The US has a really weird economy. All our recessions are 100% clear-cut. Either we have a recession or we don’t. Normal countries have borderline recessions. Not us. Either our unemployment rate rises far too little to be viewed as a recession, or so much that 100% of economists agree it’s a recession. I don’t know why that is. And I don’t know why other economists don’t view it as really weird. Maybe people just notice things that happen, not things that don’t. Not dogs that don’t bark.

I believe this weird pattern is about to end, and very soon we’ll have debatable recessions. This post is partly motivated by my previous post on Japan. I don’t think people realize how much changes when your trend rate of RGDP growth becomes zero, or even negative. Some pointed to the fact that Japan is “weird” because unemployment rose very little in the 2007-09 recession. Sorry, but Japan is now pretty normal; it’s the US that is weird. Here’s some crude data using annual changes in RGDP and the rise in unemployment from the 2007 low to the 2009 high. Note that Germany’s recession was confined to 2008-09:

Japan: Drop in RGDP = 6.5%, Rise in unemployment = 2%

Germany: Drop in RGDP = 5%, Rise in unemployment = 2%

Britain: Drop in RGDP = 5.5%, Rise in Unemployment = 2.8%

USA: Drop in RGDP only 3%, Rise in Unemployment = 5.5%

Quarterly data would be slightly better, but wouldn’t change the overall pattern. A relatively large fall in RGDP in other countries doesn’t lead to much extra unemployment. That’s partly lower trend RGDP growth (Germany and Japan have falling populations) and partly the more flexible US labor market.

And now it looks like the US trend rate of RGDP growth will fall from 3% to barely over 1%. After we “recover” it will no longer be unusual to see two straight quarters of falling RGDP. But will they be true recessions? Or the sort of phony “recession” that people think they are seeing in Japan, and that was reported in the UK a couple years ago, which later vanished with revisions in the data? (I’m referring to Britain’s triple dip; even the double dip was very debatable, with only a 1/2% rise in unemployment.)

Is it possible I’ll be wrong about the US trend growth? Sure, a change in immigration policy, or supply side reforms to boost the LFPR could help, but I don’t see much sign of that happening. The prime age workforce will soon stop growing, and productivity growth is slowing as well. Get ready for lots of phony “recession” stories, especially when the party in power is not well liked by the intelligentsia. (Which party would that be in America?)

PS. I believe I was the first blogger to blow the whistle on the phony 2011 tsunami “recession” in Japan. I’m still waiting for the delayed unemployment effect from the tsunami . . .

Japan has supposedly been in recession for 7 months—I’m sure their unemployment rate will soar any day now. Especially with Japanese firms complaining they can’t find enough workers to fill the job openings.

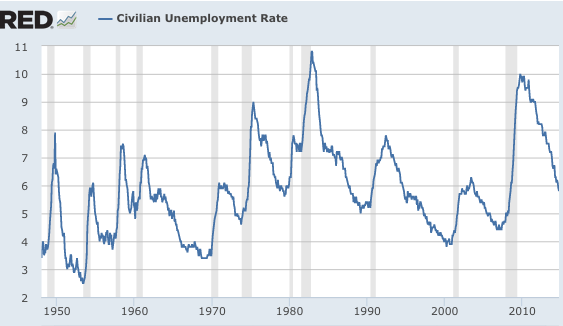

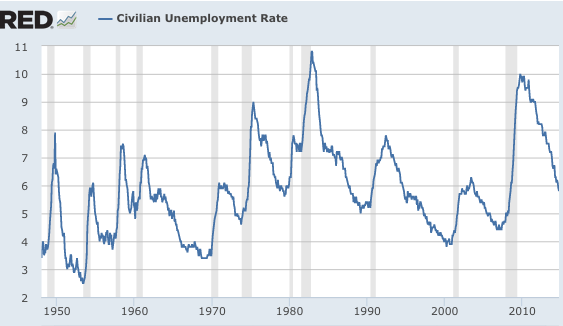

Update: For those that have trouble understanding why there are no debatable recessions, consider the following graph. During an actual recession, unemployment rises by at least 2%. When there is no recession the biggest rise was 0.8% in 1959 (nationwide steel strike) and that was really brief. Look at that tiny spike in 1959, then look at the actual recessions, and marvel at the vast difference.

Note how different it is from a random walk graph (like the stock market) where you see small, medium and large fluctuations. All we see are small and large, no medium.

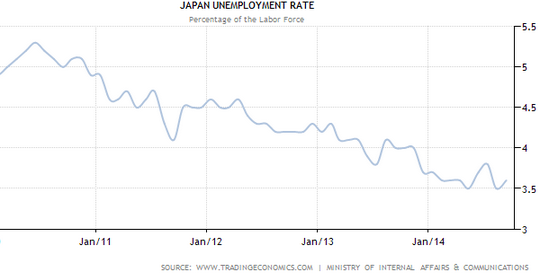

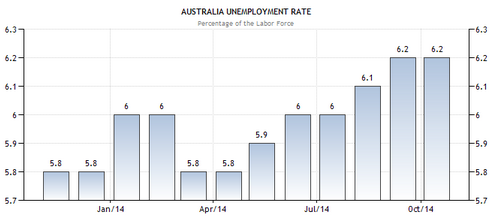

the past 12 months:

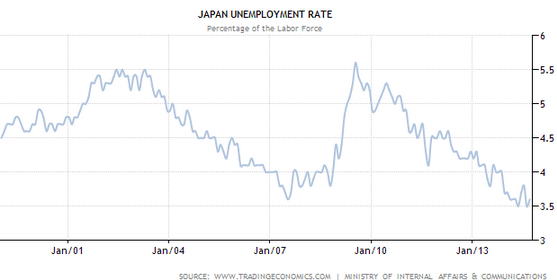

the past 12 months: