Should we aim for overshoots?

Matt Yglesias has a new post discussing macroeconomic stimulus. He argues:

1. The recent success in bringing inflation down supports the expectations view of macro (he cites Christina and David Romer) rather than the “hydraulic” view (citing Larry Summers, Jason Furman, and Olivier Blanchard.)

2. The recent success in bringing inflation down supports the view that we should aim for a fast recovery after a recession, not the sort of slow recovery seen after 2008-09.

3. We should err on the side of overshooting the target, as overshoots are much easier to deal with than undershoots.

I’m a long time proponent of the expectations view (and critic of the hydraulic view), and I’m also a long time proponent of aiming for quick recoveries. So I’m generally in sympathy with Yglesias’s views. But I do have a few minor reservations.

While I think there’s a decent chance of getting a soft landing, we are further from that goal than you’d assume from looking at the inflation data, especially headline inflation. I cringe a bit when people talk about how little the unemployment rate has risen despite PCE inflation falling from 7% to 3%, and CPI inflation falling from 9% to 3%. Those aren’t the data points that matter.

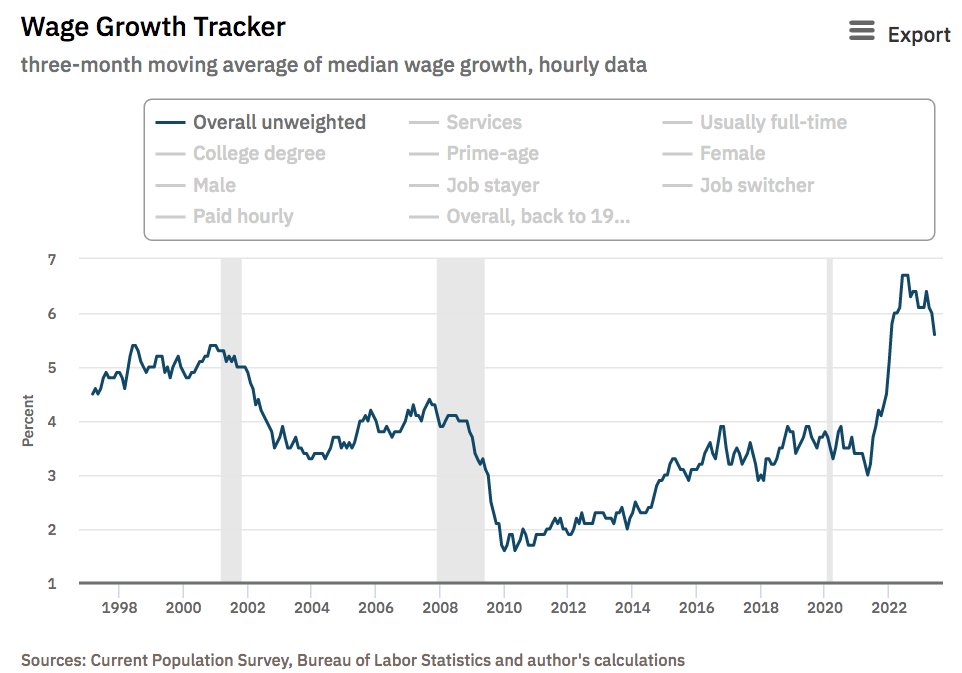

To be fair, Yglesias is aware that some of the gains are due to the fixing of supply issues, and it’s also worth noting that even the inflation rates that do matter (wage and core inflation) are coming down slightly. But we aren’t out of the woods yet. The Atlanta Fed has a wage tracker that tries to adjust for compensation composition effects:

And while NGDP growth slowed nicely in Q2, I notice that the first Atlanta Fed forecasts for Q3 are nearly 4% (implying about 7% for NGDP?) That’s a very early forecast, but in past inflation cycles there have been false dawns, so I’d still like for policy to err a bit on the side of tightness. (BTW, the Atlanta Fed hit Q2’s RGDP (at 2.4%) right on the nose.) Don’t get cute!

I’ve always thought soft landings were technically possible by slowing NGDP growth at a gradual pace. But they are not easy to achieve.

As far as the appropriate policy regime, I’m sticking with NGDPLT, even if the costs of undershoots are bigger than overshoots. I think NGDPLT would prevent big demand side recessions, so the practical difference isn’t that great. And if we are so clumsy that we continue to have big demand side recessions, then there’s no reason to expect Yglesias’s approach to policy wouldn’t also be ineptly implemented. In addition, I worry about “political economy” implications of a growing perception that we should tend to err on the side of dovishness. Might we stumble back into the situation of the 1960s? The 60s were fine—but that hangover . . .

If we are to use fiscal stimulus (something Yglesias favors and I oppose) then the argument for overshoots is even weaker. Fiscal policy is very costly, even if rates are zero. That’s because the debt you accumulate at the ZLB will eventually be rolled over at higher rates.

PS. I’m open to the possibility that the labor market is a bit more flexible than in the second half of the 20th century, which would support Yglesias’s view. It’s too soon to tell.

Tags:

3. August 2023 at 09:47

Looking at the chart you present, perhaps a 3.5% wage inflation level target would be superior to NGDPLT if only for data frequency and accuracy reasons.

3. August 2023 at 10:45

Danny, Yes, 3 1/2% on this wage series—3% on the average hourly earnings series of the BLS

3. August 2023 at 15:30

FYI…unit labor costs up 1.6% annual rate in Q2

3. August 2023 at 16:53

Way too early for Matt to declare victory.

And by the way this strategy has resulted in negative real wage growth for two years rather than just a short recession.

Also yield surge seems ominous.

The lesson is not to make a mistake in the first place, as the Fed did with taking too long to tighten.

3. August 2023 at 18:21

“The lesson is not to make a mistake in the first place, as the Fed did with taking too long to tighten.”

Exactly!

4. August 2023 at 02:46

The RBA said today inflation in Aussie is about 6% and we plan to get it down to just under 3% in a couple years.

So they are holding the RBA cash rate at 4.10% again. Not raising rates.

The RBA has a 2% to 3% inflation band target.

The RBA forecasts no recession for Aussie.

The RBA always seems sensible.

4. August 2023 at 04:22

“Aiming for overshoots”? sounds like “we want books that are just a little bit cooked”.

Seems like there is not enough accounting for how the announcement of a target itself (which has only existed for a decade or so) mucks up these “market expectations” models (including the NGDP futures market idea). I mean, I might place a big bet that the Fed will come back to its target despite what has happened because I “trust them”, just like I might buy a lot of Enron despite rumors starting to swirl because I “believe in their vision” or whatever. There may be legitimate reasons why they were slow to act…despite their data being so amazing. There are perfectly legitimate explanations for document shredding…in some circumstances.

How do you model the fact that credibility is something you lose “first a little, then all at once”? Market projections may not look especially bad in the early innings of a credibility crisis.

4. August 2023 at 07:09

Maybe it wasn´t a “mistake”, but a “bribe” conscientiously paid!

https://marcusnunes.substack.com/p/post-c-19-inflation-the-story-of

5. August 2023 at 11:31

“3. We should err on the side of overshooting the target, as overshoots are much easier to deal with than undershoots. ”

This is baffling to see when you’re talking about expectations!

Isn’t ‘err[ing] on the side of overshooting the target’ going to cause markets to expect the Fed to overshoot, worsening the scale of the overshoot every time (and thus worsening the costs of the correction)?

5. August 2023 at 18:54

MichaelM,

Absolutely. It reminds me of people back in 2021 saying, “Why act against inflation now? Inflation expectations aren’t unanchored yet…”

The past few years have been a farce of forgetting and relearning lessons from the 1970s/early 1980s at a fast rate, but I didn’t realise that the time inconsistency problem had to be relearned.

6. August 2023 at 17:08

A little OT but in the ballpark.

https://blog.rangvid.com/2023/08/06/us-core-inflation-2-percent-or-5-percent/

“If inflation in the US were measured as in the euro area, it would be only 2%.”

—30—

Of course, Sumner advocates targeting NGDP as measured, and not inflation as measured.

Are there similar measurement issues for NGDP?

My guess is that with online information systems, a pretty good estimate of real-time NGDP could be generated. Maybe that is what Atlanta GDPNow and other measurement systems are up to.

I am told that large retailers know sales every day, even by item. The barcode stuff.

GPS systems allow daily knowledge of foot traffic.

House prices are online daily at Zillow and others.

Truck traffic and rail traffic?

Interesting topic.

7. August 2023 at 03:10

I woke up more paranoid than normal this morning, so I’m going to signal a preference for overshoots because I think robust GDP growth will influence more voters in Pennsylvania to vote for Biden. We can have some real tightening, if it’s even necessary, in 2025.

More seriously, I think labor markets are a lot more flexible than they were in the late 20th century. However, this flexibility has been offset by housing cost differentials that have disrupted internal migration patterns.

7. August 2023 at 05:42

In the shorter run, when establishing a target, NGDP level targeting faces the problem other approaches to monetary policy face, which is that of trying to determine a baseline that indicates macro equilibrium. In the longer-run, which is longer than most economists seem to think, it doesn’t matter, of course.

I haven’t seen a convincing defense of the idea that the US economy reached equilibrium between the last two recessions, though I have seen attempts. I’ve even seen reasonable assumptions, but they were assumptions, nonetheless. I haven’t seen any economist claim they can reliably tell when an economy is in macro equilibrium.

I didn’t begin to conclude that monetary policy was too loose in the US until long-run inflation expectations began to rise much above 2%. I thought some temporary “overshoot” was probably a good thing, given that I think the US economy was under potential prior to the pandemic. Of course, there can always be too much of a good thing, but I don’t think the evidence so far refutes my view.

My favorite metrics for determining the stance of monetary policy, which involve stock market information, indicated that policy tightening should have begun in March of 2021, at least for those who want to level target NGDP based on the past 10 years or so of trend NGDP growth. When the S&P 500 began to rise above its long-term trend path, that was the signal. My NGDP level targeting critics would have seemed like geniuses had they used this metric.

If I’m correct, differential changes between S&P 500 earnings and stock price appreciation can be a very useful guide to determining whether the US economy is in macro equilibrium. It can allow for the imputation of NGDP growth expectations, market-based S&P 500 earnings forecasts, etc.

There is noise here and there in stock price data, but not nearly as much as most seem to assume, and the noise is mostly easy to deal with, particularly when price movements are compared to earnings. Factors such as news about changes in investment tax policy can produce one-time level changes to the stock price growth path, with each news item.

Unfortunately, few economists spend much time studying the stock market, hence common misunderstandings about how changes in NGDP growth expecations affect earnings growth expectations, and stock prices. Too many not only associate lower interest rates with looser monetary policy, but also then state that the Fed is pumping up stock prices when multiples rise, even as earnings lag, after a stock crash associated with a slowdown or recession. They seem to look only at recent stock price appreciation and often don’t even notice the lower base from which prices are rising and the fact that stock price appreciation is on a lower path.

7. August 2023 at 12:01

David, I don’t want Trump to win, but it’s a big mistake to have monetary policy try to influence the election.

8. August 2023 at 03:05

Bankers Forced to Study Xi’s Thoughts as Party Tightens Grip—Bloomberg

Firms holding studying sessions, writing papers on Xi Thought

Concerns grow over Chinese economy as confidence takes a hit

—30—

A black swan event? China GDP stagnates? Even goes negative?

What then for Fed tightening regimes?

9. August 2023 at 07:21

“According to Dr. Milton Friedman, the main reason for the non-neutrality of money in the short-run is the variability in the time lag between money and the economy.”

So, there is definitely a “sweet spot” where “overshoots” could potentially be permitted.