Mark Sadowski drives another stake through Keynesian economics

Paul Krugman claims that he only reads other liberals, because conservatives have nothing to offer. I’m sure that makes life less aggravating, but unfortunately living in a bubble can lead to a false sense of security that you are “always right” about everything. One area where Krugman has been consistently wrong is fiscal policy, where he keeps citing studies that don’t show what he thinks they show. They fail to account for monetary offset. For instance they might look at differing fiscal policies among American states.

I’ve talked about this problem many times, but Mark Sadowski left a comment in an earlier post that puts meat on the bone, with a regression showing no significant fiscal multiplier, even using Krugman’s preferred data set (but also accounting for monetary offset.) Here is Mark’s comment:

Scott,

Krugman’s latest:http://krugman.blogs.nytimes.com/2013/10/15/five-on-the-floor/

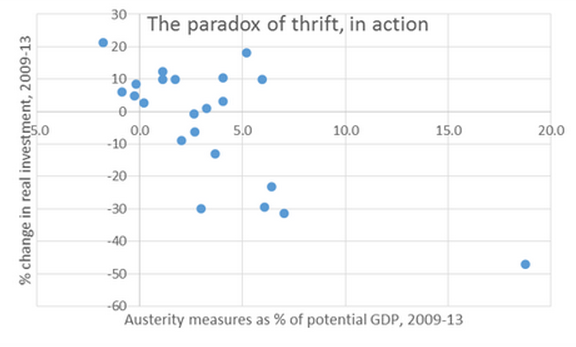

“…What’s more, the turn to austerity that began in 2010 gives us an opportunity to observe the paradox in action. Take the estimates of fiscal contraction 2009-13 from the IMF Fiscal Monitor in fall 2012 (Figure 13), and compare this with changes in real fixed investment over the same period (from Eurostat). It looks like this:

That’s Greece in the lower right corner, of course “” but even without Greece there’s a clear negative correlation between government austerity and investment. Yes, you can try to explain away the results with endogeneity, but it’s a strain.This is prima facie evidence of crowding-out in reverse, aka the paradox of thrift…”

Krugman defines the degree of fiscal contraction as the change in the general government cyclically adjusted primary balance as a percent of potential GDP between 2009 and 2013. He graphs this for 22 nations. These consist of all of the eurozone members except Cyprus, Estonia, Luxembourg and Malta, plus Denmark, the Czech Republic, Sweden, the UK, Norway, Switzerland, Iceland, Japan and the US. (Krugman doesn’t explicitly say which nations, but it is clear if you read between the lines.)

Right away you should see the problem. Thirteen of these countries are eurozone members, and another (Denmark) is pegged to the euro. Thus two thirds of the sample have the same exact monetary policy. It would be very surprising if there were no correlation between the degree of fiscal austerity and the change in real gross fixed investment.

I’ve run regressions using the exact same investment data and the change in the cyclically adjusted primary balance between 2009 and 2013 from the October 2013 IMF Fiscal Monitor. The correlation is statistically significant with the R-squared value equal to 52%. When you run the same regression on just the 13 eurozone members and Denmark the R-squared value rises to 71%. But when you run it on the other eight nations plus the eurozone as a whole, the result is not statistically significant and the R-squared value drops to only 8%.

In particular, four nations out of the original 22 nation sample had above average fiscal austerity and investment growth, namely Iceland, Slovakia, the UK and he US. I have no idea what’s going on in Slovakia, but the UK and the US have both done significant amounts of QE, and Iceland is Krugman’s poster child for the benefits of currency devaluation in his never ending feud with the Council on Foreign Relations.

PS. Some have noticed a recent increase in typos. I recently began using Dragon Dictate (as I got sick of typing 6000 pages using two fingers), and it doesn’t always print out what I am trying to say. For instance, Dragon believes “been burning key” is the current Fed chair. Look for “Janet’s yelling” in future posts. However I am a rather poor speller, so there is poetic justice in this. Spell check had been making me seem slightly less inept than I really am. IT giveth, and IT taketh away. Just read my posts phonetically.

Update: Krugman is certainly right about this:

I’m coming to this a bit late, but I see that there’s now extensive evidencethat facts not only don’t win arguments, they make people on the wrong side dig in even deeper: “When your deepest convictions are challenged by contradictory evidence, your beliefs get stronger.”

Tags:

16. October 2013 at 12:48

When tight money hawks come out and argue that loose money erodes savings, I have to wonder if markets and bank interest payments increase with looser money.

I’m just saying this because you and a few others have done a remarkable job demonstrating the importance of fiscal stimulus vs monetary stimulus. I’m almost sold on market monetarism. Which means your biggest obstacle in the future won’t be Keynesians but tight money hawks. Maybe I’ll call them tightwads.

16. October 2013 at 13:19

Thanks Benny.

16. October 2013 at 15:26

Scott, you write, “One area where Krugman has been consistently wrong is fiscal policy, where he keeps citing studies that don’t show what he thinks they show. They fail to account for monetary offset.”

I can’t figure out if you’re saying that fiscal policy *can’t* be effective because of “monetary offset,” or that fiscal policy typically *won’t* be effective because, *as a matter of policy,* central banks tend to offset fiscal policy. Or, are you saying something else?

p.s. I don’t think Krugman would deny that central banks can offset fiscal policy *if they want to,* but maybe he would.

16. October 2013 at 15:45

Holy sh*t Benny Lava comes around to my way of thinking!

Dude, you owe some apologies.

And ALL I DO is focus on how bad a job we do selling MM to the tight money guys.

There’s literally no reason Rand Paul can’t be convinced, but we gotta put the meat in the window.

16. October 2013 at 16:01

Just – USE – the other – eight – fingers – ….

16. October 2013 at 17:02

I wish Krugman would be more open-minded and ponder what a truly aggressive, growth-oriented monetary policy could accomplish…especially if sustained and telegraphed (sans FOMC undercutting).

16. October 2013 at 18:16

Despite Slovakia currently having a lousy weak socialist prime minister, the too-high corruption is still not so terrible. Slovakia makes more cars per capita than … anywhere.

Slovak wages are perhaps the lowest in the Eurozone, yet work habits and work output at IT companies and International companies (like Dell, HP, IBM) are Silicon Valley competitive.

(There continues to be a huge Roma-Gypsy problem.)

But living is comfy middle-class in the cramped condo-flats of concrete which at least are near to nice walking forest parks.

Especially in Bratislava, tho most Slovak cities are steadily improving. (5 mil folks, not so many ex-pat Americans like me)

16. October 2013 at 21:14

Benny Lava.

Excellent! Are you listening, Geoff?

16. October 2013 at 21:50

Tom & Co. , James W. Dean et al has an article in Journal Policy Modelling on Slovakian growth. I have contributed a bit with comments to the article.

See here: http://www.sciencedirect.com/science/article/pii/S0161893813000264

16. October 2013 at 22:04

Scott,

It’s worse than that. Krugman often bashes (correctly) Alesina-Ardagna’s paper on “expansionary austerity” for not accounting differences in monetary policy among countries in the data set of the paper. Then goes on making the same mistake.

Cherry picking or just plain blindness?

16. October 2013 at 22:15

Here’s the evidence:

http://krugman.blogs.nytimes.com/2010/10/05/the-imf-on-fiscal-austerity/

http://krugman.blogs.nytimes.com/2013/03/13/night-of-the-living-alesina/

http://krugman.blogs.nytimes.com/2013/04/16/holy-coding-error-batman/

17. October 2013 at 02:26

What is the source for the investment figures used in the regression referred to above ? Krugman mentions Eurostat, but doesn’t give a specific link.

17. October 2013 at 03:08

Mark Sadowski, you should start a blog.

17. October 2013 at 03:20

The reason for high investment growth in Slovakia might be that the major automotive factories (Volkswagen, PSA, Kia)were launching production of new models in 2010 and 2011. For a small country like Slovakia this might have caused an upswing in investment relative to other, bigger countries.

17. October 2013 at 04:14

Greg, Sometimes Krugman says monetary policy is effective at the zero bound, other times he denies it. So when you talk about what Krugman believes you need to specify which day of the week.

Lars and Enric, Thanks for that info.

17. October 2013 at 05:56

Greg,

It’s always true that the monetary authority *can* offset fiscal policy. (As Scott notes, it’s very difficult to pin Krugman down on whether or not the Fed can.) It’s equally true that *in the USA* the Federal Reserve has been doing so under Bernanke– even though certainly under the rule of certain Fed governors or commentators, the Fed would refuse to do monetary offset because those people think that monetary offset and QE would be ineffective at the lower bound. (That would be a self-fulfilling prophecy.)

For full disclosure, Scott (like me, Ramesh Ponnuru, Jim Pethokoukis, and other Right-leaning market monetarists) have an ideological (which we’ll claim is supported by reality) bias towards monetary easing over fiscal. Classical (traditionally Left-leaning) Keynesians have a bias towards fiscal over monetary; New Keynesians like Krugman claim (or did before 2008) to favor monetary policy over fiscal, but often say that monetary policy can’t or won’t work at the zero bound.

Those preferences and biases aside, the first point of argument is whether you believe that monetary policy *can* work, and whether it can at the zero bound. If you concede that it can work at the zero bound, then it becomes a question of what is easier– convincing Congress to enact fiscal stimulus in a timely manner *and the Fed not to offset it*, or convincing the Fed to enact monetary stimulus in a timely manner and the Congress not to offset it. I think it’s clear that it’s easier to convince the Fed.

Note that while it’s possible that Congress could engage in fiscal offset of the Fed’s actions, the Fed moves last in this game. The Fed is always more nimble than Congress, hence moves last. The hypothetical of a Congress that rapidly meets to adopt sequester-like across the board spending increases or cuts in response to Fed actions seems like nothing more than an intriguing thought experiment, especially given the recent shutdown and debt limit fights– in the current Congress there’s a strong disagreement between the two Houses as to what is the proper fiscal course.

If Krugman does believe that QE can be effective at the zero bound, he’s either putting more faith in the Republican House than the Fed (which is odd for him), or he’s simply evincing a ideological preference for more government directed spending (but, to be consistent, not government revenue.)

17. October 2013 at 06:46

‘I see that there’s now extensive evidence that facts not only don’t win arguments, they make people on the wrong side dig in even deeper….’

Which why we can still read about ‘The QWERTY Problem’ in Krugman and Wells. 15 years after he admitted to Lee Gomes of the WSJ that it turned out there wasn’t much to the story.

17. October 2013 at 07:00

oldcobbler,

Here is the real gross fixed investment data for the 22 nations in Krugman’s sample:

http://appsso.eurostat.ec.europa.eu/nui/show.do?query=BOOKMARK_DS-055482_QID_-2D1EAE88_UID_-3F171EB0&layout=TIME,C,X,0;GEO,L,Y,0;UNIT,L,Z,0;INDIC_NA,L,Z,1;INDICATORS,C,Z,2;&zSelection=DS-055482UNIT,MIO_NAC_CLV2005;DS-055482INDIC_NA,B1GM;DS-055482INDICATORS,OBS_FLAG;&rankName1=INDIC-NA_1_2_-1_2&rankName2=INDICATORS_1_2_-1_2&rankName3=UNIT_1_2_-1_2&rankName4=TIME_1_0_0_0&rankName5=GEO_1_2_0_1&sortC=ASC_-1_FIRST&rStp=&cStp=&rDCh=&cDCh=&rDM=true&cDM=true&footnes=false&empty=false&wai=false&time_mode=NONE&time_most_recent=false&lang=EN&cfo=%23%23%23%2C%23%23%23.%23%23%23

17. October 2013 at 12:03

I’d like to get any feedback anyone may offer on the way I like to attack Keynesian economics. I would try to disproving it with theory rather than data because there is so much data out there and so many complicated events and chains of causality in the real world that you can find empirical data to make any point you want no matter how nutty. Here is the chain of reasoning I would offer to any espousing Keynesian ideas.

Starting Axiom/Assumption: For a good to be consumed, it must first be produced.

Deduction #1: In order for an individual to consume a good he must either produce it directly, acquire it in exchange for a good or service he has produced, have the good or service produced for him as a gift, or seize goods and services from someone else against their will.

Deduction #2: All government expenditures originate from the production of citizens. The government pays its workers and beneficiaries with production in the form of money, a medium of exchange. The government takes the production of the citizens in three ways, confiscating production through taxation, transferring production through inflation, and voluntarily borrowing production through borrowing.

Deduction #3: Production not seized by the government is eventually consumed, given away, or stolen from the original producers. When a person saves they are merely delaying consumption.

Deduction #4: Production in the market is evaluated in terms of money. The goods produced by the government do not have a market price.

Deduction #5: Through profit and loss accounting, the individual consumers in society place a value on production. A profitable effort by an individual or group creates value while an unprofitable effort destroys value according to the prices that individuals are willing to pay for goods.

Deduction #6: It is not possible to determine whether production by the government is profitable or unprofitable. Therefore it is impossible to tell whether government production is creating or destroying value with its activities.

Deduction #7: The incentives of elected politicians who make spending decisions is to maintain their authority by winning elections. Since elections are held every two, four, or six years, there is a tendency towards shorter time horizons and little incentive to long-term planning which may involve making short-term sacrifices that could lose an election.

Deduction #8: Bureaucracies seek to expand their power by receiving more revenue. Therefore, a bureaucratic organization seeks to spend all of its revenue regardless of whether that spending creates value or not. A bureaucratic organization that comes in under budget is more likely to have its funding reduced.

Conclusion: Based on the incentives facing politicians and the bureaucracy plus their lack of economic calculation, it is very unlikely that they can spend money as efficiently as the private sector. In order to maximize value creation by society, government spending should be kept to a minimum.

If you disagree with my conclusion, show me where my reasoning went wrong. I could be completely wrong but you cannot disprove this argument with data. Is my initial assumption wrong or did I make a mistake in any of these steps? Honestly, I think that the first assumption/basic fact starts to unravel Keynes whole enterprise.

Keynesianism is fascinating. It is like some kind of awful ooze that creeps into any gaps in economic knowledge and turns people against capitalism. I think a better name for it would be consumptionism. The idea that consumption drives an economy rather than production. Older ideas of mercantilism were very similar.

17. October 2013 at 12:34

John Thacker,

Thanks for the clear and concise explanation! I think your answer to my question is: whether monetary policy offsets fiscal policy is a matter of choice on the part of the monetary authority (assuming monetary policy is effective at the zero-bound). Leaving political obstacles aside, if one has less confidence in the power of monetary policy than you and Scott have, then a coordinated application of fiscal and monetary policy would seem to be the best option, especially when the govt. can borrow very low interest rates. (I think this actually how Keynes viewed the matter). But those damn political obstacles . . .

17. October 2013 at 12:42

re: dictation software that learns..

I’ve been pleasantly surprised by the in-the-box speech-to-text support in Windows 7 (and it seems to be even better in Windows 8 on my Acer S7) when I use it with the dictation scratchpad or in Word directly. Seems even to get Bernanke right (after telling it to correct twice). And in Word you can leave up the research / dictionary / thesaurus window open on the right hand side and just point-click to pick the correct word. Not as fancy as Dragon but it seems to learn from its mistakes.

I also found using a headset with a mike reduces errors.

17. October 2013 at 13:13

“Right away you should see the problem. Thirteen of these countries are eurozone members, and another (Denmark) is pegged to the euro. Thus two thirds of the sample have the same exact monetary policy.”

Don’t you want to control for monetary policy when looking at the effects of fiscal policy? This seems like it makes the results a better confirmation than a worse one.

http://en.wikipedia.org/wiki/Scientific_control

17. October 2013 at 13:55

Jason, that was kind of my thought. Krugman’s original graph doesn’t support a nonzero fiscal multiplier, because it doesn’t control for monetary policy. An r^2 of .58 for the eurozone as a whole does support the idea of a fiscal multiplier if monetary policy is fixed. I don’t think Prof. Sumner has denied that fiscal policy has a multiplier if the central bank is failing at it’s job the level that the ECB is. The r^2=.08 regression when taking the eurozone as one country definately contradicts the argument that a fiscal multiplier exists independent of monetary policy, though. For Krugman’s argument to hold there needs to be a fiscal multiplier in the data without having to control for monetary policy. Of course, as always the sample sizes are to small to come to any concrete conclusions.

18. October 2013 at 05:37

Jason, There is no doubt that fiscal policy can work if there is no monetary offset. The problem for the eurozone is that it works at the local level, but not the eurozone level. It’s a good example of the fallacy of composition. And unfortunately its being offset by the ECB.

To be fair, I don’t think the offset is 100%. For instance VAT increases have led to higher measured inflation, which has led the ECB to tighten. So in that case Krugman is right about austerity. But for the most part monetary offset is a very real problem.

18. October 2013 at 07:18

Hey Scott,

Dragon should be able to learn proper names if you tell it too. You might find this link helpful: http://www.nuance.com/ucmprod/groups/dragon/@web/documents/collateral/nc_008052.pdf

18. October 2013 at 16:41

I actually think the opposite of John. Which is to say that the last 5 years have proved an excellent testing grounds of different economic theories. During a book every economic theory looks good. A crisis is different. And so many industrialized nations have taken different approaches. We can compare the US to different EU nations. Add in Japan, Canada, Australia, etc.

The tight money ABC economic school of thought, as far as I observe, has been completely discredited by the last 5 years. Every one of their predictions failed.

Keynesians had some hits and some misses. I’m less supportive of the view that fiscal stimulus is better than monetary stimulus at the zero bound, based on the last two years of data in the US and Japan. Throw in Iceland maybe. It is really hard to separate within EU countries since they are all in the eurozone so Ireland being in the crapper could support more than one point of view.

Market monetarists have the luxury of pointing at EU tight money and a loosening of money in Japan as vindication. Also that in the US you can point to a lack of calamity from the sequester as a point, though I have also thought that it seems very Keynesian to start drawing back fiscal stimulus once unemployment dropped below 8%.

So make predictions based on theories and let the data sets accumulate. Those that don’t fit the data get discarded. Though when you get guys like Major Freedom claiming that their economics are not bound by empirical evidence I put ABC economics in the category of “feelingsnomics”.

18. October 2013 at 17:59

Thanks Ned.

Benny, Good points.

19. October 2013 at 00:36

Menzie Chinn also had a post recently, similar to some Krugman posts, which purported to show a negative relationship between austerity and growth from 2008 to 2012. I used the data from the IMF database he referenced to check the relationship. What I found was that a negative structural balance in 2008 led to both fiscal consolidation and economic decline. Once the initial structural deficit is corrected for, there is austerity effect. In fact, for nations that began with a structural surplus, there was a positive correlation between austerity and economic growth, with causation probably running both ways. And, most of the benefit from higher structural balances came from lower initial government expenditures.

http://idiosyncraticwhisk.blogspot.com/2013/09/austerity-in-recessions.html

19. October 2013 at 00:39

edit: “no austerity effect”

19. October 2013 at 07:09

kebko, Very interesting post.

19. October 2013 at 07:10

Kebko, Have you tried breaking the sample into those with monetary offset, and those without?

19. October 2013 at 07:14

So Mark what is the bottom line you’re suggesting: as long was we have monetary offset then the more asuterity the better? After all, the more austerity the GOP imposes on us the more monetary offset we’ll get?

For me I see this as just a clever, backdoor argument for austerity-which would never make it through the front door, which is where the Repblicans keep trying to enter.

I would never deny that I’m cynical-if the world were different so would I be-but this seems to me to always have been the political trick of Monetarism.

For me better than having monetary offset is a CB that would support expansionary fiscal policy during a bad recession like the one we’ve had.

19. October 2013 at 07:16

That’s the genuine Keynesian position to have fiscal stimulus and a CB that doesn’t offset it. Under the circumstances I’m not too worried about any ‘over heating.”

19. October 2013 at 07:49

Scott,

Here is Krugman’s latest:

http://krugman.blogs.nytimes.com/2013/10/19/do-currency-regimes-matter/

“…First, nominal wage stickiness “” the key argument for the virtues of floating exchange rates “” is an overwhelmingly demonstrated fact. Rose doesn’t offer reasons why this doesn’t matter; he just offers a reduced-form relationship between currency regimes and economic performance, and fails to find a significant effect. Is this because there really is no effect, or because his tests lack power?

Second, there is the very striking empirical observation that debt levels matter much less for countries with their own currency than for those without. Here’s one view of the relationship between debt levels and borrowing costs (data from Greenlaw et al):

[Graph]

And here’s another view of the same data, with euro members identified:

[Graph]

It sure looks as if debt matters only for those on the euro, doesn’t it? For what it’s worth, here’s a regression of interest rates on debt that uses a dummy for euro membership, and allows an interaction between that dummy and debt:

[Table]

Indeed: debt only seems to matter for euro nations…”

So, four days ago Krugman posted a scatterplot in which the two thirds of the nations are eurozone members, igoring the effects of currency regime, in order to make the argument that fiscal policy matters at the zero lower bound. Today he posts another scatterplot in which a majority of the nations are eurozone members, but this time he literally highlights the currency regime, and tests for the effects of interaction, in order to make the argument that debt matters much less for countries with their own currency.

The fact that his previous post was the intellectual equivalent of Greenlaw et al, purporting to show a relationship through the use of a scatterplot consisting mostly of eurozone members without any recognition at all that the relationship is entirely driven by the fact that these nations do not have an independent monetary policy, seems to have completely escaped his notice.

19. October 2013 at 09:33

Mike Sax,

“So Mark what is the bottom line you’re suggesting: as long was we have monetary offset then the more asuterity the better? After all, the more austerity the GOP imposes on us the more monetary offset we’ll get?”

The bottom line is that any estimate of the effect of fiscal policy that doesn’t take into account monetary policy is enormously flawed.

“For me I see this as just a clever, backdoor argument for austerity-which would never make it through the front door, which is where the Repblicans keep trying to enter.”

Mike, I have never voted Republican in all of my voting life. And since the 2000 election have consistently voted a straight Democratic ticket.

I am largely indifferent to fiscal policy because I am convinced that the empirical evidence shows it has little to no effect. If one is truly concerned about the economy, as I am, one should be doing all one can to point out this fact, and encouraging people to realize what the economies of the advanced world really need right now is better monetary policy. Fiscal policy, quite frankly, is an enormous distraction from the real problem.

“I would never deny that I’m cynical-if the world were different so would I be-but this seems to me to always have been the political trick of Monetarism.”

There’ a fine line between cynicism and paranoia. Often I think you’ve gone off the deep end, because many of the things that you say, such as this, are histrionic and completely irrational

“For me better than having monetary offset is a CB that would support expansionary fiscal policy during a bad recession like the one we’ve had.”

If monetary policy can always offset fiscal policy, why would fiscal policy even matter with respect to macroeconomic stabilization policy?

“That’s the genuine Keynesian position to have fiscal stimulus and a CB that doesn’t offset it. Under the circumstances I’m not too worried about any ‘over heating.'”

The genuinine Keynesian position is that monetary policy is ineffective in a liquidity trap, and thus fiscal policy becomes both effective and necessary. But if you don’t believe in the liquidity trap, and I don’t, then the only way to fix an aggregate demand shortfall is through better monetary policy.

19. October 2013 at 11:41

Well Mark just because you’re paranoid doesn’t mean they’re not out to get you. My point about Monetarism is not that everyone who in any way expouses it is himself a Republican-though a number have been going back to Friedman himself.

However, the implication of monetary offset is that austerity is fine. Do you deny this? Why do we have post after post showing this if that’s not the endgame? I don’s see what’s ‘histronic’ about simply connecting the dots. Obvously the point of Monetarism is that we must never under any circumstances have fiscal stimulus. Now you can declare that ‘hostroinic’ whatever you think that means but my meaning is pretty clear. If you can’t even understand my point then maybe you’re becoming irrational

If you vote Democratic I wonder why you have a problem with those who criticize the sequester, why when they point out the damage it’s doing to the country make these sophistcal arguments about how monetary policy can offset it and so there’s no reason to worry about it. I mean you know the sequester was a Republican policy right?

19. October 2013 at 11:42

Also I should say Mark that I’ve never claimed or believed that monetary policy fully offsets whatever fiscal policy does.

19. October 2013 at 12:11

kebko,

I enjoyed your post so much that I posted the most relevant part here:

http://economistsview.typepad.com/economistsview/2013/10/sovereigns-versus-banks-crises-causes-and-consequences.html

19. October 2013 at 12:29

Mike Sax,

“as long was we have monetary offset then the more austerity the better? After all, the more austerity the GOP imposes on us the more monetary offset we’ll get?”

I’m pretty sure the argument is that the level of government spending should be driven by the long run interests of society, not short-run stabilization policy. The reason to use discretionary fiscal policy for short-run goals is if aggregate demand is too high or too low, but if the Fed can control the level of aggregate demand, and do so more effectively than fiscal policy, then the Fed should take the reins.

I happen the think the the gov’t should be spending an order of magnitude more on science and technology, providing a universal basic income, and adopting Canada-style single payer. I’m happy to defend all of these propositions in terms of their long-run benefits to society, not just as temporary measures to fill an output gap.

19. October 2013 at 12:45

So rbl, you’re saying that the case for public spending is about long run concerns-supply side?

You agree that fiscal policy has no place in short term demand stabiliation? Even if this is true I don’t get the reason to spend so much time arguing against using fiscal policy. It clearly doesn’t do any real harm as interest rates clearly attest.

19. October 2013 at 13:31

Mike Sax, more or less yes. There are situations where the central bank has failed terribly at its job that fiscal stimulus can be justified in short run terms, but I like the following analogy:

A greyhound bus is going down the highway. It is the driver’s job to steer the bus, not the passenger’s. Imagine, if you will, that the driver decides to turn on cruise control, jam a stick into the wheel to keep it from veering too much, and goes to the bathroom to snort a line of cocaine. It is completely appropriate for a passenger to get in there and steer the bus, not because it is their job, but because they can do it better than the driver’s stick in the wheel, and the driver’s choices are going to cause lots of needless suffering.

The European Central Bank is such a driver, and in the Eurozone’s case it is appropriate for the member countries to try and steer their economies via fiscal policy, and, for example, the Greek political elite’s choice to submit to austerity rather than defaulting and leaving the Euro is like a passenger refusing to take up the driver’s seat. The analogy fails, of course, since the ECB is causing far more suffering than any random bus driver could conceive of.

If the spending passes long-run cost benefit tests, then it should happen regardless of whether there is a demand gap or not. Even if interest rates are low, if the CB decides to offset the spending it still has a real cost, just one not reflected solely in terms of the deficit. Also, I’m not nearly as much of a deficit hawk as Prof. Sumner, I think the main downside to deficits is that they are income redistribution upward.

19. October 2013 at 13:44

Mike Sax,

“Well Mark just because you’re paranoid doesn’t mean they’re not out to get you.”

Maybe not, but if you are truly suffering from paranoia, then the biggest threat you face is not from other people.

“My point about Monetarism is not that everyone who in any way expouses it is himself a Republican-though a number have been going back to Friedman himself.”

Mike, by this token, not everyone who espouses fiscal stimulus is a Nazi or a Fascisti but a number have been, including Adolf Hitler and Benito Mussolini. I happen to believe ideas should be debated on their own merits, not on their political associations.

“However, the implication of monetary offset is that austerity is fine. Do you deny this?”

Define “fine”.

Most of the spending cuts this year have been to defense which in my opinion is good. On the other hand I am concerned about cuts to discretionary non-defense spending. And as far this year’s tax changes, those were inevitable as the previous tax levels were entirely temporary.

But in the final analyis I believe that all of this year’s fiscal policy changes will have little or no effect in terms of macroeconomic stabilization policy.

“Obvously the point of Monetarism is that we must never under any circumstances have fiscal stimulus.”

One of the points of Monetarism is that fiscal stimulus is never effective. But even Keynesians agree with this away from the zero lower bound.

“If you vote Democratic I wonder why you have a problem with those who criticize the sequester, why when they point out the damage it’s doing to the country make these sophistcal arguments about how monetary policy can offset it and so there’s no reason to worry about it. I mean you know the sequester was a Republican policy right?”

Mike, I voted for Obama, and Obama signed the Budget Control Act of 2011 that directed the automatic across-the-board cuts known as “sequestrations”. As a practical matter this is just as much a Democratic policy as it is a Republican one. That being said I certainly don’t agree with everything Obama has done as President.

19. October 2013 at 14:07

“Most of the spending cuts this year have been to defense which in my opinion is good. On the other hand I am concerned about cuts to discretionary non-defense spending. And as far this year’s tax changes, those were inevitable as the previous tax levels were entirely temporary.”

Actually I believe that about half of them have been military and half discertionary non-defense. I tend to agree about the military cuts yet the way they have been done were too sharp and too quick. The overall impact of the sequester will be long-term if someting isn’t done to ameloriate them.

While Obama did sign them and the Democrats also voted for them it was under threat-it was before they discovered the power of not negotiating with Republicans when they take hostages. At this point the Dems clearly would like to end them but the GOP is hanging onto them for dear life. So I don’t think it’s wrong to define it as the Republican sequester-it’s because of them it’s still going. You may think it will have little impact. Others disagree.

http://www.newrepublic.com/article/115256/government-shutdown-has-not-ended-and-wont-years

19. October 2013 at 14:11

The sequester at this point is a permanent lower level of non-defense discreionary spending. Its not just this year but in perpetuity if there isno deal.

“t was an awful time. Federal employees had to take unpaid furlough days. Beneficiaries were thrown off of federal programs. Courthouses had to be sold. Federal agencies like the FBI, the Food and Drug Administration, and the National Institutes of Health strained to meet commitments, leading to more crime, more outbreaks of disease and less basic research, among other horrors.”

“This may sound like a description of the recent government shutdown, which ended October 16. But this describes the fallout from sequestration, the across-the-board cuts to discretionary spending that took effect March 1″”arbitrary reductions that closely parallel the effects of the shutdown. In fact, depending on where you want to draw the line, the United States has been mired in an entrenched partial government shutdown for about four years, which has severely limited federal resources, put millions out of work, and served as a primary driver of our sclerotic recovery from the Great Recession. And while the recent appropriations lapse lasted just 16 days, this broader shutdown is poised to drag on for at least a decade. Sequestration and artificial spending caps have become the new normal, and it’s redefining the role of government, rolling back the ambitions of the past, and constraining needed investments in the future. So let’s call it what it is: a government shutdown that’s infinitely worse than the one that just ended.”

So this does sound like a long-term impact to me.

19. October 2013 at 14:31

Mike Sax,

“So this does sound like a long-term impact to me.”

Sure, it may have a long term impact on government spending. But it will have little to no impact on macroeconomic stabilization policy.

19. October 2013 at 16:07

Mike Sax,

The sequester’s cuts to SNAP, HeadStart, etc. were bad, I have no disagreement there. I however, think that the sequester would have been just as bad, if not worse, if the short-term aggregatedemand impact of the cuts had been completely offset by a reduction in the top marginal tax rate. My view is that the desirability of an expenditure or tax does not, in general, depend on where in the business cycle we are.

19. October 2013 at 16:22

Here is my update. I divided the data set into Euro and non-Euro countries. Please let me know if anybody thinks I’ve made any errors or if I should have divided the data differently.

http://idiosyncraticwhisk.blogspot.com/2013/10/more-on-austerity-growth-and-monetary.html

19. October 2013 at 17:04

” I however, think that the sequester would have been just as bad, if not worse, if the short-term aggregatedemand impact of the cuts had been completely offset by a reduction in the top marginal tax rate. My view is that the desirability of an expenditure or tax does not, in general, depend on where in the business cycle we are.”

No argument that it would have been even worse with a cut the top marginal rate. If anything that’s the one saving grace-we did end the Bush tax cuts for the rich at the start of the year.

Now on the other hand, I would support a tax cut for middle and low income people-like the payroll tax holiday that the GOP was so pleased to see end this year.

So overall you don’t think fiscal policy need be cyclical?

19. October 2013 at 17:52

Mike Sax,

Correct, as a general rule I don’t think fiscal policy should be based on cyclical concerns. The reason the recovery has been so weak is that the Fed wants it to be that way. Cutting HeadStart is a bad idea now, and it would be a bad idea if the economy was booming. Fiscalists tend to be liberal and Monetarists tend to be conservative, but there is no reason it needs to be that way. I like NGDP targeting because I think it is the best way to deliver consistently high employment while keeping inflation from going too crazy. Many of capitalism’s problems are caused by the power imbalance between workers and bosses, if we can get consistently high growth and low unemployment, the balance of power tips more in favor of labor.

20. October 2013 at 04:43

“Cutting HeadStart is a bad idea now, and it would be a bad idea if the economy was booming.”

Agreed.

20. October 2013 at 06:20

kebko, Thanks, that’s very interesting.

Mike, I thought studies showed that Head Start didn’t work. Are the Dems supposed to be the reality based party, not the faith based party?

20. October 2013 at 07:41

Prof. Sumner,

My understanding is that the benefits of Head Start as preschool are modest, there are definitely improvements to be made, but that it also greatly improves labor market access for the parents. Since for the demographics HS serve getting any sort of reliable childcare is prohibitively expensive, HS makes it much easier for parents to enter the workforce.

sources:

http://www.washingtonpost.com/blogs/answer-sheet/wp/2013/03/05/does-head-start-work-for-kids-the-bottom-line/

http://www.nextnewdeal.net/rortybomb/wont-somebody-please-not-think-children-benefits-pre-k-parents#.UR5ds_Fd7zk.twitter

22. October 2013 at 17:08

Mark, you write:

“And since the 2000 election have consistently voted a straight Democratic ticket.”

Me too, except I voted GOP up to and including 2000. I never believed the WMDs in Iraq story though. Ron Paul was the only anti-Iraq War Republican in office. Little did I know at the time that I’d like the Ron Paul and Tea Party wings even less than the neocons. I don’t know when I’ll vote GOP again.

What’s your reason?

22. October 2013 at 19:53

Tom Brown,

“What’s your reason?”

George W. Bush was a wakeup call.

I realized that the Republican Party was a menace to sound public policy and voting for my ideals (I had previously voted Libertarian) was less important than preventing Republicans from being elected.

Now I vote for the candidate most likely to defeat the Repulican candidate, which almost always is a Democrat.

23. October 2013 at 08:34

“…was less important than preventing Republicans from being elected.”

My sentiments exactly! I was prepared to forgive them after the neocons took a hit for the Iraq debacle, but in my view they’ve only gotten worse since then.

24. October 2013 at 09:24

The keynesian model is pretty darned good when your monetary policy is a failure. Given that the ECB is, at best, not helping, why would southern European policymakers abandon the the model? All they’d do by moving forward is increase their stress.

24. October 2013 at 17:44

Edward:

“Benny Lava. Excellent! Are you listening, Geoff?”

Benny Lava:

“When tight money hawks come out and argue that loose money erodes savings, I have to wonder if markets and bank interest payments increase with looser money.”

Depends on who receives the new money first, and who receives it later on.

“I’m just saying this because you and a few others have done a remarkable job demonstrating the importance of fiscal stimulus vs monetary stimulus. I’m almost sold on market monetarism. Which means your biggest obstacle in the future won’t be Keynesians but tight money hawks. Maybe I’ll call them tightwads.”

What you call “tightwads” are just those who insist on trading private property without being forced to pay in dollars that are inflated at will by coercive monopolies.

All you want is to be able to gain at the expense of others, because you find private property grounded trading as “too restrictive”. You want more from others than what you can gain through trade. You lack self-esteem. You’re afraid. You’re weak.

Good enough answer Edward, you violence advocating socialist?

14. April 2017 at 04:59

[…] http://www.themoneyillusion.com/?p=24180 […]