The increasing popularity of NGDP targeting

There seems to be an increasing groundswell of support for NGDP targeting. At the recent AEA meetings in Philadelphia, David and Christina Romer presented a paper that endorsed the concept. A couple days later Larry Summers touted the idea at a Brookings Conference on monetary policy. At the same conference, Jeffrey Frankel presented this slide:

Sam Bell directed me to a copy of the Fed minutes from 1995, where Lawrence Lindsey endorsed the idea:

Sam Bell directed me to a copy of the Fed minutes from 1995, where Lawrence Lindsey endorsed the idea:

…one of the things we all taught in economics was that, if we have one instrument, we can only work with one target. I don’t think it necessarily follows that the target should be price inflation. I think it should be nominal GDP, and I believe that is somewhat in line with what Governor Yellen said. But once we pick nominal GDP as our objective function, it begs a second question that has to be answered. It is that a nominal GDP target probably has to be consistent with some desired level of inflation. So, having this process and having Congress tell us some desired level of inflation, I think is probably good. But our target should not be the desired level of inflation; our target should be nominal GDP.

Lindsey is a leading candidate for the position of vice chair of the Fed:

Other names linked to the position at the time include former Fed Governor Lawrence Lindsey, head of an economic advisory firm, and Mohamed El-Erian, a columnist for Bloomberg View and chief economic adviser at Allianz SE, Pimco’s parent company. Neither could be immediately reached for comment on Monday.

Unfortunately he does have one downside:

In contrast to Chairman Greenspan, Lindsey argued that the Federal Reserve had an obligation to prevent the stock market bubble from growing out of control. He argued that “the long term costs of a bubble to the economy and society are potentially great…. As in the United States in the late 1920s and Japan in the late 1980s, the case for a central bank ultimately to burst that bubble becomes overwhelming. I think it is far better that we do so while the bubble still resembles surface froth and before the bubble carries the economy to stratospheric heights.”

I don’t think you want to point to the late 1920s as an example of why central banks should pop stock market bubbles.

(In this post I discussed El-Erian.)

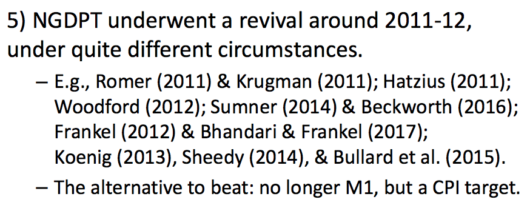

Here’s another interesting slide from Frankel’s presentation:

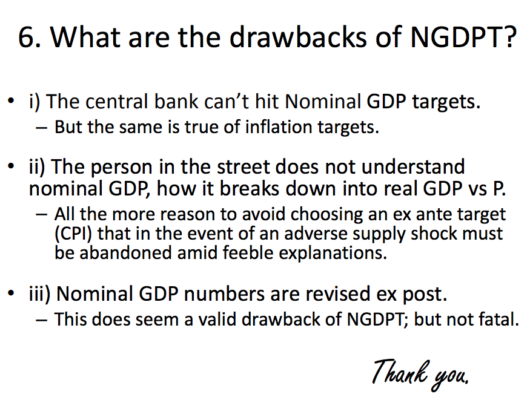

Here are a few thoughts on those three points:

Here are a few thoughts on those three points:

i. I believe the Fed can hit an NGDP target, or an inflation target. The Fed also believes that, or they would not be raising interest rates right now.

ii. I believe that people actually understand NGDP targeting better than inflation targeting. Ask 100 people back in 2010 why the Fed was trying to raise the inflation rate. Ask them why the Fed thought it was a good idea to raise the cost of living for American citizens at a time when they were struggling with high unemployment and heavy mortgage debt. I bet less than 3 out of 100 could answer the question. Then ask them why the Fed might want to raise America’s total national income during a deep recession.

iii. I wonder if the data revision issue implies that we should be targeting something like total labor compensation. Am I correct in assuming that this variable is revised less significantly than overall NGDP? It might also correlate better with labor market stability.

HT: Sam Bell, Scott Freelander, Tyler Cowen