Martin Feldstein and Francisco de Goya

During the Great Depression prices fell by about 25%. You might think that a deflation that bad would convince even the most hard-hearted conservative that monetary stimulus was needed. Not so, conservatives were horrified by FDR’s attempt to reflate, even though the price level remained far below 1929 levels for the rest of the 1930s.

But the conservatives were pragmatists. They understood the Depression was a big problem. So instead of monetary stimulus, they supported all sort of other grotesque policies. Statist policies. Protectionism. Much higher marginal tax rates. Forced cartelization of product and labor markets under the NIRA.

If we’ve got a demand problem, why not simply have a bit more demand, and leave the free market system in place? I just don’t get it. What is it about demand deficiencies that makes people become unglued? What makes people see every other problem in the world except a demand shortfall. (BTW, I have no problem with people saying there is a demand shortfall, and other problems too.)

I thought of the Great Depression when I read this essay by Martin Feldstein:

HOMES are the primary form of wealth for most Americans. Since the housing bubble burst in 2006, the wealth of American homeowners has fallen by some $9 trillion, or nearly 40 percent. In the 12 months ending in June, house values fell by more than $1 trillion, or 8 percent. That sharp fall in wealth means less consumer spending, leading to less business production and fewer jobs.

But for political reasons, both the Obama administration and Republican leaders in Congress have resisted the only real solution: permanently reducing the mortgage debt hanging over America. The resistance is understandable. Voters don’t want their tax dollars used to help some homeowners who could afford to pay their mortgages but choose not to because they can default instead, and simply walk away.

Gee, I can’t imagine why someone who lives frugally would be resentful of seeing an affluent neighbor with a good job use his house like an ATM machine, with one re-fi after another to buy boats and fancy vacations, and then dump his mortgage on the taxpayer, even though he could afford to pay it, just because his house was underwater. Why would anyone have a problem with that?

OK, I’m a utilitarian, and am therefore supposed be above emotions like envy. I’m not supposed to divide people into the deserving and undeserving. But I don’t see how this could even be justified on bloodless utilitarian grounds:

To halt the fall in house prices, the government should reduce mortgage principal when it exceeds 110 percent of the home value. About 11 million of the nearly 15 million homes that are “underwater” are in this category. If everyone eligible participated, the one-time cost would be under $350 billion. Here’s how such a policy might work:

If the bank or other mortgage holder agrees, the value of the mortgage would be reduced to 110 percent of the home value, with the government absorbing half of the cost of the reduction and the bank absorbing the other half.

And why would a respected conservative advocate this sort of grotesque interference in the free market—leading to all sorts of future moral hazard, future politicization of the credit markets, etc?

But failure to act means that further declines in home prices will continue, preventing the rise in consumer spending needed for recovery. As costly as it will be to permanently write down mortgages, it will be even costlier to do nothing and run the risk of another recession.

Oh, so we have an AD problem. In that case, WWMS (what would Milton say?) Doesn’t an AD problem call for easier money? But not only is Martin Feldstein not advocating monetary stimulus, he opposes it. So just as in the Great Depression we have conservatives who would apparently abandon the traditional system of private contracts rather than provide some monetary stimulus. Even though they concede we have a demand shortfall that threatens to push us back into recession. I just don’t get it.

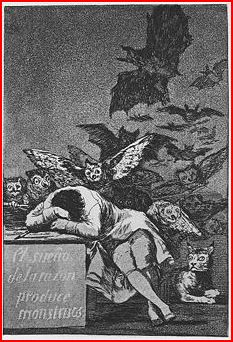

What does all this have to do with Goya? Nothing much, except for some reason his proposal reminded me of this etching:

Alternative post title: Sleeping central bankers produce statist monstrosities.

Tags:

13. October 2011 at 19:31

Fund manager and economist, John Hussman has proposed writing down mortgage principal in exchange for giving banks property appreciation rights, so it’s not quite as bad as tearing contracts up.

13. October 2011 at 20:20

The problem with both the Great Depression and the Great Recession is that the government deliberately sabotaged the market system. Hoover told businesses not to lower wages and the Bush admin. stepped in to prevent a financial liquidation.

If we already have 3.5-4% inflation over the past year, how the bureaucrats in D.C. supposed to boost aggregate demand? We need to stop trying the same old failed stimulus policies. They’re based on bad economics anyway.

Here’s the free market plan for recovery, starting with the DON’Ts

!. Allow liquidation of bankrupt firms and debt (no bailouts)

2. Allow prices to fall (no monetary inflation)

3. Do not prop up employment (no stimulus)

4. Give no assurances against failure (no nationalizations of GSEs or expanding FDIC coverage)

5. Do not subsidize unemployment (no extending of unemployment insurance)

6. Do not discourage “hoarding,” i.e., saving

Here are the positive aspects of a free market recovery plan

1. Deregulate

2. Cut taxes

3. Cut government spending

It really is that simple.

13. October 2011 at 20:32

Unintended consequences. Decreased AD leads to a a less free society.

Understood, more than you know. WWMS.

13. October 2011 at 21:09

There can’t be a shortfall in AD anymore than people have limited wants. By producing something, you’ve then created a product that can be demanded. The question is, can you sell it at a remunerative price? Market prices guide entrepreneurs into producing the things most urgently demanded by the consumers. Interference with the price structure of the market causes production to deviate from consumer demand resulting in malinvestment and unemployment.

If the government would refrain from interfering with the price structure of the market by repealing regulations, special tax breaks, tariffs, subsidies, and especially through monetary inflation, then prices would guide entrepreneurs to employ labor and resources in efficient and sustainable ways. These are the types of measures economists SHOULD be arguing for. What they should not be arguing for is more spending and monetary inflation.

BTW, Austrians define inflation as an increase in the supply of money not backed by specie. That definition applies under a non-gold standard regime as well. How do Austrians define money supply? As the amount of money in the economy available for immediate usage: currency component of M1, total checkable deposits, savings deposits, US government demand deposits and note balances, and demand deposits due to foreign commercial banks and official institutions.

13. October 2011 at 21:16

Not quite on topic but nonetheless: Scott, your take on the EU’s call for large capital requirement increases at banks? US, 1937? I mean, how can this not be contractionary, and have the economy level effect of a weakening, just the opposite of the intended strengthening at firm level?

13. October 2011 at 21:30

John wrote:

“There can’t be a shortfall in AD anymore than people have limited wants.”

And yet there is. Open your eyes. Once you see the horrible destruction and wrath caused by it, how can you turn a blind eye to it ever again.

13. October 2011 at 22:00

I too like Javier Bardem.

http://www.youtube.com/watch?v=Mt5hIffD0yQ&feature=player_embedded

I watch more foreign films than you will ever know, my friend.

13. October 2011 at 22:03

“If we’ve got a demand problem, why not simply have a bit more demand, and leave the free market system in place?”

SAY WHAT YOU MEAN SCOTT…

You put yourself out there for Romney who is preaching trade war with China and a 20′ wall as Mexican sombrero.

And you feel like an idiot.

Not all conservatives are turning into Pat Buchanan, but your conscience requires an A / B choice.

—-

The real conservative play is true fiscal productivity improvements.

You personally WANT those, but you can’t get too radical.

—-

Interesting point: Sumner is a hard core small government conservative… has he ever attacked DeKrugman from that POV.

13. October 2011 at 22:08

Mark,

The idea that economic health is related to total spending is a bad theory. It results from the uncritical application of techniques used in the natural sciences to the social sciences. In order to appear scientific, macroeconomics was created by correlating the two easiest things to measure: GDP and unemployment. It’s a bit like a drunk looking for his keys under a street light.

A better causal theory of unemployment is a mismatch between production and consumer desires brought about by interference in the price structure. The problem is that it is impossible to determine what prices should look like and what items are being overproduced or underproduced. The only way to discover this is by allowing the market system to operate. Furthermore, it is impossible to gather quantitative evidence for this theory. Therefore, it was dismissed for the pseudo-scientific theory of aggregate demand.

I want you to do a thought experiment. Imagine that the capital goods in the United States are suddenly rearranged: tractors are parked in cities, construction tools are parked on farms, factories are disassembled and shipped away, etc. Macroeconomists would look at this situation and see the same capital stock but a lack of production and spending. If they could only look at the statistics, they’d conclude that there was a lack of aggregate demand. In reality, the production structure was completely disarranged.

This story describes the misallocation of resources that occurs during a boom. Capital goods and labor were deployed in ways that didn’t best serve the customer due to the unsustainable rise in the price of tech stocks, houses, or tulip bulbs. These goods and services need to be redeployed through the market process. More than ever, accurate market prices need to work to shift resources around. The state of affairs can’t be resolved by injecting more money or having the government spend more money. These things will only further disarrange the whole system.

If you want to argue for aggregate demand, attack my logic or reasoning. Saying open your eyes doesn’t help make the case. The destruction and wrath your talking about come from the government’s interference with the price system.

13. October 2011 at 22:13

Evidently Scott wrote:

“If we’ve got a demand problem, why not simply have a bit more demand, and leave the free market system in place?”

That sounds like Scott. And the stuff ($#^*! that is) that followed sounds like stuff that “Morgan the organ” wrote.

Anybody got a problem with that?

13. October 2011 at 22:13

Scott,

Another question: If the inflation numbers are bad, why do you trust GDP numbers? Collecting accurate GDP info is just as theoretically impossible as collecting accurate inflation data. For instance, why count what the government spends as output while private industry only counts what they sell as output? If you distrust the numbers of the government, why base your whole economic policy on targeting these numbers?

13. October 2011 at 22:14

Scott, when will you do an entire post attacking DeKrugman on this meme:

“These indignant indolents saddled with their $50,000 student loans and English degrees have decided that their lack of gainful employment is rooted in the malice of the millionaires on whose homes they are now marching “” to the applause of Democrats suffering acute Tea Party envy and now salivating at the energy these big-government anarchists will presumably give their cause.”

http://www.washingtonpost.com/opinions/the-scapegoat-strategy/2011/10/13/gIQArNWViL_story.html

When will you force the bearded lady to stand for misapplied.edu as acceptable fiscal policy?

13. October 2011 at 23:18

Morgan,

What single degree makes one so valuable that they deserve to earn $400,000 a year or more?

13. October 2011 at 23:38

“What single degree makes one so valuable that they deserve to earn $400,000 a year or more?”

What kind of shallow question is this?

Earning is based on market worth, what the market will pay.

Personally, I view people with degrees as less than steller things that you buy – lawyers, doctors, etc. are just propped up with salaries because the government YOU SUPPORT keeps them from dealing with low end competition.

I have a friend with legalzoon and I cheer what they are doing to the legal profession.

I use a HSA and all medical treatment for my family I call around and negotiate / take bids on because listening to doctors haggle is fun. Twice this year I’ve taken a picture of a medical condition and paid a doctor in India $15 to give me his advice…frankly I’m stunned that I cannot go buy anti-biotics over the counter, like I did in India – and use physician assistants rather than doctors, to cut deep into what they charge.

Fortune 1000 CEOs get the pay they get because the government YOU SUPPORT encourages rent seeking. In my world, there’d be 2-3x as much turn over in the “winning” businesses as there are today.

In my world, it’d be very hard to buy anyone green and growing, unless you let them take our your company.

In a non rent seeking world, NO business would ever donate to Democrats. None.

All of these aberrations from truth are on you.

BUT, entrepreneurs, artists, athletes, deserve whatever they make and their earnings – and as far as I know – no degree is required.

Real capitalism is about everyone being able to take whatever their own personal life experiences are and asking themselves, “what unique deeply needed / wanted can I figure out to do for other people?”

And the ones who spend their lives figuring that out, don’t owe anybody shit.

14. October 2011 at 00:27

Morgan,

I sometimes don’t get what you say. Is the bearded lady a reference to Bernanke?

14. October 2011 at 00:59

But Feldstein says he´s not sure what a depression is!

http://thefaintofheart.wordpress.com/2011/10/10/hopelesness/

14. October 2011 at 01:10

very good. We, spaniards, are on the verge of seeing this particular monsters of the right, Now it is wining election in one month.

14. October 2011 at 03:21

Scott: good post. Made my heart sink and blood pressure rise to read it. And remember, Martin Feldstein is (supposed to be) one of the more sensible economists!

John: A correct reading of Say’s Law says that the supply of newly-produced goods *would* create, *if sold*, the *wherewithall* to buy those same newly-produced goods.

In other words, *if* we sell all the goods we produce, then we *can afford* to buy them.

But:

1. That doesn’t mean we *will* buy them, because everybody might decide to hold more money instead.

2. That creates a bad feedback loop. As people aren’t able to actually sell as much, they aren’t able to buy as much.

3. That creates another bad feedback loop, because the fear induced by the recession makes people want to hoard even more money.

Even Say eventually figured this out.

If the stock of existing capital goods were moved around at random, but AD were unchanged, supply of output would fall, there would be excess demand for most output goods. And there excess demand for capital goods would be as common as excess supply. That is not what we observe. It is easy to buy stuff right now, and hard to sell stuff. There’s excess supply nearly everywhere in the US.

14. October 2011 at 03:34

Come to think of it, on re-reading Feldstein, I wonder if he doesn’t understand (the correct version of) Say’s Law? “We can’t afford to buy all the goods we produce, because our houses aren’t worth as much anymore”?

14. October 2011 at 03:46

1. Allow liquidation of bankrupt firms and debt (no bailouts)

Does this include banks? Can’t liquidate too many banks, or you have to liquidate them all. Otherwise, sure.

2. Allow prices to fall (no monetary inflation)

This results in higher unemployment, and given enough time, a depression. Human beings are sticky with their wages independent of any government influence. It’s loss aversion. Support price levels.

3. Do not prop up employment (no stimulus)

Why? Scott’s proposing monetary stimulus, the most free-market and neutral type. It doesn’t adversely affect capital structure.

4. Give no assurances against failure (no nationalizations of GSEs or expanding FDIC coverage)

This results in bank runs, which results in more bank runs. If you want savings to fund long-term investment, a form of deposit insurance makes the system work even better.

5. Do not subsidize unemployment (no extending of unemployment insurance)

This is probably a good idea, but don’t put the cart before the horse. Unemployment insurance didn’t go up, then unemployment jumped. The opposite happened – politicians extended unemployment after the unemployment rate went up.

6. Do not discourage “hoarding,” i.e., saving

We can encourage saving through active deflation – steadily increase the value of the dollar. This would create a depression, but it would encourage saving.

Here are the positive aspects of a free market recovery plan

1. Deregulate

Economies can grow, albeit slower, even in highly regulated environments. They cannot grow in a monetary contraction environment.

2. Cut taxes

Good idea in and of itself, as this means more activity is organized by the private sector. But this is more about the trade-offs between taxing private activity and funding public activities. It doesn’t really do much to create or cure the current poor economy.

3. Cut government spending

Same as the cut taxes point again – better to keep spending low to keep more activity in the private sector. But cutting government spending does not fix recessions.

14. October 2011 at 03:46

Oh, and I was addressing these concerns to John.

14. October 2011 at 04:28

Nick Rowe,

That’s exactly how I had characterized Say’s law if you read my post. I agree that simply producing isn’t enough, you have to be able to sell it at a remunerative price. If people decide to hold money instead of spending it on products, and the producers cannot sell profitably, that’s an example of entrepreneurial error. There’s nothing special in the idea that people want to save money that requires a revision to the idea of Say’s law. People want to save in order to spend or invest later. In any case, you have to produce before you can demand because all exchanges are really exchanges of goods and services against eachother; money acts as an intermediary.

The whole term hoarding is stupid. It just means saving beyond what an academic economist approves of. Saving is the basis for all capital goods that make progress possible and it is something all economists should encourage. People saving more money is no more threatening than any other change in consumer preference.

14. October 2011 at 04:33

Nick Rowe,

I’m not sure what you mean when you say that it’s easy to buy stuff and hard to sell stuff. Selling and buying are two sides of the same coin. I also disagree that it is easy for people to buy stuff. Median wages have fallen since 2008 while the CPI is up since its 2008 peak. It’s actually harder to buy stuff than ever, at least for the typical American.

14. October 2011 at 04:46

Jason Odegard

1. If we had let the bad investment and commercial banks fail back in 2008, it wouldn’t have been the end of the banking and finance system. The companies that had anticipated or stayed away from the housing bubble would have been able to rapidly expand and pick up the pieces. That’s the beauty of the market system, it rewards smart entrepreneurship.

2. Falling prices are essential to recovery. When you have a monetary deflation, money supply shrinks during a credit crunch like late 2008, falling prices bring the smaller stock of money in alignment with the available stock of goods. From a recovery standpoint, the prices of capital goods will fall faster than the price of consumer goods that have a more inelastic demand. This opens up new profit opportunities.

3. Monetary stimulus is hardly free market and neutral. It rewards those closest to the injections of money at the expense of those farther away; Wall Street grows at the expense of Main Street.

4. If you want savings to fund long term investment, a system of market discipline works better. Deposit insurance and a lender of last resort create a huge moral hazard where banks gamble big with tax payer money.

5. We agree

6. Savings are essential to the economy. They are especially important after a boom-bust because they will provide the material wherewithal to launch new business projects.

Deregulation, tax cuts, and spending cuts are more important during a recession because they allow market prices to effectively reorganize capital and labor into consumer driven outputs. It is easier for the economy to do this when more resources are in the private sector and businesses don’t have their hands tied by regulations.

14. October 2011 at 05:03

John: “If people decide to hold money instead of spending it on products, and the producers cannot sell profitably, that’s an example of entrepreneurial error.”

Might it not be an example of central bank error, in not supplying the quantity of money they wish to hold?

An individual can always hold more money by buying less goods, but people in total cannot hold more money unless the central bank increases the supply.

If the central bank fails to increase the supply (or fails to increase it sufficiently) what is the effect of a demand to hold more money? They hold no more money than before, *and*, everyone buys and sells less goods than before.

If the central bank increases the supply of money, to match the increased demand, then instead they could all hold more money and still buy and sell the same amount of goods as before.

“There’s nothing special in the idea that people want to save money that requires a revision to the idea of Say’s law. People want to save in order to spend or invest later. In any case, you have to produce before you can demand because all exchanges are really exchanges of goods and services against eachother; money acts as an intermediary.”

Money is very special. All other goods are bought and sold for money. Money does indeed act as an intermediary, and a very important intermediary.

Take an extreme case. Suppose *all* money suddenly disappeared overnight, and we were reduced to some barter economy. Don’t you think that would have terrible economic consequences? Now suppose that half the money disappeared overnight. Don’t you think that would have bad consequences?

There are many types of saving. But saving in the form of money is special, just because all other goods (both present goods and claims on future goods) are bought and sold for money. If there’s an excess demand for money, that doesn’t just affect the markets for present goods, it affects markets for all other forms of saving as well.

“The whole term hoarding is stupid. It just means saving beyond what an academic economist approves of.”

No it doesn’t. It means “saving in the form of medium of exchange”. At least, that’s what *I* use the term to mean. Just because I think that particular form of saving is special. I don’t care how much people want to save in other forms. The markets can handle that. Those savings get channeled into investment. It’s saving in the form of money that’s a problem, if the central bank doesn’t match the demand for that type of saving.

Think of a university that re-uses envelopes for internal mail. If people hoard those envelopes, and enough new envelopes aren’t printed, it stops other people sending mail.

14. October 2011 at 05:15

John: “I’m not sure what you mean when you say that it’s easy to buy stuff and hard to sell stuff. Selling and buying are two sides of the same coin.”

An unfortunate metaphor in this case. Buying stuff means selling money. Selling stuff means buying money. In a recession, it is easier than normal to sell money (buy stuff), and it is harder than normal to buy money (sell stuff).

Yes, if the price level instantly dropped (the price of money instantly rose) to eliminate any excess demand for money, we would have no problem. But it doesn’t.

14. October 2011 at 05:25

lets set aside the fact that I just dont see a fair way to distribute funds to wipe away negative equity. everyone gets 10%? so a 600k house in montgomery county MD gets 10x as much as a 60k house in pittsburgh PA? everyone gets 10k? If we are giving everyone 10k lets just print money and send checks – THAT will boost AD! let people use it however they want. oh and the negative equity is highly geographically concentrated.

setting that aside, i do not really think wiping away negative equity will prevent home prices from falling in any case. There are a lot of homes already in the foreclosure pipeline.

In my area (not particularly hard hit I might add) there are few foreclosures on the market (appraiser says about the historical average). prices are depressed to 2005 levels 1)because people expected them to be depressed and 2) its hard for people to get loans (still); 3) very little wage growth that makes people confident that they can afford a step-up house.

the two biggest things the govt can do to help housing, IMHO, is to stop tightening the noose around lending restrictions for the GSEs (its ridiculous now what i had to do to refi and *i* never missed a payment on anything in 15 years) and to allow foreclosures onto the rental market. the supply needs to be absorbed. yes, many many of these foreclosures are sitting empty while rental rates are going up and up. yes the CPI is overstated. yes, if we changed this policy we might see that there is some real deflation going on in 40% of the CPI.

… which may light a much-needed fire under the fed.

14. October 2011 at 05:34

Nick, money is time. Price is how we attach value to other people’s time vs. our own.

Ultimately (for me) the perfect currency would “personal currency” backed by a committed representation of your time.

But you bring a bias to the table about niceness.

EVERYTHING sells and clears in good order if the government functions to prod the liquidation in the back.

The government’s job is to referee and keep the game the moving, by quickly ending the weak and those delaying their demise.

—-

Jason,

we actually had a tremendous opportunity in 2008, to shut down all the big banks and funnel all the money to little banks.

The govt. should have just stepped in and told all depositors to name a local bank with FDIC where their funds would be placed.

Then seized the assets of the insolvent, and sold them instantly for pennies.

And warned the bank equity holders who just lost everything that this is how we play the game.

If we’re going to have FDIC, and we are going to have it (unfortunately), it should only be granted to banks that hold their loans for an extended period.

Basically FDIC = less profitable. This formula is required.

Corporatist rent seeking is a FACT. The longer something is around, the more likely the gvt. has lodged its johnson into it and has a vested interest / relationship with it.

This is WHY we must structurally FAVOR (and codify this favor with) the green and growing.

We need to build rules that everyone knows: if you fight with youth, and you will lose, because we favor turn-over.

14. October 2011 at 05:38

“Think of a university that re-uses envelopes for internal mail. If people hoard those envelopes, and enough new envelopes aren’t printed, it stops other people sending mail.”

Again Nick you are too nice.

What really happens is that professors start turning tricks and selling their children for envelopes.

You want to believe people wont do what it takes to tease the money out of the hoarder.

But history has shown people will sell anything for a bag of rice when they are desperate enough.

14. October 2011 at 05:42

Nick Rowe,

It is not easier than normal to buy stuff. The purchasing power of the average American has been battered during the recession. If supply really was so much greater than demand, prices would fall. They’ve had 3 years now to fall to equilibrium levels. Instead, prices have risen which indicates that demand is actually in excess of supply. You couldn’t possibly more wrong about anything than your assertion that it’s easy to buy and hard to sell.

To summarize my argument against that proposition

1. Median incomes are down, the majority of Americans have less purchasing power than 3 years ago. It is hard for people to buy stuff. If it wasn’t hard for people to buy stuff, no one would be complaining.

2. If supply exceeded demand we would’ve seen prices fall. They’ve had 3 years to do so.

3. Prices in general have actually risen since their 2008 peak.

14. October 2011 at 05:50

Morgan: “Nick, money is time. Price is how we attach value to other people’s time vs. our own.”

No it isn’t. The relative price of your labour vs my labour is our relative wage rates.

“Ultimately (for me) the perfect currency would “personal currency” backed by a committed representation of your time.”

Careful there. you are starting to sound like some sort of Marxist who believes in the Labour Theory of Value!

Sure, we could imagine a world where everyone can issue IOU’s payable in their own labour and buy and sell stuff for it. And that world would have some very nice properties. Involuntary unemployment caused by an excess demand for money would be self-eliminated. The unemployed would buy stuff with their IOUs, so the supply of money would expand automatically, and they would get a job when someone redeemed that money for their labour.

But the very reason we use dollars as money is because people who don’t know us don’t trust our IOUs, and don’t know what they are worth. Promises to pay used cars wouldn’t work very well as money either.

14. October 2011 at 05:51

Nick Rowe,

If the demand for money increases and the Central Bank doesn’t add to the money supply, that’s a good thing in the long run. Prices fall to bring the decreased volume of spending into line with the supply of available goods. The second effect is resources and labor shifting into projects with longer time horizons as interest rates will fall to reflect the increased supply of savings. There will be dislocations in the short run as production adapts to the change in consumer preferences.

That’s how the market economy could get it right. Stuff goes wrong when the government and central bank inevitably interject themselves into this process. In order to give the economy the best chance of working correctly, the politicians should follow the points I outlined above. Allowing liquidations and falling prices may seem painful, but it is only painful if you think that stimulus measures work better. Our experience in the Depression and today indicate that they do not.

14. October 2011 at 05:56

Nick again,

Do you really think that the economy is so fragile that it can’t handle people saving in the form of money. Saying that markets are incapable of adjusting to that is like saying that people, in fact the most capable forecasting businessmen, are stupid. Smart businessmen can adjust themselves to changes in the purchasing power of money, whether the purchasing power goes up or down. The fundamental feature of a free market is adaptation because a free market is as adaptable as the people who make it up. Markets that have been interfered with, by regulation, bailouts, or price interference become rigid.

14. October 2011 at 06:05

Nick Rowe,

The comparison between envelopes and money is dumb. Money can divide into smaller units while envelopes can’t.

14. October 2011 at 06:05

John:

1. It would take ages for prices to fall to eliminate any excess demand for money.

2. If prices are falling, people might expect them to continue falling, and demand to hold more money (since it’s increasing in value) which makes the problem worse.

3. Unpredictable changes in the value of money causes arbitrary and unfair re-distributions of wealth between creditors and debtors.

4. That makes borrowing and lending more risky for both sides, and will probably reduce saving and investment.

If people want to both save more, and save in the form of money, then the central bank can increase the supply of money by buying some other asset. This will both increase the supply of money to prevent a recessionary deflation, and it will reduce the rate of interest (by raising the demand for the assets that the central bank buys) and so allow investment to increase at the same time.

If the central bank does nothing, the result is a recession and a decline in investment, which is exactly what we don’t want to happen if people want to consume less and save more.

14. October 2011 at 06:07

John: “The comparison between envelopes and money is dumb. Money can divide into smaller units while envelopes can’t.”

Sure. No metaphor runs on four legs. All metaphors are dumb.

14. October 2011 at 06:30

John: “Do you really think that the economy is so fragile that it can’t handle people saving in the form of money.”

Yes. Look around you. If there were a monopoly on the supply of shopping bags, and that monopoly supplier screwed up, supermarkets would face very big problems.

The cobbler knows a helluva lot about the shoe business. He is not stupid. But that doesn’t mean he knows anything about the rest of the economy. The whole point of having a market economy is that the cobbler can stick to his last, and not *have to* know about anything about the rest of the economy. (I’m channeling Hayek, of course.)

A good monetary system is one where the cobbler can concentrate on the market for shoes, and leather, and remain blissfully ignorant about monetary theory. So the cobbler doesn’t need to know that money demand has increased by 42%, and that he and everyone else in the economy needs to cut all their prices by 42%. All he needs to concentrate on is how to make shoes, and the market for shoes and the market for leather. Which is what he’s good at, and why he survives in the market.

I don’t want a monetary system where the cobblers who survive the market process are the ones who are good at monetary theory, rather than making shoes.

14. October 2011 at 06:36

Nick Rowe,

The points you made about deflation all apply to inflation in reverse.

1. It would take forever for prices to rise quickly enough to meet the increased supply of money

2. If prices are rising, people will expect them to continue rising, causing them to spend more rapidly leading to higher inflation

3. Ditto, you talked about both inflation and deflation

4. Inflation directly punishes capital formation and the extension of loans

There is little evidence that prices can’t fall fast enough to clear the demand for money provided markets are left to operate. More importantly, there is little danger that deflation makes people continually hold money. People need to eat and buy things, there is only so long people can or are willing to put off purchases. The price of computing power has fallen radically but it’s in higher demand now than ever.

About your metaphor, I agree that all metaphors are imperfect, but that metaphor was particularly bad because the ability of money to divide into smaller units is an essential feature of money itself.

14. October 2011 at 06:55

John:

1. Do you have any evidence for this? Sure doesn’t look like it took “forever” for Zimbabwe or the Weimar Republic!

2. Depends on expectations. If the monopoly supplier keeps churning them out like no tomorrow, of course inflationary expectations will become unanchored. As Nick says, the point is keeping the trend steady so businesspeople don’t need to know anything about the larger economy.

3. The key word Nick used is “unpredictable” — if nominal income grows at a predictable rate, the arbitrary effects are much less

4. You can say anything bad about inflation. Everything in the world has something bad associated with it. The question is, what do we get in return for that cost?

I can’t believe you’re arguing money is infinitely indivisible. It takes time for new divisions of money to propagate through a society. I can’t just go around offering half-cents to people for payment until a critical mass of people are willing to accept this denomination. There is a clear lower bound on money’s divisibility; there is however no clear upper bound, which is an argument in favour of inflation rather than deflation, if we have to pick one of the two.

14. October 2011 at 07:01

Excellent post. conservatives and libertarians should be all over the federal reserve, a government created monopoly institution, for doing such a poor job of keeping spending growing steady.

IMO because we have a central bank people the median voter runs monetary policy and the median voter hasn’t got a clue about monetary policy. He fears inflation way too much and the fact that many hold stocks and stocks fell in the 1970s makes things worse.

There seems no way out but keep up the good work Scott. Illegitimi non carborundum.

Perhaps we should try to think of ways to make money on their folly. Hmmm.

14. October 2011 at 07:11

@ John and Morgan Warstler

We we have is a dysfunctional government monopoly monetary system. Right now Government debt and fiat money is out competing free market investments. Without government debt people could not get-bills and without government currency people would see no advantage in hording cash. To save they would have to invest, and investing is spending. That sounds like a contradiction but there are different means of the word save. So the Fed should push people away from cash reserve and government debt.

Now if you want the Fed to continue to a poor job so as to undermine the system – it is not working!

14. October 2011 at 07:17

johnleemk,

The statements your criticizing me for were my attempts to show that Nick Rowe’s arguments about deflation were dumb because they also applied to inflation. You’re really making my point.

14. October 2011 at 07:24

Floccina,

I don’t think there should be a Federal Reserve system. I think that central banks will always do a bad job because it’s impossible for them to know all the relevant information to steer the economy, even on a gold standard.

Nick Rowe,

I don’t think it’s that important for cobblers to be able to predict and handle monetary conditions. That’s the job of bankers. It’s in the rational self interest of people involved in finance to take account of monetary conditions. For instance, if there is inflation or deflation, they could index the loans they make to the cobbler.

I obviously agree that information is dispersed; I’m a big reader of Hayek. The dispersal of information is why a decentralized banking system would be better than the Federal Reserve. They are using a very crude tool, monetary policy, and can’t know all the specific conditions necessary to steer an economy. That information is dispersed among entrepreneurs.

In the same vein, it’s better to foster conditions of stability in regards to money. Attempts to blow up the money supply also set the stage for rapid contractions in that supply. I don’t deny that this type of monetary deflation is painful, but it is necessary to restore sound conditions.

14. October 2011 at 07:25

Floccina, I favor Natural Money:

http://naturalmoney.org/

It makes hording cash near impossible.

14. October 2011 at 07:44

Morgan,

Do you really not believe in lending at interest? Idea that there isn’t enough money to pay back interest is mistaken because it looks at money as a stock concept; if you think in terms of flows, the problem resolves.

14. October 2011 at 07:49

@Morgan

I’m curious why you are constantly preaching for Perry as the man to bring reform. I broadly agree with most of what you are saying, but I don’t see anything special about Mr. Texas #2. Nor do I expect anything but more of the same from Romney. I’ve been a donating Paul supporter since 2007 (though I’ve never taken him very seriously on the monetary front), but I know he has a ridiculously uphill battle to get the nomination. Given the choices in the field I think Cain has the best combination of reform and potential to win. What are your thoughts on him?

14. October 2011 at 07:52

Another perfect post by Scott Sumner.

Why do conservatives and others resist monetary stimulus? Some sort of sickly, unhealthy worship of money. “All inflation is theft” and “If a nation debases its currency, what will it debase next?”

I think the typical gold-nut would rather have AIDS than endure 5 percent inflation. Among the jodhpurs and jackboots crowd, zero inflation is spoken worshipfully of as the goal of economic policy, not growth or prosperity. Sacrifices to make a goal are part of the human make-up. Asceticism.

Left-wingers are also useless, proferring statist solutions and fiscak deficits.

Market Monaterists Unite!!!!

14. October 2011 at 07:59

@John

I too am a reader of Hayek and see the fundamental failings of central planning. I see how this makes the Fed as it exists (and even more profoundly Government spending) inferior to a decentralized, market-based system. But like Friedman & Sumner, I can see how you can fix the failings of the existing system by neutering the Fed’s discretionary power by forcing it to act in a predictable rule-based way. Inflation targeting, Friedman’s mechanism, fails because demand/supply inflation is difficult to disaggregate. Sumner’s system of level targeting avoids this problem. The net effect is not so different from “Sound Money” – there is only limited uncertainty of inflation and the value of money.

14. October 2011 at 08:24

I don’t know if anyone noticed, but I’ve been giving the person posting as “John” a standing ovation throughout this discussion, for saying the obvious things people seem to ignore.

Thank you, John, for reassuring me that my thoughts are not indicative of insanity.

14. October 2011 at 08:30

Scott,

This is a great post. I recall Milton Friedman used to explain that (one of) the costs of inflation is that it forces the shopkeeper to make frequent trips to the bank. Thomas Hoenig recently gave the same explanation for his aversion to inflation: frequent costly trips to the bank for the shopkeeper.

It amazes me how few people talk about the huge societal loss caused by contract abrogation due to systemically falling prices.

14. October 2011 at 08:48

John,

“The statements your criticizing me for were my attempts to show that Nick Rowe’s arguments about deflation were dumb because they also applied to inflation.”

Yes, I know. You haven’t rebutted my point that your attempt to make his statements applicable to inflation is just wrong. You’re insane if you think markets can adjust as fast to a decrease in money supply as they do to an increase. There is no evidence for this belief, yet you insist the two are symmetrical.

14. October 2011 at 08:54

John: “The points you made about deflation all apply to inflation in reverse.”

I basically agree with you here. I don’t want the central bank printing either more or less money than is demanded.

But, as we agree, the economy will eventually adjust to almost any average growth rate in the money supply (Zimbabwean levels aside). The demand for money will eventually adjust to the supply of money through inflation or deflation. What matters more is not making it have to adjust quickly to something the economy is not used to.

For example, the Canadian economy (I’m Canadian) has become used to a monetary policy that produces 2% inflation over the last 20 years. I am very loth to ask the economy to adjust to either a new monetary policy aimed at either a higher or lower inflation rate than that. Either would cause a monetary disequilibrium.

So it’s mostly a symmetric for either increases or decreases in average money growth rates and inflation. But there are a couple of asymmetries:

1. Because of taxes and monopoly power, the level of output and employment is usually lower than it should be. So a faster growth rate of the money supply than the economy is used to can *temporarily* improve things at the macroeconomic level. But it’s not sustainable, of course.

2. If you had too low an inflation rate (too high a deflation rate) the demand for money would be very high, and the central bank would need to buy up and own all the capital in the economy to make the money supply big enough. I don’t want the central bank/government to own everything. Deflation leads to communism.

“I don’t think it’s that important for cobblers to be able to predict and handle monetary conditions.”

I agree that it didn’t *ought* to be important. But unless we have a monetary system where monetary disequilibrium is prevented from happening, it will be important.

14. October 2011 at 08:59

John, I think forcing people to hold only equity wealth is genius.

Its like stem cells to build nirvana.

Ending “safe” returns and forcing everyone desperate to keep their pile to be focused like a laser on what their brothers and sisters want to buy next is where christianity becomes capitalism.

Being able to loan without that sense of desperation rewards the worst in us.

—-

Cthorm,

Love Cain. Love Perry. Love Paul. Love Gingrich. Love Rubio.

My favorite thing about Perry is that he’s fundamentally a state rights guy (so is everybody these days), but after that its his absolute submission to Small Business.

He really does draw a line mentally… I believe he’s not just ask what is good for business, but is it better for small business than big business.

And that’s crucial, its impossible to be a small government guy and not favor small business.

Anyone who doesn’t draw the distinction is suspect.

14. October 2011 at 09:06

Hi, I’m a cobbler, and I have the RIGHT, the inalienable RIGHT to get the same amount of sales I was getting in ’05, and if Bernake doesn’t hand out enough 0% interest loans to make it happen, then we will no longer have a true market economy.

14. October 2011 at 09:35

Silas: don’t be silly. You know I’m not saying that. Or, as the Brits say: “Cobblers!”

14. October 2011 at 11:29

So false demand was created in the housing market through government pressuring lenders to lower standards, creating the housing bubble, and your goal is to bring demand back up to the false, inflated, non-market driven levels that created the problem in the first place?

Maybe the true pain to unwind the rigged market will be equally and oppositely emotional as the joy and exuberance people felt as it went up falsely.

I am no economist. I am just a middle class working guy that pays his mortgage and carries no other debt who doesn’t want to see his tax dollars letting people off the hook who made terrible decisions. Good people made terrible decisions and are paying the price. That’s painful but that is a reality of free markets.

It is also the price to be paid because the federal gov decided to pick winners and losers. Maybe I’m a simpleton but every time the government sticks it’s hand in the cookie jar, I’m the one that gets slapped…….. and the gov still gets the cookies.

14. October 2011 at 11:42

Well, then what exactly do economists want? Vast changes are happening all around us, yet you expect all the standard metrics to look like they did in ’05. Why? Because that’s what an economy is supposed to look like? Some businesses need to fail, some need to grow. Yet we’re all trapped in this fantasy about going back six years, when useless businesses could hide their complete unprofitability.

If you’re “short on capital”, then GTFO. Don’t expect Bernanke to do the Greenspan put. Sorry your business plan was so brittle, we’ll wait for more robust plans to come through.

Bankers were pulling out their hair in ’08 when they had to pay 9% instead of 4% _annual_ on a freakin one-week loan. That’s a price increase measurable in ppm! Get real, if you can’t weather that, you deserve to fail.

Oh crap, I’m starting to sound like Morgan_Warstler.

14. October 2011 at 12:18

Silas Barta wrote: “Vast changes are happening all around us, yet you expect all the standard metrics to look like they did in ’05.”

It seems like the monetary hawks / Austrians are at least as guilty of that as anyone. They all want “normalized” interest rates — as in significantly positive real rates. Guess what, high real rates can only exist in a world where at the margin borrowers see opportunity. In order for that to happen, you need enough NGDP growth that good businesses can grow, and enough stability that good businesses won’t get liquidated during panics. But that doesn’t stop the hawk/Austrian crowd from fantasizing about the “standard metric” of interest rates going back to 2005 levels.

14. October 2011 at 12:29

Nick Rowe,

Ok so we have some common ground here. I’ll agree completely that stability is essential but I disagree that the central bank should step in if people want to hold more money. Deflations in the modern economy result after periods of credit expansion. I think the most important policy consideration is preventing the credit expansion that causes the boom-bust in the first place. What I’m arguing is that it is better for the government and central bank to sit back after the bust happens and do whatever is possible (cutting taxes, spending, and regulation) to allow prices to adjust. Deflation always reverses itself because people always have to spend money (food, clothing, shelter, cars, etc). No money system has failed because of “hyperdeflation.” When the central bank steps in and tries to prop up prices, it prevents the essential adjustment of prices.

14. October 2011 at 12:43

This post is like a feast from which one cannot get up from the table. Nick or Scott, do you believe that unsticking today’s sticky markets could free up Say’s Law once again? Unsticking markets: imagining all kinds of new production for consumers outside the status quo. Sort of like creative destruction used to work before all the zoning and consumer rules and laws were written.

14. October 2011 at 13:53

John, I’ve never seen the term “credit expansion” clearly defined, but I do agree that current central bank policies are de-facto destabilizing. Money was very easy in the 1990s and early 2000s, because supply-side improvements were keeping inflation numbers down and masking the underlying NGDP trend. These earlier developments have now subsided, and the chickens are coming home to roost: current monetary rules imply that we’re going to have a rather painful stagnation (at best) in order to keep the price level on its former path.

The alternative is to target total spending, but if this policy is to be credible we’ll need to restrain money creation during supply-side expansions, even when this lowers overall prices. The trade-off is worthwhile, if only because a recession is quite a bit more damaging than the lack of a money-fueled boom.

14. October 2011 at 13:57

@Benjamin:

“Left-wingers are also useless, proferring statist solutions and fiscak deficits.”

I think you are missing out on an opportunity to dupe the OWS crowd into supporting you. The recent college grads drowning in debt protesting in NYC right now don’t realize how higher infaltion helps them while at the same time hurts their perceived corporate overlords. I would suggest you go to one of the “teach-in” sessions at the protests, talk about how the Fed has been timid in recovery attempts, propose nGDP targeting, suggest Charles Evans for Fed chair in 2014 or at Bernanke’s resignation.

Later, we can sing some Kumbayah and burn our manziers. It will be a hoot!

14. October 2011 at 16:54

I just want to thank Dr. Rowe for taking time to explain these things really well. It’s exchanges like Rowe vs. John that make this blog’s comments as good as the posts.

15. October 2011 at 04:10

John: yes, we have a lot of common ground.

Are the seeds of the recession sown in the preceding boom? Sometimes, very probably. But not always, I think. I can imagine cases where the economy is humming along in equilibrium, then some exogenous shock causes the demand for money to increase. And even if the seeds are sown in the boom, the resulting recession can and sometimes will often be worse than just correcting the excesses of the boom. The high tech crash corrected the excesses of that one sector, without (roughly speaking) causing healthy sectors to go down too. This current crisis looks like a massive over-reaction.

As an aside from our main debate:

“No money system has failed because of “hyperdeflation.” ”

Yes. That to me is an interesting fact, and one I have blogged about in the past. New Keynesian macroeconomics predicts the possibility of hyperdeflationary “black holes”, and yet we have never observed a black hole. Why? I think NK macro is wrong on this, and it’s wrong because it leaves out money. If the price level got low enough, I would buy the whole world economy with the cash in my pocket. But I had better be quick, or you and Scott would buy half each first, but you and Scott would know this, and would jump in ahead of me..etc.

15. October 2011 at 04:22

Lewis: thanks! I too thought it was a good exchange with John.

Becky: Maybe, if someone came up with some marvelous new good, that everyone wanted to buy, it would reduce the demand for money and help the economy escape. Maybe. But I wouldn’t want to rely on this, or sit here waiting for it to happen. If the underlying problem is monetary, then a monetary cure seems appropriate.

Silas: “Well, then what exactly do economists want?”

I want monetary equilibrium. I want the supply of money to stay equal to demand, while all the other changes are happening in the economy, so it lets those other changes happen the way they ought to. How to achieve monetary equilibrium in practice? That’s the harder part. Something like Scott’s expected NGDP level path targeting is probably a reasonable approximation.

15. October 2011 at 06:32

Rajat, Better, but more AD would be better still.

John, No, the Depression was caused by the 50% fall in AD. Bad supply side policies were the CONSEQUENCE of that fall. Just like today. If NGDP doesn’t collapse, if prices were stable, Hoover wouldn’t have done the high wage policy.

John, You said;

“BTW, Austrians define inflation as an increase in the supply of money not backed by specie.”

You do know that the ideas you expose here have nothing to do with Austrian economics, don’t you? The Austrians think the 50% fall in NGDP in the early 1930s was a huge policy mistake.

mbk, I don’t know enough to comment. Is the ECB targeting inflation? If so, it’s probably not deflationary.

Mark, I’d like to see John read some Hayek, like where he admits he was wrong about the Great Depression.

Is the Goya film out yet?

Morgan, You asked?

“Sumner is a hard core small government conservative… has he ever attacked DeKrugman from that POV.”

Yes, and Krugman replied to my attack.

John, You said;

“Collecting accurate GDP info is just as theoretically impossible as collecting accurate inflation data.”

False, Collecting NGDP data from Dell Computer is simply their revenue from selling computers. But the price of computers is much trickier, indeed impossible to know when quality is changing fast.

Marcus, Thanks for the link. Good post.

Luis, What does the right propose?

Thanks Nick.

Jason, Yes, with NGDP targeting you can safely do all those free market reforms.

John, You said;

“Falling prices are essential to recovery.”

Just the opposite. Prices didn’t fall in 1982 and we had a very robust recovery in 1983-84. Prices did fall in 2009, and we had a horrible recovery.

Even if you claimed the 1983 was due to some other factor, it would completely discredit your claim about falling prices being “essential.”

dwb, Good points, but I’d rather see easy money than lax lending standards.

Thanks Flocinna, Steve, and Ben.

Silas, So you also think Austrian economics is wrong? You also think it doesn’t matter if NGDP falls in half? How about 99%, would that matter? Are you sure you want to associate with John?

Nick, Don’t expect Silas to EVER correctly characterize what you are saying. If it happens, look for a blue moon outside the window.

Scott, You said;

“So false demand was created in the housing market through government pressuring lenders to lower standards, creating the housing bubble, and your goal is to bring demand back up to the false, inflated, non-market driven levels that created the problem in the first place?”

That’s certainly not my view–I want houses to settle at their true market value. I also want stable NGDP growth.

Becky, Freeing the market would help somewhat, but you’d still have monetary shocks causing recessions (a la 1921). It’s just that the recoveries would be faster. What’s the best way to get positive market reforms? Easy money, which lowers unemployment and causes the government to reduce maximum UI benefits from 99 weeks to 26 weeks.

anon, I don’t agree. Errors in measuring inflation have no impact on NGDP.

ChacoKevy, If they take their marching orders from Krugman/DeLong/Yglesias they already should know that. Are they really that uneducated?

Lewis, Yes, Nick provides great comments:

“Are the seeds of the recession sown in the preceding boom? Sometimes, very probably. But not always, I think. I can imagine cases where the economy is humming along in equilibrium, then some exogenous shock causes the demand for money to increase.”

I’d go even further, The 1929 Depression was an example of an economy in almost perfect shape, that was devastated by a big fall in NGDP. Even worse, it wasn’t more money demand (at least initially), the monetary base fell by about 7% or 8% between October 1929 and October 1930. Bernanke’s right, the Fed was guilty.

BTW, because Canada lacked banking panics, I think their base fell sharply all the way to 1932 (at least their currency stock did, not sure about the base.)

15. October 2011 at 09:21

Well, you’re right Scott that Feldstein is being goofy here. But rather than go your route, I go my route: No bailouts for homeowners, and no inflation! There is no AD problem, just let prices adjust! Freeeeedom!

15. October 2011 at 11:28

Bob: Wouldn’t it be better if the central bank didn’t create/allow monetary disequilibrium? Presumable you don’t want the central bank to create a monetary disequilibrium. What’s the difference between creating a monetary disequilibrium and allowing one to happen?

Let me ask the same question a different way. Presumably you want the central bank to do nothing. But what does “doing nothing” mean? Hold the stock of base money constant? Hold nominal interest rates constant? Hold inflation constant? Hold NGDP growth constant?

15. October 2011 at 15:03

Scott,

I don’t know why you don’t think I’m expressing Austrian ideas. The quote about inflation came straight out of Rothbard’s “Man, Economy, and State”. What “Austrians” are you reading?

15. October 2011 at 15:04

In fact, I often post quotes on here and they always come from the two most important Austrians, Mises and Hayek. Many of the arguments I present about the Depression and other matters come from Bob Murphy, the best living representative of the Mises-Rothbard tradition.

15. October 2011 at 16:39

Nick,

I agree that an exogenous shock could cause people to hold more money. I also think that it’s hard to find any examples of this causing economic problems, theoretically, I can’t see it as the true cause of difficulty in a free market system. In a market system, the boom can cause real problems by misallocating resources. In the case of an exogenous shock, there hasn’t been this kind of misallocation, hence, I can’t think of any examples of a sudden, exogenous increase in money demand causing econ. problems.

I want to bring to your attention one potential weakness of your theory. If I’m right that you’re in favor of the Fed accomodating money demand, then there’s the problem that money demand is impossible to measure. Just like the purchasing power of money, there are some things in economics that are impossible to measure. This is one of the things that causes mainstream economists to use incorrect tools and reach disastrous conclusions.

The reason’s why there hasn’t been a hyperdeflation seem pretty obvious to me. Governments almost never pursue deflationary policies but almost always pursue inflationary ones. Deflation is immediately painful while inflation is immediately (meaning in the short term) rewarding. Furthermore, as you sort of pointed out, there is a minimum floor on spending (I think we can agree on that) while there is no minimum floor on saving; people can always spend their money as soon as they get their paycheck the way they do during a hyperinflation.

I think that the fear of deflation is responsible for a lot of our economic woes; that’s why I argue so hard about it. It is mostly based on the experience of 1931-3. Before and since then, deflationary episodes came and went. Sometimes they happened during recessions, sometimes not, but the economy never slid into another Great Depression. In fact, there is no good reason that recessions should be deflationary; the reduced supply of goods can actually bid up prices. The last 60 years in the US showed that about half of our recessions were not even disinflationary. Based on what I’ve learned about economics, I believe that deflation is self-reversing and a necessary precondition for recovery following periods of credit expansion.

Thanks for having this discussion with me Dr. Rowe. It’s the best I’ve had yet on this site. I’ll be sure to check out your blog in the future.

15. October 2011 at 18:21

Scott,

You’re wrong about GDP numbers being better than inflation numbers

1. They don’t count unpaid labor or black market spending

2. Government spending rather than output is counted as NGDP. This is obviously wrong. There’s no good way to count government expenditures since the revenue comes from taxes rather than voluntary contributions where individuals evaluate and attach market prices to the government’s output.

Another point I want to make is in response to you saying that falling prices are not essential. I should have been more clear because I was talking about a situation like we had in 2008 or 1929 where an inflationary bubble ended. I should have been more clear in saying that relative prices are what is really essential and the government needs to step out of their way so they can shuffle resources in line with consumer preferences. So long as their is a minimum of interference with market prices, the recession should be sharp but short.

Producer goods fall faster in this scenario since they have more elastic demands than consumer goods, which people need to survive. As the price of capital goods drops more rapidly than consumer goods, profit making opportunities open up.

It is unfair to blame the Great Depression solely on deflation. At least have the courtesy to mention Hoover’s program of propping up wages, the fact that the bank failures didn’t start kicking in until late 1930, the fact that there had been sharper but self-reversing deflations in the past, the passage of the Smoot-Hawley tariff act, Hoover’s public works programs (Hoover damn for instance), his efforts to steer the course of big business such as the Reconstruction Finance Corp, or his massive tax hikes in 1932.

Further, stop blaming the Great Depression on the Gold Standard. It was the first time the Fed didn’t follow the rules of the Gold Standard and protect the dollar to gold ratio. When they finally decided to stop gold outflows, the economy was already dead and jacking up interest rates to prevent this just made matters slightly worse.

16. October 2011 at 06:25

Bob, See Nick’s comment.

John, Based on what I’ve read from the best Austrians, AD shocks do matter, although they may not call them AD shocks. But unless I’m mistaken I believe that Hayek, Garrison, White, Selgin, Horvitz, etc. believe that a big fall in NGDP will unnecessarily raise unemployment, even if the money supply is constant.

BTW, What word do you use to describe a huge rise in the overall price level?

You said;

“Further, stop blaming the Great Depression on the Gold Standard. It was the first time the Fed didn’t follow the rules of the Gold Standard and protect the dollar to gold ratio.”

Not even close to being true. Much of my life’s work has been spent studying gold policies during the 1920s and 1930s.

The big deflation of the early 1930s could have happened without there being a Fed at all.

In any case, if the gold standard only works when the Fed follows certain mythical rules (which were never even followed before the Fed existed–have you ever looked at Treasury policy before the Fed?) then it’s not much of a standard. Why not just have the Fed follow good fiat money rules?

16. October 2011 at 16:41

“monetary stimulus”

Your arguments are continually undermined by your pathological use of language …

If the argument is a monetary disequilibrium argument, why mislead everyone and undermine the logic of your argument with the unhelpful and misleading word “stimulus”?

16. October 2011 at 16:57

Steve, you seem not to know the history.

Do you know the names “Foster” and “Catchings”?

Hoover and many other Big Government Progressives in the GOP — what you call “conservatives” — where huge fans of Foster and Catchings.

Most of these “conservative” policies you sight where aimed at propping up demand and, via propped up demand, profits.

The fashionable High Wage policies of Hoover were straight of of the Foster & Catchings play book for increasing aggregate demand.

Point blank — have you ever heard of Foster and Catchings?

17. October 2011 at 06:38

[…] Sumner, “Martin Feldstein and Francisco de Goya“, The Money Illusion, 13 October […]

17. October 2011 at 06:53

Greg, Others know what I mean by stimulus.

11. December 2011 at 05:36

العاب دورا…

[…]TheMoneyIllusion » Martin Feldstein and Francisco de Goya | My Post News[…]…