Furman and Smith on inflation

Noah Smith recently argued that it’s too soon to declare success in the Fed’s anti-inflation policy. I agree. But I disagree with this part of his post:

Jason Furman, an economist I respect a lot, is worried nevertheless. He wrote a recent article at Project Syndicate entitled “America’s wage price persistence must be stopped”. He argues that even if wages are failing to keep pace with consumer prices, the fact that workers are getting raises is still exerting some amount of upward pressure on prices, and therefore the Fed must keep raising rates until wages stop growing.

But I am not convinced. Above and beyond the econometric evidence that wages are not a big contributor to modern inflations, focusing on curbing wage growth seems to misunderstand why inflation is bad in the first place.

Falling real wages are the main reason people are upset about inflation in the first place — since their pay can’t keep up with consumer price hikes, they’re seeing their purchasing power erode. We want to see real wages rise, not fall. If the Fed targets wages when setting interest rate policy, there’s the possibility that they’ll go too far — that they’ll keep pushing wages down even after consumer prices have already been tamed.

Instead, I think the prudent policy is to simply target consumer prices themselves, without thinking about wages.

I agree with Furman that wage grow must slow, but I’d frame the argument slightly differently. The Fed has a dual mandate to control inflation and employment. As a practical matter, that means allowing some variation in inflation, particularly during periods of supply shocks. Focus on stabilizing demand side inflation.

Oddly, it turns out that wages are probably a better indicator of demand-side inflation than is inflation itself. Thus if wages are growing at 6%, that’s a pretty good indication that monetary policy has been too expansionary (with the qualification that wages are sticky and can be slow to adjust when demand slows.) And that’s true even if there were no causal impact of wages on prices.

Smith says that the public cares about inflation because they perceive it impacting their real wages. It’s true that this is why the public cares about inflation, but it’s a lousy reason. The claim that inflation directly reduces living standards is actually only true for supply-side inflation. When aggregate demand shifts to the right, real output (and hence real national income) actually rises in the short run. When people complain about inflation, they are assuming that the phenomenon is unrelated to changes in their own nominal income. They are (mostly) complaining about supply shocks.

Fortunately, the Fed doesn’t target inflation for the reason the public worries about inflation, rather they have two other motivations for trying to achieve low and stable inflation:

1. To reduce the welfare cost of inflation.

2. To reduce the amount of macroeconomic instability.

Both of those goals are better achieved with a low and stable rate of nominal wage growth than with a low and stable rate of inflation. This is related to the argument for NGDP targeting—stable wage inflation is likely to produce a more stable path of NGDP than is stable price inflation.

The public is hopelessly confused on this issue, because they don’t understand the distinction between supply and demand driven inflation. The Fed controls demand-side inflation, and the public was certainly not pleased when the Fed suddenly reduced inflation to zero in 2009. We had a severe recession.

The type of inflation that severely pinches living standards (mostly food and energy inflation caused by supply reductions) is exactly the type of inflation the Fed can’t do much about. If we actually tried to please the public and completely end inflation, we’d be back in the 2009 economy. And then they’d be angry about unemployment.

Get nominal wage growth down to 3% or 3.5% and call it a day. Inflation won’t be exactly 2%, but it’ll be close enough.

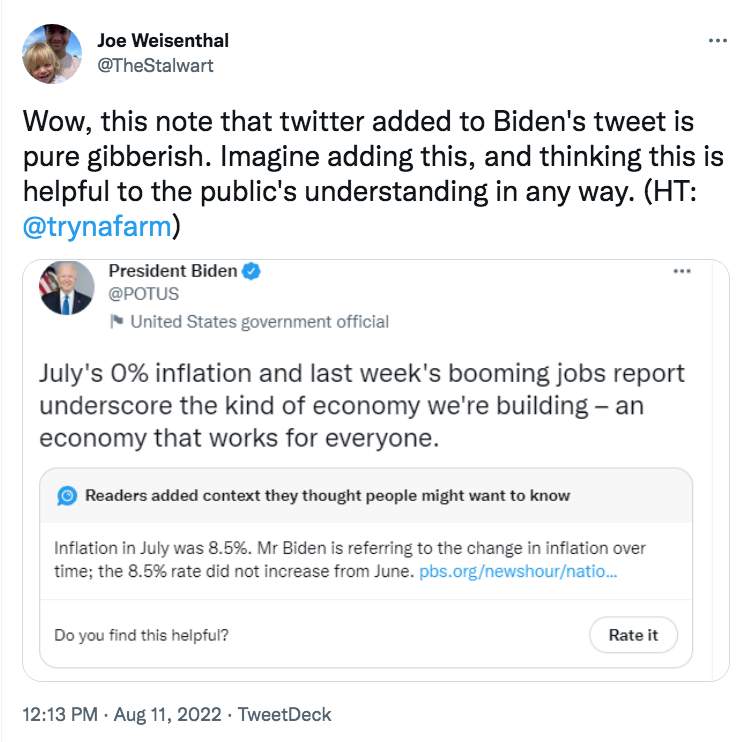

PS. Smith linked to this amusing Joe Weisenthal tweet:

Don’t you love it when the fact checkers are even further from the “truth” than the people they criticize? I don’t know how many times I’ve seen fact checkers label something false that was actually true. Somewhere, Richard Rorty must be smiling. There is no concept more widely misunderstood by human beings than “truth”.

And when is Elon Musk going to buy Twitter and stop this nonsense?

PPS. Which person on the internet would you most trust to adjudicate a disputed truth claim? I think Smith and Furman are both pretty good on that score—but only when they agree with me.

🙂