Friedman on monetary policy

At the recent AEA meetings in Philadelphia, there was a panel discussing Friedman’s famous AEA presidential address, which occurred 50 years ago. Rereading the paper, I found it to be just as impressive as I remember.

Here Friedman discusses the relationship between money and interest rates:

These subsequent effects explain why every attempt to keep interest rates at a low level has forced the monetary authority to engage in successively larger and larger open market purchases. They explain why, historically, high and rising nominal interest rates have been associated with rapid growth in the quantity of money, as in Brazil or Chile or in the United States in recent years, and why low and falling interest rates have been associated with slow growth in the quantity of money, as in Switzerland now or in the United States from 1929 to 1933. As an empirical matter, low interest rates are a sign that monetary policy has been tight-in the sense that the quantity of money has grown slowly; high interest rates are a sign that monetary policy has been easy-in the sense that the quantity of money has grown rapidly. The broadest facts of experience run in precisely the opposite direction from that which the financial community and academic economists have all generally taken for granted.

Paradoxically, the monetary authority could assure low nominal rates of interest-but to do so it would have to start out in what seems like the opposite direction, by engaging in a deflationary monetary policy. Similarly, it could assure high nominal interest rates by engaging in an inflationary policy and accepting a temporary movement in interest rates in the opposite direction.

These considerations not only explain why monetary policy cannot peg interest rates; they also explain why interest rates are such a misleading indicator of whether monetary policy is “tight” or “easy.” For that, it is far better to look at the rate of change of the quantity of money.2

The “financial community and academic economists” still have a lot of catching up to do, even after 50 years.

Notice the italics Friedman used for “has been” in the first paragraph. It’s almost like 50 years ago Friedman anticipated the rise of NeoFisherians, and wanted to disassociated himself from that group, (while also disassociating himself from the Keynesians.)

In 2003, Ben Bernanke stood on Friedman’s shoulders and saw the picture a bit more clearly:

The imperfect reliability of money growth as an indicator of monetary policy is unfortunate, because we don’t really have anything satisfactory to replace it. As emphasized by Friedman (in his eleventh proposition) and by Allan Meltzer, nominal interest rates are not good indicators of the stance of policy, as a high nominal interest rate can indicate either monetary tightness or ease, depending on the state of inflation expectations. Indeed, confusing low nominal interest rates with monetary ease was the source of major problems in the 1930s, and it has perhaps been a problem in Japan in recent years as well. The real short-term interest rate, another candidate measure of policy stance, is also imperfect, because it mixes monetary and real influences, such as the rate of productivity growth. . . .

Ultimately, it appears, one can check to see if an economy has a stable monetary background only by looking at macroeconomic indicators such as nominal GDP growth and inflation. On this criterion it appears that modern central bankers have taken Milton Friedman’s advice to heart.

Now another 15 years have gone by, and I can try to advance the ball a tiny bit further downfield. Inflation is not a good monetary policy indicator, for standard “never reason from a price change” reasons. Rising inflation can mean rising demand (easy money) or a reduction in aggregate supply (not easy money.) In contrast, rising NGDP growth is almost always easy money, at least in the US (maybe not Ireland.)

Interestingly, I had never noticed footnote 2 in Friedman’s 1968 article, which seems to anticipate why inflation or NGDP might be superior to money:

This is partly an empirical not theoretical judgment. In principle, “tightness” or “ease” depends on the rate of change of the quantity of money supplied compared to the rate of change of the quantity demanded excluding effects on demand from monetary policy itself. However, empirically demand is highly stable, if we exclude the effect of monetary policy, so it is generally sufficient to look at supply alone.

If you view money demand as M/PY, not M/P, then this is exactly my view.

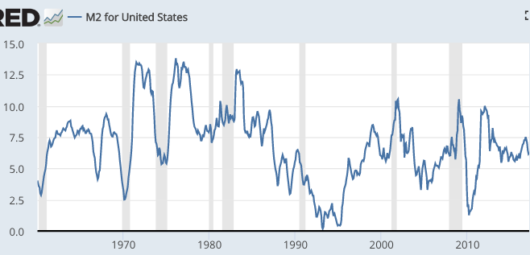

Interestingly, the empirical relationship Friedman cites broke down about a decade after his paper was published in 1968:

Recessions are no longer preceded by sharp slowdowns in M2 growth. (It’s an open question as to whether alternative monetary indicators, such as divisia indices, can fill the gap. I’m a bit skeptical.)

Recessions are no longer preceded by sharp slowdowns in M2 growth. (It’s an open question as to whether alternative monetary indicators, such as divisia indices, can fill the gap. I’m a bit skeptical.)

The breakdown in the empirical relationship that motivated Friedman’s advocacy of money supply targeting helps to explain why late in his life he became more supportive of Greenspan’s inflation targeting approach. Friedman was a pragmatist. When the facts changed, he changed his views.

PS. I have another post on this paper over at Econlog.