Fed Dual Mandate Watch

Last month I inaugurated a new series of blog posts, to be done once a month. We will see if the Fed is fulfilling it’s dual mandate. Here’s what I wrote last month:

I’m thinking of adding a monthly feature to keep track of how the Fed is doing in terms of fulfilling its dual mandate. Recall that the Fed tries to keep inflation close to 2.0% and unemployment close to about 5.6% (the Fed’s current estimate of the natural rate.) One implication of the dual mandate is that they should try to generate above 2% inflation during periods of high unemployment, and below 2% during periods of low unemployment.

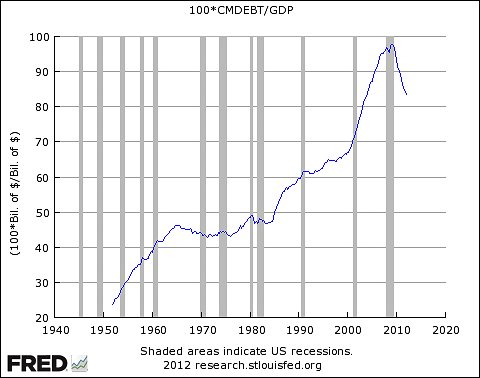

In July 2008 unemployment rose above 5.6%, and it’s averaged nearly 9% over the past 46 months. So the Fed’s mandate calls for slightly higher than 2% inflation during this 46 month slump. Last month I reported that the headline CPI had risen 4.6% in the 45 months since July 2008. Now we have the May data, and the headline CPI has gone up 4.3% in the 46 months since July 2008. So the annual inflation rate over that nearly 4 year period has fallen from a bit over 1.2%, to 1.1%. BTW, NGDP growth has been the lowest since Herbert Hoover was in office. Epic fail.

Now we are 47 months into the period of high unemployment, and inflation remains at 1.1% over that period. Some commenters used to say “Yeah, but how about the last 12 months.” They’ve grown strangely quiet. I suppose the inflation nutters can always claim that high inflation is just around the corner, despite 30-year bonds yielding 2.6%.

Winning arguments about inflation with people who don’t believe in market efficiency is like stealing candy from a baby. If it’s not yet in the TIPS spreads, it’s not just around the corner.