The Fed throws in the towel

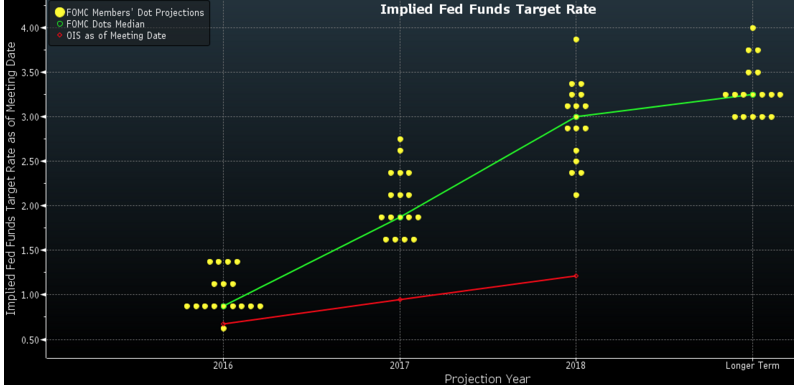

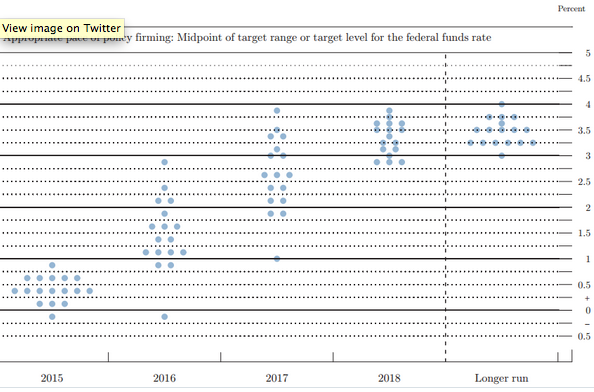

Last December the Fed forecast 4 rate increases during 2016. That’s still possible, but increasingly unlikely. The markets forecast 2 rate increases. Today the Fed threw in the towel, and admitted that the market forecast was better:

The Fed’s expectations for GDP growth in the near-term dropped since December, while forecasts for core inflation remained mostly unchanged, and the median expectation for unemployment fell slightly to 4.5% by 2018.

Fed officials’ projections for the federal funds rate indicate two quarter-point rate hikes this year, a slower pace of rate increases than envisioned last December. The Fed previously expected to raise rates four times this year.

The downshift in rate increases may not be due to new concerns over the domestic or global economy, but may simply be an extension of the Fed’s January decision to keep accommodative policy measures in place.

BTW, that third paragraph makes no sense. If anything, it was caused by the Fed’s decision in December to raise rates.

Here’s what I wrote last December:

People laugh at how far behind Kocherlakota is on the dot graph, like the little boy that can’t keep up with his Boy Scout troop:

Only 1% interest rates in 2017? Yes, that’s probably too low, but it wouldn’t surprise me all that much if Kocherlakota had the last laugh. His 1% forecast is certainly far more plausible than the official who predicts 4% in 2017. Consider that Japan and probably even the eurozone are still going to be at zero in 2017. How plausible is it that the US has 4% rates when the rest of the developed world is at zero? Especially given that we are growing at just over 2% in a period of rapidly falling unemployment, and the unemployment rate will stop falling by 2017, and hence RGDP growth will slow sharply from the current pathetic levels. We might even have another recession, recall that America has never had an expansion that lasted 10 years.

It’s also important not to overstate the accuracy of market forecasts. Saying they are the best we have does not imply they are very good. There are certain things that are simply hard to predict—for instance markets are not very good at predicting recessions. (The yield curve is probably the best of a bad lot.) So the fact that the market was right and the Fed was wrong in this case (so far) does not prove anything. By analogy, examples where the market was wrong (and hence I was also wrong) also don’t prove anything.

For example, suppose the market forecasts 1.25% interest rates in 2018. The market might actually think 1.25% rates are unlikely, but that zero and 2.5% rates are equally likely. If we have a recession between now and then, rates will be at zero in 2018; if continued expansion, then rates might be 2.5%. Obviously I don’t know if that’s exactly right, it’s just something to keep in mind when looking at point estimates. I have no idea when the next recession will occur, but I do have a strong conditional forecast that when it does occur, rates will quickly fall to zero and stay there for many years.

This may explain the difference between the market and the new Fed forecast; only the market thinks a recession is possible:

Also note that the Fed’s new end of 2017 forecast is closer to Kocherlakota’s “crazy” 2017 forecast from back in December, than it is to the Fed’s own forecast back in December. And the market forecast is now almost identical to Kocherlakota’s December forecast for 2017.

You might say, “yeah, but he was wrong about 2016”. No, those are policy settings that the person deems appropriate. Thus they can only be viewed as predictions in the long run, as in the short run the Fed may be too tight to hit its inflation forecast.

Tags:

16. March 2016 at 12:15

I note that Kocherlakota’s preferred interest rate path converges with the consensus by 2018. Ironically, his more accommodative policy would be the more likely path to achieving this result. Given the committee’s preference for tight policy, they will be fortunate to achieve a 3% interest rate in 2018.

16. March 2016 at 12:39

The book is very interesting, just finished chapter 4, fascinating even just to see gold flows dominating the headlines during that period. You really took on a tough task in trying to document and measure market reactions using news reports, but the framework holds together pretty well so far, especially on reserve ratios and OMPs.

16. March 2016 at 12:46

If Trump becomes President, I forecast zero rates for a long, long time. He’d balance the budget and cut spending to such a degree that even more exports via better trade deals and giant wall projects wouldn’t help much to counteract the fall in demand.

16. March 2016 at 13:03

The stock market showed an abrupt increase on the Fed release, while the 10 year treasury rate declined by about 8 basis points. Large banks also declined on the news. Kind of puzzling set of market reactions.

16. March 2016 at 13:04

Kocherlakota’s commentary on Bloomberg View has been really excellent

“The U.S. Federal Reserve’s latest economic projections contain an encoded message crucial to understanding the central bank’s policies: Inflation has been stuck below the Fed’s target in part because officials don’t actually want to get it back up.”

http://www.bloombergview.com/articles/2016-03-16/the-hidden-message-in-the-fed-s-economic-projections

16. March 2016 at 13:42

@A: the bank reaction is as expected, the big banks like higher rates, good for profit margins.

16. March 2016 at 14:36

A and msgkings

a classic response overall to easing: expected nominal growth up, dollar down, stocks up, inf expectations up, bonds down (yields up)

banks a bit weak on hawkish comments on regulation (and they are usually long bonds at any one time)

16. March 2016 at 14:41

Brainard the hero of the hour, dragging Yellen along. Easy monetary policy at least until Hilary safely in the White House?

https://thefaintofheart.wordpress.com/2016/03/16/fomc-splits-and-it-is-a-good-thing/

16. March 2016 at 14:49

But the 10 year was bumping around 1.99% before the press release, and then quickly dropped to 1.91%.

16. March 2016 at 15:46

Jonathan, That’s right.

Thanks Talldave.

SG, Yes, that’s good.

James, I think A is right, bond yields rose.

16. March 2016 at 16:14

Great post, one quibble: you seem to accept the langauge that the Fed is “keeping an accommodative policy.”

The Fed has a monetary noose around the neck of the economy.

16. March 2016 at 16:27

Scott, you might enjoy reading this Bloomberg article on the reaction of the yield curve slope to anticipated Fed announcement and to surprise at Fed announcement:

http://www.bloomberg.com/news/articles/2016-03-16/the-best-illustration-of-fed-s-inflation-relations-with-markets

At least someone in the business press is looking at instantaneous market reactions to Fed announcements.

16. March 2016 at 16:27

“Obviously I don’t know if that’s exactly right, it’s just something to keep in mind when looking at point estimates”

Market future prices are not predictions. It is the point that based on current Fair value the market sees future fair value. It believes that is the poit where 50% of outcomes will be higher and 50% of outcomes will be lower (although mathematically what I just said is not perfectly correct, more like 51+/49-). If a market is trading 1.5 and someone wants to bet even money away from where the market is I do highly suggest betting with this person as often as possible, bad things will happen to them. With that said, and i you wish to use markets as predictions you need to understand that single point estimates are NOT what the market is forecasting but instead the market is predicting a distribution and you need to look at volatility to see what the distribution being forecast is. If it is 1.5 in 2018 at a 10 volatility the market is telling you it likes its prediction, the same forecast of 1.5 at 100 volatility is the market telling you something completely different (that it has no f**ckin clue!!… this is why short term volatility almost always “pops” going into announcements). Looking only at price is missing every other page of the book.

16. March 2016 at 16:32

From the same article, the concluding paragraph:

“Yellen and her colleagues need to find a sustainable way to boost the inflation risk premium in markets if they are going to continue raising rates. If they can’t do that, but decide to move forward with tightening anyway, they run the risk of bringing about the ultimate nightmare scenario: an inverted yield curve with interest rates too close to zero.”

Someone who understands that to avoid the zero-rate bound in the future, the Fed needs to avoid raising rates too quickly now.

16. March 2016 at 16:59

As pointed out by Tyler Cowen in his blog the other day, US inflation is starting to tick upwards. So much for Sumner’s criticism.

16. March 2016 at 18:28

Fantastic post, James Alexander, thanks!

16. March 2016 at 18:28

You should talk about neoliberal reforms happening in Argentina and how the brazilian economy (praised by Krugman a short time ago) is collapsing.

16. March 2016 at 18:58

Ben, No, I don’t accept that.

BC, Thanks, I’ll do a post on that tomorrow at Econlog.

Ray, You are looking at the wrong inflation numbers, check my comment in his post today.

Orange, I wrote that exact post a week ago, and will post it in a few days (I have a backlog)

16. March 2016 at 20:49

Scott, being one of the unfortunates out on the concrete steppes, I get confused about the expectations aspect. Does it work that when the Fed indicates 4 rate rises coming up that then banks don’t want to lend for investment now, preferring to wait for higher rates? So even though the Fed indicates rate rises, because they are expecting a booming economy I guess, the fact that they indicate such rises constitutes a tightening of policy, that paradoxically makes those rises less likely?

16. March 2016 at 20:57

Peter K, from my understanding of the Trump platform (if you can call it that), there is no chance that any balanced budget would occur. Considering just the Yuge tax cuts, and the expanded military spending and operations to wipe out Isis and the family members of suspected terrorists, there really isn’t going to be any balanced budget. And since the wall is going to be built by Mexico somehow, I doubt that counts one way or the other. But maybe he can make the Chinese pay for most of it…

17. March 2016 at 04:11

We are starting to see evidence of a replay of 2007-2008. Nominal growth is slowing, corporate profits are declining and energy prices are rising.

We must understand this all makes perfect sense. Low energy prices were a consequence of cheap debt that enabled increased supply. Now it has been shown that at low prices debt levels are unsustainable. And it is not just energy prices that have been artificially depressed by low interest rates and high leverage. If history repeats inflation of 5%+ is in the cards.

Maybe this inflation will be temporary. But whether it is or is not two things are true: (1) No one knows the future of inflation – economic predictions notwithstanding and (2) Evidence continues to mount that low interest rates and high debt invite financial and economic instability that far exceeds the capacity of central bankers to control.

17. March 2016 at 05:27

Scott

Bonds down is yields up!

40+ comments on Trump only 20 on the FOMC. How times have changed. Still Trump is forcing the FOMC, for whatever reason, to go easier (sorry, Ben, less tight) than they were otherwise planning. Good news for the US economy: flirt with Trump, get a recovery.

17. March 2016 at 06:45

Sorry. I was wrong. Bond yields indeed fell across the curve. Surprisingly so, given the reaction of the US$ and stocks.

I think I was a little bit excited by the steepening of the yield curve, a positive sign. 10yr benchmark yield dropped by only 6pbs from 1.97% to 1.91%, while the 2yr benchmark dropped by 11bps from 0.96% to 0.85%. The 10yr-2yr thus rose from 101bps to 106bps. It is a closely watched number. At the height of QE3 it had risen to 250bps, it’s fall back to 100bps has been a sign of ever tightening monetary policy.

https://ycharts.com/indicators/210_year_treasury_yield_spread

17. March 2016 at 07:41

“For example, suppose the market forecasts 1.25% interest rates in 2018. The market might actually think 1.25% rates are unlikely, but that zero and 2.5% rates are equally likely. ”

For fun, I will give another lesson in upper upper level financial valuation for you to ignore. If a center point is 1.25, then 2.5 and 0 ARE NOT valued as equivalent possibilities. If anyone ever offers that bet (0 or 2.5) there is a clear bias on which to choose.

17. March 2016 at 10:12

A recent goldman research piece after the Fed states that if the fed doesn’t hike this year the economy will run hot and the FED will be forced to hike rates even higher.

A basically agree with this. If the Fed hikes twice this year we are probably on a path of full economy cycle averaging 1.5-1.8% inflation. If the FED waits to hike we might actually raise the neutral rate of interest back to 4-5% (if we go with Kocherlakota dot points). Basically Fed and Kocherlakota are both right but have different goals.

18. March 2016 at 09:09

‘Yellen and her colleagues need to find a sustainable way to boost the inflation risk premium in markets if they are going to continue raising rates.’

Announce that ‘interest rates are not the price of money’, would be a good start.

20. March 2016 at 16:51

Jerry, I don’t understand the question.

James, Good point about Trump leading to easier money.