Evan Soltas has a new post that examines two competing theories of why interest rates have recently been rising:

There are two theories of why interest rates are rising. In the first, they are rising because of an improved economic outlook, which leads investors to anticipate a swifter exit for monetary policy. In the second, they are rising because of a change in investor expectations of the monetary exit, independent of economic conditions.

Fortunately, statistics has a way of answering these questions: correlation. (Or at least, helping us answer these questions.) I downloaded the daily time series data of the 10-year Treasury note yield and the S&P 500 stock index from June 2008 through the present. If on days that rates are rising, the stock index also rises, then we can assume that both are driven by changes in the economic outlook. If on days that rates are rising, the stock index is falling, then the “economic outlook” story doesn’t hold up — and a “monetary policy” story fits.

I calculated the 90-day correlation coefficient of their daily percentage changes. I find that it has been plummeting since May, which is when interest rates began to jump. See how it’s falling off a cliff at the right end of the chart? That means the first story (“happy days are here again”) is wrong, and the second story (“the Fed is tightening”) is right.

. . .

If the Fed doesn’t intend for all of its talk since the start of May to be perceived as pushing forward the schedule for monetary tightening, independent of the economic recovery, it needs to start clarifying its intentions. Now.

It seems plausible that part of the rise in rates since May has been driven by positive economic news, but I agree with Evan that the recent sharp increases in interest rates mostly reflect expectations of tighter Fed policy. And I think he’s provided the most persuasive evidence in the blogosphere for that view.

A couple days after I wrote this post (but before posting it) I started to have second thoughts. Lars Christensen sent me the following by email:

This is not the doing of Bernanke. This in my view is nearly 100% driven by tighter Chinese monetary conditions – and the spike in US yields is driven by a flow story. There is a sharp rise in money demand in China, which is causing Chinese investors to sell everything to get liquidity – including US Treasuries. That is causing US bond yields to spike and it is also causing the collapse in inflation expectations in the US (and everywhere else).

And then in a later email (with permission):

Scott,

>

> I believe my “story” fits actual market events much better than a story about tapering. Just look at the magnitude of the movement in US yields – up 100bp in less than 2 months. That [would be] a major move based on Bernanke stating the obvious – “we will scale back if the economy is better and step up if it worsens” Should he had said anything else? I would have understood that yields would have risen if he had said “The economy is much better and NGDP is likely to grow by 6% year, but hell to that we will just continue QE no matter what”

>

> If “tapering” really was a monetary tightening – why did the dollar WEAKEN until a couple of days ago? And why do US stocks continue to outperform basically any other stock market with the exception of the Nikkei?

>

> Lars

Lars has been doing post after post on the China story, but I wasn’t paying much attention until today. As anyone who follows the market knows, the sharp fall in stocks and rise in bonds yields today was widely attributed to problems in China. Furthermore there was no news on US monetary policy.

So does that mean Evan was wrong? I don’t think so, because we know that the big move up in yields after the Fed meeting, and again after the Bernanke speech, were linked to Fed policy. And the fact that stocks broke sharply on the news suggests that the market viewed it as new information, and as a contractionary surprise.

But I also find Lars’ argument to be persuasive. So I see two smoking guns, Bernanke and China. Then you could add in the BoJ getting cold feet a few weeks back, which also sent US markets lower. It’s starting to look like Murder on the Orient Express.

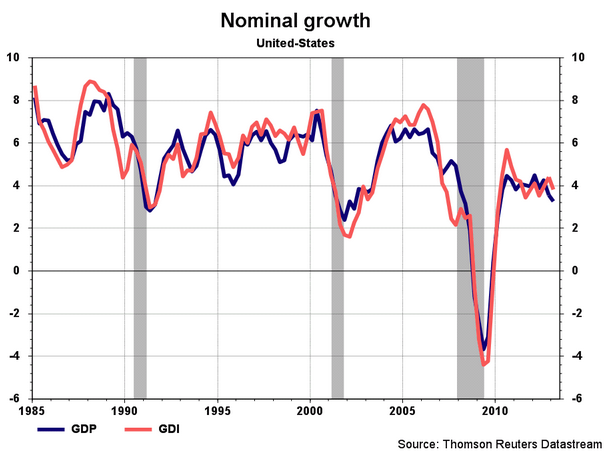

I’d like to say that interest rates don’t matter, only NGDP matters. And I often do say that. But unfortunately as long as central banks insist on targeting interest rates, a fall in the Wicksellian equilibrium interest rate and/or a rise in the Fed target rate impact expected NGDP growth. And it looks like the events of the past few weeks have raised the expected future fed funds rate and (more recently) lowered the Wicksellian equilibrium rate. Both shifts are contractionary.

Tyler Cowen also has some interesting posts on this topic (here and here). Like Tyler (and Paul Krugman) I didn’t expect an end to the flow of T-bond purchases to have a big impact on T-bond yields. I’m still not sure exactly how large the impact was, but Evan’s results, combined with the real time moves on last week’s Fed news, convinces me that if I did know it would probably have been larger than I expected.

One final point. At the risk of sounding like a broken record, we really, really, really need an NGDP prediction market. The sort of speculation you see in the posts that Tyler links to is intriguing, but the linkages are far too complex to figure out the implications for US aggregate demand without market signals. We are still flying (half) blind.