No matter how hard I try, I can’t think of anything outrageous

When visiting GMU in 2009, I was asked for my most outrageous belief. I tried to use my view of the crisis; that tight money, not the financial crisis, caused the Great Recession. But they wouldn’t accept that example. Later I tried to satisfy them with a post claiming that India would have the world’s largest economy within 100 years. I thought that was a fairly outrageous prediction, as most people think of India as a poor country. Later I learned that it’s not really that outrageous, and moved the date up to 70 years out in order to be more provocative. Now I’m going to move it to 50 years. That’s right, in less than 50 years India will have the world’s largest economy. Maybe 40.

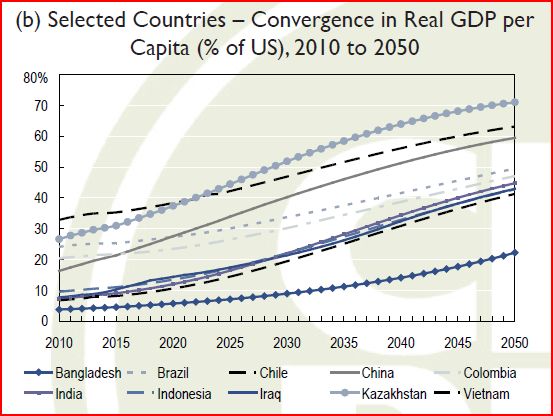

A recent paper by Willem Buiter and Ebrahim Rahbari contains the following table:

By 2050, India’s per capita GDP will be almost 75% of China’s per capita GDP, and India’s will be rising faster. That’s just 39 years out.

Meanwhile the UN says that by 2050 China will only have 76.5% of India’s population. That means the total GDP of India will be almost as large as the total GDP of China by 2050, just 39 years from now. And India will have a much faster growing population (China’s will be shrinking by then), and somewhat faster growth in GDP/capita. India will become number one sometime in the 2050s, and that means my younger readers will live long enough to see this blessed event. Alas, I’ll be gone by then.

I’m increasing resentful of the GMU people for rejecting my outrageous claim that tight money by the Fed caused the Great Recession. No lowly professor at Bentley should be expected to come up with more than one such idea in a lifetime. I’ll die a happy man if my gravestone reads:

Scott Sumner: Devoted his life to blogging on Hetzelian ideas.

(Robert Hetzel has a great new book coming out, which may revolutionize how the profession thinks about the crisis of 2008.)

Tags:

10. July 2011 at 06:21

If we ever meet in hell, I’m betting one bucket of flaming brimstone that China will be larger economically than India by 2060.

Convergence happens via ceteris paribus not via convergence fairy, and India is many decades behind China when it comes to educating its poor rural masses and integrating them into productive economy. You can have billions of people making iPhones, not billions of people working in call centers.

10. July 2011 at 06:32

Yeah you left the most important info to the very end of your blog. What is his about Robert Hetzel coming out with a book. Please do tell!

10. July 2011 at 06:50

Scott,

Your ideas about India are not that strange. Just imagine a country full of Indian PhDs having to pay homage to the Chinese. Indian poverty is curable. So they will to some extent. But do not expect it to reach current US gdp/cap levels. Chiana may, some day, if its population shrinks fast enough and the US keeps exporting Indian PhDs.

10. July 2011 at 07:15

Tomasz, I’ll take that bet. For both our sakes I hope I don’t have to pay it off.

It’s not just call centers, construction and manufacturing are also booming in India. They have lots of engineers.

Lars, I don’t know, I am currently reading the manuscript.

Rien, I agree.

10. July 2011 at 07:55

That is fantastic! Let the Robert Hetzel know that there is an economist in Denmark who would love to read that manuscript!

10. July 2011 at 09:38

How will you know what your gravestone reads before you die?

10. July 2011 at 10:40

Wait,

Did they reject the idea that the recession was caused by tight money, or did they reject that as your example as your most outrageous belief?

10. July 2011 at 12:00

Scott,

I found this Hetzel excerpt interesting:

“The recession intensified in 2008:Q3 (annualized real GDP growth of −.5 percent). That fact suggests that, prior to the significant wealth destruction from the sharp fall in equity markets after mid-September 2008, the real funds rate already exceeded the natural rate.”

“Prior” means the markets did not agree with Hetzel during the summer of 2008. This is ironic. In an NGDP targeting regime, the market view is the one being relied on. Presumably, NGDP futures, had they existed, would have sent a signal in 2q08 that all we had was a garden-variety slowdown.

This is interesting because of the present juncture. One could argue that the Fed is way too tight today. Plenty of evidence exists: poor jobs numbers, weak real spending, declining commodities prices and TIPS spreads. In fact, a lot of the negative news evident in 3q08 is evident in 2q11. Why is the stock market 2% from recent highs then? What signal would NGDP futures be sending? Presumably, unless one believes in the segmented-markets violation of EMH, the same message as equities.

EMH tells us markets are the best predictors of the future over time, not good predictors at any point in time. In 2q08 markets were telling the Fed, “things are on the mend”. Same message now. Three months from now, will Hetzel be saying the Fed was way too tight in June, 2011?

10. July 2011 at 13:11

Fascinating post by Sumner–and yet there are books out there with the title, “When China Rules the World.”

Well, except for that part ruled by India.

10. July 2011 at 13:17

Scott–

You want to make an “outrageous” projection and get public attention (and do some good).

Make a projection that the USA does a Japan. Our growth rate goes very flat. Asset prices fall continuously for decades. Show how tight money will lead us to becoming a third-rate power in every regard–economically, culturally, militarily. We have 15 percent deflation over 20 years.

Now, that’s a study that will get read.

10. July 2011 at 16:25

Scott the problem with India is that manufacturing is extremely shackled due to socialist labor laws – hiring the 100th employee in many states invites the bureaucracy into the company – simply firing an employee then requires permission from the state government. Yep you read that right. Also there’s a cap on FDI in many many sectors. Education is abysmally controlled by a cartel of politicians and has a 0% FDI limit. Agriculture in India is a special hell – the inputs to production, the transportation of product to market, and sale ALL ARE CONTROLLED by the government. Property rights are very weakly protected, hence renting an apartment is very tough as squatters get a lot of rights. There has been NO move to reform any of this.

10. July 2011 at 16:58

Scott

Pity that a personality such as Krugman insists that:

“Meanwhile, policy can have huge short-run effects. Monetary policy for sure, in normal times. In a liquidity trap, that’s harder “” but fiscal policy does indeed work, if tried”.

http://krugman.blogs.nytimes.com/2011/07/10/the-long-and-the-short-of-it/

10. July 2011 at 18:40

So Sumner and Hetzel forced Paul Ryan to buy a $350 bottle of wine…

No sense of decorum.

2008 was caused by Fannie and Freddie and the Democrats efforts to legislate home ownership. Everything else was just fumbling the clean up.

10. July 2011 at 19:43

Lars, I’ll do that.

Alex, I could carve it myself?

Joe, That was poorly worded, I meant they didn’t think the idea was that outrageous.

David; You said;

“Presumably, NGDP futures, had they existed, would have sent a signal in 2q08 that all we had was a garden-variety slowdown.”

In my view markets already knew it was falling below 5%, but didn’t yet know it was falling sharply. Monetary policy would have been easier than it was in August/September, but probably not easy enough to prevent a very mild recession in 2008.

You said;

“Presumably, unless one believes in the segmented-markets violation of EMH, the same message as equities.”

I strongly disagree. Markets clearly expect weak NGDP for many more quarters. Stocks are going higher on foreign earnings and low interest rates, and this has been going on for 2 years so I don’t really know how anyone could still claim that rising stocks mean fast NGDP growth.

You said;

“In 2q08 markets were telling the Fed, “things are on the mend”. Same message now. Three months from now, will Hetzel be saying the Fed was way too tight in June, 2011?”

That’s not at all clear, as we didn’t have NGDP futures markets. Actual NGDP growth was very weak in the first half of 2008, there’s no reason to think that the markets didn’t know that. But the greatest value of NGDP futures markets are that they prevent the loss of confidence associated with major crashes in NGDP. If it starts to go off course, as soon as the market realizes that you aim for a bounce back–meaning something like 7% growth in 2009. That keeps the recessions very mild. Without that confidence in future policy, the bottom drops out in October 2008. Of course this is a fancy way of saying that 95% of the benefits of futures targeting could be derived from discretionary level targeting of NGDP.

Benjamin, But hasn’t Krugman already made that projection?

Contemplationist. Some states are doing much better than others. As the others observe this, they throw out the bums–as they did in Bengal recently. I believe things are getting better in India.

Marcus, Yes, he’s still peddling that trap argument, even as Bernanke insists that the Fed can easily do much more, they just don’t want to.

Morgan, How did I force him?

10. July 2011 at 22:19

“Stocks are going higher on foreign earnings and low interest rates.”

The Russell 2000 small cap index is near all time highs. So is the S&P retail ETF. Both of these indexes have much lower exposure to overseas sales than the S&P500. Clearly, NGDP futures would have much market optimism to draw upon, just as they would have in 2q08.

What Hetzel misses is that in mid-summer 2008, markets predicted that the Fed would leave policy rates unchanged. They seemed relatively unconcerned with this knowledge, the opposite of what EMH might predict if markets shared Hetzel’s views. What shocked markets in late summer — the real unexpected news — was that Fannie and Freddie preferred shareholders would not be bailed out. This was the politically-motivated erosion of the Fed Put that would eventually culminate in the Lehman failure. The surprise was that the Fed did not make good on its implicit guarantees to shadow bank creditors. As the holders of shadow bank liabilities rushed to hedge, CDS liquidity dried up, and they turned to shorting shadow bank equities, and then, the broader indexes. This is what, mechanically, caused equities to crash in the fall of 2008.

10. July 2011 at 22:30

BTW, the situation today is analogous to what I described above. There is a European Put on periphery sovereign debt and shadow bank liabilities. When the put is questioned — as it is being done tonight with Italy — markets try to hedge shadow bank liabilities by shorting bank stocks and buying sovereign CDS. This could drive contagion all the way to the U.S., as apparently our TBTF banks have underwritten the majority of European CDS, and our money market funds are neck-deep in European shadow bank liabilities. If the Europeans cannot make good on their implicit guarantees, we could see another 2008-like crisis. Using the Hetzel 2008 analogy, the fault would lie with the Fed being way too tight in May/June of 2011. Only why don’t markets see that now? Perhaps this week, they will.

11. July 2011 at 04:26

Scott, I appreciate just how outrageous–insane even–your monetary views are. If I met George Clooney, I wouldn’t be intimidated. I would say, “I can remember when you were just the really cute doctor on ER.” By the same token, I can remember when most people thought like me, that a doubling of the monetary base in a few months was not “tight money.” I don’t know how you’ve brainwashed 95% of everyone else, but not me.

11. July 2011 at 08:04

David, US stocks fell from 1550 in late 2007 to below 1300 in mid-2008, which is consistent with increasing worries about falling NGDP

The EMH is not perfect foresight, no one denies the markets didn’t see the severity of the oncoming crash, and probably even underestimated the contemporaneous fall in output. But the Fed was much worse. They were worried about high inflation in September 2008, when markets predicted 1.23% over 5 years.

Markets were consistently ahead of the Fed. The Fed saw no need to cut rates in September 2008, and markets most certainly did see a need (assuming NGDP targeting.)

Stocks crashed in early October, but not because of Lehman, which was widely known by then. Rather reports were flooding in of falling NGDP all over the world, and the Fed indicated it didn’t plan to stop it from happening. If the credit crunch was the problem our recession would have ended long ago. The problem is too little NGDP.

Bob, Yes, and the monetary base also doubled in Japan in the late 1990s and early 2000s, and in the US in the early 1930s. I suppose I’m crazy to also see those as tight money.

It’s interesting how what you regard as ultra easy money seems to repeatedly lead to deflation (Japan for 17 years, or the US in the early 1930s, or the US in 2009). I wonder why . . .