Viking-style austerity: A market monetarist success?

The Norseman who settled cold, barren, windswept Iceland over 1000 years ago were not wimps. Modern Iceland is, genetically speaking, about 40% Celtic. The Vikings apparently kidnapped lots of Irish brides on their way to Iceland. So you wouldn’t expect modern-day Icelanders to wring their hands during an economic crisis and say “There’s nothing to be done. If only we could debase our fiat currency, but we just don’t know how.”

Iceland was hit by a massive real shock in 2008 when their ponzi-like banking/real estate sector collapsed. I find it hard to get any objective data on fiscal policy (in any country), but all the bloggers I read suggest that they opted for the only sensible policy; fiscal austerity. Here’s the Financial Times:

The trick here? Sharp cuts in state spending, capital controls and a currency unit called the Krona..

And here’s Kevin Drum:

And state spending, although it went up in krona terms, was cut sharply in real terms. Iceland isn’t really an anti-austerity poster child.

Nor is it a pro-austerity poster child. Rather it’s a market monetarist poster child, as the following Paul Krugman post indicates:

From Statistics Iceland:

GDP is still below previous peak, but I think one could argue, much more so than in say America, that a significant part of that peak involved a Ponzi financial sector that isn’t coming back.

I think I was one of the first outsiders to notice that Iceland’s heterodoxy was yielding a surprisingly not-so-terrible post-crisis outcome.

[I’m picturing Bob Murphy reading this Krugman post and saying to himself; “Whoa, I don’t recall Krugman pointing out that the Latvian peak GDP should be ignored because it was just a frothy bubble after years of double digit growth.”]

The Financial Times reports that Iceland is doing so well that their central bank needs to raise interest rates. They quote this report from the Icelandic Central Bank:

National accounts data for Q1/2012 are broadly in line with the Bank’s May forecast, which stated that GDP growth would continue to reduce the margin of spare capacity in the economy. The economic recovery is broadly based, and the growth in domestic demand is robust. Signs of recovery in the labour and real estate markets are steadily growing stronger.

Now you might wonder what all this has to do with market monetarism. Recall that we are the ones claiming that Britain and the eurozone need to combine tight fiscal policy with monetary stimulus. The tight fiscal policy addresses the looming debt crisis, and the monetary stimulus keeps AD (i.e. NGDP) growing at the sort of rate needed to keep the economy close to full employment. Is there any evidence that Iceland did some monetary stimulus? Here’s Kevin Drum:

Also worth noting: the Icelandic krona got devalued a lot. In 2008 a euro bought 90 krona. Today it buys 160 krona.

Iceland did almost everything right. They stiffed the bank creditors to avoid aggravating the moral hazard problem, just like the textbooks recommend. In the eurozone the bank creditors are being bailed out. They relied of fiscal policy to address S/I and debt issues, and let monetary policy address AD, just as the New Keynesians were recommending in the 1990s. In the eurozone they combined tight money with reckless deficits. And now Iceland is growing fast and the eurozone is stagnating.

I do realize there are tricky issues involved when analyzing the GDP of a country with 310,000 people. One big aluminum smelter could probably have an impact on GDP. I’d focus on the fact that their GDP is up about 12% from 7 years earlier. That’s not great, but they clearly aren’t in a depression. I seem to recall that Britain’s GDP is flat over the past 7 years, and some of the weaker eurozone members have done even worse.

I realize that people will say that Iceland is special, it doesn’t count, Just as Australia doesn’t count and Sweden doesn’t count and Poland doesn’t count and Israel doesn’t count and Argentina doesn’t count, and all those countries in the 1930s that just happened to start recovering after they left the gold standard don’t count. But still, it’s one more data point.

Iceland is one of my favorite countries. Here’s I’ll do a Cowen-style appreciation:

1. Favorite Icelandic economist: Gauti Eggertsson.

2. Favorite Icelandic fiscal policy: Their simple and flat income tax. (Update: I’m told it’s no longer flat.)

3. Favorite Icelandic pop stars: Sigur Ros and Bjork

4. Favorite Icelandic book: The Sagas

5. Blondes, blondes, blondes. (spelling corrected.)

6. Favorite Icelandic campaign commercial (indeed favorite campaign commercial from any country).

7. Favorite Icelandic films: Cold Fever, Children of Nature, The Seagull’s Laughter.

8. Favorite Iceland trip: My 2010 trip to the volcano, described in this post.

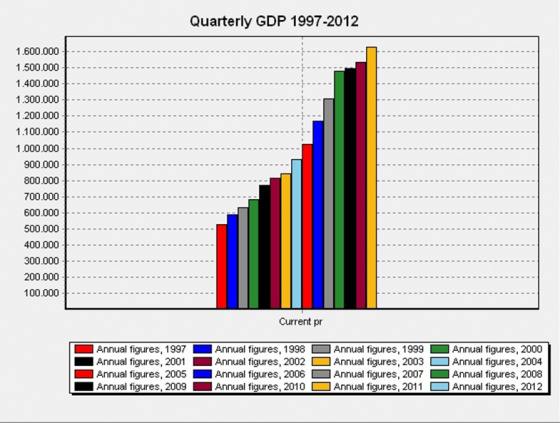

Update: JJ sent me the following NGDP date for Iceland:

Don’t be fooled by the arithmatic scale, long term growth has been pretty steady. Obviously short term growth sped up in the bubble years before the crisis, and then slowed sharply after 2007. But if you look at the 7 year period from 1997 to 2004, it looks like NGDP rose from about 530 to 930 (up 75.5%) and then from 2004 to 2011 it rose from 930 to 1630 (up 75.3%.) That’s an indication that long term NGDP is close to level targeting at around 8.3%/year. If NGDP had fallen after the 2007 peak (i.e. if they’d been fixed to the euro), then the real recession would have been much worse. Unemployment is currently 6.6% in Iceland.

Tags:

14. June 2012 at 06:23

Krugman does not know anything about Lithuania:

http://krugman.blogs.nytimes.com/2012/06/14/peripheral-performance/

What about you, Scott?

14. June 2012 at 06:23

Krugman does not know anything about Lithuania:

http://krugman.blogs.nytimes.com/2012/06/14/peripheral-performance/

What about you, Scott?

14. June 2012 at 06:24

Ok I’m not the only one repeating

14. June 2012 at 06:26

lol. “a drug free parliament by 2020”.

if the parties here did a video like that and stopped throwing poop at each other like zoo animals they might actually win.

14. June 2012 at 06:42

“all the bloggers I read suggest that they opted for the only sensible policy; fiscal austerity”

Well Krugman is a blogger that you read and he certainly doesn’t credit fiscal austerity for Iceland

14. June 2012 at 06:56

From the comments on the Krugman post:

“Gee Paul, you didn’t mention that Iceland’s government has raised taxes and cut government spending in a massive effort of fiscal austerity. I guess that austerity is okay if a country has its own currency? So austerity is okay for the U.S., right?”

Good point.

Right now, it looks like the Austerians have a lot to explain away (austere countries failing like mad), as do Keynesians (near universal failure of fiscal stimulus). Do MMs have anything to explain away?

Scott, what is the single best data point for people who want to bash MM? There’s got to be something, but I can’t think of it.

14. June 2012 at 07:35

You’re talking about a market monetarist poster child, and you don’t even have a plot of NGDP? Things are getting sloppy around here… so I did it for you, and it makes the case even more clearly.

http://postimage.org/image/r4z34oigz/

14. June 2012 at 07:59

“Blonds, blonds, blonds.”

Me personally, I prefer blondes to blonds, Scott. NTTAWWT.

14. June 2012 at 08:06

The krona, like the polish zloty, has the unique characteristic that it is not a reserve currency, meaning that during a crisis the markets do the devaluing for you. Which is one of the reasons both countries have fared so well while everyone around them flounders. Central banks are too slow, you need the market to do it for you. Which in my mind is even more of reason to employ an ngdp futures market, so you can announce a target and let the markets take care of the rest.

14. June 2012 at 08:32

Scott, you know I have spend a lot of time talking about Iceland over the past six year – even since I in 2006 wrote a report forecasting doom-and-gloom in Iceland and I must admit that I am sick and tired of talking about Iceland. That said, I think the got it pretty much right. Monetary easing (a collapse in the currency) and significant fiscal tightening. The austerity in Iceland has been pretty impressive and Iceland is now well underway out of the crisis.

Furthermore, I think that the Icelandic authorities to a large extent have tackled debt restructuring in the private sector – both households and corporation.

Iceland, however, still have one major problem and that is draconian capital controls – which is not only keeping money in Iceland but is also keeping capital out. I would hope the Iceland government and central bank would move faster in getting rid of these controls.

Finally I would argue that the Icelandic situation is and was very special and unlike the general perception the banks were not allowed to collapse. It was only the international part of the banks that collapsed. The domestic part of the banks were de facto nationalized.

We can learn a lot from the Icelandic experience, but I would be very careful in making into some “dream” model for a certain policy response. The initial policy response in Iceland was horrific – for example a attempt to implement a fixed exchange rate policy which I as far as I remember lasted 3-4 hours…

14. June 2012 at 08:38

By the way the koruna rate Drum mentions is wrong – that is the on-shore rate. Due to the capital controls there is a massive difference between the on-shore and the off-shore rate. The off-share is much weaker.

In terms of austerity there is no doubt Iceland is certainly Krugman’s wet dream. The Icelandic government moved to slash public spending aggressive. By the way the Finance Minister who did it (SteingrÃmur Sigfússon) is a former Marxist.

14. June 2012 at 08:39

FRED has iceland nominal gdp, which appears to tie to the official Iceland statistics (yay, FRED).

http://research.stlouisfed.org/fred2/graph/?g=80z

For government expenditures, based on the Iceland stats, in both real and nominal terms, it looks as though they jumped in 2009 (about 16% higher than 2007 in real terms) and have been on the decline (in real terms, about a 11.5% decline since then). meanwhile inflation not shockingly jumped but has not decellerated.

looks to me like a case study of how to manage a small open economy!

(check my #s)

Year, General government revenue, General government expenditure, GDP Deflator (FRED), Real Revenue, Real Expenditure

1997, 140,283 , 139,047 , 73.7, 190,343 , 188,666

1998, 167,388 , 159,651 , 76.7, 218,237 , 208,150

1999, 194,993 , 177,964 , 80, 243,741 , 222,455

2000, 207,561 , 195,411 , 83.6, 248,279 , 233,745

2001, 220,854 , 221,305 , 92.2, 239,538 , 240,027

2002, 233,762 , 246,810 , 93.1, 251,087 , 265,102

2003, 259,766 , 268,854 , 94.8, 274,015 , 283,601

2004, 280,696 , 280,382 , 97.3, 288,485 , 288,162

2005, 336,937 , 308,383 , 101, 333,601 , 305,330

2006, 381,336 , 314,716 , 111.2, 342,928 , 283,018

2007, 454,066 , 369,583 , 112.7, 402,898 , 327,935

2008, 444,751 , 451,750 , 137.8, 322,751 , 327,830

2009, 414,605 , 551,457 , 143.9, 288,120 , 383,222

2010, 461,866 , 530,963 , 145.1, 318,309 , 365,929

2011, 468,147 , 525,500 , 154.5, 303,008 , 340,129

14. June 2012 at 08:40

^^”has not decelerated” should be “has decelerated”

14. June 2012 at 08:41

Here is my 2006-paper: http://www.mbl.is/media/98/398.pdf

14. June 2012 at 08:42

… and link to the public finance #s i used.

http://www.statice.is/Pages/1406?src=/temp_en/Dialog/varval.asp?ma=THJ00114%26ti%3dGDP+and+Public+finances+++++++++++++++++++++++++++++++++++++++++++++++%26path%3d..%2fDatabase%2fthjodhagsreikningar%2fhagvisar%2f%26lang%3d1%26units%3dVarious

14. June 2012 at 08:45

I agree about Bjork (though I was a little disappointed by Biophilia; she should have reallocated the time and energy spent on gimmickry to improving the tracks) but Sigur Ros? Seriously, et tu, Scott? I just don’t understand what everyone sees in them.

Btw, what do you think about medieval Icelandic anarcho-capitalism?

14. June 2012 at 08:48

That seems like a non-sequitur.

14. June 2012 at 08:54

Saturos, I missed a “no” wet dream. Fiscal policy in Iceland since 2009 has been a lot more fiscally conservative than what Krugman would like.

I should maybe also note that even though market monetarists like myself think the weakening of the koruna was a great thing for the Icelandic economy that view is not widely accepted in Iceland.

14. June 2012 at 08:59

Saturos, I missed a “no” wet dream.

ah, i was wondering about that too. thanks for the link!

14. June 2012 at 09:03

The krona, like the polish zloty, has the unique characteristic that it is not a reserve currency, meaning that during a crisis the markets do the devaluing for you. Which is one of the reasons both countries have fared so well while everyone around them flounders. Central banks are too slow, you need the market to do it for you. Which in my mind is even more of reason to employ a target, so you can announce it and let the markets take care of the rest.

14. June 2012 at 09:23

and… Europe is doomed part 591: Jens Weidmann edition.

with such vast cultural and linguistic difficulties, i just don’t see how this is going to work.

http://www.marketwatch.com/story/ecb-must-resist-efforts-to-expand-mandate-2012-06-14-114853042

Can we just get right to the end, please, i hate this hurry up and wait stuff.

14. June 2012 at 09:38

ssumner:

The tight fiscal policy addresses the looming debt crisis, and the monetary stimulus keeps AD (i.e. NGDP) growing at the sort of rate needed to keep the economy close to full employment.

Hayek said maintaining NGDP at an appropriate level, such as 5% growth, for the purposes of maximizing full employment, is an incorrect theory, and to act on it would be very harmful.

NGDP doesn’t finance employment. Employment payments finance NGDP.

How do you know that NGDP didn’t fall because employment and hence spending from employees fell? This theory is also consistent with the data.

NGDP can go up with zero change to employee payments. NGDP doesn’t even include wage payments. NGDP includes that which is financed in part out of wages. If NGDP falls, then the reason is more than likely the case that that which finances NGDP fell, such as wages.

Wage earners don’t suddenly stop consuming, or consume less, for no reason. They typically only reduce their consumption spending when their wages are at risk, or become zero due to being laid off. Thus, the drop in wage payments is what then leads to a fall in consumption spending, and the portion of NGDP that consumption spending entails.

Your theory is not only not backed up by the data (since a counter-theory is also consistent), but it makes less sense than the counter-theory.

You simply cannot infer from the correlation between NGDP and employment that the former is a driver of the latter. Hayek knew it was false, yet here you are repeating it as if it’s never been criticized/refuted umpteen times.

14. June 2012 at 10:12

And Sumner turns the corner!

June 14th, 2012 – we get a stronger emphasis on TIGHTER FISCAL.

No longer is it that Fiscal doesn’t work yada yada…

NOW, FINALLY it is we need less Fiscal Spending.

Thankee Kee-ryst!

—-

The larger point here is that one of the main reasons conservatives have for supporting a NGDPLT is that it provides and IMMEDIATE POSITIVE FEEDBACK LOOP to cutting govt. spending.

As long as we assume that current public spending is highly inefficient and likely counter-productive, cutting that spending, not only keeps you from wasting it, borrowing from China, but the Fed will gladly debase the currency for our moral rectitude.

MM and the CB prefer the same things;

1. Employer Tax cut

2. Long term Structural Govt. Reform – public productivity gains, tax reform, and entitlement reform

14. June 2012 at 10:12

There are so many things wrong with the above post, and so little time. MF, what your dad spent on your MBA, if that is even true, would have been better spent on red in vegas for all the effort you put into it. Nothing “finances” ngdp, and wages and compensation are about 55% of nominal gdp (actually 65% if you include rental income and proprietors income, much of which is actually “management labor”).

http://www.bea.gov/iTable/iTable.cfm?ReqID=9&step=1

14. June 2012 at 10:15

Sumner and Woolsey have many posts on the productivity norm and Selgin’s “Less than Zero”

http://monetaryfreedom-billwoolsey.blogspot.com/2009/11/more-about-productivity-norm.html

14. June 2012 at 10:18

not me, dwb I think we have a good 6 months of waiting…

If you are Germany, don’t you have a much stronger hand with President Romney?

14. June 2012 at 10:20

Morgan,

SSSHHH!

You are the WORST right wing conspirator ever.

14. June 2012 at 10:24

Niall Ferguson says the Euro could still be saved.

http://www.thedailybeast.com/newsweek/2012/06/10/niall-ferguson-on-how-europe-could-cost-obama-the-election.html

He calls for a United States of the Euro Zone, with Eurobonds. He notes the cost of breakup would be higher to Germany than the costs of federalism.

What Europe needs is an Alexander Hamilton.

14. June 2012 at 10:26

dwb,

Thanks for the link to Woolsey. Exactly what I was looking for.

14. June 2012 at 10:28

Oh no!! Great economics, but now I find out terrible taste in music. That halo effect is slipping…

14. June 2012 at 10:54

123, I know exactly as much as Krugman knows about Lithuania.

Mike Sax, I meant all the bloggers who mention their fiscal policy, claim it’s been tight. You are right, I didn’t word that properly.

Cedric, I think the weakest part of MM is our assumption that most problems around the world are demand-side. We might well be right that steady 5% NGDP growth is best, and yet be wrong about how much it would turn things around in countries like Britain. That is the part I’m least sure about. In other words conservative critics who say we underestiamte structural problems are more likely to be right than liberal critics who say NGDP can’t be boosted with monetary stimulus when at the zero bound.

jj, Thanks, I’ll do an update.

John Thacker, I thought it was misspelled, but the spell check didn’t underline it so I thought I must be wrong. It turns out I was right that I was wrong, or something like that. My spelling really is dreadful.

more to come . . .

14. June 2012 at 10:56

not me, dwb I think we have a good 6 months of waiting

sorry the “above” post was MFs, your post crossed in the timeline.

14. June 2012 at 10:57

“You are the WORST right wing conspirator ever.”

Morgan, I like you but Cedric’s got you nailed there.

Negation Niall gets it the question is does Germany get it?

You’re totally right about Hamilton he’s exactly what they need-I wrote 2 posts about them the last few days

http://diaryofarepublicanhater.blogspot.com/2012/06/germany-still-doesnt-get-it.html

http://diaryofarepublicanhater.blogspot.com/2012/06/alexander-hamiltons-money-mischief.html

14. June 2012 at 11:08

@Negation of Ideology

yes, the Euro “could” be saved, and I agree with a lot of Jen Weidmanns comments also that Europe needs a democratic referendum on fiscal unity, constitutional changes, etc etc.

The problem is that those were great ideas 2 years ago, now there is no time to implement them before the crash. so, chicken or egg: does the ECB act to save the Euro before democratic referenda etc, anticipating a “yes” vote on fiscal/political union, or does, the ECB hold tight and let the Euro burn? What choice they make essentially determines the EU fate.

I am sympathetic to the ECB’s position: they have been put in the inappropriate position of having to make this choice to salvage the Euro for the EU, undemocratically. you could argue they put themselves in this position with tight money, but the real failure is a monetary union without a political or fiscal one in the first place.

14. June 2012 at 11:35

Everyone, I added the NGDP graph provided by JJ.

Ryan, You said;

“The krona, like the polish zloty, has the unique characteristic that it is not a reserve currency”

Actually most countries are similarly “unique”. But I accept your point that the US needs something like an NGDP futures market, as the markets won’t do the work for us. Indeed the dollar rose during the global crisis of late 2008.

Lars, I agree about the capital controls, and that the initial attempt to fix rates was a mistake. Regarding banks, the issue I care about is not whether they are nationalized, but whether the creditors are stiffed. I want to see the creditors suffer.

Is there a typo in the Krugman comment, I don’t want to get too personal, but isn’t this his worst nightmare?

dwb, Thanks, I honestly don’t know how to analyze fiscal data. What is the benchmark? With countries like Iceland no one knows where the trend line is, so the concept of full employment surpluses is murky. But if liberal like Drum tell me the success was not due to fiscal stimulus, who am I to argue?

Saturos, I have very poor taste in music. And pop music is very subjective. Sigur Ros is precisely the type of group I don’t like (artsy and pretentious) so I can’t tell you why I like them. I have much better taste in the visual arts, which is my main interest.

Lars, Thanks for correcting that!

dwb, Yes, let’s have the apocalypse now!

Morgan, You said:

“And Sumner turns the corner!”

I suppose you’d get mad at me if I said this just applied to Iceland.

Negation, I think the costs of breakup are far smaller in the long run. As fiscal union means the weaker states become a bottomless pit for German tax money.

AL, Yup, bad taste in music. See my reply to Saturos. I know it sounds like schlock to people with good taste, but fortunately I’m not cursed with good taste.

14. June 2012 at 11:37

Mike Sax,

“You are the WORST right wing conspirator ever.”

“Morgan, I like you but Cedric’s got you nailed there.”

Don’t credit me. I stole the idea from some jerk with a blog.

http://diaryofarepublicanhater.blogspot.com/2012/04/morgan-warstler-explains-market.html

14. June 2012 at 11:41

“Cedric, I think the weakest part of MM is our assumption that most problems around the world are demand-side. We might well be right that steady 5% NGDP growth is best, and yet be wrong about how much it would turn things around in countries like Britain. That is the part I’m least sure about. In other words conservative critics who say we underestiamte structural problems are more likely to be right than liberal critics who say NGDP can’t be boosted with monetary stimulus when at the zero bound.”

This is what I find so interesting…

I view NGDPLT as essentially not only replacing the fed with a computer, but a computer that prefers private spending over public spending.

It is 100% certain… read this BLS report from 1996:

http://www.bls.gov/mfp/mprff97.pdf

Read it, but look at Table 1 (p. 22). It will make you throw up in your mouth.

—-

The first thing to get off the table is that Baumol doesn’t apply to public service. Teachers get replaced by the Internet – that’s a fact of life.

But then looking at Table 1 with a mouthful of bile:

1. the same shit happened in state and local govts.

2. it only got worse AFTER 1996, where we saw an virtual explosion in public employee compensation from1998 on.

If you do the math, and look at a Public Sector that has essentially delivered under 1% in productivity gains YOY for OVER $) YEARS

vs.

A Private Sector coming in at 2.5-5% YOY for the last 40 years.

——

Scott, HOW can you not see $1T a year in reduced govt. spending under NGDPLT?

The only thing better than NGDPLT is my Guaranteed income plan.

NGDPLT loves productivity gains because that’s RGDP and deflation to boot.

NGDPLT hates anything that gets in the way of productivity gains and causes inflation.

Under NGDPLT the CBO will issue INFLATION REPORTS on every single new bill, because basically:

Anything that grows govt. is now INFLATION! Increase the unproductive and borrowing rates go up. Increase the productive and borrowing rates go down.

It is a pure virtuous cycle.

14. June 2012 at 11:44

2. Favorite Icelandic fiscal policy: Their simple and flat income tax.

Well, not *that* flat ?

http://en.wikipedia.org/wiki/Taxation_in_Iceland

…and highly contingent on a very socially homogeneous population.

Also, arithmEtic.

14. June 2012 at 11:53

“Cedric, I think the weakest part of MM is our assumption that most problems around the world are demand-side. We might well be right that steady 5% NGDP growth is best, and yet be wrong about how much it would turn things around in countries like Britain. That is the part I’m least sure about. In other words conservative critics who say we underestiamte structural problems are more likely to be right than liberal critics who say NGDP can’t be boosted with monetary stimulus when at the zero bound.”

Scott, thank you so much for this, and it looks exactly right to me. Of course, Morgan says one the ways we can fight structural problems is with NGDPLT. I think he might be right.

Morgan, I see a beautiful union of market monetarists, Keynesians, and conservatives joining hands and leading us out of the crisis via monetary stimulus. And then when he least expects it, we stab Mike Sax in the back and cut his Medicaid. It’s brilliant.

14. June 2012 at 11:57

dwb:

There are so many things wrong with the above post, and so little time.

I’ll anxiously hope that you can prove what’s wrong with it, rather than just claim it.

MF, what your dad spent on your MBA, if that is even true, would have been better spent on red in vegas for all the effort you put into it.

I financed my own MBA. Furthermore, I got all As and Bs, which was difficult in my program because the particular marking scheme.

The fact that I did not accept the Keynesian and Monetarist crap I learned does not mean I didn’t put an effort in learning it. You confuse effort with acceptance. They are different.

Nothing “finances” ngdp, and wages and compensation are about 55% of nominal gdp (actually 65% if you include rental income and proprietors income, much of which is actually “management labor”).

So that’s it? You came here to quibble over my use of the word “finances”? Fine, use whatever word you want to describe the type of spending that leads to NGDP spending. I use the word finance to refer to what type of spending is responsible for the statistic in question.

What you say is 55% “of” NGDP, I just say “finances” NGDP. It’s to signify the direction of spending. Employees spend, and that’s what contributes to a part of NGDP. Investors spending is the other.

If NGDP falls, then we have to look at the components of it, investor and consumer spending.

Market monetarists seem to have the causation backwards. Employment doesn’t fall when NGDP falls. NGDP falls when employment falls, since workers who are unemployment or at risk of becoming unemployed spend less.

14. June 2012 at 11:59

ssumner:

“Cedric, I think the weakest part of MM is our assumption that most problems around the world are demand-side.

That’s false. Most problems around the world are supply-side.

14. June 2012 at 12:03

“Don’t credit me. I stole the idea from some jerk with a blog”

Wow Cedric, I consider jerk a high compliment.

“Morgan, I see a beautiful union of market monetarists, Keynesians, and conservatives joining hands and leading us out of the crisis via monetary stimulus. And then when he least expects it, we stab Mike Sax in the back and cut his Medicaid. It’s brilliant.”

When did I become the enemy of MM-I say give it a shot, I’m not standing in your way. I got reservations but that’s something else.

14. June 2012 at 12:04

I don’t have Medicaid though, not that there’s any shame in it.

14. June 2012 at 12:09

“I financed my own MBA. Furthermore, I got all As and Bs, which was difficult in my program because the particular marking scheme.”

remind me what school you went to so i dont hire anyone from that school. anyway, i’ve seen you make too many basic errors, so i remain skeptical

14. June 2012 at 12:12

Govt expenditure at 2011 prices

2001 564,159

2002 586,924

2003 619,573

2004 644,424

2005 663,599

2006 684,824

2007 736,508

2008 1,016,695

2009 839,469

2010 816,477

2011 751,048

http://www.statice.is/Pages/1144

14. June 2012 at 12:22

“Blonds, blonds, blonds.”

Me personally, I prefer blondes to blonds, Scott. NTTAWWT.

Blond/blonde, what are we, French? Let’s behave like modern English speakers, shall we? You can split an infinitive if you like, it’s acceptable to end a sentence with a preposition, and “blond” is damn well gender neutral.

14. June 2012 at 12:30

“When did I become the enemy of MM-I say give it a shot, I’m not standing in your way. I got reservations but that’s something else.”

Just joking 🙂

14. June 2012 at 12:32

Gotcha Cedric! LOL

14. June 2012 at 12:33

In truth I’m siked you read it

14. June 2012 at 12:49

Always have to keep an eye on the enemy . . .

14. June 2012 at 13:07

Iceland’s unbroken NGDP rise is indeed impressive. And I suspect it does indeed explain the much lower unemployment in Iceland than in countries, such as the Baltics and Ireland, that kept their euro link and practiced “internal devaluation”.

But it hasn’t resulted in much difference in RGDP, which old-fashioned types like me still see as the measure of standard-of-living. You can see that in the graph in Krugman’s post today: http://krugman.blogs.nytimes.com/2012/06/14/peripheral-performance/. (Why does he persist in citing GDP when it doesn’t make his preferred policy look any better and when what he really cares about is clearly unemployment?)

It’s also worth noting that Iceland massively stiffed its creditors, while Ireland and the Baltics didn’t stiff theirs. It would be a fairer comparison to look at the income paths of these countries plus their creditors.

14. June 2012 at 13:10

“Always have to keep an eye on the enemy”

Agreed.

14. June 2012 at 13:11

dwb:

remind me what school you went to so i dont hire anyone from that school.

You can just add them to the list of the entire population of the the world that you’re not hiring.

anyway, i’ve seen you make too many basic errors, so i remain skeptical

You haven’t shown any such “basic errors”, so your skepticism is as credible as your lack of understanding economics.

14. June 2012 at 13:20

yep, i’d be embarrassed too.

14. June 2012 at 13:27

So it looks like you’ve got to do three things:

1. Austerity

2. Devaluation

3. Default.

So, it’s not that we should all be choosing one of the three. We need to be doing all three. Got it.

14. June 2012 at 13:29

dwb:

It’s a question of privacy, not embarrassment.

14. June 2012 at 13:51

Scott –

I wasn’t thinking of a transfer union where one member gives money to another, or guarantees another’s debt. I was thinking of a United States of the Eurozone buying the Central Bank for say 3 Trillion Euros. Now the members are 3 Trillion less in debt, but the new USE has 3 Trillion in debt. Germany would get its share of debt payoff according to population like everyone else. Then the ECB would buy Eurobonds like the Fed buys Treasuries. And you could structure it so the USE assumes the debt to the ECB and the stability fund first rather than pay cash to members. The ECB would probably end up owning most of the Eurobonds. But I definitely see why you and Angela Merkel are concerned.

David Wright –

“It’s also worth noting that Iceland massively stiffed its creditors”

I was under the impression that Iceland didn’t default on its creditors, it just refused to bail out creditors of private banks residing in Iceland. If my impression is wrong, please correct me. If not, I’d say that’s a huge difference.

14. June 2012 at 14:09

Negation:

Like most countries, Iceland had a bank deposit insurance scheme backstopped by its government. Icelandic banks had many foreign depositors, mostly British and Dutch citizens. After the collapse, the Icelandic government decided that it would only cover deposit insurance claims by Icelandic citizens. That is the default to which I am refering, not any default on government bonds.

The British and Dutch governments ended up covering their citizens deposits and presented the bill to the Icelandic government. They worked out a plan to pay it that would have diverted 5-10% of Icelandic GDP for the better part of a decade. That gives you an idea of just how massive the default was, and how much difference the repudiation of that liability meant to Icelandic income. It also gives you an idea of why the plan was overwhelming defeated in a referendum.

14. June 2012 at 14:44

and all those countries in the 1930s that just happened to start recovering after they left the gold standard don’t count.

They count. If I had my own printing press, and I was saddled with debts and non-performing assets, then I too could “recover” by transitioning my costs onto others and printing myself money. Yes, I too could return to producing if I reneged on my contractual obligations to others.

How is this in any way an argument against gold and abiding by contracts?

What happened in the early 1930s was a game. Governments and elite businessmen in each country knew that other countries could gain at their expense, by dropping gold. So it was a situation where countries that stayed “honest” would have gotten burned by “dishonest” countries that reneged on their promises.

Imagine two people contracting with each other, and then only one reneges on the other. The honest person would lose. Given that the one will renege, the other has a high incentive to renege too in order to avoid his own losses.

In terms of the data, Germany and the US experienced an increase in industrial output 1932-1933. They left the gold standard in 1931. But France also experienced an increase 1932-1933, and France stayed on gold until 1936.

The US experienced a recovery in 1933 over 1932 in terms of output. But there was also a relatively large increase in output 1935-1936, after the dollar had again been tied to gold at a different redemption rate.

Most important of all, and this is where there is a kernel of truth to the claim that “going off gold helped”, is that throughout the 1930s, wages were being propped up above market clearing rates by deliberate government and big business policy. In THIS situation, inflation can “help” boost output by preventing what would otherwise have been widespread unemployment and declining output.

This isn’t a vindication for fiat money. For the free market could have done this on gold. Wages would not have been propped up, unemployment would not have risen, and output would not have fallen. So the dropping of gold in the early 1930s and the consequent increase in output as allegedly being proof that fiat money is superior than gold, is an illusion. One had to understand the events that were taking place. A crude casual glance at a chart that shows “output” for various countries rising after the gold standard was dropped, cannot be taken as evidence that fiat money is superior to a free market gold standard.

14. June 2012 at 14:57

ssumner:

If NGDP had fallen after the 2007 peak (i.e. if they’d been fixed to the euro), then the real recession would have been much worse.

Exactly!

If my friend’s business revenues had falled after their 2008 peak (i.e. if they didn’t print their own money and were fixed to the US dollar), then their “recession” would have been much worse.

Happily enough, they did not think it was wise to remain on a pseudo-gold standard that is the monetary system in California, so they printed their own money and avoided having to lay off any of their employees, and they could continue in operation.

It worked out wonderfully, because they couldn’t quickly reduce their employee’s “sticky” wages.

Anyone who dogmatically and piously says this is “stealing other people’s purchasing power” should move to Somalia.

14. June 2012 at 14:58

fallen

14. June 2012 at 15:06

http://www.brobible.com/life/article/13156649

14. June 2012 at 15:20

Morgan,

“http://www.brobible.com/life/article/13156649”

That is awesome.

But you gotta remember, the number of Bees in Iceland is exactly . . . ZERO. So I’ll stay in good old Uncle Sam country if it means I have instant access to bold flavors.

http://www.applebees.com/menu/burgers-and-sandwiches/sandwiches/roast-beef–bacon—mushroom-melt

14. June 2012 at 17:39

dwb,

http://www.bloomberg.com/news/2012-06-13/private-equity-has-too-much-money-to-spend-on-homes-mortgages.html

14. June 2012 at 18:10

@Morgan,

yep there is a lot of money chasing these properties now with rental yields so good, ain’t capitalism great! I wish we could push more through the pipe.

14. June 2012 at 18:27

To, Thanks for that update. A few years back they had a flat 32% rate. They must have changed it during the recession. I’ll do an update.

Regarding the government spending data, I notice it’s completely different from dwb’s data. I see that in country after country–which is why I don’t tend to trust government spending data—it’s all over the map.

(Not saying you are wrong, I have no reason to disbelieve your data. I just don’t know.)

David, RGDP data is very difficult to interpret, which is why I prefer employment data. For instance, I think the Iceland unemployment data looks much better than Latvia because the RGDP data is very misleading. In 2005 Iceland was already a fully developed economy. At that time Latvia was a very fast growing middle income economy. So even though both Latvia and Iceland have pretty similar growth from 2005 to 2012, Iceland has probably done much better relative to trend, and hence it’s employment number looks much better.

It’s very important that the creditors who misallocated vast quantities of capital be severely punished. That’s why it was so harmful to the future of the global economy when creditors of Irish banks, and others, were bailed out. In any case what matters here is not income, but output. You don’t want to waste potential output by having mass unemployment. It seems to me the Icelanders are doing better in that regard.

IVV, “We” don’t need to default, if you mean the US government. Regarding our banks, see my previous comment.

Negation, I’m still skeptical, but it is certainly possible it would work. The markets would almost certainly like that idea.

David, I missed your point about the deposit insurance. That’s a whole other issue, and I don’t have strong views either way on that issue. It’s one of those cases where neither side (Iceland nor Britain/Netherlands) really understood what was going on before it all blew up. Wasn’t there some dispute about whether the Icelandic government backstop was de jure?

14. June 2012 at 18:38

Figuring out innovative ways to do bulk buying seems in order.

14. June 2012 at 19:45

[I’m picturing Bob Murphy reading this Krugman post and saying to himself; “Whoa, I don’t recall Krugman pointing out that the Latvian peak GDP should be ignored because it was just a frothy bubble after years of double digit growth.”]

Actually Scott I would once again chuckle at Krugman patting himself on the back for recommending that the Icelandic government shouldn’t bail out the banks. I seem to think there was at least one other major school of economists saying the same thing, and far more consistently…

14. June 2012 at 19:47

Regarding the government spending data, I notice it’s completely different from dwb’s data. I see that in country after country-which is why I don’t tend to trust government spending data””it’s all over the map.

(Not saying you are wrong, I have no reason to disbelieve your data. I just don’t know.)

yep i should have footnoted: the numbers i posted are the monthly “cash basis” but there is also an “accrual” basis (=To’s, which are at 2011 prices) which include 192 MM debt assumption in 2008 and various “other expenses” … and the Govt final consumption numbers going into GDP are slightly different still (but closer to the cash basis #s).

… they are all correct, but depends on what the question is. I think that they all tell basically the same story though.

15. June 2012 at 00:09

Scott: After the collapse, the Icelandic government did make some agruments that they weren’t legally required to cover foreign depositors. Those are rather undermined by the fact that, before the collapse, the Icelandic government reassuared any depositor or government that asked that of course their deposit insurance would cover foreigners as well as locals.

15. June 2012 at 05:06

Hey Scott are you going to do a post on the recent UK stimulus measures from the Bank Of England?

15. June 2012 at 05:10

Woot!

The lines are drawn!

DeKrugman is Anti-Fiscal Cuts, since they slow down the economy…

http://www.nytimes.com/2012/06/15/opinion/krugman-we-dont-need-no-education.html

Leaving Scott to FINALLY explain the gorgeousness of NGDPLT to conservatives.

No mamby-pamby talk of inflation will help, just flat out, if you do NGDPLT, you can cut govt. to the bone, and it won’t even make a blip on the economy.

Ok Scott, go!

15. June 2012 at 05:12

Scott:

I agree, the US Government doesn’t have to default on their bonds. I suppose that by “default” I mean the breaking of promises that are too costly to honor–like the Icelandic government backstopping British depositors.

Incidentally, I don’t really care if the banks are bailed out or dismantled. The banks themselves don’t care. Wind them down if it’s cost effective, or keep them around if they hold so much infrastructure that they’re costly to remove. Bankers, on the other hand, they’re the ones who make these decisions. They are the ones who should be punished greatly. So if it means, say, keeping Lehman around but removing and arresting the decision makers and confiscating their assets, so be it.

Heck, that would get a whole bunch of safeguards installed really quickly, don’t you think?

15. June 2012 at 07:16

you know the interesting thing about this state and local debate is that state and local receipts and expenditures actually have gone up even though employment has gone down. hows that? I looked it up and states lost 621 Bn on pensions in 2009 while contributions only amount to 125 Bn/yr… so a lot of these expenditures are going to plug holes in unaffordable benefits. I think a lot of these pre-recession deficits states were running along with benefits were not sustainable.

15. June 2012 at 07:29

and even more data in Iceland govt: this time from the GDP series (which is probably more apples to apples on the “austerity” question: the public finance numbers include a 192 MM debt assumption in 2008, along with other stuff).

(also i checked this series agrees with world bank data)

… no matter how i slice it nominal govt spending may have gone up a bit, but real govt spending is down on the order of 12%

Year, 8: GDP, 1: Priv fin cons, 2: govt fin cons, 3: gross capital, 3.1: bus invest, 3.2: resid invest, 3.3: govt serv, 2 + 3.3, GDP Deflator, Real govt expenditure (GDP Basis)

2006, 1168.602, 679.943, 285.371, 402.611, 285.52, 74.48, 42.611, 327.982, 108.804, 301.443

2007, 1308.53, 751.611, 316.828, 373.048, 227.792, 90.6, 54.656, 371.484, 114.952, 323.1645

2008, 1481.986, 789.923, 367.309, 362.524, 218.788, 80.903, 62.833, 430.142, 128.558, 334.5898

2009, 1495.36, 764.338, 396.946, 207.316, 117.668, 40.11, 49.538, 446.484, 139.193, 320.7661

2010, 1534.228, 787.367, 398.618, 197.369, 119.846, 35.542, 41.981, 440.599, 148.799, 296.1035

2011, 1630.15, 852.258, 411.017, 229.698, 153.992, 39.966, 35.739, 446.756, 153.421, 291.1961

8. Gross Domestic Product

1. Private final consumption

2. Government final consumption

3. Gross fixed capital formation

3.1 Business sector investment

3.2 Residential construction

3.3 Government services

http://www.statice.is/?PageID=1267&src=/temp_en/Dialog/varval.asp?ma=THJ01601%26ti=Quarterly+GDP+1997-2012+%26path=../Database/thjodhagsreikningar/landsframleidsla_arsfj/%26lang=1%26units=Million%20ISK/percent

15. June 2012 at 08:18

David Wright –

Ok, I see your point. If the government gave a legal guarantee on a deposit and reneged then that would constitute a default. All the articles I read on the topic mentioned the referendum (including the over 90% No vote), but were never clear on whether Iceland had given a formal guarantee.

As an aside, I think this is the problem with guarantees in general. I read a financial adviser who said that you should never cosign a loan, even to your own children. Deposit insurance is basically the government cosigning depositors loans to the bank. It seems to me that either the government should never guarantee any private debt, or it should be like Potter in “It’s a Wonderful Life” and take a huge share of the profits in exchange for that guarantee. Definitely not this “heads I win, tails you lose” plan.

If we need a place for people to put risk free cash guaranteed by the government for electronic bill payment and such, you could have accounts 100% backed by Fed deposits or perhaps government bonds.

15. June 2012 at 08:20

dwb,

That’s the San Diego / Jose issue – it isn’t going to be about raising taes to fund govt. servics.

it is going to be about cutting current pension payments to fund services.

And the votes will be overwhelming.

Frankly, I’d like to see State Wide votes that say “No public employee pension will be more than the average wage of private sector earners in the state”

Overnight there every city and the state will be on a clear path to surplus.

15. June 2012 at 10:02

“it is going to be about cutting current pension payments to fund services.”

right, the pension and health benefits are clearly out of line with the private sector, and voters are not going to have much sympathy for that. It was interesting that Walker’s rebuttal to Romney last week echoed that reducing pension benefits would allow WI state to add teachers, firefighters etc.

15. June 2012 at 11:47

“It’s a question of privacy, not embarrassment.”

dwb, if one is going to roam the Internet being an insulting jerk like MF, one *must* retain one’s privacy!

15. June 2012 at 12:09

Bob, Krugman takes credit for being the only one who was right? Really?

Davod, I know the deposit insurance covered foreigners, that wasn’t my question. Rather my question was whether the Icelandic government covered the deposit insurance company.

I’m sure everyone assumed they did, but I recall it wasn’t explicit. Think of the analogy of the Treasury backing of the GSE, which was assumed but not explicit.

I’m not trying to defend their government here, I think there is blame on both sides. The Brits were also foolish to assume 300,000 Icelandic taxpayers would pay off millions of British and Dutch depositors.

Brito, I just did one.

IVV, Bank stockholders and bank creditors need to be punished, as they enabled the bank managers.

dwb, Thanks for that new data.

15. June 2012 at 12:21

Gene I thought it might be a legal constraint-they don’t want it known they gave him a diploma much less “As and Bs”

15. June 2012 at 12:33

Gene:

dwb, if one is going to roam the Internet being an insulting jerk like MF, one *must* retain one’s privacy!

Hahaha, more people think you’re a jerk, than think I’m a jerk.

Insulting? You insult people almost every day on Murphy’s blog. You also have a reputation of treating others like jerks, then crying like a baby when you’re treated equally.

15. June 2012 at 12:43

Major (Un)Freedom I cant imagine more people think Gene is a jerk. Because a whole lot of people thnk you’re a jerk. I’m sure you’d win Biggest Jerk on Money Illusion. Not even close.

Come to think of it that must be why you hate democracy so much.

15. June 2012 at 16:48

ssumner

15. June 2012 at 12:09

” Davod, I know the deposit insurance covered foreigners, that wasn’t my question. Rather my question was whether the Icelandic government covered the deposit insurance company.

I’m sure everyone assumed they did, but I recall it wasn’t explicit. Think of the analogy of the Treasury backing of the GSE, which was assumed but not explicit.

I’m not trying to defend their government here, I think there is blame on both sides. The Brits were also foolish to assume 300,000 Icelandic taxpayers would pay off millions of British and Dutch depositors. ”

300,000 depositors in the UK and 125,000 in the Netherlands.

What I think you are asking is did the Icelandic government have an obligation as sovereign guarantee of last resort for depositors. Quite clearly yes. Iceland as a member of the EEA were bound by EU directive 94/19/EC covering deposit insurance. They transposed the directive into national law in 1999, setting up the Depositors’ and Investors’ Guarantee Fund. It is the government of Iceland who sign up to be bound by EEA obligations and not the commercial banks. Therefore, it is the sovereign who has the obligation to ensure their companies are in compliance with the laws that the sovereign has agreed to through their EEA membership. There were not enough funds in the guarantee fund and that fault lies ultimately with the government of Iceland.

According to EU law any shortfalls if a fund is operated should be met by the other credit institutions contributing to the fund. That clearly was not practical in Iceland as the rest were bust or too small. That leaves the government as the body that agreed to be bound by that particular EU law. One can’t sign up to a law and also claim to be immune from the obligations.

Icesave was just an online brand. The deposits were held in Landsbanki’s branches in London and Amsterdam. Therefore, to treat Landsbanki depositors in the UK and the Netherlands different to Landsbanki depositors in Iceland was clearly discriminatory. Article 4 of the EEA agreement prohibits “any discrimination on grounds of nationality”. Moreover, until the UK, Dutch and German government seized Landsbanki assets, they were moving funds out of those countries to cover the pledges to depositors in Iceland.

I think the lesson here is in the absence of a central bank with huge reserves small nations should not engage in cross-border lending at all.

16. June 2012 at 01:50

Richard W.

Glad to see someone reminding readers that Iceland has had the benefit of what is effectively a large forced transfer payment from Britain and the Netherlands. For anyone who is interested in the facts of the Icesave dispute, rather than the simplistic or sentimental ideas spread by many commentators, I offer my post written at the time of the first Icesave referendum: http://reservedplace.blogspot.co.uk/2010/03/on-thin-ice.html

I agree that Iceland is culpable. The underlying problem, I think, is that Iceland was trying to act as a full-scale country, with a deposit protection scheme naively copied from larger EEA members, which Iceland was simply not large enough to operate. For example, the Icelandic deposit protection scheme was managed by a single person working part-time out of the central bank who often did not attend European meetings on deposit protection policy. In my opinion, Icelanders should philosophically accept the burden of repaying the British and Dutch as the natural volatility of fortune that goes with being independent as a small and undiversified economy.

16. June 2012 at 07:53

Richard, You said;

“I think the lesson here is in the absence of a central bank with huge reserves small nations should not engage in cross-border lending at all.”

The real lesson here is that our system of deposit insurance is a disaster. In the US, in Europe, and in Iceland. We should blow it up and start over (with no government involvement.)

I don’t know the details of what happened, so I have no reason to question your facts. Even so, it is not 100% clear to me whether it make sense for roughly 150,000 Icelandic taxpayers to pay off 425,000 European depositors. This is very similar to the question of whether Greece did the right thing in defaulting on its national debt. Obviously there is some reduction in living standards of the Greek people that would have allowed them to pay off their debts to foreigners. Would it have made sense for them to accept that decline in living standards? I can’t say.

As far as who is to blame in a moral sense, obviously the Icelanders deserve some blame. So does the EU for setting up the insane system of deposit insurance.

Of course this is all off topic, unrelated to Icelandic policies regarding NGDP and RGDP.

16. June 2012 at 09:28

Scott, if by your own admission, you don’t know the details, you should refrain from comments like “so does the EU [deserve some blame] for setting up the insane system of deposit insurance”.

Ex-post funding of deposit insurance schemes is not unreasonable for a large country with many banks and other insurance fee paying institutions. The idea is that the scheme borrows, if necessary from the government, to bridge the gap between paying off the depositors and recovering the money from the banks. Iceland uncritically imported such a scheme from larger European countries. Now, EEA (the relevant group here, rather than the EU) rules allow free competition in banking, and Landsbanki cited these rules when the British regulators expressed doubts about the adequacy of the Icelandic deposit protection scheme. Basically, Britain and the Netherlands are paying the price for respecting Iceland’s status as a grown up member of the EEA.

Dare I suggest that you read my blog post?

This is only unrelated to Iceland’s post-crisis GDP growth if you think that taxation has no effect on GDP.

17. June 2012 at 07:54

Rebeleconomist, I view any government involvement in deposit insurance as insane. But I was specifically addressing the British government decision (or the EU decision) to allow Iceland to insure the deposits in the UK, knowing quite well that Iceland didn’t have the money to pay off the depositors.

18. June 2012 at 10:37

Before you start celebrating, how about explaining why Iceland isn’t simply trading a finance bubble for a housing bubble? http://www.businessweek.com/news/2012-05-29/iceland-property-bubble-grows-with-currency-controls-mortgages

18. June 2012 at 11:59

Mike Sax:

I cant imagine more people think Gene is a jerk.

Your imagination is not as accurate as reality.

Because a whole lot of people thnk you’re a jerk.

A whole lot more think Gene’s a jerk.

I’m sure you’d win Biggest Jerk on Money Illusion. Not even close.

I’d happily accept that distinguished award.

Come to think of it that must be why you hate democracy so much.

I hate initiations of violence, even if they’re carried out by the majority of an arbitrary population against the minority of that same arbitrary population. If that makes me a jerk, then so be it. I’d rather be a jerk in that way, then what you consider yourself to be, which is a non-jerk, but who is OK with majorities coercing and aggressing against minorities.

That’s probably why you love democracy so much. It gives you a chance to be a jerk among many other jerks, and you can pretend that being among many jerks, somehow makes you not a jerk.

Kind of like how the Catholic priests don’t consider it rape against boys when many priests do it. Then it becomes holy, and those who think they’re jerks, magically become jerks themselves.

18. June 2012 at 12:00

Scott, you said: “Rebeleconomist, I view any government involvement in deposit insurance as insane. ”

But uhm (ignorant student asking here) we have to have government deposit insurance under a fractional reserve system don’t we? Otherwise the system is prone to bank runs, no?

18. June 2012 at 12:05

ssumner:

Rebeleconomist, I view any government involvement in deposit insurance as insane.

I view any government involvement in money production as insane.

So I can say any government involvement in deposit insurance AND money production is insane. You are compelled to say government involvement in money production is not insane, but government involvement in deposit insurance is insane.

Why is one government involvement not insane, but the other government involvement is insane? From what basis are you making this judgment?

Who’s insane again?

18. June 2012 at 13:57

Scott:

“IVV, Bank stockholders and bank creditors need to be punished, as they enabled the bank managers.”

Awesome, that convinces me, dismantle the banks.

19. June 2012 at 11:22

[…] reading: Scott Sumner on Iceland vs. Europe Share this:TwitterFacebookLike this:LikeBe the first to like this. from → Europe, […]

20. June 2012 at 06:06

Mads, Canada had no deposit insurance until 1966, and they had no bank runs. I’d expect that private companies would offer deposit insurance for small savers. If you target NGDP, then any banking crisis is likely to be relative small.

If we must offer deposit insurance, then any insured deposits (preferably with a low cap) should be 100% back with T-securities.

27. March 2017 at 03:04

[…] http://www.themoneyillusion.com/?p=14895 […]

27. March 2017 at 03:04

[…] http://www.themoneyillusion.com/?p=14895 […]