How likely is another Great Recession?

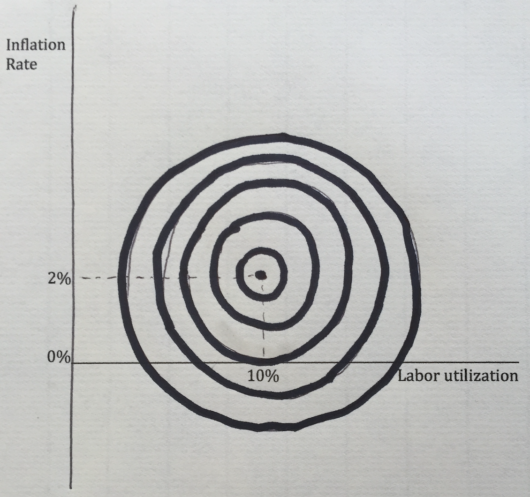

If you only have time for one post today, make it David Beckworth’s very important post showing that the Fed is edging in the direction of level targeting, indeed something not too far away from NGDPLT.

Tyler Cowen recently linked to my previous post:

5. Is another Great Recession just around the corner? Well, is it?

I’m not sure what qualifies as a “Great Recession”. I suppose 1893-97, the 1930s, the 1980-82 double dip, and 2007-09 are the most plausible candidates, at least since 1860. So perhaps once every 40 years or so.

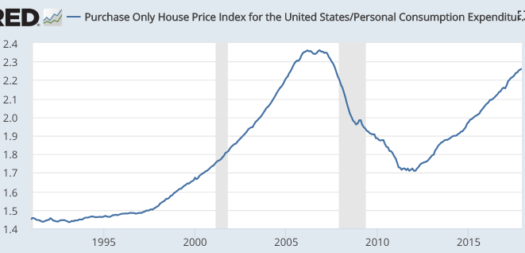

So let’s suppose I’m right that the “housing bubble” did not cause the Great Recession. In that case, the fact that we are having another housing price boom is not particularly worrisome. It doesn’t increase the odds of another Great Recession. So let’s say the odds are roughly 1 in 10 that another Great Recession will occur in the next 4 years, based on past performance.

Can’t we forecast better? I’m not sure, as the additional information we have cuts both ways.

1. Perhaps the slowness of the recovery makes it more likely that the expansion has more room to run. Or perhaps we’ve learned something from the previous debacle. Australia hasn’t had a recession in 27 years; no reason we can’t beat the record of the previous US expansion, which was 10 years.

2. On the other hand, big recessions are more likely at the zero bound and we are likely to hit the zero bound again in the next recession. So perhaps another Great Recession is now more likely than usual.

If I had to guess, I’d say point #1 is slightly more persuasive than point #2, but I don’t have a high degree of confidence. Where I am confident is in stating that the housing bubble did not cause the Great Recession, and thus the current housing price boom (very similar to 2001-06), does not make another Great Recession highly likely in the near future. Unless I’m mistaken, the bubble-mongers should be predicting another Great Recession in the near future.

PS. I am amused to see commenters say, “it wasn’t the price bubble, it was blah, blah, blah.” Deep down they know that the bubble theory is wrong, and they are looking for a way out. Unfortunately, that’s rewriting history. At the time, people were saying the problem was the price bubble. They were saying that those prices were obviously unsustainable. (Even though Canada, Australia, Britain, New Zealand, etc., did sustain them.) Kevin Erdmann has convincingly shown this “unsustainable” view is wrong, and more importantly he did so long before prices had recovered. I’d have more sympathy for the other side if in 2012 they had not said “prices were obviously crazy in 2006”, but rather had said, “prices in 2006 might be rational at a given interest rate, and hence if rates stay low and rents keep rising I would expect prices get right back up to bubble levels.”

PPS. My opponents are like astrologers. When I say to an astrologer, “OK, lets take data on a million people, based on the sign they were born under, and correlate it with personality data. It’s an easy test.” They respond. “It’s more complicated than that, there’s all sorts of other factors to consider.” Well I’m a Libra, and we don’t believe in those sorts of excuses.