Scott Alexander recently linked to a graph showing PISA scores by country and by income deciles within countries. Three that caught my eye were Argentina, Chile and Uruguay. These are three countries with populations of Western European descent, and are also the only three countries in South or Central America with per capita GDPs above $20,000. But the Southern Cone does appalling bad at taking PISA exams, scoring among the lowest of all countries on the list. Argentina is even lower than (much poorer) Brazil and Tunisia, something I would not have expected. Argentina also scores extremely low on indices of “Economic Freedom”.

Argentina’s an interesting case to think about. It’s a sort of composite of the worst of Chile and the worst of China. Chile scores extremely high on economic freedom, the only developing country in the top 10 (unless Estonia is viewed as developing). Argentina ranks 156 out of 180. China’s sort of the opposite of Chile. It ranks pretty low on economic freedom (#111), but (probably) pretty high on PISA scores. I say “probably” because the scores being reported are for Shanghai, which is definitely smarter than the average Chinese city or village. Indeed Shanghai scores above any other country in the world, including high achieving city-states like Hong Kong and Singapore. Nonetheless, based on other studies I’ve seen, I am confident that China would still do pretty well on a more national PISA exam. Perhaps about at Vietnam’s level. (Vietnam is roughly comparable to Finland, and far above the US, UK or Sweden.)

So Chile and China each have one good trait and one bad trait. Argentina has the bad trait of each. Argentina’s a classic example of a glass half full/half empty situation. From one perspective, you might expect Argentina to be rich. It’s mostly settled by Western Europeans (I think it might be the most Western European country in all of North and South America), and those countries are usually pretty developed. But Argentina’s per capita GDP seems to be either lowest in the world for ethnic Western European countries, or second lowest (I had trouble getting racial data for Costa Rica.) A hundred years ago it was among the world’s richest countries. It has a world-class port, and rail lines fanning out across some of the world’s most profitable farmland. It’s got lots of mineral resources. It’s technically sophisticated, completing Latin America’s first nuclear power plant way back in 1974.

Chile’s population is also primarily Western European, but considerably less so than Argentina. Chile also scores very low on PISA, but not as low as Argentina. And of course Chile has far more economic freedom. (Just to complete the Southern Cone, Uruguay is in between the two in terms of education and economic freedom, and also GDP/person.)

China is poorer than the Southern Cone. But that may be misleading; as it’s clearly growing faster and hasn’t reached the “middle income trap” that the Southern Cone seems to have reached. China’s high PISA scores are consistent with the high scores in other ethnic Chinese/Japanese/Korean/Vietnamese areas, but NOT other parts of Asia.

I’d like to claim that some combination of economic freedom and PISA scores explains wealth, but I see too many exceptions. Mexico scores higher than Argentina on PISA tests, and also far higher on economic freedom, but is poorer. Why?

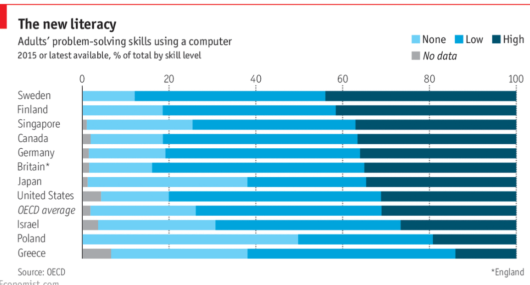

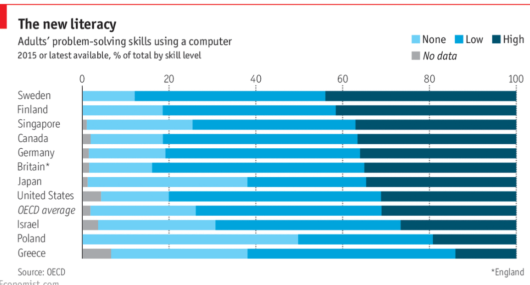

Sweden is much richer than Finland, despite doing dramatically worse on PISA, and being fairly similar on economic freedom. Maybe the answer here is that PISA and “economic freedom” don’t always measure what we might assume. Take the Heritage Economic Freedom Index. Argentina is down there with countries like Uzbekistan, New Guinea, Niger, Haiti and Afghanistan. I don’t know about you, but if I were opening a new winery, I think I’d prefer the Mendoza area to Afghanistan or Niger. Indeed reading the Heritage description of Argentina makes me wonder why it ranks so low. As far as PISA scores, I wonder if they measure the sorts of skills required for a modern economy. According to The Economist, Swedes are the most computer literate of this set of countries, despite scoring relatively low on PISA tests.

I do think both the Heritage rankings and the PISA scores are correlated with what we think they measure (which might be ease of starting businesses and keeping the wealth you create for the Heritage index, and ability to do complex jobs for PISA). The question I have is whether the outliers we see, such as Argentina and Sweden, are due to flaws in these two metrics, or because there are other factors that influence development, which go beyond economic freedom and intelligence/education.

I do think both the Heritage rankings and the PISA scores are correlated with what we think they measure (which might be ease of starting businesses and keeping the wealth you create for the Heritage index, and ability to do complex jobs for PISA). The question I have is whether the outliers we see, such as Argentina and Sweden, are due to flaws in these two metrics, or because there are other factors that influence development, which go beyond economic freedom and intelligence/education.

At the bottom, I have (IMF) estimates of GDP per person in 2016 for the top 91 countries. A few things worth noting:

1. The US continues to be inexplicably rich. Among “normal countries” (i.e. not oil rich, tiny, multinational dominated and/or city states) only Switzerland scores higher. And number three (Netherlands) is more than 10% lower than the US. We are no longer top 10 in economic freedom, and our PISA scores are mediocre. So why are we so rich? Because we are large? But lots of small Northern European countries are high on the list.

2. Spain finally surpassed Italy, after many decades of gradually catching up. Wait, wasn’t Berlusconi going to Make Italy Great Again? Seriously, I wonder if a combination of population density and regulatory complexity make if much harder to do major projects in Italy than Spain, like large new real estate developments. Can anyone confirm?

3. South Korea is now very close to overtaking Japan. That may be partly due to the fact that Koreans have lower taxes and work more hours.

4. China finally overtook Brazil, and it looks increasingly like they will overtake Mexico by 2030, (allowing me to win my bet with Talldave.)

5. Malaysia overtook Greece and will soon overtake Portugal. It seems increasingly likely that Malaysia will escape the “middle income trap”.

6. There used to be a lot of articles about how the former Soviet bloc’s transition to capitalism had failed. But there are now 5 former communist countries that are richer than Greece and Portugal, with the Czech Republic leading the way.

7. All you need to do is look at countries #31 to #35 to realize that GDP/person (PPP) can be extremely misleading. I wonder about some of the figures.