The AD surge is 100% monetary policy

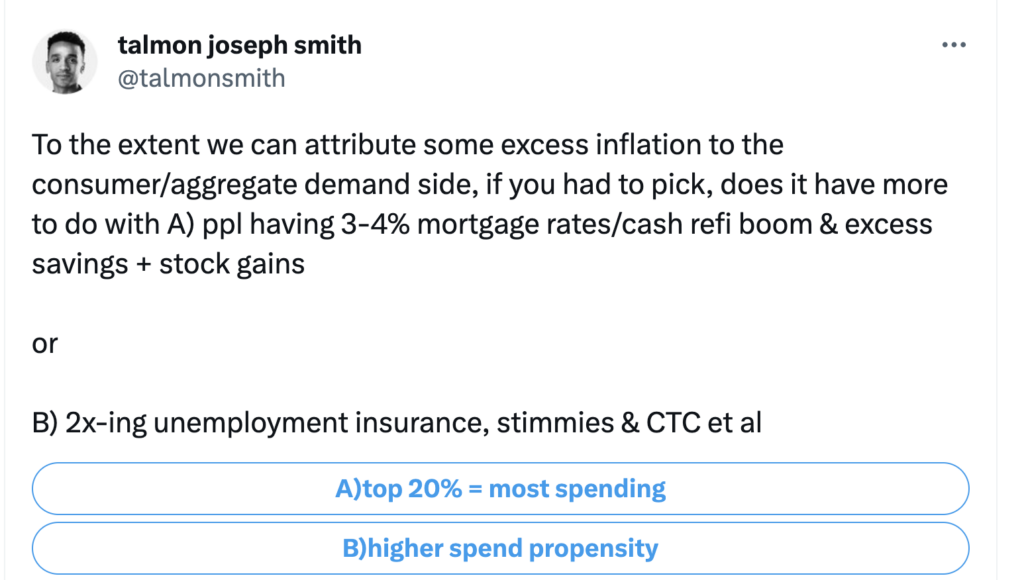

David Beckworth directed me to this tweet:

I’d put a weight of 0% on A and 0% on B. I’d put a 100% weight on monetary policy. In 2021, the Fed should have set their fed funds target at a level that would return NGDP to the pre-recession trend line. In fact, they set rates well below their equilibrium level, and hence NGDP rose about 8% above trend. Thus 100% of the excess demand was caused by the Fed not doing its job.

BTW, I’m not sure what “consumption/aggregate demand” means. Consumption and aggregate demand are very different concepts.

PS. I’m almost ready to take a victory lap on this post from late 2022, where I expressed skepticism about the Fed’s forecast that the unemployment rate would rise to 4.6% by the end of 2023, despite positive RGDP growth of 0.5%. I suggested that conditional on positive GDP growth, the unemployment rate would not rise very much.

Here’s Yahoo:

Fed officials see inflation finishing the year close to 4% now, compared with 3.6% prior. Unemployment is only seen rising to 4.1% from 4.5% previously. Officials now see stronger economic growth this year of 1% verses 0.4% previously.

Tags:

16. June 2023 at 06:48

Both the volume of money and its rate of expenditure are inflation determinates. But Greenspan discontinued the transaction concept of money velocity in September 1996. See:

https://scholarship.richmond.edu/cgi/viewcontent.cgi?article=1205&context=masters-theses

And Mises debunked the FED’s attribution of inflation to the Ukraine war.

https://mises.org/wire/commodity-prices-debunk-blame-ukraine-excuse-inflation

Atlanta’s GDPnow Latest estimate: 1.8 percent — June 15, 2023. The trajectory is parallel to the roc in short-term money flows.

Separating the wheat from the chaff isn’t as difficult as Friedman hypothesized (separating money from near money substitutes). There is no “fool in the shower”.

16. June 2023 at 08:47

Technical debates aside about growth vs level targeting, the appropriateness of fed posture in 2021, etc., isn’t it noteworthy that forward indicators are all basically at target? Even looking back, cpi excluding shelter has been below 2% MoM persistently since last June. There have been 2 quarters of barely positive GDI growth and forward GDP growth appears to be back down to normal.

16. June 2023 at 09:01

Nobel Laureate Dr. Milton Friedman argued that “there is a continuum of assets possessing in various degrees the qualities we attribute to the ideal construct of ‘money’ and hence there is no unique way to draw a line separating ‘money’ from ‘near-moneys’” (1960, p. 90). (or money products from savings’ products)

But George Garvey thinks otherwise: Deposit Velocity and Its Significance (stlouisfed.org)

“Obviously, velocity of total deposits, including time deposits, is considerably lower than that computed for demand deposits alone. The precise difference between the two sets of ratios would depend on the relative share of time deposits in the total as well as on the respective turnover rates of the two types of deposits.”

16. June 2023 at 09:02

The problem is that Jerome Powell thinks banks are intermediaries. That’s why the FED uses interest rates as its monetary transmission mechanism.

Powell: “When times are good in the economy, banks and other lenders tend to have a lot of money to LEND. And in case you didn’t realize, banks are in the business of making money off of loans. So if they can LEND to more people who they believe will pay them back on time, they’ll make more money.

But right now it’s costing banks more to get the funds they need to make loans. Part of that goes back to the Fed’s interest rate hikes. But the other part comes from the recent bank failures. Since many depositors withdrew money from mid-size and regional banks, these banks have less money to lend.”

THE MONEY STOCK IS NOT SYNONYMOUS WITH SAVINGS.

16. June 2023 at 20:53

Kevin, I think NGDP growth is still too high. Let’s see what the second quarter looks like.

17. June 2023 at 05:09

The transaction’s velocity of money seldom falls. It did during the S&L crisis and during the GD. But monetary policy must remain tight today, tomorrow, and for as long as it takes to drive down N-gDp.

The demand for money is dropping at an historic rate. With FedNow (instantaneous payments) starting in July, velocity is likely to stay high.

26. June 2023 at 10:24

Can we now say that ‘inflation expectations’ isn’t what is driving demands for wage increases.

It’s ‘inflation catchup’.

The banners I see from strikers don’t say “We want a 35% rise in order to maintain our income levels in the forthcoming 7% inflation environment we foresee with absolute certainty over the next five years”. They say “We want a 35% rise due to 15 years of below inflation wage increases”.