Why do you care about recessions?

I recently discussed the current German recession, which is accompanied by a very strong labor market. In a recent post, Tyler Cowen provides a summary of Czechia’s recent recession, which shows the same pattern. In another post, he links to a Jason Furman tweet on the puzzling pattern of US growth in income/output:

Unlike many other countries, the official (NBER) definition of recession does not involve two negative quarters, but lots of people wrongly believe it does.

I’m interested in another question—why do we care about recessions?

I cannot be certain, but I suspect that many people fall for the following logical fallacy:

A implies X

A is strongly correlated with B

B implies X

I think I know why we care about recessions. Recession are generally associated with lousy labor markets. The high unemployment of the 1930s was such a severe social problem that it put macroeconomics on the map as an important field of inquiry, and as an area of interest to government policymakers.

In the US, recessions are highly correlated with two declining quarters of GDP. But the correlation is not perfect. There was clearly a recession in 2001, but we did not experience two consecutive negative quarters. There was clearly a boom in early 2022, but we did experience two negative quarters.

I suspect that many people are making the following logical fallacy:

We all know that recessions are traditionally associated with really bad labor markets (true). Thus past recessions have been important events (true). Recessions are almost always correlated with two negative quarters (true). Thus future cases of two negative quarters will be important events (false).

Here I’m dodging the question of whether two negative quarters are “actually a recession”, which is about as uninteresting a question as one could imagine. Who cares?

[Actually, I can think of an even dumber question: Is economics a science? Watch me move right along at the cocktail party when I hear that one.]

I’ll tell you who cares about recessions—dumb people who believe that words have magical powers. “If only I could convince you that this is a recession!” Yawn.

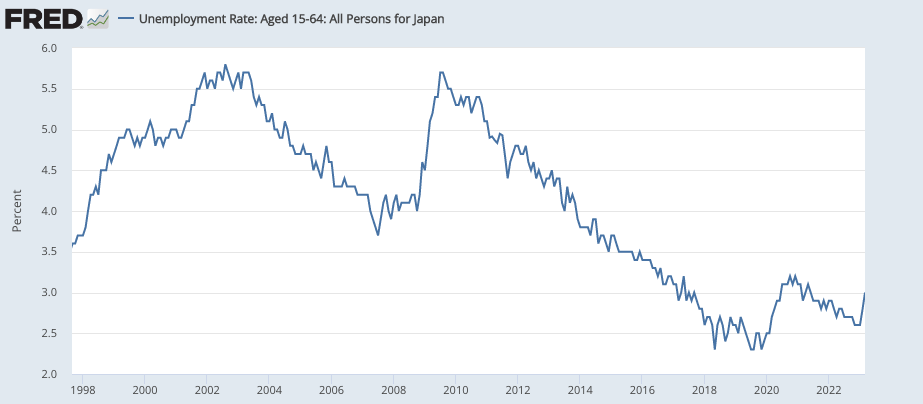

It’s not that I think you are wrong; it’s that I don’t care. Japan had a bunch of recessions in the 2010s. Do I care? No, none of them showed up in the labor market:

It’s incredibly uninteresting to see a slow growth economy alternate between slightly positive quarters and slightly negative quarters.

The entire world is now becoming more like Japan, with ever slower trend GDP growth rates. In the future, there’ll be lots more of these “recessions” with booming labor markets.

This is why the “Will there be a recession?” debate is so dumb. I don’t care whether the US experiences a recession; I’m simply not interested. The interesting question is whether the US will experience the sort of recession that we experienced in the past, where the unemployment rate always rose by at least 2 percentage points.

Now that’s an interesting question.

The German and Czechia recessions are so boring that the news media should not have wasted any ink reporting on these two events. No one cares.

PS. Another really dumb topic is “greedflation”. I’ve stopped even reading the articles. Josh Hendrickson brilliantly nails the underlying problem here:

This brings me inevitably back to so-called “greedflation.” This story is an attempt by people to treat every bout of inflation like isolated cases that require the fresh eyes of a new detective.

It’s even worse. Lots of economists also think we need to treat every recession like isolated cases requiring detective work. It’s (almost always) the falling NGDP, stupid. (Covid in 2020 was the exception that proves the rule.)

PPS. BTW, US productivity and output growth was overstated in 2020 and is now being understated. The longer run figures are more accurate.

Tags:

1. June 2023 at 10:19

Negative quarters (an absolute decline in real output) are associated with negative roc’s in M*Vt. Employment is not the only fallout. Tax receipts decline too – raising fiscal deficits.

1. June 2023 at 10:47

A recession means the economy is being run in reverse.

1. June 2023 at 12:05

My guess is that if Scott is correct that labor markets will remain strong through the next recession, then equity prices will be hit even harder than they usually are at the beginning of a recession.

From the NBER website: “The NBER’s definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months”

So, if in the near future we see “a significant decline in economic activity that is spread across the economy and lasts more than a few months”, then firms’ earnings should be lower. In the past, they would have laid off workers or cut wages to shore up their bottom lines, but if they can’t/won’t do that this time around then I would expect earnings to be hit harder than one would expect looking at past recessions.

The interesting question to me, if we see this occur, is why aren’t firms laying off more people?

1. June 2023 at 13:33

MSS1914, I have no crystal ball on the job markets. I do notice that everywhere I travel I’m told the service sucks because firms can’t find enough workers. I don’t recall that in earlier expansions—something seems to have changed in the labor market. But certainly a severe enough recession would drive unemployment much higher. The exact timing of recessions is close to impossible to predict.

1. June 2023 at 13:43

Scott is right about N-gDp targeting. It’s the tangible/verifiable side of the equation of exchange. I.e., you can’t calculate P & T.

But economists are wrong about the savings->investment process. Banks don’t lend deposits. Just like electricity, the flow is one directional.

2021-01-01 11.7

2021-04-01 13.8

2021-07-01 9.0

2021-10-01 14.3

2022-01-01 6.6

2022-04-01 8.5

2022-07-01 7.7

2022-10-01 6.6

2023-01-01 5.4 (2nd qtr. might be a cause for changing directions).

1. June 2023 at 15:16

A nation with tight labor markets is a happy country.

1. June 2023 at 15:27

Latest unit labor cost figures, released yesterday, seem to point away from a wage-price spiral.

By the way, old timers will remember when The Wall Street Journal proclaimed that any rate of inflation under 5% was good enough, and that was when Ronald Reagan was president.

Now people get the heebie-jeebies when inflation is trending towards 3%.

1. June 2023 at 18:57

Yes, long-term real and nominal Treasury yields are at highs not seen in over 10 years, but inflation expectations are below target and we have relatively low unemployment. Also, the dollar is strengthening again. Looking more like estimates of RGDP growth are rising. Some previous Great Stagnation types are now techno-optmists.

I maintain that the primary problem all along was tight money. We’re now seeing the power of looser monetary policy, even if it did get too loose for a while.

In fairness, some of the recent developments in technology might already be driving these better macro numbers.

1. June 2023 at 20:38

Recession confirmation bias seems to be a type of populism. Populists want to point to evidence that the elites in power are screwing up. Recession is one of a handful of economic terms that most people understand is bad. (Some people may even just equate recession with a “bad economy”.) So, even when bad economic policies are likely to say reduce long term growth but not necessarily impact business cycles, populists want to say that the policies are causing a recession. One can’t actually see reductions in long term growth rates, except over many years. Elites are also notorious for playing word games and spin-meistering, so when elites try to explain to populists that an easily applied definition like 2 consecutive quarters of negative GDP growth doesn’t always mean a recession, that just stokes populist suspicions even more.

1. June 2023 at 21:23

BC, Sounds right.

BTW, have you noticed how people increasing use the term “populist” as a euphemism for “stupid people”. I’m certainly not saying all populists are stupid, just noticing that this is the clear implication of how the term is used today. Like when people say “young urban males” to represent minorities living in big cities.

1. June 2023 at 21:42

The reason you “move along” at the cocktail party, when someone asks an profound question, with profound consequences upon society, is because you are not a powerful thinker.

Glenn Loury spoke about these concerns just recently, because unlike you Glenn is a real intellectual powerhouse. Thomas Sowell and Walter Williams, among many Austrians, have also expressed their concerns over economists pretending they are practicing science.

In other words, when you draw bad conclusions, because your axioms and premises are flawed, and when you use these conclusions to build policy proposals predicated upon fallacies with very little predictive value, and with the audacity to do so under the banner of science, and with negative effects upon millions of people, then one needs to have a discussion about what science actually is; and that discussion will eventually involve placing you and the entire branch of monetary economics, along with most of psychology, into the dustbin of history along with eugenics and alchemy.

And when your peers claim to create models of human behavior, without accounting for the unpredictability and variance that exists between individuals, their goals and objectives, then you are practicing pseudoscience not science.

Keep in mind, also, that you told everyone inflation would be moderate and transitory, and not to listen to those conspiracy theorists predicting a year or two of elevated inflation. That was your prediction.

And you were wrong and the Austrians were right. Why? Hmmm…

Because you don’t know what you are talking about. Your model is garbage. It makes no sense. None. Nada. Zero. Just like your one world NATO.

2. June 2023 at 00:50

Actually, if you dig deep into the data, one begins to see some serious manipulation. It’s as if Stalin himself is providing the data.

This article nails it down.

https://www.zerohedge.com/economics/all-new-us-jobs-covid-crash-have-gone-foreign-born-workers

In short, there are no new jobs. It’s just a fairy tale. The economy has lost jobs, which as we know correlates with recession.

2. June 2023 at 01:31

You said.. “It’s (almost always) the falling NGDP, stupid. (Covid in 2020 was the exception that proves the rule.)”

First, why are you calling people stupid?

Secondly, it’s not everyone else. It’s you. Your model doesn’t provide any value. The very fact that you state there is an “exception to the rule” makes it totally unreliable. It’s like the hedge funds that use statistical indicators. They look at a period of time, and create an indicator which works for a while, then when the indicator fails they claim the failure was just an exception; then it keeps failing and they go out of business. Then, someone comes along and revises, and creates another indicator which works for a short time, only to fail later.

We can restate this another way; if gravity worked most of the time, then suddenly there was an “exception to the rule”, we’d have a real problem on our hands.

You say words don’t matter, but they do matter.

Language is a tool used to convey meaning. Definitions are extremely important. The whole point of monetary economics, according to monetary economists, is to avoid recessions. Therefore, if the goal is to avoid a recession then one needs to define what a recession is. You cannot avoid what you cannot define.

Now if you want to argue recessions don’t matter, then let us also ask if monetary economics matters. Does targeting inflation matter. Does targeting NGDP matter: when in your own words it’s a model with “exceptions to the rule.”

You’re simply digging a bigger hole for yourself to climb out of.

2. June 2023 at 05:28

Wow, the May jobs number was a blowout, all while inflation breakevens continue to fall. More support for the perspective that current inflation is largely supply-side and/or the result of lagged data. Also, potentially increasingly consistent with a growing productivity boom.

The Chatbot I designed a couple of weeks ago, just automating updating prompts for GPT-4 in reference to a dataframe or database, not only allows for automated assistance on websites, but for automated email handling, and even omni-channel customer service/sales generally. More broadly, however, it can also be expanded into a complete operating system, for external or internal customers, for data analytics, CRMs, etc.

I developed this in 2 hours, with a few more hours to polish the design. I’ve been coding for a few months. Nearly anyone can do things like this now, fast.

In addition, I’ve automated nearly all of my Excel processes. I’m still building a website from scratch, which is slower going, given my lack of experience and the use of so many coding languages, such as Python, JavaScript, HTML, and CSS, and the need to coordinate code between the frontend and backend…

How many millions of others are doing likewise, with little or no coding experience?

2. June 2023 at 05:31

Where can I read cogent theories about the GDP-GDI divergence?

It seems simply ignoring the divergence and saying “take the average” might be ignoring a possible explanation for a full employment recession?

2. June 2023 at 05:57

@ sara:

The Austrian economists don’t know a debit from a credit. ABCT is tripe.

Lending/investing by the DFIs expands both the volume and the velocity of new money. Lending by the NBFIs increases the turnover of existing deposits (a transfer of ownership), within the commercial banking system.

It is much more desirable to promote prosperity by inducing a smooth and continuous flow of monetary savings into real investment, than to rely, as we have done c. 1965 (with the advent of interest rate manipulation as the FED’s monetary transmission mechanism), on a vast expansion of bank credit with accompanying inflation to stimulate production.

2. June 2023 at 06:10

@ Michael Sandifer:

Chat GPT is only as good as the conventional wisdom.

2. June 2023 at 08:03

Sara, Have fun debating the meaning of words!!

Michael, It’s all demand side inflation—just look at NGDP. The NGDP overshoot is very similar to the inflation overshoot. Supply is fine.

Todd, These divergences often get removed when data is revised. I wouldn’t focus on it; it’s a minor issue.

2. June 2023 at 09:55

Scott,

Ceteris paribus, I agree that NGDP being above trend would be strong evidence for demand-side inflation, but much of the rest of the evidenece seems very inconsistent with demand side inflation right now.

How do you explain what are now well-below target inflation breakevens, despite real and nominal interest rates that are at 10+ year highs? Do you think there’s something wrong with the Treasury markets? We know there are flaws in those markets, due to government input into design. Those problems seem to primarily show themselves during acute crises.

And, as you’ve noted, the Fed Funds futures curve has been inverted for quite sometime. The Fed Funds rate is expected to come down, while long-term interest rates are apparently expected to remain at 10+ year highs.

Also, the stock market is predicting significantly higher than 4% nominal growth, with growth expectations riseing, despite very low and falling inflation breakevens.

With regard to what would be an unusually early effect of a new technology on productivity growth, the stock prices of the leading players in AI are up well above gains by the broader market since the debut of ChatGPT last November. Nvidia, Microsoft, Alphabet, Meta, Apple,…etc.

NGDP can both above the previous growth trajectory and quite appropriate as a new starting point for NGDP level targeting.

2. June 2023 at 09:58

Scott,

Oh, and I nearly forget to mention that we know we’re in the midst of real shocks right now, related to the war in Ukraine, inefficient shifts to industrial policy(with some of the negative effects temporary as the economy adjusts), and we’re still not entirely out of the grips of pandemic-related problems yet.

2. June 2023 at 10:00

What about other negative developments such as real wages? According to the newspaper WELT we had a 4% slump in real wages in Germany in 2022. The biggest slump measured since World War II by far. I may link an illustrative graphic if there is some interest and if the link comes through.

As we all know, wealth can shrink massively in other ways. You don’t have to have more unemployment. Nor is it the case that there has been no increase. Compared to May of last year, the number of unemployed has risen by 284,000 this May, which is more than 10% of the 2.5 million unemployed. The agency does not provide any information on the percentage point increase, and I am too lazy to look it up right now.

Not to mention that it is extremely hard to become unemployed in Germany with these layoff rules anyhow. Or think of German inventions like “Kurzarbeit”. Invented around 2008 in times of the financial crisis, some companies have been doing this since then almost every year, basically for 15 years. Another trick: unemployed people are very quickly removed from the unemployment statistics and simply retired or written off sick. The GDR had quasi 0% unemployment for years on paper and how many recessions?

I am not saying that the FRG is the new GDR, but the trend is very clearly going away from a free market economy in nearly all relevant areas.

2. June 2023 at 10:28

@Scott “I’m told the service sucks because firms can’t find enough workers”.

Another phrasing is that service sucks because firms are not willing to pay sufficient wages to attract enough workers.

2. June 2023 at 11:23

No sarcasm intended. But I have never seen so much meaningless sounding ideas. My awareness that I don’t know what we are talking about for some reason makes me feel safe.

I miss the good old days of wet markets and COVID. I do like that S&P up 13.5% this year. I like amazing number of jobs. 10 year bonds have flattened at about 3.5%. I especially like the Lucy Charlie Brown game we play every year about the scary threat to default. S&P is probably up because this year we believed it.

If it isn’t obvious, I have no idea what anyone is talking above it. That includes me.

I am sure Spencer is a comic. How many times does he need to tell us that banks don’t lend deposits? When did anyone think they did? I think I might be the only one who has commented on this —I am probably the only one who doesn’t know he is joking.

Michael Sandler is an AI specialist. Great. Did not know that.

Stocks up, bonds flat, unemployment low, China a “nothing burger”. Russia is farce.

It all seems good to me

2. June 2023 at 11:37

Michael Rulle,

My whole point is that I’m a novice, and have been able to acheive things that used to take years of coding experience.

2. June 2023 at 11:47

@Solon…the US has tight labor markets. Does it seem like a happy country to you?

2. June 2023 at 11:54

@Michael Rulle:

“Stocks up, bonds flat, unemployment low, China a “nothing burger”. Russia is farce.

It all seems good to me”

Thanks Biden?

2. June 2023 at 15:16

https://fred.stlouisfed.org/series/CES0500000003

This chart shows total hours worked in the US economy worked in the US economy. It actually spiked during the pandemic (!) and has been rising since.

This strikes me as good news.

3. June 2023 at 03:22

msgkings—-no, not thanks Biden. There is no correlation between party in power and economic and market outcomes. It raises a thousand questions——-all interesting and all impossible to answer.

Non-economic out comes are likely correlated to party in power (e.g., abortion, gender fanaticism, war, the the desire to despise the other party, and so on). But not economic and market outcomes. Don’t know why——but it has always been the case.

3. June 2023 at 05:02

@Michael Rulle

The complete deregulation of interest rates was a conspiracy perpetrated by the ABA. Ask Dr. George Selgin for a rebuttal.

See: “Profit or Loss From Time Deposit Banking”, Banking and Monetary Studies, Comptroller of the Currency, United States Treasury Department, Irwin, 1963, pp. 369-386

The banksters didn’t like it so they paid off the economists debating the subject (to not discuss it any further).

It is simply dismissed as the demand for money. And that’s why my time series works.

3. June 2023 at 05:20

The correct response to stagflation is to tighten the monetary screws and drop the administered rates at the same time.

The 1966 Interest Rate Adjustment Act is the answer.

Reducing deposit insurance is the answer (see Dec. 2012 reduction)

Leonardo Da Vinci said it best: “Before you make a general rule of this case, test it two or three times and observe whether the tests produce the same effects”

The S&L crisis (“the failure of 1,043 out of the 3,234 savings and loan associations in the United States from 1986 to 1995”), is the antithesis.

3. June 2023 at 05:30

see: https://centerforfinancialstability.org/amfm/Divisia_Apr23.pdf

That’s why Scott Sumner doesn’t like money #s. William Barnett is saying were already in a recession when N-gDp is @ 2023-01-01 5.4%.

3. June 2023 at 05:42

Chat GPT’s answer as to what is an intermediary:

An intermediary financial institution, also known as a financial intermediary, is a firm or institution that acts as a middleman between borrowers and lenders, facilitating the flow of funds between them. These institutions play a crucial role in the financial system by connecting individuals, businesses, and governments that have excess funds (surplus units) with those that need funds (deficit units).

Examples of intermediary financial institutions include banks, credit unions, insurance companies, mutual funds, pension funds, and investment banks. Each type of institution performs specific functions within the financial system, such as accepting deposits, providing loans, offering insurance products, managing investment portfolios, or underwriting securities.

Intermediary financial institutions provide several key services, including:

Mobilization of Savings: They gather funds from individuals and entities with surplus money and pool them together to create larger amounts available for lending or investment.

Risk Transformation: Financial intermediaries help manage and mitigate risks associated with lending and investing activities. They achieve this through diversification of portfolios, spreading risk across a range of assets, and using risk management techniques.

Provision of Credit: Intermediaries provide loans and credit facilities to individuals, businesses, and governments, thereby enabling economic activities and promoting growth.

Payment Services: Banks and other financial institutions offer payment and settlement services, such as checking accounts, debit cards, wire transfers, and electronic fund transfers, allowing individuals and businesses to conduct transactions efficiently.

Asset Transformation: They transform the financial assets held by depositors or investors into other forms of assets, such as loans, mortgages, or securities, which are more suitable for the needs of borrowers and investors.

By performing these functions, intermediary financial institutions enhance the efficiency and effectiveness of the financial system, channeling funds from savers to borrowers, allocating capital, and facilitating economic development.

No. Never are the commercial banks intermediaries in the savings->investment process.

3. June 2023 at 08:09

Michael, Where were those breakevens a year ago? This is why we need level targeting.

Foosion, You said:

“Another phrasing is that service sucks because firms are not willing to pay sufficient wages to attract enough workers.”

Here’s an even better phrasing: “Because of recklessly expansionary monetary policy, the profit maximizing wage for companies is too low to attract the needed workers.”

3. June 2023 at 10:17

Loans = Deposits

UNIVERSITY OF KANSAS Prepared by:

Department of Economics Leland J. Pritchard

Professor Emeritus of Economics

CONSOLIDATED CONDITION STATEMENT FOR COMMERCIAL BANKS AND THE MONETARY SYSTEM

Item 1939….. 1979

Loans and Investments 40.7….. 1229.8

Cash & Due from banks 22.5….. 169.5

Total Assets—Total

Liabilities & Net Worth 65.2….. 1480.3

Demand Deposits 32.5….. 400.5

Time Deposits 15.3….. 675.8

Borrowings –….. 180.5

Currency outside the banks 6.4….. 106.1

Reserve Bank credit 2.6….. 128.3

MONETARY AND BANKING CHANGES

End of 1939 to end of 1979

(figures in billions of dollars)

Net effect on the volume of time and demand deposits and borrowing of all factors, except commercial bank credit (principally capital accounts) …..13.5

Net expansion of commercial bank credit….. 1189.1

Net increase in time and demand deposits and borrowings….. 1202.6

SOURCE: Computed from data reported in All-Bank Statistics, U.S. 1896-1955; Federal Reserve; and the Federal Reserve Bulletin

3. June 2023 at 11:44

Scott,

A year ago the 5 year breakeven was above 3% in CPI terms. Even I became somewhat concerned as it approached that level last year, but that was last year. The Fed has tightened policy and breakevens are now below target in core PCI terms.

Of course, explicitly, at least, whether under the Fed’s current asymmetric average inflation targeting regime, or NGDP level targeting, we should not necessarily care about inflation or inflation expectations being above 2%. The Fed regime mentions no timeline for its average target.

I doubt you disagree that we’re still in the midst of some negative supply shocks, but you can correct me if I’m wrong. How much of the current inflation do you attribute to these various shocks versus monetary policy? It’s not as if I’m just assuming we have negative shocks.

Also, how much of the current high inflation numbers is due to lagged components?

3. June 2023 at 19:41

Michael, I don’t think the aggregate supply situation is any worse than a year ago, thus I attribute 100% of the inflation over the past year to demand. Price rises due to reductions in supply in some industries are roughly offset by price declines in other industries due to improving supply.

4. June 2023 at 00:17

Savings flowing through the nonbanks increases the supply of loan funds, but not the supply of money. Just why do you think stocks are going higher?

4. June 2023 at 04:55

Michael Sandler.

I really did find it interesting—-will take a look myself. Not persuaded we are really discussing the same concept——-but will look anyway.

4. June 2023 at 05:53

Speaking of the PS and isolated cases… Isn’t that what’s going on with minimum wage “science” lately, too? It’s analogous to me releasing CO2 in my back yard, measuring the resulting temperature data there, and then coming forth with my conclusions about global warming. Based on what we already know, it just seems like intellectual bad faith.

4. June 2023 at 06:26

Scott,

So, do you predict inflation will be signifcantly above 2 percent 5 years from now, in core PCE terms? If not, should the Fed care that inflation is high now? I thought market monetarism was about using forward-looking indicators, rather than looking out the side windows and rearview mirrors.

Sure, NGDP level targeting implicitly needs a memory, but how far back do we go to caculate the baseline? We still disagree on that.

And then there’s the question of what do to if we end up with permanently higher prouctivity growth, or even growth in productivity growth. You’ve seemed to favor not adjusting NGDP level targets for higher productivity growth, but I suspect you’d agree that if the jump in productivity growth was large and sudden enough, the NGDP level target would need to rise to avoid unncessary unemployment.

To be clear, I’m not saying we’re experiencing such a large, sudden growth in productivity right now, but we should not entirely rule it out, nor rule out it occurring sometime in the fairly near future.

4. June 2023 at 07:48

Scott, Yes, I’m very skeptical of some of the recent work on minimum wages.

Michael, I think you are mixing two issues. NGDP growth may well be appropriate going forward (it’s hard to tell.) My point is that we’ve experienced a huge AD shock in the recent past. That’s why I am looking at past data, to see what’s already happened. NGDP is roughly 8% above a trend consistent with 2% inflation. That’s comparable to 2008-09, but in the other direction.

4. June 2023 at 08:45

Maybe “Is economics a science?” is, as you think, a dumb question. But it is interesting to compare what economists do (or are supposed to do) with the activities of mathematicians, physicists, biologists, psychologists, historians, and journalists. Is the ordering I have given these different callings really appropriate, and if so, why? Is there a break in the order so significant that we should want to say that all and only the fields on *this* side of the break are “scientific”? But yes, a cocktail party is an unpromising place to find a useful discussion.

4. June 2023 at 09:31

Philo, What’s a shoe? Are flip flops shoes? Are ski boots shoes? Are socks shoes? Which things that we put on our feet are shoes?

I don’t care. I know that flip flops are flip flops. Ski boots are ski boots. Socks are socks. Whether these things are also shoes is utterly unimportant. “Shoe” is just a word.

Economics is economics.

People often debate “Is economics a science?” thinking they are debating “Is economics prestigious?”. That’s when you know they are hopelessly confused.

And that’s just the beginning. Most people don’t understand that the dictionary has multiple definitions of “science”. So is the debate about the nature of economics, or the nature of science? I find that most people give little thought to these questions.

And it gets even worse. Some non-economists think “Economics is not a science because economists don’t run their field the way I think it should be run.” Or some economists might think “Economics is a science because we use lots of math”. LOL.

Seriously, there is no more stupid debate. It’s a debate for stupid people. No one else cares.

4. June 2023 at 18:18

Michael Rulle,

I have no idea what your coding background is, but if you’ve never coded before, you can download Anaconda, for example, which features the Jupyter notebook. This is an application that makes getting started with Python coding pretty easy. Then, you can prompt ChatGPT to write some code to develop an application, and just keep iterating with prompts. You can get increasingly sophisticated with your prompts, and eventually, you might automate your prompts as I’ve begun to do.

This really is automating automation, as imperfect and incomplete OpenAI’s products currently are.

By the way, I recommend the paid premium version of ChatGPT, as ChatGPT-4 is worth the money if you’re going to code.

4. June 2023 at 19:52

Scott,

Many Boomers want a recession because they do not own any stocks and they want gold and bonds to go up and stocks down. They are pessimists for some reason. It is sad more than anything, they spend their time watching cable news.

4. June 2023 at 22:10

Scott,

I take your point that, with NGDP being pretty far above its longer-term trend path, that some current inflation could be caused by that fact, even as inflation expectations fall. However, I’d have expected current inflation to fall more quickly than it has if that were the primary cause.

We have the Ukraine war, inefficient new industrial policies being implemented, some residual pandmic supply-side issues, and problems in the banking system… We have some real factors driving up prices.

5. June 2023 at 11:32

Tf, You said:

“It is sad more than anything, they spend their time watching cable news.”

Yeah, I know people like that. I find it depressing.

Michael, Again, the data suggests that it’s almost all demand. We are getting almost exactly the inflation overshoot I’d expect given NGDP growth—why look elsewhere? We need to control NGDP. If there are a few supply issues then there’s nothing the Fed can do about that.

6. June 2023 at 03:09

@msgkings:

I don’t know if you are still reading, but think how miserable Americans would be if official unemployment was near 10%.

Americans do seem unhappy. It may reflect housing costs and low wages. Taxes are higher; see Social Security taxes in 1960 and now. The rat race may be worse than ever.

The two political parties appear at great pains to stoke divisions, and globalists insist even more cheap labor in America is the solution to everything.

Also, while the chattering classes may be unhappy, how about people looking for work at McDonalds or WalMart, Ralphs?

They do not tend top write columns for the NYT or WaPo.

America needs to be a place where people believe they can work their way into the middle class, raise a family. Does anybody believe that on the entire West Coast of the US anymore?

7. June 2023 at 05:23

Why do we care about recessions? Today, we’re at the same spot as in 04/1/2007:

04/1/2007 ,,,,, 5.3

07/1/2007 ,,,,, 4.6

10/1/2007 ,,,,, 4.2

01/1/2008 ,,,,, -0.2

04/1/2008 ,,,,, 4.4

07/1/2008 ,,,,, 0.9

10/1/2008 ,,,,, -7.6

01/1/2009 ,,,,, -4.8

04/1/2009 ,,,,, -1.4

07/1/2009 ,,,,, 1.9

Powell shouldn’t let N-gDp fall below 5%.

7. June 2023 at 11:48

sara – based on your comments over the past few years I would marry you sight unseen. You have a brilliant mind, and I mean that.

8. June 2023 at 11:56

What credit crunch? The o/n rrp award rate is lower than money market rates (rates < 1 year). An increase in t-bills should keep short-term rates higher than the award rate. Thus, funds will come out of the O/N RRP to meet demand.

10. June 2023 at 18:52

Scott,

Yes, David Beckworth’s NGDP gap chart helps illustrate your point. I think I’ll put an NGDP versus 10 year trend graph on my website economic indicator dashboard, so that people don’t forget to look at that.

14. June 2023 at 02:01

If the Hypermind NGDP betting market was still active I would be adjusting my 2023 estimate to a range of 5.3 to 5.9 right now. If compelled to state a single value I would lean towards 5.5. Hopefully, we’ll have good PCE data by the end of summer.

On another topic, if you have a Slow Boring subscription you can read a dry, concise, and carefully worded assessment of Donald Trump by Matt Yglesias.

14. June 2023 at 03:25

David, Yes, 5.5% sounds plausible. (Q2 may be higher)

And yes, the Yglesias piece on Trump is very good, but then almost all his posts are very good.