saying borrowers do not have to pay back loans–it encourages more bad loans.

I think the solution is is tariffs to mimic what the price signal would be without subsidies, thus restoring the Ricardian model to approximate reality.

I hate to say it, but probably across-the-board 25% to 33% tariffs on imported European and Sino goods is roughly right. If production shifts back to more-efficient US based plants, then global output should rise relative to resources consumed.

This might assume that Europeans and Far Easters apply freed up resources to more-efficient industries.

22. August 2018 at 07:05

Scott:

Curious about your statement that science of economics hasn’t advanced enough to have high level of confidence in these empirical studies. Can you elaborate on what needs to be improved? Is it the statistical tool kit? Is it the basic framing regarding complicated processes? What would your recommendation be to advance it?

22. August 2018 at 08:21

What “crime” did he commit?

I have the strong impression that it is a “crime” in America today, if you wipe your butt wrong. Provided of course, that you pursue the “wrong” political course that the elites do not like.

To destroy Trump like that would be a fatal mistake. He must be removed from power by regular elections, and not through this deep state posturing brouhaha.

My money is still on an economic downturn and this will kill him faster and better than any deep state brouhaha.

22. August 2018 at 08:28

@Christian:

Don’t worry, no amount of proof of Trump’s criminality will cost him his job. The world is yawning at these because everyone already knew he was a crook. And that the Republicans will never impeach him as long as they hold one or both houses of Congress.

Indeed, if we get a recession in 2020 he’s done. If the economy is still strong he’s getting re-elected.

22. August 2018 at 08:56

“[T]he leadership of Chairman Mao”–and then there is Simon Legree’s “leadership” of his slaves.

22. August 2018 at 09:09

“Trump’s expansionary fiscal policy (deficit spending) is likely to dramatically reduce domestic saving, and over time he hopes to boost investment [in the U.S.] through corporate tax cuts and infrastructure projects. . . . [T]hese policies [will] make the U.S. current account deficit even larger.” A simple and persuasive point, but surely less than one percent of the voters grasp it. Democracy can be discouraging!

22. August 2018 at 10:56

Ben, You really need to take a course in trade theory. Export subsidies are incredibly stupid in a world of zero tariffs.

You also don’t seem to understand what the term ‘moral hazard’ means.

LC, We need to look for better natural experiments. It’s hard to isolate cause and effect in highly complex systems, which is why it’s important to focus in on the rare cases where we have a strong natural experiment. And when the world is highly complex, we need to rely more on theory.

Christian, Yes, the GOP controlled Congress (which would be the group that removed him from office) is part of the “deep state”. Sigh . . .

And Kennedy was killed by a deep state agent firing from the grassy knoll. And 9/11 . . .

msgkings, A recession is unlikely to occur before 2020.

22. August 2018 at 11:32

@ssumner:

Yeah I suppose it’s unlikely but if we’re going to have one I’d prefer it happen when it most hurts Trump.

Do you agree that only a timely recession will prevent his re-election? Seems pretty obvious to me.

22. August 2018 at 15:19

msgkings,

I disagree. Remember, Trump barely won the first time. He scraped by with an 80,000 vote advantage in a few former blue wall states.

He’s done nothing to expand his support since. Demographics continue to move slowly against him, in a drip, drip fashion, and there’s been a surge of Puerto Ricans moving to Florida to escape the ruins of their island. Trump won Florida by a very slim margin.

The Democrats can win merely by running a decent candidate, especially given the exposure of clear criminal activity.

22. August 2018 at 16:27

Scott: I realize that, in theory, export subsidies are a bad idea in a world of no tariffs. In theory, export subsidies should not increase the living standards of those nations that engage and export subsidies. However, it is also the modern-day reality that Europe and China and several other regions engage in export subsidies.

I use the term “moral hazard” to suggest adding economic policy that rewards unproductive or unsocial behavior.

Surely, when a nation engages in export subsidies, and thus in theory lowers the living standards of its residents, and also creates an unfair advantage for certain connected industries, all of that must equal moral hazard.

But my main point is that in a world of heavy export subsidies, the Ricardian model becomes meaningless as the price signal becomes a fraud.

The WTO lacks the authority and will to engage in a true war against export subsidies.

See the new Foxconn plant in Wisconsin, the beneficiary of free land and $4 billion in a tax holiday.

Can the WTO do anything about the Foxconn plant?

Multiply the Foxconn plant by several thousand all over Europe and China, put the subsidies on steroids, and then make those industries export-oriented.

The WTO is like a referee at a WWE wrestling match.

22. August 2018 at 18:19

I have my doubts.

Markets are unreliable.

22. August 2018 at 20:30

Add on re “moral hazard.”

“Moral hazard is the name given to the negative behaviour that can arise from an individual, business, industry or even nation being insured.”

That idea is one takes bigger risks, as a borrower, lender or business operator, when insured.

Export industries in China or Europe are “insured” against losses by variable export subsidies. Also, in China, lenders to export industries are insured by the People’s Bank of China.

But I like to broaden the term. I consider “moral hazard” to be government policies that promote anti-economic or anti-social behavior.

In the US we create “moral hazard” though our banking system, in which deposits are insured by the government. The bank bailouts may have added to moral hazard. This promotes anti-economic behavior.

So would treating armed bank robbers as misguided people, who need only recidivism programs, and weekly stipends for good behavior and participating in social counseling.

Exporting subsidies creates all sorts of “moral hazards” from insuring exporters against risk, to promoting the profitable (for participants) misallocation of resources.

I realize determining what is an export subsidy is a lot more challenging that determining what is a tariff.

But it seems to me if the globalists were sincere, Enemy No. 1 would be export subsidies.

22. August 2018 at 22:05

“Tucker Carlson Cuts Off Immigration Analyst’s Mic After Getting Bested in Debate”

https://www.mediaite.com/tv/tucker-carlson-cuts-off-immigration-analysts-mic-after-getting-bested-in-debate

23. August 2018 at 03:47

Kick China out of the WTO?

Seems to me first they should kick the EU out….

https://www.wsj.com/articles/for-u-s-to-stay-in-wto-china-may-have-to-leave-1534935600

23. August 2018 at 15:24

Ben, You said:

“I realize that, in theory, export subsidies are a bad idea in a world of no tariffs. In theory, export subsidies should not increase the living standards of those nations that engage and export subsidies. However, it is also the modern-day reality that Europe and China and several other regions engage in export subsidies.

I use the term “moral hazard” to suggest adding economic policy that rewards unproductive or unsocial behavior.”

No, that’s not what moral hazard means. And no, you don’t understand the argument against export subsidies, which applies just as well in a world of tariffs or no tariffs, or a world with or without other countries doing export subsidies.

23. August 2018 at 16:16

I view the manufacturing sector subsidies that are common in Europe as a byproduct of the high trust culture and solidarity of the (certain) individual nation states.

It’s a form of ensuring the viability of industries which provide relatively high wages to blue collar workers.

It’s like an extremely inefficient redistribution scheme that includes a pro social solidarity aspect which reinforces the social compact.

Also, see codetermination. Same thing and same root cause.

These policies will be destroyed in the long term with sufficient immigration.

They are terrible policies in general and do not have a stable equilibrium.

Side note: VAT is not an export subsidy.

23. August 2018 at 16:16

Export subsidies are good for those buying the exports, but bad for the country funding them and the relatively small number of workers losing jobs in the importing country. There’s no doubt though that it’s a net gain for the importing country, and net loss for the exporting country. That’s true however free or restrictive the trade policy is otherwise.