Yes, the Fed is serious about creating inflation

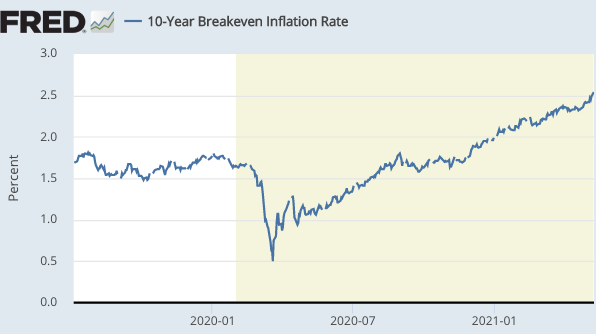

In 2020, I got a great deal of grief from people who thought I was naive when I suggested the Fed’s new AIT regime was a big deal, and that it would lead higher inflation going forward. When TIPS spreads were 0.6% last March, I suggested that TIPS might be a good investment.

What do you people say today?

Tags:

11. May 2021 at 12:44

That chart tells you something about the relative performance of T-bonds and TIPs, but it really doesn’t tell you about the total returns of TIPs.

iShares says the TIP ETF rose (on a total return basis) 10.9% in 2020, but was down -1.7% in Q1. It has an average maturity of around 8 years. A comparable government bond ETF is IEF, which rose 9.8% in 2020, but is down -5.8% in Q1. So it looks like not a lot of difference in 2020, but a better outperformance in Q1 2021. What you’d really need to do is go long TIPs and short Treasuries and then lever it up.

Compared to equities, of course, bonds underperformed.

11. May 2021 at 12:53

John,

If you’re going to grade him on his call you have to get the timeframe right. TIP is up 17.27% from March 19th, 2020 to yesterday, versus -0.59% for IEF.

11. May 2021 at 12:56

John, Good point, and my specific suggestion was that TIPS would probably do better than T-bonds.

Thanks Garrett.

11. May 2021 at 13:00

Scott,

Looking at the real yield curve right now (link below) I see -1.88% 5-year real rate and -1.29% 7-year. That implies the real rate curve will be completely positive around 2027. Do you expect real rates to rise faster than that?

11. May 2021 at 13:06

Forgot the link:

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield

11. May 2021 at 13:58

Dear Scott,

What is your response to this critique from Neil Wilson:

https://new-wayland.com/blog/too-much-money/

@It is too much demand for too few goods and services that may cause prices to rise. Demand is desire backed by the ability to pay – which could just be a decent line in credit from a bank, since banks create money. Similarly the quantity of money in the economy according to the ‘money supply’ figures may not be causing any demand at all, because it is held by people as savings, either as a status symbol or as insurance against an uncertain future. They do not desire to spend their money. (See Japan for details).

Or it may be that the supplier simply runs out at the current price, in which case the demand remains unfulfilled and the money stays in the bank – introducing a mathematically intractable time delay into proceedings that mainstream cognitive dissonance appears permanently unable to detect.

The mainstream belief is that money can only be treated as static if it is exchanged for bonds paying a different interest rate. Until then all of it is permanently in motion – as though saving in a bank never happens. It’s a ridiculous notion at odds with the real world.

What we have here is the ‘loanable funds’ belief creeping in by the back door. The crazy idea that some magical interest rate will arise that will balance savings and borrowings – such that all ‘money’ things will flow in a perfectly offset manner. That doesn’t happen in the real world where money is created and destroyed constantly via the actions of the financial system.

Dynamically, the usual state of affairs is that there is an excess of saving over borrowing by the private sector. That constant drain to savings has to be accommodated or the fiscal drag will collapse the economy. That accommodation tends to show up as less tax collected than government spends.

Should it ever switch around the other way, then the extra spending from savings will cause additional taxation to arise and a government surplus will appear, or, more likely, the savings will move abroad which will show up as increased imports and a widening trade deficit.

None of these things require a shortness of breath and an increased pulse rate. They are a natural consequence of the correct understanding of the monetary system.

One using the lens of Modern Money.’

11. May 2021 at 16:21

Lester, MMT still makes as much or little sense as the last time Scott talked about it.

11. May 2021 at 16:38

But have they retained the ability to correct for an overshoot should it occur?

11. May 2021 at 16:42

Garrett, I don’t have a strong view on that.

Kester, I have a long critique of MMT over at Econlib (Two parts)

Effem, Yes, but I’m not at all confident that they will do so in a timely manner. I hope so. We shall see.

11. May 2021 at 17:38

Doesn’t the Fed have to overshoot at least a little bit to retain credibility about the average inflation target? I would think that if the Fed moves too quickly to a disinflationary policy, everyone will just assume that the Fed has gone back to a 2% ceiling. If we don’t see higher inflation that isn’t ruinous, how will the Fed sustain an average inflation target throughout a changing of the guard on the board of governors?

12. May 2021 at 01:50

I was a little slow, but I moved my personal Treasury allocation from long-term nominals into short-term TIPS in mid-June last year. +6.86% vs -12.05% since then. Should have shorted the long-terms!

12. May 2021 at 06:16

Obama supported rising asset prices because it was what was on offer to overcome the financial crisis and great recession. Trump supported rising asset prices because he is Trump and Republicans always support rising asset prices. Biden supports rising wages because he is Biden and isn’t hamstrung with the economic mess Obama inherited. That a policy of rising wages causes the investor class to have a hissy fit says a whole lot about the investor class. I have nothing against the investor class, but isn’t it about time that workers experience a rise in wages after all these years of rising asset prices and rising net worth of the investor class? How long is the investor class going to engage in class warfare?

12. May 2021 at 06:33

It’s like I said, inflation peaks in April (reported in May). Inflation is the most destructive force capitalism encounters.

12. May 2021 at 06:47

I’m sure economists will be just as vocal about the Fed correcting an overshoot as they were an undershoot…

12. May 2021 at 06:54

A suppressed or even negative yield curve, reflecting an excess of savings over real-investment outlets (and associated mal-investment), stems from the fact that adding infinite money products (QE-Forever), decreases the real-rate of interest ( – R *), has a negative economic multiplier, and depresses the exchange value of the U.S. $.

Whereas the activation and discharge of monetary savings, $15 trillion in commercial bank-held savings (income not spent), of finite savings products (near money substitutes), increases the real-rate of interest (+ R *), produces higher and firmer nominal rates, and has a positive economic multiplier.

12. May 2021 at 07:00

The solution to Alvin Hansen’s chronically deficient AD, is to drive the banks out of the savings business – making them more profitable.

12. May 2021 at 07:34

We have a strong CPI report today and equities tank. I wonder: “What did the market think 2.71% breakevens meant?”. This next year will be the test for the Fed, can they stand up to the pressure, get the relevant parts of the public comfortable with 1990s levels of inflation?

Unfortunate the supply side hit of enhanced unemployment benefits is happening now, but it doesn’t matter so much. The essential task, as I see it, is to stand up to the various voices who will start talking about Zimbabwe and Weimar Germany in the face of a few months of 3.5% YoY CPI. You can stare down those fools with supply-side or demand-side inflation

12. May 2021 at 07:40

Chairman Jerome Powell: “there was a time when monetary policy aggregates were important determinants of inflation and that has not been the case for a long time”

The CPI in January was up 0.3%. It was up 0.4% in February, 0.6% in March and now 8% in April

Long-term, ex-ante, money flows, proxy for inflation:

12/1/2020 ,,,,, 1.26

01/1/2021 ,,,,, 1.31

02/1/2021 ,,,,, 1.40

03/1/2021 ,,,,, 1.51

04/1/2021 ,,,,, 1.54

12. May 2021 at 08:12

Lizard, They are currently doing exactly what you recommend.

Tacticus, Good move.

12. May 2021 at 08:40

re: “how will the Fed sustain an average inflation target throughout a changing of the guard on the board of governors?”

Powell has changed more things on the fly without outside consensus. But Biden’s infrastructure bill will have to pass in order to keep the economy buzzing.

An increase in money products is counterproductive. No, contrary to Bankrupt-u-Bernanke’s claim that: “Money is fungible”…“One dollar is like any other”, pg. 357 in “The Courage to Act”, the utilization of savings is a catalyst, it is not a matching of economic accounts, not a 1-2-1 economic transaction (correlation between two sets).

This is aptly demonstrated by debits to particular deposit accounts.

The regulatory release (yes it is up to Congress), of savings invokes a spontaneous chain reaction, an expanding sequence of reactions, a self-propelling and amplifying chain of events. In other words, savings’ products have a positive economic multiplier (and $15 trillion are frozen), whereas new money products (QE forever) have a negative economic multiplier.

How could this be? It is because lending by the commercial banks is inflationary, whereas lending by the nonbank public is non-inflationary (if savings are not expeditiously activated, put back to work, then a dampening economic impact is generated).

And if savings aren’t activated, velocity falls, AD falls, and the FED must inject digital dollars.

12. May 2021 at 12:37

Economists don’t know a debit from a credit. Banks don’t loan out deposits, deposits are the result of lending/investing.

Savings flowing through the nonbanks never leaves the payment’s system, there is just an increase in the supply of loanable funds, a velocity relationship. Where do you think velocity has gone since 1981?

The U.S. Golden Era in Capitalism was where monetary savings were expeditiously activated and invested in real investment outlets.

12. May 2021 at 14:14

well, he (Powell) now faces the forces of inflation fear—the ghosts in our closet since 1980. Even as he said we want average inflation at 2%.He did say in April the “base effect” (low inflation last march and april) would cause higher headline inflation this year for the next few months—-before dropping back to…..? some target still above 2 I assume. cannot tell what market fears more—a tightening or a crazy Fed letting inflation go haywire. Really, the market fears uncertainty—-but should there be uncertainty–beyond normal? Is this number really “unexpexted inflation” (basically the only real kind)–5 year breakeven inflation is same as Monday. He just TOLD us it would be highewr than normal.

But now we fear economy is weaker than we thought—is it? He is not going to tighten. Well at least we don’t have Trump around any more confusing everyone :-).

12. May 2021 at 18:16

Michael, It seems like you mention Trump in every single one of your comments. Just let him go; he’s no longer president.

12. May 2021 at 18:22

What does higher expected inflation mean (if anything) for stock prices? For house prices? For rents?

12. May 2021 at 18:28

Trying to learn, It depends whether it’s demand or supply side inflation, and whether it’s above or below the Fed’s target. Stocks typically do well when inflation is low but positive, and close to target.

13. May 2021 at 00:13

‘ “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

― Warren Buffett’

13. May 2021 at 03:07

Scott——tit for tat—-yes. But I really don’t care about Trump—-except I really do wish he would disappear off the political stage—He had his day——and he could not win—-however close—-and if others did cheat——why didn’t they prevent it? Or be more persuasive in the close states. Because he did not know how too. And he should have——but he also did not stand much of a chance once some percent believed he “killed 100s of thousands of people” as Biden said, cheered on by a grotesque media and even writers on this site. Okay, that’s my last apologia on Trump.

This essay’s title is odd. Of course AIT would mean forward inflation should have been expe

13. May 2021 at 03:25

Expected to be higher——-but average inflation not. Short term yes, long term No. You criticized correctly Yellen’s seemingly political hypocritical odd support for the massive spending bills—-but when Powell’s term is up do you think she will support him? I don’t—nor will it be her decision. Powell himself may start losing his nerve. We are calling the current times “supply side” shortages—-caused by policy——but maybe we have exaggerated job openings.

Blogs (especially on monetary policy) are for commentary on the actions of the day——which is why I read this. I don’t care if you name names——I want your views on policies that matter. Obviously it’s your blog, do what you want. Just telling you what I wish you would discuss.

13. May 2021 at 06:10

It looks like PCE is already back to level. So by the same logic that tips were undervalued in March 2020, aren’t they slightly overvalued now?

13. May 2021 at 09:43

Dale, Maybe, but TIPS adjust to inflation with a lag, so the recent inflation spurt is not yet priced in.

14. May 2021 at 13:06

Because mainstream people have a fantasy of an unobservable “real interest rate” that exists and they are trying to locate because that determines the growth path of the economy.

They see the economy sort of like a water bed and believe that if you press down in one area with ‘nominal demand’, it must pop up another area via ‘inflation’.

So you’ll here such sage comments such as “the central bank can set the nominal interest rate, but it can’t set the real interest rate”, usually in a tone that implies that is some kind of information rather than a form of religious affirmation.

MMT institutional analysis never even uses the term