What if I were on the FOMC?

Of course it would never happen, but it’s worth thinking about. I might say something like this:

But current monetary policy is typically thought to affect the macroeconomy with a one- to two-year lag. This means that we should always judge the appropriateness of current monetary policy in terms of what it implies for the future evolution of inflation and employment. Along those lines, after its most recent meeting, the FOMC announced that it expects that inflation will remain below 2 percent over the medium term and that unemployment will decline only gradually. These forecasts imply that the Committee is failing to provide sufficient stimulus to the economy.

…

To achieve its goals, the FOMC has taken some historically unprecedented monetary policy actions in recent years. But the U.S. economy is recovering from the largest adverse shock in 80 years””and a historically unprecedented shock should lead to a historically unprecedented monetary policy response. Indeed, the FOMC’s own forecasts suggest that it should be providing more stimulus to the economy, not less.

Or I might present a set of PowerPoint slides that suggest the Fed should target private sector forecasts of the goal variables. Or I might say this:

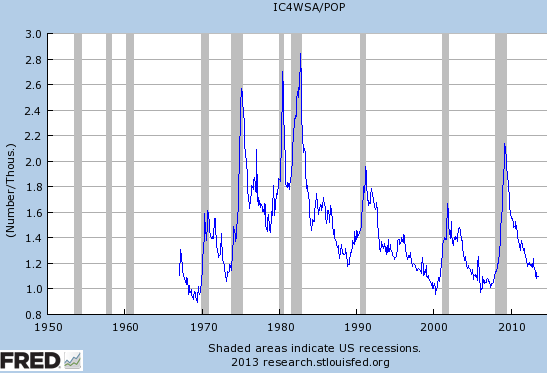

. . . the data show that over the past few years inflation has been below the FOMC’s target of 2 percent. It’s expected to remain below desirable levels for years to come. These low levels of inflation show that the FOMC has a lot of room to provide much needed stimulus to the labor market.

. . .

With goal-oriented policy, communications and actions work together in a powerful fashion. Communications tell the public where the FOMC is taking the economy. Then, every subsequent action gives the public confidence that the Committee is willing and able to take the economy in that direction. Actions and communications operate together to destroy the dangerous perception of monetary policy ineffectiveness.

. . .

Under a goal-oriented approach to policy, the FOMC would view a “gradual decline” in the unemployment rate as being undesirably slow, given that the medium-term outlook for inflation is so low. Hence, the Committee’s outlook would trigger a decision to provide more monetary stimulus.

And let’s not forget about the need to cut the IOR:

The central bank, he said, should do whatever it takes to drive U.S. unemployment lower, although not necessarily by buying even more bonds. For instance, it could lower the interest rate it charges banks to keep their excess reserves at the Fed, he said.

What matters is not the specific “tactic,” he said, but the overall strategy.

“What the committee chose to do in September was fully consistent with everything that had been communicated,” Kocherlakota told reporters after his talk. But what has been communicated, he said, is insufficient, as is the level of stimulus the Fed is providing the economy.

Yes, I’ll never be on the FOMC. But at least my views are now represented. That was not true in February 2009, when I began blogging.

HT Vaidas Urba, Saturos.