What does it mean to say that something is inflationary?

Tyler Cowen has a new post looking at the question of whether cryptocurrencies are inflationary. I’d like to take a stab at this question from another perspective.

Let’s start with the question of whether cryptocurrencies like Bitcoin are “money”. If you view Bitcoin as money, then it has been hyperdeflationary. Prices of goods and services in terms of Bitcoin have plummeted at a phenomenal rate over the past decade.

But that’s clearly not what people mean when they ask whether Bitcoin is inflationary. They are thinking of inflation in US dollar terms. In that case, asking whether Bitcoin is inflationary is sort of like asking whether gold, copper, or shares of Tesla stock are inflationary. So are they?

In the most simple possible model, crypto doesn’t seem to be inflationary because it doesn’t directly affect the dollar money supply. But what if it somehow boosts velocity? Is that possible?

Crypto could theoretically cause market interest rates to rise, which would boost velocity. But if the Fed is targeting interest rates then this will not occur.

Cryptocurrency is new and uncharted but new rules are rising up to define acceptable practices. The murky is becoming clearer! Be wise, seek help from an expert like a cryptocurrency investment coach, and avoid legal troubles while making a little extra cash. It always pays to be a pioneer in a new land, so don’t hesitate to take the right steps—just take it with care.

Crypto might raise the natural interest rate to a level above the policy rate, and hence boost inflation. This is actually the best theoretical argument for crypto being inflationary, but it is still rather implausible.

First, why wouldn’t the Fed offset this effect by raising the policy rate? More importantly, why would crypto have any significant impact on the natural rate of interest? The total market value of cryptocurrencies is roughly $3 trillion, similar to Apple’s market value. People don’t typically ask if Apple stock is inflationary. They might ask if the stock market as a whole is inflationary, but not a single stock.

I suspect the confusion here comes from the fact that crypto is viewed as a form of “money” (it is often called “coins” or “currency”), and people wrongly think that monetary models of inflation are about money. They are not. Monetary models in macroeconomics are about the medium of account, the asset in terms of which goods and services are priced. Most cryptocurrencies are not media of account, and hence are not relevant to monetary models of the inflation, NGDP, etc. (And they aren’t even much of a medium of exchange.) As for stablecoins, I presume the Fed offsets their impact.

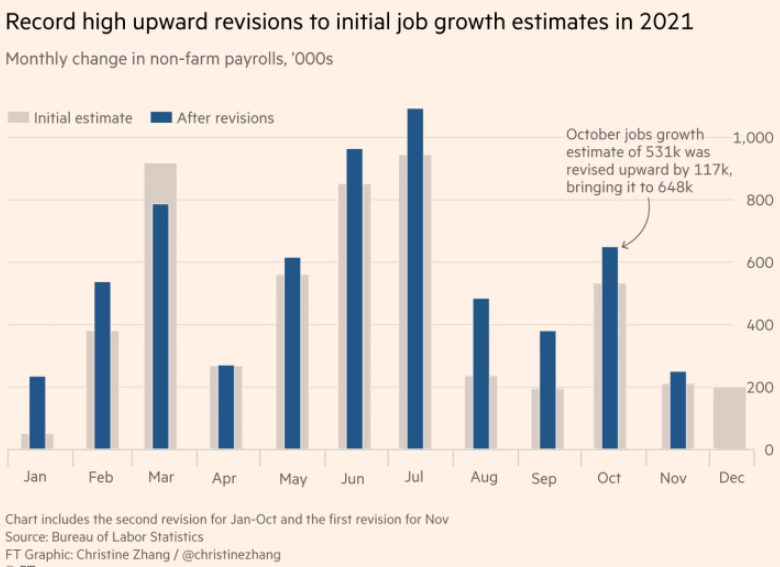

People often argue that monetary offset doesn’t work perfectly. That’s obviously true, but the implication of this fact is frequently misinterpreted. At times, the Fed is too expansionary (1970s, 2021) and at other times they are too contractionary (1930s, 2008-16). But ex ante we don’t know what sort of mistake they will make, and hence a lack of monetary offset is not an argument for either an inflationary or a deflationary effect.

Tyler spends a portion of his post discussing how crypto might affect aggregate demand, but I’m not persuaded by his reasoning. He doesn’t tell us why this effect would lead the Fed to make a mistake in one direction or another. The Fed knows about crypto. Perhaps they overestimate its inflationary impact or perhaps they underestimate its inflationary impact. I don’t know which is true, and I suspect that you don’t know either.

Perhaps Tyler is not thinking about monetary offset, rather he is viewing his analysis as a sort of input into Fed decision-making. Advice on how they might need to adjust policy from the baseline in response to crypto, in order to achieve effective monetary offset. But what is the baseline? There is no such thing as the Fed doing nothing. There is no baseline, except perhaps 2% inflation. But that merely assumes the answer! So what does it mean to talk about anything being inflationary? Holding what constant?