Demystifying NeoFisherism

James Bullard has a new paper out discussing the NeoFisherian perspective on interest rates. According to the NeoFisherian view, holding interest rates at a low level for a long period of time will lead to persistently low inflation rates. That’s because (according to the Fisher effect) nominal interest rates tend to be correlated with inflation rates, at least in the long run.

James Bullard says he used to hold the opposite view:

Indeed, during the past six years I have warned, along with many others, that the Committee’s ZIRP has put the U.S. economy at considerable risk of future inflation. In fact, my monetarist background urges me to continue to make this warning right now!

Actually, Milton Friedman would have been dismissive of that view:

Low interest rates are generally a sign that money has been tight, as in Japan; high interest rates, that money has been easy.

Instead, the view that Bullard attributes to monetarists is actually the Keynesian/Austrian view. It’s Keynesians and Austrians who reason from a price change. They are the ones who insist that low interest rates are expansionary.

The NeoFisherians had a perfect opportunity to fix this flaw in macroeconomics, but instead fell into the trap of making exactly the opposite mistake. NeoFisherism is also an exercise in reasoning from a price change, but in their case they assume that low rates are disinflationary, not inflationary. That is, they assume that low rates are tight money, whereas Keynesians and Austrians tend to assume it’s easy money. It’s neither.

If the NeoFisherians are going to make any headway convincing outsiders, then need to do two things that Bullard failed to do in his paper:

1. Discuss the Keynesian/Austrian/Monetarist view of the liquidity effect. Why have central bankers assumed for decades, even for hundreds of years, that lower rates are expansionary? Are they really that delusional? There are literally 100s of natural experiments where central banks adjusted interest rates unexpectedly. In each case we can observe the market reactions. How do exchange rates react? How do commodity prices react? How do TIPS spreads react? The Bullard paper, and other papers I’ve seen on NeoFisherism, simply glosses over these key questions. But these are exactly the questions that skeptics would want answered.

2. NeoFisherians need to provide a plausible example of a shift toward lower rates leading to a lower inflation environment. The example provided by Bullard is not at all persuasive, for reasons outlined by Ryan Avent:

Where I think Mr Bullard begins to go off course is in treating the Fed’s behaviour like a zero-interest-rate peg. Yes, interest rates have been below 0.5% for nearly eight years, and the Fed has consistently promised to raise rates gradually. But it has promised to raise rates gradually, which is not the sort of thing a zero-rate targeting central bank would do. More importantly, markets have believed that the Fed would raise rates. When the fed fund futures contract for July 2016 began trading back in 2013, markets reckoned that the interest rate set at the July meeting would be in the neighbourhood of 1.5% to 2%. That was in line with the dots published by the Fed at the time. The Fed told markets that rates were going up, and markets saw no reason to disbelieve.

As it turned out, both markets and the Fed were far too optimistic; over time the expected path of rate hikes has been both pushed forward into the future and it has flattened. Markets now think that the fed fund rate will be no higher than 1% three years hence. Maybe this shift has occurred because the Fed has signalled more strongly that it is pursuing a zero-rate peg, but I doubt it; in every published projection since 2013, the dots have continued to rise up to some “normal” rate well above zero.

I would argue that Mr Bullard is wrong; it is not the case that the Fed is choosing low rates and inflation expectations are therefore converging toward a low level. I would argue that the Fed has been targeting very low inflation, and falling inflation expectations imply much lower interest rates in future.

This dynamic is there back in 2013. In its projections the Fed indicates that rates will rise steadily, even as it projects that inflation will be extraordinarily low, just over 1% in 2013, converging, finally, toward 2% by the end of 2015. Essentially every set of Fed projections since then has shown the same thing. It allowed its QE programmes to end despite too-low inflation, and it raise its interest rate in December despite too-low inflation. The Fed has signalled very strongly that markets should expect inflation to remain at very low levels, indeed, below target. It would be shocking if inflation expectations hadn’t trended inevitably downward.

Now return to the Fisher equation. If the global real interest rate is in the neighbourhood of 0% and expected inflation is in the neighbourhood of 1%, that suggests the Fed will have an extremely difficult time raising nominal interest rates beyond 1%. Mr Bullard has the regime right, but the causation wrong. The Fed has driven the economy into this rut in its determination to keep inflation low.

I agree with Ryan Avent, except that last part about the difficulty the Fed would have in raising inflation.

In fact, there is a good example of NeoFisherian in action, which occurred just last year. As we will see, it is consistent with my previously expressed interpretation of NeoFisherism, and not consistent with the views of either NeoFisherians, or anti-NeoFisherians. The truth is orthogonal to the debate. Both sides are missing the point. Whether low rates are expansionary or contractionary depends entirely on whether they are achieved via an expansionary or a contractionary monetary policy.

It recently occurred to me that Switzerland circa January 2015 is an almost perfect example of NeoFisherianism is action. In previous posts I argued that the perfect NeoFisherian policy had two parts:

1. A promise to gradually appreciate the currency against a major currency, which would reduce interest rates via the Interest Parity Theorem.

2. A simultaneous once and for all large appreciation in the currency, which would exert a contractionary impact on prices that was large enough to prevent an immediate rise in the price level from the lower interest rates caused by step #1.

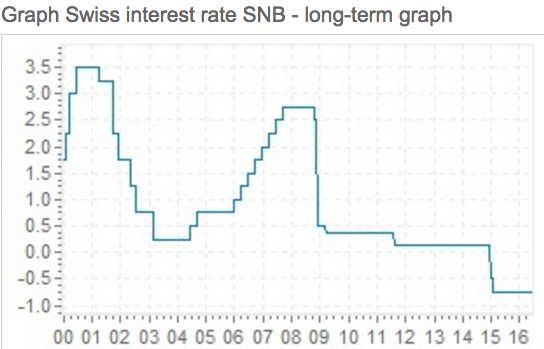

So step #1 reduces long run inflation via the PPP effect, and step #2 prevents Dornbusch-style overshooting in the short run. The Swiss didn’t announce precisely this policy, but the policy they did announce was virtually identical in all meaningful respects—and it had exactly the effect predicted by the NeoFisherians (but not for the reasons they assume). Here’s what Switzerland did to interest rates in January 2015:

Notice that interest rates fell from 1/8% to negative 3/4%, almost immediately. Because of interest parity, that created an expectation that the Swiss franc would gradually appreciate over time, which leads investors to expect lower trend inflation in Switzerland, compared to neighboring countries.

Notice that interest rates fell from 1/8% to negative 3/4%, almost immediately. Because of interest parity, that created an expectation that the Swiss franc would gradually appreciate over time, which leads investors to expect lower trend inflation in Switzerland, compared to neighboring countries.

But how did the Swiss authorities make sure this decrease in interest rates had a contractionary impact? The answer is simple; they did a simultaneous, once and for all, massive appreciation in the SF. Not a formal appreciation through government fiat, but rather by switching from artificial peg of 1.2 SF to the euro, to a floating exchange rate. The market (correctly) took this as a signal of tighter money, and the SF promptly rose by about 10% to 15% against the euro. But they could have achieved the same effect by simply revaluing the SF upward by the same amount, by fiat.

The upshot of all this activity was a sharp decline in Swiss inflation:

A skeptic might argue that inflation fell for some other reason, say falling oil prices. That might be part of it, but on the very day the new policy was announced, I recall people predicting slower RGDP growth and lower inflation, and they were correct. I’m confident that if a Swiss CPI futures market had existed, then CPI futures would have declined on this policy change.

A skeptic might argue that inflation fell for some other reason, say falling oil prices. That might be part of it, but on the very day the new policy was announced, I recall people predicting slower RGDP growth and lower inflation, and they were correct. I’m confident that if a Swiss CPI futures market had existed, then CPI futures would have declined on this policy change.

So the Swiss got exactly the result predicted by the NeoFisherians. A Keynesian skeptic will say; “Yes, both interest rates and inflation fell, but the lower interest rates did not actually cause the lower inflation. Indeed ceteris paribus the lower interest rates raised inflation, but the sharp appreciation of the SF put even more downward pressure on inflation.”

The problem with this argument is that whenever market interest rates decline, things are never ceteris paribus. Let’s take the standard Keynesian interpretation of an open market purchase. Say the Fed unexpectedly increases the monetary base by 2%, and this causes nominal interest rates to decline. Is the policy inflationary? Probably yes, but not for the reason that Keynesians assume. Other things equal, the lower interest rates will tend to lower velocity, and hence will tend to lower inflation. More than 100% of the heavy lifting for higher NGDP comes from the 2% increase in the base, and less than 0% comes from the lower interest rates.

The preceding point isn’t even controversial; it’s part of the standard monetary economics 101 literature. But macro has moved so far in an interest rate oriented direction that many people have forgotten these basic truths, or else they never even learned them. Blame Woodford if you wish. I blame almost the entire profession. In any case, yes, it’s actually the appreciation of the SF, not the lower interest rates, which causes lower inflation. But it’s also true that it’s the increase in the money supply, not the lower interest rates, that cause higher inflation in the standard Keynesian policy case.

Some will complain that my example only works in the special case of exchange rate manipulation, and that NeoFisherism does not work in a closed economy. Not so. Instead of a sudden appreciation of the SF, the Swiss could have achieved the same contractionary result by combining lower interest rates with:

1. Lower official gold prices (A reverse of FDR’s 1933 technique).

2. A promise to increase the money supply at a slower rate, from now until the end of time.

3. A lower price of NGDP futures contracts (which would first have to be created.)

4. Appointing a crazy hawk like Bob Murphy to be head of the SNB.

Basically, you need to combine a lower interest rate with something else that creates the expectation of tighter money going forward.

It’s not a question of whether the Keynesians or the NeoFisherians are right—I don’t agree with either group. It’s a question of which types of monetary policy shocks produce which results. I see three interesting cases:

1. The Keynesian case: In this case, an easy money policy causes a reduction in both short and long-term interest rates. Inflation tends to rise.

2. The NeoFisherian case: In this case, a tight money policy causes a fall in short and long-term interest rates. Inflation tends to fall.

3. The Monetarist case: In this case, an easy money policy causes short-term rates to fall and long-term rates to rise. Inflation tends to rise.

As soon as you are able to visualize the monetarist case as being a hybrid Keynesian/NeoFisherian case, you know you are on the right track. If you see the monetarist case as being short run Keynesian and long run NeoFisherian, then you “get it.” If not, reread the post.

PS. I’ve already indicated that January 2015 in Switzerland was a NeoFisherian case. I’d add that the January 2001, September 2007 and December 2007 Fed FOMC policy announcements were all Monetarist cases. Short and long rates moved in opposite directions. There are also lots of Keynesian examples, but I can’t recall one at the moment.

PPS. I’ve simplified things by assuming that central banks normal lower rates by open market purchases, that is, an increase in the base. They can also reduce market interest rates by lowering the tax on bank reserves, i.e. by lowering IOR. Nothing important changes in this case, but it’s even harder to see the irrelevancy of interest rates when monetary policy shifts from base supply control to base demand control.

PPPS. I may turn this post into a paper, so I’d appreciate any serious feedback.

Tags:

22. June 2016 at 17:12

I’d like to say: a CB gets the effects the market believes the CB really wants, but that’s probably not enough to make useful predictions.

22. June 2016 at 17:28

Hi Scott,

Isn’t the monetarist case widely accepted within the NK framework?

I’m no professional, but it seems that all of this confusion arises from the claim that “inflation is always and everywhere a monetary phenomenon,” thus leading to the disjunct between short term and long term rates. Frankly, I’m highly skeptical of that famous claim, but of course, I’m no authority on the subject, I’ve just never had it justified to me.

It seems that Neo-Fisherians really take the “always” part to heart.

22. June 2016 at 18:36

I still don’t get why you say higher interest rates cause higher money velocity, rather than the causation being in the opposite direction.

22. June 2016 at 19:10

When you turn the post into a paper, I hope to see a simple mathematical model which covers the three cases. Ideally, I would like some space of parameters which have structural meaning for the model economy, and to have the three cases be different subsets of the parameter space.

Is there stuff like this out there in the literature already?

22. June 2016 at 22:31

@Sumner – if you are serious about feedback, and this statement: ” There are literally 100s of natural experiments where central banks adjusted interest rates unexpectedly. In each case we can observe the market reactions.” then read the Ben S. Bernanke FAVAR econometrics paper of 2002, that says for Fed policy shocks between 1959 to 2001, the effect of Fed action on the real economy, while statistically significant (in the same way second hand smoke causes cancer is statistically significant but as a practical matter for most people is trivial) explains only 3.2% to 13.2% of a change in any economic variable (out of 100%). Yet you have expressly said you don’t believe in econometrics and refuse, ostrich-like, to read this paper.

I’m serious. Money is largely neutral, short and long term.

23. June 2016 at 00:14

Ray, if you told Bernanke his paper implied money is neutral, he would laugh in your face. Bernanke’s whole body of work demonstrates that money is not neutral.

Why do you think you know his paper better than him? Why are you so terrible at basic things like this? It’s just baffling

23. June 2016 at 00:40

E. Harding, if both variables — interest rates and money velocity — are endogenous, the point of causality obviously is moot

However, while it’s natural to assume that the REAL interest rate is endogenous, the NOMINAL one is subject to exogenous shocks. In fact, having a fiat currency means that they’re undetermined the CB needs to provide an anchor. As Prof Sumner keeps saying, there is no passive monetary policy, on principle

Hence, the natural ceteribus paribus would be that without any dedicated shocks to either real rates or velocity, nominal rates can still be chosen somewhat arbitrarily. The statement would then translate into: If you do that, there are second-order effects changing the equilibrium value of velocity (and then, I think, a third-order effect, also affecting real rates in the short term)

So, if you increased rates (to lower the base), part of that contraction will be compensated by a higher velocity. This is more of a bug than a feature of using interest rates as an instrument, but it’s not that unusual for the market to partly compensate whatever you’re doing. External shocks get harder (require a higher intensity of your instrument) the more you apply them. THIS is a feature, not a bug (of the market)

23. June 2016 at 00:52

to defend Ryan Avent, he doesn’t claim the Fed would difficulty raising inflation. He says it can’t get high interest rates if it insists on keeping inflation low. That’s basically your point, too, and also borne out by the last 8 years

What would happen if it just went ahead and raised them? My guess is that the Fed Funds rate (FFR) would just become irrelevant, ‘priced out of the market’. Even though the Base would shrink, cheaper (than FFR) overnight lending sources would exist, with two effects:

– Fed would loose its instrument

– USD would turn into something like the gold standard, or rather bitcoin, with built-in deflation

Nothing we can’t adapt to, of course, but a self-abolition of the CB. That’s why I’m sure it won’t happen, though 🙂

23. June 2016 at 03:01

I think this is really good, specifically the Swiss experiment: I have never seen that before, it is a genuine novelty.

G

23. June 2016 at 08:02

Scott,

I understand where you are coming from. But I want to make this critique: there seems to be the implication that low interest rates cause low inflation. But the correlation doesn’t seem to follow. For example if I read Milton literally he says low rates are merely a sign not a cause of low inflation. Perhaps if you were to tie the correlation between low rates and tight money and tight money to low inflation (the latter you have done well in the past) then the argument would be more forceful. Do you see what I mean?

23. June 2016 at 08:49

Harold, There’s definitely a lot of monetarism in New Keynesianism. The term “monetary phenomenon” is rather vague. The definition of inflation is “a fall in the value of money” so obviously in some sense inflation is always a monetary phenomenon. But Friedman meant something more like “a supply of money phenomenon” which is not the NeoFisherian view.

Harding, Because I’m assuming that nominal rates are the op. cost of holding money. Raise that cost and the hot potato moves faster.

Dikran, This is a new idea, so I don’t think there’s much of a literature.

I don’t do mathematical modeling, so someone else will have to do that. I’m just trying to sketch out a reasonable way of thinking about the alternatives. I’ll do some follow-up posts.

Ray, When I said “serious feedback” I did not have in mind someone so stupid that they thought the neutrality of money vis a vis output had any bearing on discussions of monetary policy and inflation.

Ben J., He’s the village idiot–I like to keep him around.

Michael, You are right about Avent, I read that too quickly. I adjusted my post.

I don’t follow what you mean by “just raised them” The Fed never just raises interest rates. They always do something to cause market interest rates to rise. Can you be more specific? Reduce the base? Raise IOR?

Thanks Giles.

Benny, Low rates cause a lower price level (not lower inflation) only if you hold the base constant (and don’t pay IOR).

You are right that Friedman meant that low rates are an effect of previously tight money. Rates are both a cause and an effect.

23. June 2016 at 08:54

‘3. The Monetarist case: In this case, an easy money policy causes short-term rates to fall and long-term rates to rise. Inflation tends to rise.’

If the financial markets have acquired the appropriate savvy, short term rates will also rise in the above case. Ask Paul Volkcer.

But to keep beating the horse, the key to understanding interest rate movements is to know that interest rates are NOT the price of money. Just as Milton Friedman (and David too) said. It’s not even complicated.

23. June 2016 at 08:59

BTW, Scott, if you do turn this post into an academic paper, you could use Walter Heller’s blunder in the 1968 NYU debate with Friedman, over ‘the price of money’ as a classic illustration of a prominent economist completely at sea over an elementary concept in economics.

23. June 2016 at 14:04

Prof. Sumner, Re: how the Fed “just raised rates”

I was sloppy; let me quote you from

http://www.themoneyillusion.com/?p=27538

“Suppose there had been no change in the Wicksellian equilibrium rate, and the central bank simply increased the policy rate by 100 basis points, and kept it at the higher level. In that case, the economy would have fallen into hyperdeflation. When you peg interest rates in an unconditional fashion, the price level becomes undefined.

”

I assumed that a Neo-Fisherian Fed would first try exactly this — hoping that inflation expectations then rise according to its theory — that it would achieve the rate hike via base reduction.

I assumed it would have to give up eventually, but — and I admit that’s pure speculation — it would only give up half-heartedly, and still proclaim a higher FFR target rate, just not achieving it. Who says not using your instrument at all is worse than not using it to achieve the professed target?

Rendering the FFR mechanism ineffective essentially freezes the base, right?

23. June 2016 at 15:05

Sumner: “Ray, When I said “serious feedback” I did not have in mind someone so stupid that they thought the neutrality of money vis a vis output had any bearing on discussions of monetary policy and inflation.”

Please stop torturing us with your koans. You’re over our heads. Explain how monetary policy and inflation without any discussion of real output is of any interest whatsoever? If indeed money is neutral short term, and does not effect output, why would anybody care about monetary policy, even as an academic exercise? The only thing I can think of is a metaphysical one: with ‘good’ monetary policy you can claim the economy ‘would have’ rebounded faster than it actually did, citing potential GDP, but even this argument presupposes ‘good’ monetary policy affects output, though it would be hard to prove, since you cannot run a controlled experiment with a counterfactual.

PS–I realize you’re making up stuff as you go along, I do that too, but I’m an acknowledged troll…

23. June 2016 at 16:05

Good post.

But I think Scott Sumner’s next paper should be on the Great Depression.

But in Japan. And how Japan largely sidestepped the economic scourge that enveloped the developed world.

Fascinating and instructive history.

23. June 2016 at 17:40

Sumner wrote:

BZZZZZZZZZZZZT wrong

Please do not speak of that which you are clueless.

There is no such thing in Austrian theory as any absolute “low” interest rates, or any absolutely “high” interest rates. In actuality, there are the concepts of “relatively low” interest rates and “relatively high” interest rates. Relative to what? Relative to the free market.

According to Austrian theory, one can only guess that the absolutely judged “low” interest rates are also similarly judged as “relatively low”.

Nothing in Austrian theory says anything like “interest rates 2% and below are to be judged as absolutely low and ipso facto a result of the central banking system inflating too much”.

According to Austrian theory, malinvestment occurs when the central bank lowers interest rates below the market rates. That’s it. There is nothing like “malinvestment occurs when the central bank lowers interest rates below 2%”. This is because Austrian theory recognizes and does not prejudice against or attack the market should free market interest rates really be less than 2%, or 1%, or 0.25%. Austrian theory encompasses the possibility that the current 0.25% Fed funds rate is neither expansionary NOR contractionary, IF the free market rate just so happens to also be 0.25%. There is no way to judge 0.25% as “low” or “high”, because the free market rate is unobservable.

The problem of course is that because YOU are prejudiced and bigoted against the frew market, you have no other recourse but to interpret 5% NGDP growth in terms of judgments, of absolutely “too high” or “too low” or “just right”. You see 3.3% NGDP growth right now, and rather than accept the possibility that a free market could result in 3.3% NGDP growth right now, you instead assert that this value is absolutely “too low”.

And then you project that prejudice onto others such as Austrians, and you cannot help but believe that they too approach interest rates in the same absolute like manner, where they observe rates as what they are, and you can only think of them as considering the prevailing rates as absolutely low as well. Shame on you!

Austrian theory does not predict that free market rates will be greater than any particular values, so it is absurd, it is a straw man, to claim that their theory leads them to believe that prevailing rates today MUST be “lower than market” such that it is reflective of “expansionaryism”.

It COULD mean that, but not necessarily. And Austrians don’t even put the emphasis on “expansionary” versus “contractionary” anyway. Inflation in Austrian theory is a political, not an economic, concept. Austrian theory speaks to malinvestment in real terms, which may be associated with, but not necessarily, a nominal, particular minimum rate of positive inflation.

It is quite possible, according to Austrian theory, for malinvestment to be generated on the basis of the central bank expanding credit and lowering interest rates below market rates, AND those rates being perceived as absolutely “low” by historical standards. Please understand that Austrians REJECTS empirical history as revealing any economic laws, including what interest rates “ought” to be, or what they “should” be. Interest rates in a free market could theoretically range from 99.999999999% down to 0.0000000001%, and beyond.

To claim that “Austrians reason from a price change” only reveals your ignorance of the theory. Have you actually READ any Austrian texts? It seems like you only have projected your own beliefs into a misunderstood interpretation of what you casually read from blogs. So irresponsible.

To repeat, the prevailing interest rates, according to Austrian theory, could be either lower than market, at market, or above market. There is no empirical test to determine where they are, since the free market rates are not observable.

23. June 2016 at 17:52

Austrians do not have to speak on behalf of central bankers. Central bankers believe “low” rates are expansionary because in order to pull rates down, they have to engage in a higher rate of OMOs. Austrians do not believe ANY rates are abaolutely “low”.

23. June 2016 at 19:26

Scott,

Is the “Leave” vote a “Black Swan” event? Who expected it? What does it say about the predictive power of markets that the financial markets are in commotion tonight as the actual vote counts show Leave winning?

Put another way, was the optimism in Remain a “Bubble” that did not reflect reality?

24. June 2016 at 07:16

that must have been the least unexpected black swan ever

also, if complacency about Brexit was a “Bubble”, it was the least euphoric — I’d say the best hidden — bubble ever

24. June 2016 at 10:31

Michael, You didn’t answer my question. HOW did they raise interest rates?

24. June 2016 at 16:26

by reducing the Base via OMO, selling back all the bonds bought during QE

25. June 2016 at 20:36

[…] So, it’s frustrating when Scott writes stuff like this: […]

26. June 2016 at 07:52

Hi Scott,

I thought I’d point out a passage from Bernanke’s memoir, describing the market reaction to QE1 on page 421:

“Longer-term interest rates fell on our announcement, with the yield on ten-year Treasury securities dropping from about 3 percent to about 2.5 percent in one day, a very large move. Over the summer, longer-term yields would reverse and rise to above 4 percent. We would see that increase as a sign of success. Higher yields suggested that investors were expecting both more growth and higher inflation, consistent with our goal of economic revival.”

26. June 2016 at 11:13

Michael, OK, but then the drop in the money supply is depressing the economy, while the increase in interest rates tends to expand the economy.

Harry, Yes, I recall him saying that.