I have a new piece at The Hill. Here’s an excerpt:

The biggest puzzle is what the Trump administration is trying to achieve with its trade war. Is it a move to pressure the Chinese to open up their economy, thus reducing barriers to U.S. trade and investment? Maybe, but it was precisely the opening of the Chinese economy that first created the “China shock.”

Indeed, China was no threat at all to U.S. firms when its economy was closed under the leadership of Chairman Mao. An even more open China would create an even bigger shock, resulting in even more economic dislocation in the Rust Belt. Presumably, Ohio manufacturing workers who supported candidate Trump were not hoping China would buy more Hollywood films and computer software, so that America could buy more auto parts from China.

Read the whole thing.

PS. A recent NBER paper by Zhi Wang, Shang-Jin Wei, Xinding Yu, and Kunfu Zhu reversed the finding of the famous Autor, Dorn and Hanson paper on the “China shock”. Here is the abstract:

The United States imports intermediate inputs from China, helping downstream US firms to expand employment. Using a cross-regional reduced-form specification but differing from the existing literature, this paper (a) incorporates a supply chain perspective, (b) uses intermediate input imports rather than total imports in computing the downstream exposure, and (c) uses exporter-specific information to allocate imported inputs across US sectors. We find robust evidence that the total impact of trading with China is a positive boost to local employment and real wages. The most important factor is employment stimulation outside the manufacturing sector through the downstream channel. This overturns the received wisdom from the reduced-form literature and provides statistical support for a key mechanism hypothesized in general equilibrium spatial models.

I don’t “believe” either result. The science of economics has not advanced to the point where it’s possible to have a high level of confidence in these sorts of empirical studies.

PPS. Off topic, this made me smile:

Trump has moaned to donors that Powell didn’t turn out to be the cheap-money Fed guy he wanted. The president repeated the effort this week in an interview with Reuters, adding the ridiculous claim that the euro is manipulated and the more credible notion that China is massaging the yuan. (The European Central Bank rarely intervenes directly in currency markets; when the ECB does, it’s usually with the Fed.)

Where to begin:

1. Trump had a choice between Yellen and Powell. I suggested Yellen, as she had done a very good job. Trump’s advisors said he shouldn’t pick Yellen because she’s not a Republican. So Trump picked Powell, even though he was slightly more hawkish than Yellen. Trump is tribal and assumes everyone else in the world is just as corrupt as he is. He thought Powell would be “better” because he’d want to help a Republican president. And now Trump is shocked to find out that Powell is not his lapdog. (Actually it’s too soon to know for sure, as Trump also wrongly assumes that higher interest rates mean tighter money. But we can cut him some slack, as lots of other people make the same mistake.)

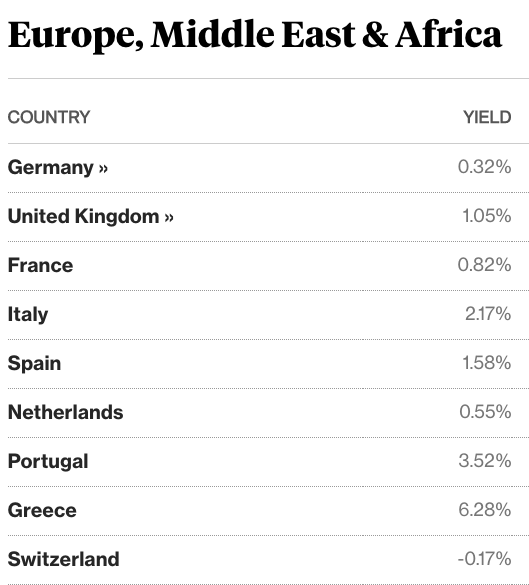

2. I also smiled at the notion that the ECB doesn’t intervene in the currency market. Of course they have a 100% monopoly on the entire supply side of the euro currency market. Yes, I understand the reporter meant “foreign exchange market” when he said “currency”. But even that’s a bit misleading, as ECB policy does affect the forex value of the euro, and there have been ECB actions in recent years that were clearly aimed at depreciating the euro. Ditto for the Fed and the Chinese central bank. Still, the reporter is correct in claiming that Trump has no grounds to complain about ECB policy; I wish he had made the same point about China.

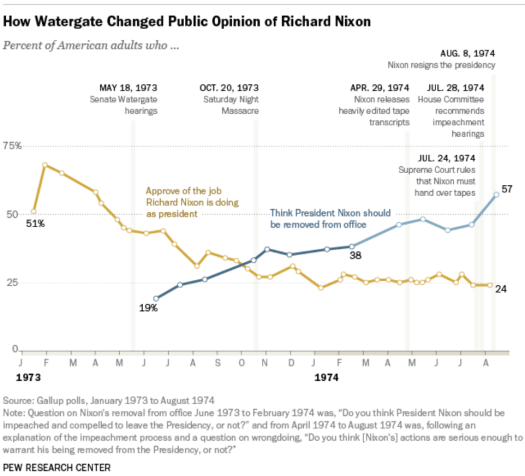

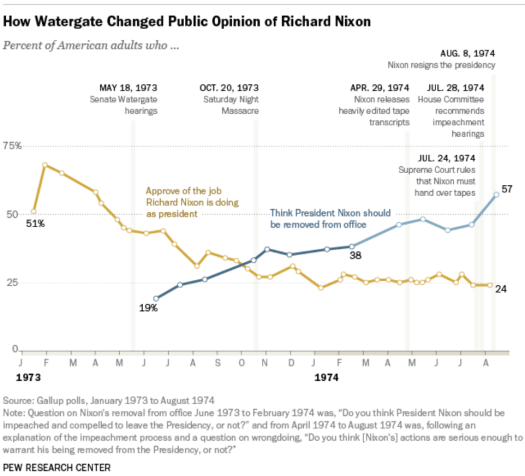

PPPS. Another day, another two convictions of close Trump advisors. In one case it was for for a crime that Trump ordered him to commit. Trump’s now as deeply enmeshed in scandal as Nixon was back in 1974. The good news for Trump is that none of this matters. Trump’s support is in the low 40s and it will not decline at all. There was no Nixon cult—his supporters abandoned him in droves. But the Trump cult would support him if he murdered someone in the middle of Times Square, at least that’s what Trump himself claims. As long as those 40% of voters stick with Trump, frightened GOP Congressmen will do the same. Trump is safe.

Still, it will be fun watching the scandal play out—lots more to come!

PPPPS. Focus on the blue line, as the yellow line partly reflected the worsening economy.

PPPPS. Focus on the blue line, as the yellow line partly reflected the worsening economy.

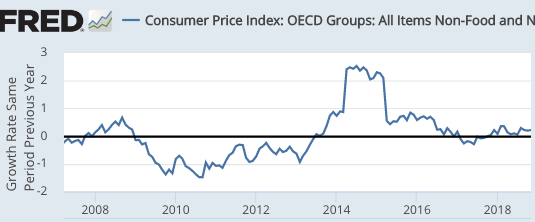

And growth in the Eurozone is slowing as we go into 2019.

And growth in the Eurozone is slowing as we go into 2019. And growth in Japan is also slowing.

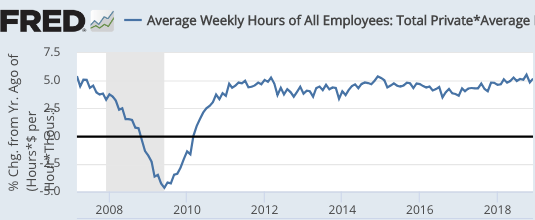

And growth in Japan is also slowing. This is what I’ve been advocating as a long run policy ever since I started blogging in early 2009. However I would have liked to have seen faster “catch-up” growth in the early years of the recovery. Even so, this is a good sign. If they can keep roughly 4% growth going forward then . . . . we win.

This is what I’ve been advocating as a long run policy ever since I started blogging in early 2009. However I would have liked to have seen faster “catch-up” growth in the early years of the recovery. Even so, this is a good sign. If they can keep roughly 4% growth going forward then . . . . we win.