Is another Great Recession just around the corner?

When I stated blogging in early 2009, people were incredulous when I blamed the recession on tight money. Most people thought it was “obvious” that the recession was caused by the house price bubble. (There was no housing construction bubble–Kevin Erdmann has lots of research showing that housing construction during the 2000s was at normal levels.)

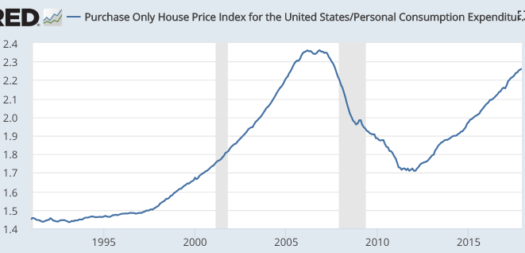

OK, if was obvious that home prices were wildly excessive in 2006, why is that not also true today? Nominal house prices are now far above 2006 levels, and even in real terms they are rapidly approaching the 2006 peak, as this graph shows (deflating by the PCE index):

So let’s see what these pundits say today. Are they calling for investors to engage in “the big short”, as John Paulson did in 2008? Are they predicting another Great Recession? Are they predicting another crash in housing prices? Are they predicting another banking crisis? If not, why not?

So let’s see what these pundits say today. Are they calling for investors to engage in “the big short”, as John Paulson did in 2008? Are they predicting another Great Recession? Are they predicting another crash in housing prices? Are they predicting another banking crisis? If not, why not?

Is it possible that the housing boom was not a bubble? Is it possible that fundamentals (such as building restrictions and lower real interest rates) support much higher real housing prices during the 21st century than during the 20th century? Is it possible that the real problem was nominal, a fall in NGDP engineered by a monetary policy that (during 2008) held the Fed’s target interest rate far above the equilibrium interest rates? Is that why unemployment stayed low as housing construction fell in half between January 2006 and April 2008, and then soared when tight money pushed NGDP down in late 2008?

Lots of pundits were saying housing prices were excessive as far back as 2003; when even in real terms they were far lower than today. Do these same pundits again predict a collapse? If not, why not?

It’s rare that life gives us a second chance to test a theory. Let’s not waste it; let’s follow this experiment quite closely over the next few years. I plan to, and I’ll keep reminding people of the outcome.

Tags:

27. February 2018 at 11:55

maybe instead look at total monthly mortgage payments to see if housing is overvalued? in 2006, mortgage rates were 6%, now they’re 4%

27. February 2018 at 12:02

I wonder that Google’s car lot is comfortable living place at the autonomous car era (or not)

27. February 2018 at 12:10

I meant the parking lot

http://www.businessinsider.com/why-google-employees-live-in-the-parking-lot-2015-10

27. February 2018 at 12:22

[…] suivez les réponses à cette entrée via le flux RSS 2.0 . Vous pouvez laisser une réponse ou Trackback depuis votre propre […]

27. February 2018 at 12:25

Jim, Yes, but NGDP growth expectations were much higher back then.

27. February 2018 at 12:36

I feel you made a bit of a straw man here. Most people weren’t talking about a home construction boom. They were talking about a housing boom. The whole sector. Not just new home sales or housing starts, but also existing home sales.

I didn’t feel like finding a more up-to-date source, but the Economist had a chart in 2016 on housing that includes things like price to rent and price to income. Both are relatively close to historically averages, while they were much higher back in the “boom” period.

https://www.economist.com/blogs/graphicdetail/2016/08/daily-chart-20

When investors argue “prices are high”, they almost never think just in terms of levels. They often think compared to income or rents or whatever. I don’t dispute that these can be distorted due to interest rate movements, but it’s never just that some price is high. It’s high relative to what. That’s the argument you would need to refute.

27. February 2018 at 16:32

That analysis doesn’t adjust for interest rates. If housing’s fundamental value is PV of future rent, then the underlying value is very sensitive to interest rates.

A really simple analysis is taking 10 year rates of 4% in 2005 and 3% today. Perpetuities are valued at 1/r. (1/0.03)/(1/0.04) works out to a 33% increase. Instead real housing values are merely flat between 2005 and now.

27. February 2018 at 16:57

John, They were talking about a home price boom. It was prices that got all the attention.

As far as rents, that just proves my point, or more specifically proves Kevin Erdmann’s point. He claims that given the level of rents, and the speed at which they were rising, prices in 2006 were not unreasonably high. He made that claim years ago, and people scoffed at the time. But events have shown that he was right.

Imagine someone claimed Amazon was too high back in 2006, based on P/E ratios, and then when shown they were wrong (in 2018), claimed the price in 2006 was irrational because earnings weren’t very high back in 2006. In 2018, people would laugh at that excuse, as they should. It turns out the high prices of 2006 were justified. For Amazon and for houses.

27. February 2018 at 18:51

Aren’t chances high that a relevant recession is around the corner considering Trump’s procyclical economic policy, his unbalanced budget policy, his protectionist trade policy, and his replacing of Yellen?

China with Xi, who is taking more and more power, doesn’t look so bright either. I don’t get why you are so optimistic. The red flags are there and I don’t see too many green ones.

27. February 2018 at 20:37

Excellent blogging. Also, in 2008 the Fed was obsessed with inflation and oil prices. If the Fed tightened hard again today, we might get the same Great Recession, or near it. And many want the Fed to dump its balance sheet and “normalize” rates. Others want the Fed to gt back to a 4.75% unemployment rate. So maybe we get a run-of-the-mill recession, though we will hit zero on lower bound again.

The wild card: China. Chairman Xi. Probably the state central planning, mercantilism, and growth-oriented monetary policy keep working for another year. But Xi makes Trump look like Peter Pan. Egads. Get used to Xi, he will still be Chairman when many of us have passed away. Like other strongmen (Putin, Stalin Mao, Saddam Hussein) Xi will likely leave office, but only if feet first.

China, like the US, is an ongoing experiment in economic growth, central planning, mercantilism, social-economic-business controls, all married to a growth-oriented and I think competent central bank.

27. February 2018 at 21:02

Tim Duy:

“Federal Reserve Chairman Jerome Powell delivered the Fed’s Semiannual Monetary Policy Report Tuesday morning. Powell smoothly and confidently responded to – or deflected – questions as if he were already seasoned in the role of Chair. As to the content of his remarks, they were hawkish. More hawkish than I anticipated and arguably signaled a significant change of focus for the Fed.

……….

Powell revealed the movement of his own “dot” today. Now, we can all infer the likely movement, to be sure. But his predecessors avoided revealing much information about their own dots in fear that market participants would place a heavy weight on that dot.

Powell appears to be less concerned about such influence. He must know that market participants will shape their expectations on his statements over all others. And that setting those expectations helps set policy outcomes. That suggests three possibilities to me. The first is that Powell intends to shape policy more directly. The second is that Powell is taking more control over the messaging. The third is that Powell revealed more than he intended and will be more circumspect in the future.“

https://blogs.uoregon.edu/timduyfedwatch/2018/02/28/avoiding-an-overheated-economy/

27. February 2018 at 21:27

The main difference is leverage. In 2006 the banking system was leveraged to the hilt, balanced on a belief that home prices could never go down nationwide. When they did, the entire financial system seized up. Markets failed to clear. The asinine change in mark to market rules in 2007 exacerbated the problem, and until they fixed that on March 9, 2009 (the exact bottom of the stock market) the Great Recession was in full force.

Today the banking system is dramatically better capitalized, and the mark to market rules are back to the sensible place they were from 1937 (I think) to 2007.

History rarely repeats exactly. The world of 2018 is not the same as the world of 2006, and the next recession will not be the same kind. I expect a smallish 2001-style recession, if the Fed can be smart.

28. February 2018 at 12:05

O/T but are US lawyers, courts, prisons and police gearing up for a nice substitute when pot, soon hopefully, becomes fully legal?

https://theintercept.com/2018/02/28/criminalization-of-debt-imprisonment-aclu-report/

Good post, of course.

28. February 2018 at 12:36

Not really. This is why:

https://fred.stlouisfed.org/series/FODSP

That said, a recession may still occur, but a major banking crisis is unlikely.

28. February 2018 at 13:02

Surely debt levels matter as a sign of a bubble.

In Q4 2007, household debt service as a % of disposable income peaked at a whopping 13.2%.

Today it’s down to 10.2%, lower than at any point since the 1970s.

https://fred.stlouisfed.org/series/TDSP#0

Mortgage debt in particular has come down sharply. At the top of the bubble, mortgage debt payments peaked at 7.2% of disposable personal income.

Today it’s down to 4.45%, the lowest on records going back to 1980. https://fred.stlouisfed.org/series/MDSP

28. February 2018 at 14:03

Is that the right deflator to use? Shouldn’t housing prices go up by more than PCE inflation? Maybe an average of PCE and NGDP?

28. February 2018 at 14:05

I thought the proximate cause of the last recession was gas at $4 a gallon, which made enough of those exurban home buyers unable to pay their mortgages that people started seriously thinking about mortgage backed securities, and began to realize that they weren’t AAA debt instruments (which was effectively a huge contraction of the money supply given the role that AAA debt plays in transactions).

28. February 2018 at 14:34

Christian, Recessions are hard to predict. While the current pace of NGDP growth makes a recession slightly more likely, I still think it is unlike to occur in the next few years. This will be the longest expansion in history (which is no big deal.)

msgkings. You said:

“Today the banking system is dramatically better capitalized”

The data I’ve seen suggests otherwise. Do you have a link supporting that claim?

Thanks Pavel.

Cooper, You want to look at the amount of debt, not debt service. NGDP growth was higher back then.

Robert, It would be interesting to get a very long (100 year) graph of real housing prices. That would answer the question.

P Burgos, No, tight money caused the recession. High gas prices were an indirect cause, leading the Fed to tighten in 2008.

28. February 2018 at 15:24

Scott: Bought a new house in Florida in December of 2004 for $400 thousand. Zillow valued it at $489 T in 12/2008 (its highest); $336 T in 12/2009; $322 T in 12/2011, $489 T in 12/2017. At 2% per annum inflation it should now be valued at $518 T. The loss of the wealth in held in housing from 2008 to 2011 certainly impacted demand.

28. February 2018 at 15:29

Scott, thanks for your answer. Even though I disagree, I really appreciate it.

@mskings

The main difference is leverage. In 2006 the banking system was leveraged to the hilt,…

Your wisdom is a simple hindsight “explanation” only. When the next recession is there, you will come up with the next hindsight explanation why the recession was “obvious” and “bound to happen”.

28. February 2018 at 16:33

If the next recession is just around the corner we should stop teaching macroeconomics. Virtually nobody is predicting one and there doesn’t seem to be agreement on what caused the last one. Also we should stop thinking of macro as having any connection with science. Science progresses and predicts, macro wanders and pontificates. Maybe macro should be thought of as a failed attempt at rational religions.

I guess I’m just channelling Binyamin Applebaum

Binyamin Applebaum: @BCAPPELBAUM ON TWITTER: “I am not sure there is a defensible case for the discipline of macroeconomics if they can’t at least agree on the ground rules for evaluating tax policy. What does it mean to produce the signatures of 100 economists in favor of a given proposition when another 100 will sign their names to the opposite statement? How does Harvard, for example, justify granting tenure to people who purport to work in the same discipline and publicly condemn each other as charlatans? How are ordinary people, let alone members of Congress, supposed to figure out which tenured professors are the serious economists?…

28. February 2018 at 17:47

OT but in ballpark:

Are market monetarists about to become helicopter pilots?

David Beckworth says that QE is not inflationary and perhaps has little impact as long as people believe the monetary stimulus is not permanent.

Okay, so we hit another recession. We hit zero bound rather quickly. We think QE will be of limited impact as long as the central bank says it will sell the bonds back someday. (QE made even more feeble by IOER).

So, go to helicopter drops.

The Fed used to buy bonds directly from the Treasury, bypassing the whole primary dealers, commercial banks, reserves claptrap.

A nice tool to have in the toolkit, and one that may be necessary in the next recession.

28. February 2018 at 21:46

[…] efficaces marché du logement . Vous pouvez suivez les réponses à cette entrée via le flux RSS 2.0 . Vous pouvez laisser une réponse ou Trackback depuis votre propre […]

28. February 2018 at 23:59

> gas at $4 a gallon, which made enough of those exurban home

> buyers unable to pay their mortgages

That does not make any sense, as additional gas expenses relative to ‘normal’ prices are nowhere near mortgage expenses.

1. March 2018 at 09:04

I think we are returning to old Fed induced recessions and not the asset price collapse.

1) Job markets are tight and labor supply is not increasing enough. We are returning to the 1950s economy with labor supply being the main constraint.

2) With the Trump tax cut, we are on the road to returning to government debt crowding out private investment. (In the post Obama years the government debt dropped enough before could happen.)

3) Short rates are increasing a lot the last 12 months and the drop of 2012 – 2015 commodity prices is reversing.

4) Mortgage debt on single family homes is not exponentially growing like 2004 – 2007. I would watch the Q4 2017 & Q1 2018 Mortgage debt amounts if grows. (January 2018 housing sales are down.)

1. March 2018 at 10:50

The difference in debt levels between 2008 and 2018 is interesting. While, clearly, debt can be destabilizing in a contraction, there is a difference between saying debt caused a recession vs. a recession was made worse when it led to dislocations related to debt.

I see comments in a lot of places that imply that high debt levels caused the financial contraction. But, really, it was the loss of $7 trillion in real estate value that caused the financial contraction. The fact that some of that equity was made liquid through credit markets meant that that decline caused a liquidity crisis.

If the contraction was caused by too much debt, I would ask the question: if in 2010, there had been $12 trillion in mortgages outstanding instead of $10 trillion, would the economy then, and for the 8 years since, have been more stable and more productive? The answer to that clearly is “yes”.

The fear of debt led us into a liquidity crisis. The reason lower debt levels now mean that there is less cause for concern is just because we have imposed a chronic liquidity event the economy for a decade. You can’t fall out of a tree you didn’t climb, but you can’t pick many apples out of it either.

It would probably make sense to structurally make debt less favorable, but to make it structurally favorable and then to counter that with tight and sometimes disruptive monetary policy is not optimal.

1. March 2018 at 10:57

In fact, I think it can be argued that the significant loss in home equity that happened in 2006 and 2007 before mortgage growth flattened, before prices collapsed, and before the recession started was part of an early reaction to the lack of liquidity, and that is why there was simultaneously a collapse in housing and a panic in CDO markets, even while there was a frenzy for liquid securities. Those CDOs were created to meet that frenzied demand for liquidity, but the problem was that the CDOs became unstable because the source of that demand was homeowners trying to make home equity liquid.

https://fred.stlouisfed.org/graph/?g=iNMZ

1. March 2018 at 15:01

Zoning was preventing building homes in Western States like Nevada leading too a huge price run up in those States due to extreme scarcity of homes to buy in 2007?

What about Detroit, Cleveland, etc. Was there a shortage of housing in such cities driving up house prices, but the Fed tight money starved eager home buyers with solid incomes and 20% down payments from buying those housing? Zoning prevented replacing homes with high rise condos for working class families, especially minority families, in those cities?

Why isn’t the economic problem ever caused by businesses paying their customers far too little, and depending on their customers borrowing money they can never repay to generate high growth in business revenue and profits, plus on government giving their customer bailouts to fund the consumption businesses needed in excess of wages from their employees?

SNAP is government funding business revenue and profits.

EITC is government funding business revenue and profits.

In both cases, the consumers steering SNAP and EITC cash to businesses are already working at wages below the consumer spending their employers demand. Or the consumers steering government debt to employers who would never employ them as slaves, ie, zero wages, but they need to provide bread and Water and shelter and striped clothing, because they would never spend any money at any business.

When consumer spending is driven by debt, especially by debt on asset inflation, no business will support increase the supply of assets that deflate asset prices, forcing debt defaults, and a elimination of asset price inflation funded consumer spending.

The GOP is trying to restore the conditions for growth fueled by debt from asset price inflation caused in significant part by restricting asset supply.

2. March 2018 at 06:01

George Colpitts: know any doctors that can predict exactly who will develop cancer this year, or have a stroke?

But so nice to have the medical profession for those who do. In 2008, at least some economists (and others) rightly diagnosed the event unfolding, had researched treatment plan options available, and the relationships with politicians to implement them.

Many would agree: we are better off today because of it.

2. March 2018 at 06:16

Never reason from a (lack of) price change?

3. March 2018 at 09:00

Kevin,

I have a lot of agreement with your 10:50 post. The 2008 crisis was a consequence of bad debt. The situation became the Great Recession because of mismanagement by the Federal Reserve and by the horrible Bush Administration / Treasury Department. Who can ever forget Hank Paulson melting down on TV about the financial crisis – talk about losing one’s head in the moment! Of course his Goldman Sachs faced insolvency so I suppose he was scared to death of what would happen without a bailout for his friends.

Where I differ with Sumner on the 2008 situation is he oversimplifies the complexity of it all. Up through summer 2008 inflation was running above target. Oil prices were in a mania – yes a bubble – and this made it difficult for the Fed to cut rates all the while gas was at $4 a gallon. Then in September the bottom fell out. This is where the Fed should have acted quicker. But they were lethargic and the politicians were even worse. Everyone panicked and started talking about bank runs and a failure in commercial paper and Hank Paulson himself was fueling to the panic!

Of course all of this was nonsense. TARP passed and the markets continued to fall because, as has been pointed out, the banks were known to be insolvent and would be as long as mark-to-market rules were in place. When these rules were changed in March 2009 the risk of more Wall Street bankruptcies was lifted and stocks rose.

Bad policy enabled the crisis and a bad response worsened it. The next crisis, it appears, will be public debt financing – and a repeat of the 1987 – 1990 market and gyrations and the politics of public debt and debt interest and the dollar seems to be on the horizon.

3. March 2018 at 10:14

Dan W.,

Good points.

I think March 2009 also marked the beginning of significant cash injections from QE1, and some other stabilizing policies from Geithners treasury. The mark to market thing does seem to be part of the mix.

5. March 2018 at 16:40

[…] in a recent post, Scott is kinda-sorta taunting the people who warned of the housing bubble, last time around. Since […]