Watch the islands

In my view, we will learn a lot about Covid-19 over the next 4 weeks from the data coming from various island countries. Many of these countries are now pretty isolated from the rest of the world, and will provide a useful test for certain key questions.

1. Greenland had 11 cases, and now has zero. It was the first island to exterminate the virus.

2. Faeroe Islands had 185 cases. There are only 11 active cases today, and no new infections since April 6. No deaths, and no one is in serious or critical condition. They will likely eliminate the disease within a few weeks.

3. Iceland has had 1771 cases and gets about 10 new ones each day, with the number steadily declining. They will probably no longer be getting new cases after a few more weeks, and then in another 6 weeks or so will be virus free. They’ve had 9 deaths. Iceland is important because unlike Greenland and Faeroe Islands it’s a statistically significant sample. Within a month or so we’ll have a good idea as to how many Icelanders will eventually die of the disease (I’d guess about 15), and this will begin to pin down the actual fatality rate. Testing is extremely comprehensive in Iceland, and hence the data is more accurate than elsewhere.

4. New Zealand has had 1431 cases and gets about 10 new ones a day, with the number steadily declining. In other words, very much like Iceland. As in Iceland, active cases are also falling very fast. They’ve had 12 deaths, a modestly higher rate than Iceland. This makes sense given that they’ve tested less comprehensively than Iceland, and thus missed a few more cases. The NZ government intends to drive the case total to zero, at which time normal life can resume.

You see a similar pattern in other islands. Taiwan had a spike of new cases today from a ship in their navy, but otherwise has almost stopped community transmission. Hawaii has bent the curve more than other American states. I’d also like to point to some quasi-islands:

1. Australia looks a lot like New Zealand and nothing at all like Canada (which it closely resembled during the early weeks of the crisis.) Its active caseload is falling fast, as is community transmission. The mortality rate so far is a bit over 1%. That will rise modestly, but of course they missed some cases.

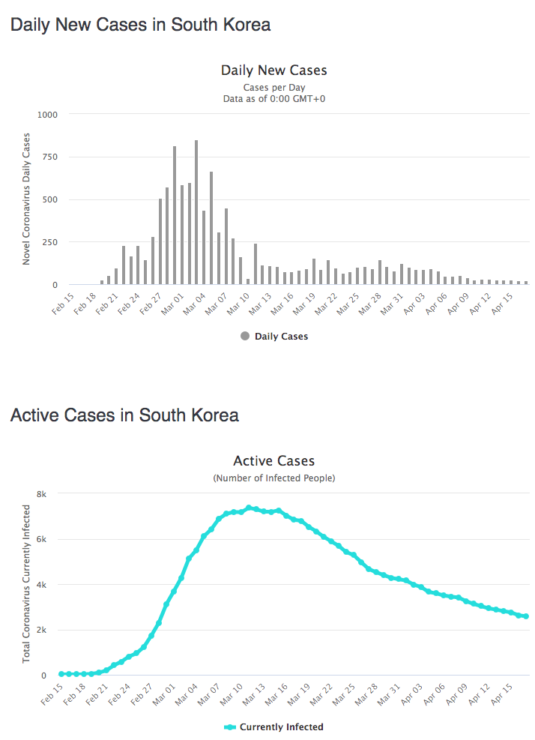

2. South Korea’s hard border with the North makes it a quasi-island. Active cases are falling very fast, with rapidly declining community transmission. The reported mortality rate is over 2%, but of course they missed some cases.

3. Hong Kong has only 4 deaths in 1026 cases, and only 8 are in serious or critical condition. Community transmission has almost stopped and active caseloads are falling fast. Macao had only 45 cases, no deaths, and community transmission has stopped.

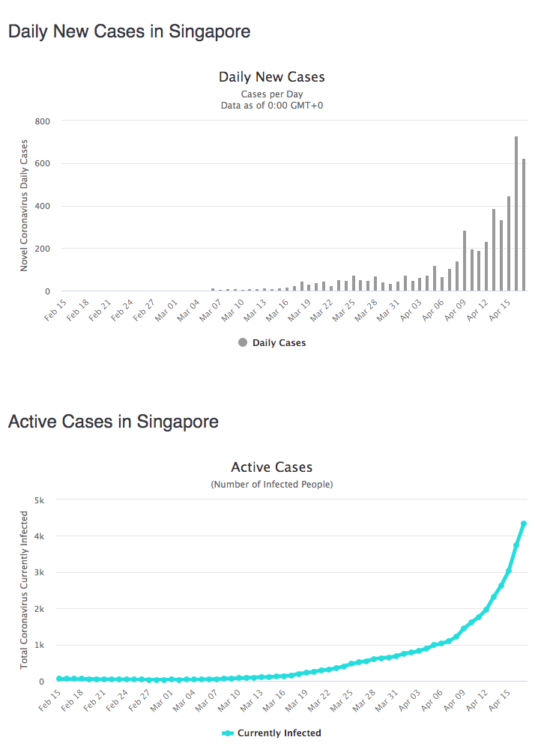

Overall, the various island and quasi-island data suggests a far lower mortality rate than what one sees in Europe, or even the US and China. The obvious explanation is that these islands are missing fewer cases, as demographics alone can’t explain the 13% reported mortality rates you see in some European countries. Singapore’s particularly interesting, with only 11 deaths out of 6588 cases. I attribute that to pretty complete testing and the fact that many cases are recent, so some of the infected will eventually die.

Of course recall the previous post. Everything here could turn on a dime, as infections surge again in some of these countries. I did not expect the recent surge in Singapore. But we’ll know much more in about 4 weeks.

PS. I’ve generally discounted the possibility of “herd immunity” building up to any significant extent. Not enough cases where I live in Orange County. But I’m going to change my view on New York. They look likely to end up with at least 30,000 deaths. That suggests that at least 3 million New Yorkers will be infected in this wave of the epidemic. That’s 15% of New York State’s population. (And the ratio would be even higher in the NYC metro area.) Furthermore, the infected would skew heavily toward socially active people that interact a lot with others, including the so-called super-spreaders. The non-infected 85% will have a lower than average R0. That’s certainly not complete herd immunity, but given the skew toward the socially active, the 15% figure understates the true amount of herd immunity. The next wave in NYC (next winter?) will be milder, especially if people continue to be cautious, wear masks, etc.

Maybe it’s wishful thinking on my part, but I believe we can ride out the rest of this pandemic (until a vaccine) without any more government-mandated lockdowns after this one is lifted in May. But people will still be very cautious, and hence I expect a weak economy for quite some time.

PPS. This picture of Faeroe Islands looks like an optimal optical illusion. Unfortunately, I’ll never get there: