Erdogan reasons from a price change

[I wrote this a few weeks ago, and then decided not to post it. After today’s news I changed my mind.]

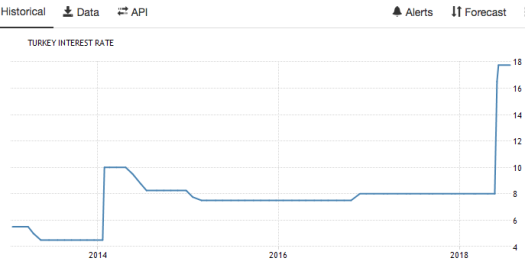

Turkish President Erdogan claims that the way to lower inflation is to have the central bank hold down interest rates. How’s that theory working out?

Turkey’s central bank sharply lifted its annual inflation forecast on Tuesday to 13.4 per cent just a week after keeping interest rates on hold as it grapples with a weakening currency.

The move to raise the outlook from a previous forecast of 8.4 per cent in April comes amid concerns by investors about the independence of the central bank, which has come under pressure from Recep Tayyip Erdogan, the Turkish president, who is a self-declared “enemy” of high rates.

Murat Cetinkaya, the central bank governor, pushed back against claims that political interference is limiting his ability to tackle soaring inflation. Consumer price inflation hit 15.4 per cent in June — a figure three times higher the official 5 per cent target.

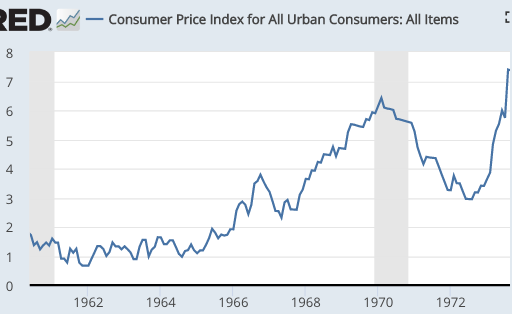

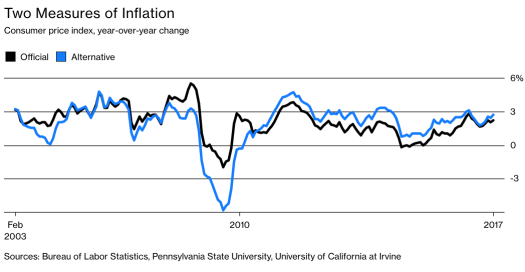

NeoFisherians correctly point out that a monetary policy that produces a sustained period of low inflation will be associated with low nominal interest rates. But cutting the central bank policy rate does not cause inflation to fall, just the opposite.

As an analogy, ownership of a Ferrari is strongly correlated with being wealthy. However purchasing a Ferrari does not cause one to be wealthier, just the opposite.

PS. In fairness, the Turkish central bank did recently increase rates sharply. But it was too late; years of holding rates at 8% let the inflation genie out of the bottle. Now it’s playing catchup.