The third way

Yichuan Wang has an excellent post discussing the two ways to think about recessions. First goods and money:

Any macroeconomy can be broken down into two main markets: a real market for current goods and services, and a financial market for claims on future goods and services. For brevity, I will reduce the model for financial assets to the market for money, which, because of money’s role as a store of value and medium of exchange, captures the notion of “claims on goods”. To simplify further, I take all the markets for goods and reduce them down to one composite market, say, for apples. From this caricature, we can start thinking about how markets fit together.

In normal times, people receive apples and money from the sky in the form of endowments (i.e. their wealth), and they make decisions about how to spend their cash and apple balances. Apples are transacted, bellies are filled, and life is good.

But suddenly, a recession hits. What does this look like? By definition, a recession is when there is a general glut of goods that aren’t consumed.

And then adding financial markets:

The goods market by itself is not enough to generate a recession with a general glut of goods. Only when there is the possibility of excess demand in money markets can recessions actually occur. Therefore the market for money is what gives a macroeconomy its business cycle feel. This is why money is so important for macro — fluctuations in the money market are the proximate cause for any general fluctuation in the goods market. This is why, as Miles Kimball says, money is the “deep magic” of macro. While this “apples and money” approach is the canonical presentation of general equilibrium, it is not the only representation. For another interpretation, think about what the financial market really is. Since it represents the entire universe of claims on future goods, finance can be understood as a veil between the present and the future. So instead of focusing on the relationship between goods and financial markets at one point in time, we can cut out the middle man and instead think of general equilibrium as a sequence of goods markets that occur across multiple points in time. In this version, there is no financial market per se, but buying an apple in “tomorrow’s goods market” represents buying a financial contract in the canonical model. Therefore, instead of thinking about the markets for goods and money, we can instead think about the markets for goods today and tomorrow.

The same excess supply and demand relationship works in this model. If there is an excess supply of goods today, then it must mean that there’s an excess demand for goods tomorrow. So we get a corollary to the first diagnosis of recessions: If there is an excess supply of goods today, it must be the result of an excess demand for goods tomorrow.

The first definition is something I associated with monetarists like Nick Rowe, and the second seems New Keynesian. Monetarists tend to worry that the second approach doesn’t pin down the price level:

Each of these stories has its own strength. Since the first goods-money model includes actual money, it can help us understand how the price level is determined through monetary neutrality. On the other hand, since general equilibrium is only concerned about relative prices, and since individual dollars are not transacted in the second story, the second story has no “goods/money” relative price — i.e. the second story cannot pin down an aggregate price level. However, the second story does a better job of being explicit about intertemporal choice. And for now, this intuition about relative prices between the past and the future will be powerful enough that I will focus on this second approach.

I certainly like the Rovian goods and money story better than the intertemporal substitution story, but I greatly prefer a third approach; labor and money. Indeed I don’t even like the definition of “recessions” that Yichuan starts off with. I don’t see the problem during recessions as being excess supply of goods. Or goods that are not consumed. Rather the goods market seems to be in equilibrium, it’s just that equilibrium output has fallen. I see excess supply of labor as the key characteristic of recessions, at least demand-side recessions. Yes, in theory output could drop while we remained at full employment due to falling productivity, but how often does that occur in the US? In practice, recessions mean excess unemployment.

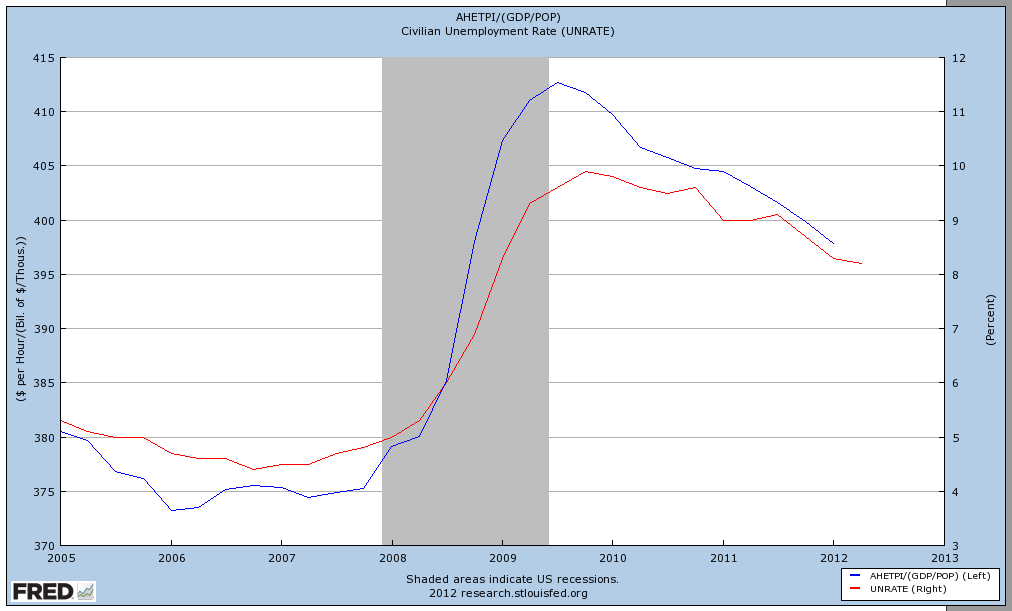

So my recession model is one where nominal wages are sticky, and monetary shocks cause aggregate nominal income to fall. That leads to less hours worked, and thus less employment. There is no need to assume disequilibrium in the goods market. Some object to sticky wage theories because real wages don’t seem to behave as predicted. Actually real wages are very countercyclical in flexible-price competitive industries such as commodity production. However, most industries are monopolistically competitive, and hence you really want to look at the ratio of hourly nominal wages to NGDP. And that does correlate quite closely with the unemployment rate.

To conclude, interest rates don’t matter. Any monetary shock that affects current NGDP will impact the ratio of wages to NGDP, and hence create a business cycle. Monetary policy can fix the problem without having any effect of interest rates; just stabilize the path of NGDP. That’s the fatal flaw in intertemporal models. They don’t pin down the price level or NGDP, and hence cannot explain the path of W/NGDP, or the business cycle itself.

PS. I just got back from a week in Australia, and will gradually try to address a mountain of comments.

Tags:

28. August 2013 at 10:35

Scott: Welcome back!

I don’t want to make a big deal of the distinction between employment of labour (and other productive resources) and output of newly-produced goods. The demand for productive resources like labour is derived from the demand for newly-produced goods, so an excess supply of one in terms of money usually means and excess supply for the other in terms of money. (At least, when we are talking business cycles, because a binding indexed minimum wage law could create an excess supply of some sorts of labour even if the goods market is clearing). I think the important distinction is between money and *all* other goods, both newly produced and old goods (like old houses and land), both labour and output.

Related to that, the one big thing I think Yichuan got wrong is to speak of “*the* money market”. Every market is a money market (except for barter markets).

The big problem with the second approach (Maybe “Neo-Wicksellian” is more precise than “New Keynesian” is that it tries to make one relative price (the real interest rate) act as a proxy for monetary disequilibrium, and as you know, it fails badly in that job.

28. August 2013 at 10:48

Scott,

If you need a more up to date version of my graph here it is:

http://research.stlouisfed.org/fred2/graph/?graph_id=81259&category_id=0

28. August 2013 at 11:13

Here’s another version with bolder lines:

http://research.stlouisfed.org/fred2/graph/?graph_id=134646&category_id=0

My more recent large FRED graphs have included bolder lines because I think they look better.

28. August 2013 at 11:21

“a recession is when there is a general glut of goods that aren’t consumed”

This makes no sense to me on an intuitive or economic basis. A good produced is by definition consumed, otherwise you would classify it as investment.

28. August 2013 at 12:02

Nick, I agree that the goods and money approach is similar to the goods and labor approach. I guess I like the labour market approach best because it seems obvious to me that the labor market is in disequilibrium during recessions, whereas it doesn’t seem obvious to me that the goods market is in disequilibrium. Put another way, I don’t think it would make much difference if goods prices were 100% flexible, and the supply of goods always equalled the demand for goods. Shocks to W/NGDP would still create the same sort of business cycle. But yes, there is a sense is which these two approaches are two sides of the same coin.

Thanks Mark, I also created an updated graph recently, but didn’t have it with me when I did this post.

Honeyoak, I agree, although I think it was just a poor choice of words, I imagine Yichuan sees this the same way as you and I do.

28. August 2013 at 12:25

By saying that “monetary shocks cause aggregate nominal income to fall”, you are either implying that there is a lot of deflation, which does not (and would hardly if wages are sticky and there is downward rigidity), or that there is lower output, and so by that you are actually talking about the goods market. Isn’t that right?

28. August 2013 at 12:59

apt, Yes, NGDP = NGDI. But I am talking about nominal concepts, not real concepts. The distinction is very important.

28. August 2013 at 13:08

Scott: yep. You will get much the same patterns in output and employment in response to a monetary shock if money wages are sticky or if money prices are sticky. (My hunch, which seems consistent with the data, is that it’s hard to tell which is more sticky, so I generally assume both are about equally sticky.)

28. August 2013 at 13:14

Yichuan Wang sets off my proggie spidey senses right away:

“By definition, a recession is when there is a general glut of goods that aren’t consumed. In this toy economy, this corresponds to a situation in which some people have apples but choose not to eat them!”

To honor Noah, this is derpistan.

We just simplified the toy down to money (storehouse of value got a mention, so how could it be proggie right???) and apples.

And then, he derps loud and proud: People have apples and choose not to eat them!

HUH?

No, people have MONEY and choose to rely on its storehouse of value, and NOT BUY APPLES.

This decision is usually made bc they decide the price of “apples” has gotten to high, and if they wait abit, they expect to see prices FALL.

I’d mention Warren Buffett, but maybe you can think of a time when you HAGGLED.

——

IS there ANYONE among MM that while we grok Money Illusion is a real thing, we don’t ALSO want to the illusion go away?!?!?

This is why GI CYB appeals to anyone who’s rational and ready to split political differences and get on with other things.

Because it lets the problem of labor get back to just being about price.

REFRESHER COURSE: those who argue sticky wages / prices force us into taking Macro or Fiscal action have a moral obligation to seek and destroy policies that cause sticky wages / prices.

It’s repugnant to both architect sticky wage policies than say “DAMN! Now we have to deficit spend or print money”

You don’t get to break a window and sell the owner insurance.

——

Nick,

Once an econo admits that money is a storehouse of value.

And econos measure demand for money.

And then econos say HEY LETS DESTROY the storehouse of value!

Isn’t there in there somewhere something that basically makes these types of econos essentially bad people?

You come upon a tribe of people that worship their own god, and have built their systems around that god (storehouse of value).

And you set out to STUDY them.

And you end up trying to take from them the very thing they set out to establish when they built their system, until they literally HATE YOU.

That doesn’t feel very Sciency.

Isn’t it better to say you showed up and fell in love with the people who’s not very good in the system, and you want to topple it so that your favorites have more status and power?

28. August 2013 at 13:36

1) There are no bad assets (or goods) — only bad prices.

2) Rang a bell — this guy has a lot to say about the money versus apples balance — at near zero rates, demand for money is high — and base money has been duly produced. The resulting equilibrium is found… at what price, again?

http://fofoa.blogspot.com/2010/09/just-another-hyperinflation-post-part-3.html

28. August 2013 at 13:46

So then Y Wang says GO SEE the Supply Side with Frances:

http://coppolacomment.blogspot.com/2013/08/the-law-of-rotten-apples.html

And she does the same thing!

“some people have apples but choose not to eat them”

no offense wtf is it with these people that they don’t think:

“some people have apples but choose not to SELL them”

You’ve got apples, you want oranges in between you either BARTER or SELL your apples.

Those are your too choices.

How can money be the medium of account if you aren’t forced to price your apples to be SOLD???

I think what both, all these proggies really mean is this:

They DESPERATELY want the friggin apples to be a storehouse of value.

Guys has a ton of apples, he really doesn’t want to sell them for the price offered bc he won’t get to stay in apple business next year.

They want the guy with apples to always be able to get enough oranges and everything else to LIVE!!!

How do we figure out the relative value of things, if both the supply sider and the demand sider think think the apple guy HAS TO STAY IN BUSINESS???

Its mind boggling. He’s obviously not supposed to be in the Apple business, there are TOO MANY APPLES!!!

This is why GI CYB is such a damn good idea, and why Frances is so friggin afraid of defending her “leisure society” against my plan.

Look, to follow the logic out the the end, IF they both think that its a travesty that the price people can get for their apple glut, the logically the solution is to use the Internet to drastically improve the barter economy.

Then there is a natural price support system that’s at least better than letting the apples rot.

It’s not going to guarantee the guy gets to sell apples for as much money as he wants, but at least he know the pure trade value amongst the things he really needs.

The Internet solves quite a bit of the coordination problem, if you get a bunch of proggies all wanting to play in the thing.

Why does money have to be ruined, just for these fetishists determined to pretend most people can earn enough to support themselves at levels the fetishists deem acceptable?

Just ADMIT they can’t earn it, give them their GI, require them to CYB and recover as much of the GI as we can, where the labor is choosing the job they do.

Choosing the job you do is PLENTY. We don’t have to totally bend over and give them leisure.

28. August 2013 at 14:26

a recession is a glut of goods….

I suppose you could call labor a good. I have a supply of labor and each day I sell a few hours of my labor to my employer….

If all prices were known, and there was no friction in the employment markets there should never be a recession. Most theories of recessions say that is the failure of prices to adjust to changes circumstances that put the price of labor above its market clearing level…. I think that the frictional aspect of employment may be under-appreciated. If I want to hire someone, I must search for candidates interview, and train them. There are significant costs to be met to bring someone aboard.

28. August 2013 at 15:14

Morgan,

I think you have somewhat misunderstood what I wrote. Please read it again.

I’m not in the least afraid of debating my ideas with you provided you are polite and don’t SHOUT AT ME. Let’s have calm well-mannered debate.

28. August 2013 at 15:29

The easiest way to think about this is to consider the exchange of financial asset for real good and services.

1. In a recession, a change in expectations and/or a drop in real price of financial assets causes a reduction in the exchange of financial assets for real good and services (i.e. a drop in AD).

2. Because wages are sticky, the real price of goods and services does not drop sufficiently quickly to restore a full employment equilibrium.

The basic problem is that wages are sticky and financial assets prices are not.

28. August 2013 at 16:59

dtoh, But since making financial asset prices sticky would not help, a more succinct way to make your point is:

“The basic problem is that wages are sticky.”

28. August 2013 at 17:15

I see many of the typical errors long since corrected in Wang’s post.

1. There is no such thing as a “general glut”. For human actors, the desire to consume is practically infinite. We are constantly striving to achieve new ends because the ones we have achieved are past and settled and yet we’re still alive and still required to make choices. What Wang is referring to is the tendency for recessions to “look like” a whole bunch of unsold goods sitting on store shelves. If we only go by what is seen, and we ignore what is unseen, then yes, it does appear as though recessions are periods of significant “general gluts.” But upon deeper analysis, we actually find that the unsold surplus is not “general”, but particular. We can grasp this by taking into account THE UNSEEN. The unseen are all the goods and services NOT invested in and NOT produced and NOT made available to be purchased at the right prices, due to the fact that scarce resources were used up in the production of goods that we see, the goods that are viewed as “the definition of a general glut”. What is actually happening during recessions is that there is a partial relative overproduction goods, which is seen, and a corresponding, partial relative underproduction of goods, which is not seen. This is “the definition” of a recession. The notion of a “general glut” follows from a flawed theoretical consideration of human actors. It is grounded on the assumption that there exists a fixed supply goods that humans desire to consume, any more of which will thus go unconsumed. It is true that if scarce resources were all perfectly allocated, then there would never be any surplus. The question then is to find out why partial relative over and underproduction of goods takes place.

2. Wang’s discussion of time, and of present and future goods, was doing fairly well, until he made this comment: “The same excess supply and demand relationship works in this model. If there is an excess supply of goods today, then it must mean that there’s an excess demand for goods tomorrow.” The truth is the opposite. Just like a consideration of cross-sectional relative over-production in one part of the economy means a partial relative UNDER-production elsewhere in the economy, so it is the case with present and future goods. If there is an excess supply of present goods, then there is a DEFICIENT supply of future goods, not a corresponding excess supply of future goods. An example may help. Mr. Smith has 10 units of supply of goods. He can devote these goods to one use at a time. If he devotes too many of these goods to present goods consumption, such that his future is bleaker than he intended it to be, then there must be a (partial) relative UNDER-production of future goods. If he devoted more of the 10 units to future goods, then his future will be what he intended it to be.

I regret that Wang is being exposed to too much conventional equilibrium analysis in his schooling, and not enough market process analysis, and not enough analysis of human action.

—————————

Dr. Sumner:

“I see excess supply of labor as the key characteristic of recessions, at least demand-side recessions. Yes, in theory output could drop while we remained at full employment due to falling productivity, but how often does that occur in the US? In practice, recessions mean excess unemployment.”

The implication of this theory of recessions is rather troubling. For it presumes that if in a socialist economy a monopolistic institution of coercion were to either enslave everyone else, or pay everyone from a coercive printing press money operation to produce what those in the monopoly want, then Dr. Sumner’s theory of recessions would require him to DENY that there is any recession, even if, like he said, output determined by and for the sovereign consumer is at zero. If 99% of the population were slaves building pyramids for the 1% Pharaoh and his army, then since unemployment would be zero, there would be no recession. But who would seriously entertain the notion that there is no recession here?

One likely response to this might be that recessions should only be relevant to free market economies. OK, but we don’t have a free market, so this response doesn’t work, because one cannot simultaneously hold that we can use “recession” for a non-free market like our own, but not a slave economy. They’re both not free markets, so we either use “recession” for both, or neither. To use it for one but not the other would be arbitrary.

“However, most industries are monopolistically competitive, and hence you really want to look at the ratio of hourly nominal wages to NGDP. And that does correlate quite closely with the unemployment rate.”

The data that is presented in the chart Dr. Sumner linked to does not conclusively exclude the theory that a fall in employment is in part a cause for a market process driven decline in spending, not the other way around. Sure, the chart is consistent with the theory that a fall in spending causes a rise in unemployment, but it is also consistent with the theory that a rise in unemployment causes a market driven fall in spending.

This latter theory, by the way, is not refuted by arguing that “OK, fine, let us consider the theory that a fall in employment causes a market driven decline in final goods spending. BUT, if the Fed printed more money than they did, and they brought about a larger spending than they did, THEN there would not have been such a fall in employment.”

One cannot argue this because it contradicts the fact that final goods spending does not finance wage payments. Wage payments PRECEDE final goods spending, both temporally and logically. If final goods spending (NGDP) decreases, then it is almost certainly due to a previous decline in investment spending. Investment spending actually “finances” most of “aggregate spending” in the economy. Consumption spending is actually a modest component of total spending during any given time period.

28. August 2013 at 17:19

Sorry, by “excess supply”, I know Wang was referring to “excess demand”, but I also hold that there is no such thing as a general excess demand (or supply), so my argument stands, although admittedly it is less relevant.

28. August 2013 at 18:15

Scott, you said;

But since making financial asset prices sticky would not help, a more succinct way to make your point is:

“The basic problem is that wages are sticky.”

1. Fed action does (or should) make financial asset prices sticky.

2. The reduced exchange of financial assets for real goods and services is the reason for the drop in AD. Likewise, an increased exchange is what drives recovery. So just talking about “sticky wages” gives you a very incomplete understanding of the business cycle.

28. August 2013 at 18:34

Geoff: “my argument … admittedly … is less relevant.”

Ah, yes! An excellent summary of the many words in all your various comments on this blog. I agree with you wholeheartedly!

29. August 2013 at 09:14

Wang is subscribing to what Rowe calls the “Neo-Wicksellian (New Keynesian)” view. I leave it to Nick Rowe to correct him properly, but the thing is that observed equilibrium (or near enough) prices have to clear market exchanges that occur at a particular time. If you (correctly) wonder how a glut of goods-in-general is even possible, then talking about matching excess supply with excess demand for future output doesn’t actually solve the problem. Here’s the post which Yichuan needs to read; I think he’s smart enough to get it: http://worthwhile.typepad.com/worthwhile_canadian_initi/2011/04/walras-law-vs-monetary-disequilibrium-theory.html

(It would also help Scott to read it, and learn to distinguish between *notional* and *realised* demands and supplies for goods, thus explaining why he shouldn’t disagree with Yichuan’s definition of recessions.)

And here is a quick summary of the same position: http://worthwhile.typepad.com/worthwhile_canadian_initi/2010/12/unobtainium-and-walras-law.html

Once again, Scott’s “musical chairs” model is fully compatible with what Rowe says; his is just a more complete version of the same explanation (not to start up that debate again). Yichuan however is somewhat wrong – though of course most of the best macro and monetary economists today would agree with him!

29. August 2013 at 09:40

The key is to recognise that money, and only money, is the exchange-clearing commodity which alone can explain why Walras’ Law doesn’t hold. You must visualise that good passing through all other markets explicitly. And yes, interest rates don’t matter so much, except that of course present NGDP depends on both expected future NGDP levels and the corresponding interest rates.

29. August 2013 at 09:42

And you need to think explicitly about stocks and flows of goods, money and other assets, NGDP being the (aggregate) flow supply of money which is determined by the stock demand and supply for money…

29. August 2013 at 09:59

dtoh, No, the Fed does not and should not make financial prices sticky. It could not even if it tried. You may be confusing sticky with stable. For instance, gold prices were completely stable from 1879 to 1933, but also completely flexible.

Saturos, I agree that Nick and I have similar views. But I disagree on the medium of exchange. The apartment market fails to clear in NYC when there are rent controls, and the labor market fails to clear in the US when nominal wages are sticky. The medium of exchange plays no role in this, but the MOA is all important for sticky wages. If the MOA and MOE are different, then the MOA is key.

I don’t agree that NGDP is the flow supply of money, as most money is spent on things that are not part of NGDP.

29. August 2013 at 10:08

Fluctuation in W/NGDP seems like a natural fit to explain normal business cycle recessions, but I think it requires a bit more explanation to show how they can explore depressions or longer-lasting recessions. In particular, why is it that falls in W create corresponding falls in NGDP, preventing the normal adjustment process from taking place, but exogenous increases in NGDP won’t likewise increase W?

29. August 2013 at 10:21

Scott one thing I think most people don’t get is that rental controls fails to clear.

They think “all rent control apartments get rented”

Whereas with GI CYB, the goal isn’t to subsidize labor costs.

The goal is to get the cost of ZMP labor down low enough that SOMEONE ANYONE can find ROI on the ZMP.

And at a starting job offer of $40 per week, we are low enough to ensure two things:

1. There will be heavy duty signals to workers about what people REALLY VALUE. $5 per hour vs. $5 is big deal. To a ZMP worker that’s an extra $5K a year (and also an extra $100 in GI we don’t have to spend).

2. At $1 per hour, ZMP workers have the BEST POSSIBLE HUMAN CHANCE to have their “dream job” – if someone will give you $40 per week to sing, dance, paint, rap, edit video, write, learn to code, whatever you dream up – you GET THAT JOB.

Frances, you outright refused to to get into GI CYB vs you plan, you said you prefer leisure… you cared not a whit about the extra consumption the poor get under my plan from lower prices.

29. August 2013 at 10:34

You may want to account for the “missing potential” across the board — NGDP and employed.

http://research.stlouisfed.org/fred2/graph/?g=lUp

29. August 2013 at 10:35

Scott,

No I don’t think I’m confusing sticky with stable. Financial asset prices quickly adjust to a new level which results quickly in a new equilibrium of exchange between financial assets and real goods and services. The can cause a change in AD, which because wages are sticky, results in disequilibrium in the labor market. If the Fed buys or sells financial assets against the trend of the market, this has the effect of slowing the rate of price change of financial assets…i.e. makes financial asset prices stickier.

29. August 2013 at 10:38

and, taking it to an extreme — (actual NGDP per employed) less (potential NGDP per population), year over year change.

http://research.stlouisfed.org/fred2/graph/?g=lUq

29. August 2013 at 13:13

and, since Scott, you mentioned the fixed/floating price of gold — here is a potentially useful connection between wages%ngdp question and the MOE/MOA monetary unit (pre-1968 linked flat at $35/oz).

Bottom line, real wages % ngdp has declined in line with USD devaluation vs gold.

Potential lesson: worker wages were more closely linked with NGDP gains under gold standard, and have repeatedly given up productivity gains since. Workers ought to ask for — no, demand — the gold standard back, or else their nominal wages will continue to lose ground to nominal gdp as the price of gold rises in line with the monetary base.

http://research.stlouisfed.org/fred2/graph/?g=lUI

29. August 2013 at 22:08

Don Geddis:

BURN! Now my feelings are hurt. haha

30. August 2013 at 16:49

This post allowed me to finally write down a first approximation to your model you asked for over a year ago (http://www.themoneyillusion.com/?p=14826)

http://informationtransfereconomics.blogspot.com/2013/08/scott-sumners-model-part-2_30.html

It is similar to a (I’m sorry to tell you) Keynesian cross (45 degree line) model with the axes being the price level and real output, the position along the 45 degree line being set by monetary policy (P = k M with M ~ Y), and a downward sloping “labor supply” curve intersecting the 45 degree line at the level of output.

http://en.wikipedia.org/wiki/Keynesian_cross

Boosting the monetary base increases output (and output can’t increase without increasing the monetary base). Fiscal policy is completely offset by monetary policy (again, output can’t increase without increasing the monetary base). The model recovers Okun’s law and does a reasonable job of describing the price level from the labor supply and NGDP.