The wrong lessons

The Economist has an article discussing how recent Japanese history provides some useful lessons for China. There are correct that Japan is a cautionary tale, but unfortunately they draw the wrong lessons:

And Mr Koo is himself keen to emphasize one “huge” difference between the two countries. When Japan was falling into a balance-sheet recession, nobody in the country had a name for the problem or an idea of how to fight it. Today, he says, many Chinese economists are studying his ideas.

His prescription is straightforward. If households and firms will not borrow and spend even at low interest rates, then the government will have to do so instead. Fiscal deficits must offset the financial surpluses of the private sector until their balance-sheets are fully repaired. If Xi Jinping, China’s ruler, gets the right advice, he can fix the problem in 20 minutes, Mr Koo has quipped.

Unfortunately, Chinese officials have so far been slow to react. The country’s budget deficit, broadly defined to include various kinds of local-government borrowing, has tightened this year, worsening the downturn. The central government has room to borrow more, but seems reluctant to do so, preferring to keep its powder dry. This is a mistake. If the government spends late, it will probably have to spend more. It is ironic that China risks slipping into a prolonged recession not because the private sector is intent on cleaning up its finances, but because the central government is unwilling to get its own balance-sheet dirty enough.

In other words, they are calling for China to make the same mistake the US has made in recent years, a reckless and irresponsible increase in fiscal deficits.

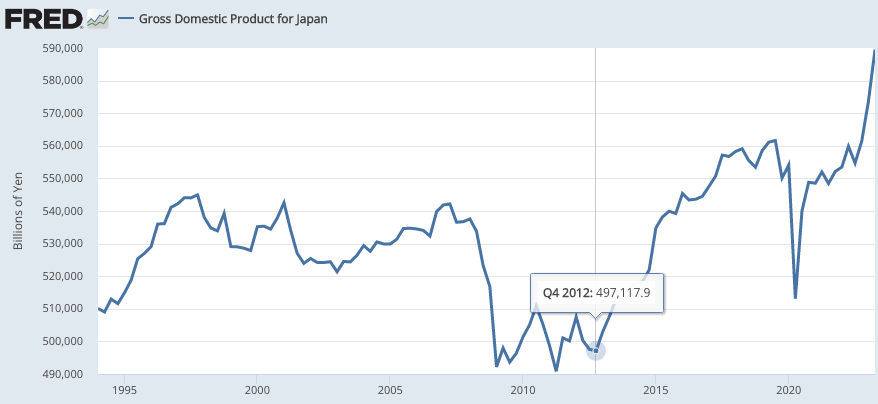

Japan ran huge budget deficits during the period from 1994 to 2012, partly under the influence of Western economists. The policy was a spectacular failure, with Japan seeing perhaps the weakest growth in aggregate demand ever seen over two decades, at least in a developed modern economy. By the end of 2012, Japan’s nominal GDP was actually lower than in early 1994:

When Prime Minister Abe took over at the beginning of 2013, he rejected this failed Keynesian advice, and switched to monetary stimulus. Over the following 21 11 years, Japan’s NGDP has risen by nearly 20%. Even that is too low—Abe should have switched to NGDP level targeting—but it’s a vast improvement over what came before. And fiscal policy actually became more contractionary, with several large increases in the national sales tax. Growth in the national debt slowed sharply.

Japan also has notable supply side problems. A country with such a high level of education and social cohesion should have a per capita GDP close to that of Germany or the Netherlands, not Spain or Italy. Thus monetary policy won’t solve all of Japan’s problems.

Similarly, China has some supply side problems, especially a high degree of investment in wasteful projects such as spectacular bridges in remote Guizhou province (which has 1/2 of the world’s tallest bridges). Those resources need to be redirected into more productive uses, such as high tech investments and consumption.

But if China does slip into a situation where there is a demand shortfall, the solution is not fiscal stimulus. Rather they need a “whatever it takes” approach to using monetary policy to sustain adequate growth in NGDP. Once the aggregate demand problem is fixed, it’s easier to address supply side issues.

PS. There is no such thing as balance-sheet recessions. Bad balance sheets are often the result of a bad monetary policy that sharply slows NGDP growth, leading to financial distress. When there are balance sheet problems, the natural interest rate often declines. If the central bank is targeting interest rates, this will cause an unintentional tightening of monetary policy. What looks like the cause of the recession (bad balance sheets) is more often the symptom. The underlying cause is bad monetary policy that leads to too little growth in NGDP.

Even when the balance sheet problems are unrelated to slowing NGDP growth (as is arguably the case in China), monetary policy still needs to adjust in order to prevent the decline in the natural interest rate from spilling over into a broader decline in aggregate demand.

PPS. In per capita terms, the post-2012 revival of NGDP growth was even more impressive.

Tags:

29. September 2023 at 15:35

Is there a significant difference between the government keeping spending unchanged (or decreasing it by cutting unproductive investment) and reducing taxes to run a deficit, and the central bank increasing the money supply?

29. September 2023 at 15:50

Jonathan, Yes, a big difference. A deficit creates future tax liabilities, which slows economic growth.

29. September 2023 at 16:07

Japan is always a puzzle.

Since the Bank of Japan owns half of the national debt…are taxpayers truly indebted?

The fractional reserve banking system preceded central banking. In Western orthodoxy, expanding the money supply must be done through the regulated, fractional reserve commercial banking system.

Is Michael Woodford right? That QE plus federal deficits is really a form of money-financed fiscal programs?

That is, a method to expand the money supply without working through the clunky central bank and commercial banking system?

29. September 2023 at 16:35

… but doesn’t increasing the money supply lead to an increase in private sector liabilities which will slow their future spending? If the problem is that too much credit has been channeled towards state-owned companies/local government infrastructure/apartments, there seems no guarantee that won’t continue with monetary policy easing (infrastructure and apartments may be out but I bet cheap loans to SOEs and preferred industries explode; the household debt to income ratio is already higher than in the US, etc), and that has already taken the country to the brink of a financial crisis. We don’t normally consider ‘how to get money spent so that it adds most value’ to be part of the policy discussion because it can be taken for granted that it will be, but precisely the problem in China is that that isn’t what has been happening. There are also hopeful signs of some local governments funding deficits by selling off assets to the private sector. Isn’t it plausible that the best way to increase value creation is by private sector tax cuts, and if that doesn’t generate a sufficient increase in future tax revenues to make debt payments as the economy grows then sell off government assets – it’s not like it doesn’t have enough of them

29. September 2023 at 18:32

“Over the following 21 years, Japan’s NGDP has risen by nearly 20%” I think you meant 10 years

29. September 2023 at 22:25

Jonathan, Good monetary policy doesn’t guarantee that the government won’t have wasteful fiscal or credit policies. But that’s no reason not to do good monetary policy. Good monetary policy does not lead to reckless lending.

Tax cuts are fine if you also cut spending, and thus don’t boost the deficit. It’s fiscal stimulus that I oppose.

Garrett, Thanks, I fixed it.

30. September 2023 at 11:06

Scott, Interest Rate Parity generally holds in nominal terms (I think). Should real interest rate parity also hold? If all of the major industrial countries had their own version of TIPS, one would think it should hold. Still, in expectation terms, I would think real interest rate parity should hold regardless of whether there are a variety of TIPS for each country. What’s your opinion?

30. September 2023 at 11:57

As far as I can tell, Switzerland also had zero inflation and had RGDP = NGDP. Why do you think the Swiss economy did much better than the Japanese.

30. September 2023 at 16:56

“Good monetary policy does not lead to reckless lending.”

Yes. And good monetary policy is no monetary policy.

The free market doesn’t need you.

1. October 2023 at 01:25

China is better positioned than Japan was to avoid a prolonged stagnation, but I’m guessing that leadership will go hardcore Andrew Mellon* on policy for a few years. We can expect Xi to make a statement along the lines of: “Western style profligacy will not be tolerated in our New Golden Age. Property speculation has corrupted too many people and they must bear the penalty for their bad behavior.”

*Maybe Mellon didn’t actually say what Hoover said he did, but that spirit lives on.

1. October 2023 at 09:54

Travis, No, I would not expect it to hold in real terms.

Tsergo, Way better supply side policies.

1. October 2023 at 23:26

Scott,

you write: “…Those resources need to be redirected into more productive uses, such as high tech investments and consumption…”

how can consumption be productive?

“..There is no such thing as balance-sheet recessions. Bad balance sheets are often the result of a bad monetary policy that sharply slows NGDP growth, leading to financial distress…”

What if balance sheets are impaired because of bad monetary policy in the past (overstimulus) resulting in overindebtness? In this case you can have a balance sheet recession, even if current MP is fine…

You oppose fiscal stimulus, but advocate for “whatever it takes MP”. How does this work?

2. October 2023 at 09:48

Viennacapitalist,

“how can consumption be productive?”

Producing consumption goods generates utility.

“In this case you can have a balance sheet recession, even if current MP is fine…”

No, production gets reoriented toward other sectors, as in 2007.

“You oppose fiscal stimulus, but advocate for “whatever it takes MP”. How does this work?”

You set a NGDP level target, and buy as many T-bonds as is required to hit the target.

2. October 2023 at 22:44

Scott,

Output generates utility. Producivity is about the relationship beteen output and input. Output doesn’t generate its own output – no there is no productive consumption.

Redirecting production is what causes the pain. Shifting capital to other sectors is not easily possible. That’s how you get a BS recession (flexible markets help).

Buying bonds without fiscal (or private) credit growth, gets recycled into asset prices. No fiscasl or private credit growth, no NGDP growth.

3. October 2023 at 11:18

Viennacapitalist, I disagree with that. Reallocation does not cause recessions. We boomed in 2006-07 as resources were reallocated out of housing construction.

Not sure what point you are making about asset prices. Just have sound monetary policy and let markets determine asset prices. Don’t overthink it.

Not interested in “productivity” word games.

3. October 2023 at 11:26

Scott, if you don’t expect real rates to be the same, then wouldn’t that imply that covered interest rate parity wouldn’t hold either?

3. October 2023 at 23:35

Scott,

there is an (micro) economic definition, of what productivity means, no game played

as for the reallocation argument causing recession, it is a matter of proportion, I would say:

If the reallocation of ressources is large, as can be expected after havin wrong MP for too long, then the capital that has to be shifted beetween sectors is large with overall recession as the result.

NGDP growth = private + public sector growth.

If you have responsible fiscal policies, only private remains. Monetrary policy, under certain circumstances, has limited effect on private credit demand. If you look at the past decade (until covid), private loan growth in the US has been subdued despite low IR and QE…(John Hussman has good charts on that).

4. October 2023 at 10:09

Travis, Interest parity only applies to nominal rates.

Viennacapitast, I strongly doubt that. Where are the reallocation recessions? Has the US ever had one? (Maybe 1946?)

Private credit demand has nothing to do with private sector NGDP growth. You are mixing up unrelated concepts. Monetary policy is not about credit, it’s about NGDP.

4. October 2023 at 17:20

Scott, I should have been more clear. If real rates are different between countries, then doesn’t that imply that *nominal* interest rate parity won’t hold?

4. October 2023 at 22:32

Scott,

I would not say that the recession leading to the GFC was no reallocation recession. Just look at the (dramatic) stock index sector changes that have happened since then. Many a worker in the then booming financial sector found a new home in the now booming IT sector. In the meantime we have seen rising and then falling unemployment – classic reallocation recession (among Fed policy mistakes worsening the situation).

To your second point:

PxY (NGDP)= MxV

V is a function of credit growth and preference shifts (influenced by expected uncertainty). V, of course, is not constant, not even close.

How then, can you say that they are not related?

The most recent QE episode (until Covid) is a good example: Amid exploding M, V has collapsed as net commercial loan growth and mortgage growth have been below average.