In search of tight money

Over the past few years, I’ve searched and searched for that tight money everyone keeps talking about:

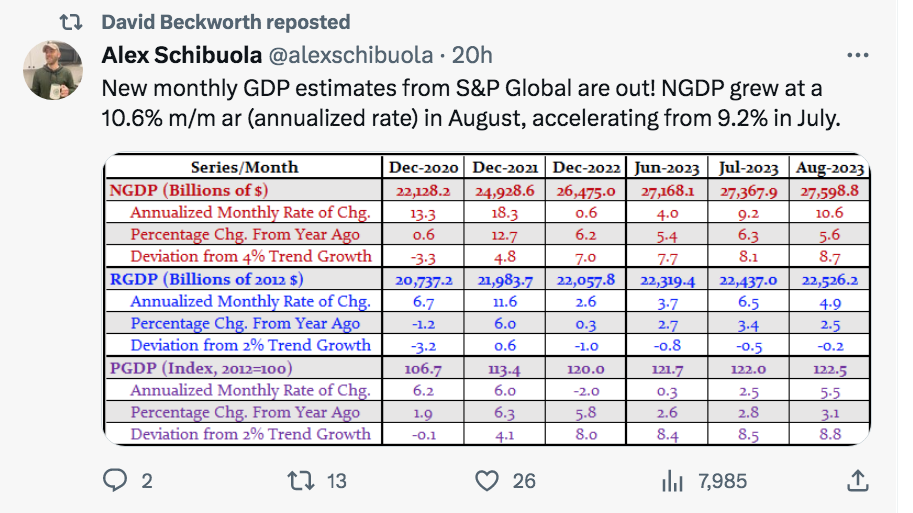

Instead, I keep stumbling across data points like this:

OK, that’s just a forecast. It’s not like the financial markets are worried about NGDP growth.

Oh wait:

And it’s up another 20 basis points today (not shown.)

Tags:

3. October 2023 at 11:00

I don’t disagree with your main point. But can you not quote annualized mom data? YOY is still too high and I have no disagreement there. But some monthly variances can turn into big annualized numbers.

Are these even seasonally adjusted? I could see august being high because it’s vacation season then fall slows down just on people staying home etc.

No disagreement that Ngdp probably needs to be around 4-4.5% and we are still high. Though the YOY data is getting better.

3. October 2023 at 14:10

Scott,

If core PCE is running below 2.5 percent is there a problem? Maybe we do have tight money and high productivity? Is it impossible to have an era of high real growth?

3. October 2023 at 15:46

The Fed probably needs to sit on its balance sheet.

Aruoba Term Structure of Inflation Expectations

A continuous curve of inflation expectations three to 120 months ahead, analogous to a yield curve

29 Sep ’23

From the Philadelphia Fed. (I do not think I can post links here but try the key words in Google search)

Shows expected inflation at 2.4% in two years on the CPI…which is about 2% on the PCE-core.

Fed is probably too tight already.

Not sure a recession would cool inflation much anyway.

OPEC? House prices? Housing rents? Medical costs?

3% inflation is good enough for a while.

3. October 2023 at 16:34

OT question:

In WWII, the US government did not tax heavily enough to finance the war, and so borrowed money.

Should have the US relied only on taxes?

Some people have said taxes were already too high in WWII.

But some people were asked or told to pay for WWII with their lives and limbs, or live through incredible peril and ugliness, and endure lifelong memories.

Surely, higher taxes pales in comparison as a burden.

What gives?

Why borrow money?

3. October 2023 at 16:58

TF, You asked:

“Is it impossible to have an era of high real growth?”

No, just exceedingly unlikely.

Core PCE is 3.9% over the past 12 months.

3. October 2023 at 17:57

If the markets are worried about a period of high NGDP growth why is the s&p selling off and TIPs breakevens headed down not up?

3. October 2023 at 18:57

My preferred metrics also suggest loose money right now, but one should be cautious in how loose one judges money to be at the moment, for the following reasons:

1. Oil prices are up a bit more than 12% over the past couple of months, the rise of which roughly coincides with the current stock market selloff. Oil futures prices indicate that this increase is expected to be entirely reversed within a year.

2. Inflation breakevens are a bit below 2% in core PCE terms, have remained flat over this two month period, and are a even bit down lately.

3. The S&P 500 futures curve is only predicting a mean annual gain of about 3.5% over the next 5 years. These gains are predicted to be pretty steady.

4. We only have projections for NGDP growth for the Q3 so far. Also, the official numbers have been questionable during the pandemic recovery, and have been subject to rather large revisions. And, we shouldn’t put too much weight on a single data point anyway. It could be idiosyncratic.

5. We may in fact be in the early stages of a productivity boom.

GDPNow still has Q3 RGDP projected to be nearly 5%, which would certainly be high in the context of the past generation, even for a one-off quarter. I take this projection and fact seriously enough, that coupled with significantly lower projected S&P 500 earnings yield, using concurrent rather than trailing earnings, to strongly signal that the economy is running somewhat hot, even if inflation is continuing to cool. But, I acknowledge I could be wrong about this.

3. October 2023 at 19:08

Scott,

I wonder if you’ll comment more, or perhaps do a new post soon that explains your seeming deep pessimism about US productivity growth in the foreseeable future. I’m like many who for whom it seems very hard to believe we won’t see a significant rise in productivity growth soon, due largely to AI breakthroughs and the unique way this techology can be quickly and relatively cheaply distributed and deployed. This is not like electrification, which required significant capital upgrades to factories, for example. This technology, when cloud-based at least, has already been deployed by me, for example, to automate all of my “paperwork”. I know this is just an anecdote, but it is one among a great many, and this technology is advancing very rapidly at the moment.

3. October 2023 at 20:34

Scott,

I was referring to the third quarter PCE and growth. Not LTM.

3. October 2023 at 21:08

S and P futures curve is just an arb between interest rates and dividen yield per year

3. October 2023 at 21:23

Sean,

I disagree and more importantly, markets disagree. First, logically that shouldn’t be true, but it’s also contradicted by the yield curve. If you look at the Fed Funds futures market, for example, just take the December 2024 contract as an example. Pair it with the December 2024 S&P 500 futures contract, and the expected dividend yield would have to fall to just a bit over 40 basis points for your statement to be true. Historically, I don’t see such a dividend yield below 1% going back to the 19th century.

3. October 2023 at 22:41

Ten-yr breakeven inflation peaked around May 2022. It dropped pretty quickly from 3.0% at that time to 2.3% by July 2022. After that, it has fluctuated between 2.0% and about 2.6%.

The rise in nominal 10-yr yields has been due to rising real rates, which rose from about 0% in May 2022 to 2.3-2.5% now. So, the problem in the rates markets seems to be real rather than nominal.

Similar story in forward rate markets, e.g., 10-yr forward 20-yr rates (rates between 10 and 30 years from now). Presumably, rates starting 10 yrs from now are relatively insensitive to current macro cycles. Indeed, the corresponding forward breakeven inflation rate has fluctuated steadily between 2.0% and 2.5% even in 2022. The forward real rate has risen steadily from 0% at the start of 2022 to 2.4% at the end of Sep 2023.

What non-cyclical reasons would cause forward real rates to rise so dramatically? Unsustainable govt debt perhaps?

3. October 2023 at 23:13

Alex, The stock market has never liked high inflation. Recall the 1970s.

Michael, Yes, faster growth is possible, but I doubt it. The internet didn’t noticeably affect growth.

TF, OK, but you said “era”, which usually implies more than one quarter.

BC, The real rate is part of the nominal interest rate, and is correlated with real GDP growth.

Yes, the budget deficits are probably one factor. But if money truly were tight, you would not expect nominal yields to be rising so strongly.

4. October 2023 at 03:20

Business people don’t know anything about Nominal GDP targeting, nor do they care.

Bond Yields are climbing simply because people don’t want to give their money to banks and MNC’s with bad books. It’s certainly not because they are monitoring NGDP.

The whole financial system has reached a crossroad; it can accept the mistakes its made, and let the market reset naturally (good for fiscal, not so good for those invested in the market) or the powers that be can continue the ponzi scheme and tax the economy into submission.

Please read “As We Go Marching” by the journalist John Thomas Flynn.

There are parallels of latitude between socialist Italy and Socialist America.

he writes:

“Italian politicians made nonsensical calls for reduced taxation and increased public works, and calls for greater social security and greater prosperity.” (contradiction)

Buying votes through public works, i.e., providing aid to specific communities, and currying favor, became the modus operandi. Those who played by the rules received aid; communities that didn’t, received nothing.”

The probability that America will be fascist is certainly increasing, but not because of Donald John Trump, but because the lefts policies have led us into an unsustainable situation, just as it did in Italy and Germany. Trump or RFK jr are the solution, not the problem. The problem is the establishment octogenerian gangsters that stumble and bumble down consitution avenue.

4. October 2023 at 03:55

Meanwhile,OT:

SINGAPORE, Oct 4 (Reuters) – To own a car in Singapore, a buyer must bid for a certificate that now costs $106,000, equivalent to four Toyota Camry Hybrids in the U.S., as a post-pandemic recovery has driven up the cost of the city-state’s vehicle quota system to all-time highs.

—30—

Somehow, people keep calling Singapore a free-trade, free-market nirvana.

Where all the land is owned by the government, and 80% of the population lives in public housing.

And the right to buy a car costs $106,000.

4. October 2023 at 05:41

Scott, I agree that American nominal GDP seems to be growing a lot. Do you have an idea about why 5-year TIPS spreads still seem so subdued?

They seem to be at around 2.2% according to FRED.

4. October 2023 at 05:44

Scott,

Good point on the era word choice, just optimism on my part.

Great post.

4. October 2023 at 05:45

Solon,

https://en.wikipedia.org/wiki/List_of_countries_by_home_ownership_rate says that Singapore has 87.9% private home ownership rate. (You might be confusing statistics? About 80% of people in Singapore live in housing _built_ by the government, but not owned by the government.)

In the UK, all the land is owned by the crown. Not sure how Singapore is special here?

Not quite sure why you bring up Singapore here? What does it have to do with the rest of the discussion?

4. October 2023 at 05:51

Solon, Singapore is a small place. They practice something like a cap-and-trade system for cars. There are roughly one million cars allowed on the island.

Those one million permits are auctioned off for ten years each. Every month about 1% of permits expire, and replacements get auctioned off to the general public.

The recent prices reached in that auction is what you seem to be quoting.

Cap-and-trade is a widely accepted mechanism for rationing off limited resources. It’s pretty compatible with free markets and free trade.

(If you want to complain about Singapore in that regard, complain about male conscription or about stamp duty on real estate transactions.)

4. October 2023 at 07:18

Honest questions seeking understanding, not trolling:

“But if money truly were tight, you would not expect nominal yields to be rising so strongly.”

Is the quote above related to Friedman’s observation that low rates result from previously tight money? Because of low expected inflation?

But does it necessarily follow that high rates are indicative of loose money? If they were high because of expected inflation, wouldn’t that show up in the TIPS spread?

4. October 2023 at 09:21

Michael no clue what you are talking about.

That’s literally just textbook intro to futures contract pricing. I hope you never touch a futures contract. Out years are not market predictions. There just the sum of the product going into the contract adjusted for costs of financing

4. October 2023 at 09:52

Matthias, I suppose markets believe the Fed will eventually adopt a tight money policy, which seems plausible. But they certainly did not do so in 2022. So my claims made last year have proven accurate. Money was far too easy.

Todd, It’s certainly possible for tight money and fast rising rates to co-exist, just rather unusual. The best argument against my position is that it is fiscal recklessness that is driving rates up, not NGDP growth.

4. October 2023 at 10:40

@ssumner:

“The best argument against my position is that it is fiscal recklessness that is driving rates up, not NGDP growth.”

This concerns me greatly…is the bill finally coming due on the debt? Rising real yields would fit that pretty snugly.

4. October 2023 at 12:21

Why is it not showing up in the inflation numbers:

https://x.com/jasonfurman/status/1707819272255254564?s=20

4. October 2023 at 16:40

Carl, Hard to say. Inflation figures tend to be a bit volatile. I focus more on wages, NGDP, etc.

4. October 2023 at 16:59

Sean,

Stock Index Future Price = index spot price [1+ rf(d/365) – div yield], right?

How does your oversimplication represent this relationship, which itself is a simplification? Are you talking fair value, or actual market price? And what factors determine the interest rates and dividend yields, in the context of changing spot prices?

4. October 2023 at 19:10

Would be interested in hearing your rebuttal to this view

https://www.linkedin.com/posts/camharvey_inflation-recession-yieldcurve-activity-7111062513546338304-3FDP?utm_source=share&utm_medium=member_android

5. October 2023 at 06:02

Seems as if the increase in real rates is due to increased probability of default, no?

https://www.chicagofed.org/publications/working-papers/2023/2023-17#:~:text=We%20infer%20the%20likelihood%20of,it%20was%20in%20October%202013.

Inflation expectations have nudged up a bit, but nowhere near the impact of real rate increase.

https://fred.stlouisfed.org/graph/?g=PfTR#0

5. October 2023 at 07:39

Will, I agree on housing costs. It’s nominal wages that have me concerned.

sd0000, I don’t really know enough to comment on that.

5. October 2023 at 08:08

From a recent Brookings article:

“First—given the unusual economic conditions since the beginning of the pandemic, it is way too soon to know whether these higher real rates will persist. Second, even if they do persist, it matters why rates have increased. If rates have increased because productivity growth has increased—for example, in response to AI—then such an increase will also be neutral for the fiscal outlook, as shown in the equation in the box. If real rates have increased for other reasons—increasing worries about the fiscal trajectory, or the Fitch Ratings downgrade of the U.S. debt, for example, then it is possible that we will look back on this recent rise in rates as a turning point.”

Stock markets have been sideways all year – so I doubt (real) rates are increasing because productivity growth has increased.

So the increase in real rates probably is due to borrowers demanding greater return because they perceive greater risk.

Again – ties to the Chicago Fed working paper suggesting default probabilities have skyrocketed over the past year:

https://www.chicagofed.org/publications/working-papers/2023/2023-17#:~:text=We%20infer%20the%20likelihood%20of,it%20was%20in%20October%202013

If you look at markets, I’m not sure if there’s any other conclusion.

Stock markets: sideways

Default probability: up significantly

Real rates: up significantly

5-year inflation estimates: slightly elevated, but not significantly out of whack with historicals

The only way out of it is some sort of deficit reduction, either from higher economic growth, higher taxes or decreased spending.

5. October 2023 at 10:07

It’s possible that markets expect the Fed to raise rates to counter inflation from higher oil prices, and that we’re having a productivity boom and a negative nominal shock at the same time. However, the Fed supposedly focuses on core PCE, which normally shouldn’t be impacted so much by oil price hikes.

5. October 2023 at 10:39

Actually, I think I was wrong. Doing a back of the envelope calculation, the 12% rise in oil prices should lead to a roughly 0.48% rise in core PCE inflation, ceteris paribus. If the Fed is expected to offset this, it should result in the roughly 7% decline in the S&P 500 since oil prices started moving up. The increase in the 10 year Treasury is roughly proportional to the rates needed to offset the effects of the oil price increase on core PCE, assuming near perfect Fed credibility.

The most plausible explanation for the high real GDP and high real interest rate figures, from this perspective, is an increase in productivity growth, coupled with a negative nominal shock.

Someone correct me if I’m wrong on the impact of the oil price rise on core PCE inflation.

5. October 2023 at 13:49

You equation looks correct but probably need to multiply dividend yield * (d/365) too.

The rate is a repo rate likely fairly close to fed funds and the dividend yield is the expected dividends divided by current market price.

I’m seeing Dec Es price at 4288. January ES price at 4337.

The interest rate should be a little over 5. The dividend rate I am quickly finding is 1.54% which feels lower than I thought.

5-1.5 = 3.5. 3.5/4 = .87% per quarter. .87 * 4288 is about 38 bps. Actual spread is 49 bps. I might be missing something on my estimates but looks like it’s shaped correctly and close to correct.

5. October 2023 at 13:53

@sd0000

Thank you, this is what I referred to above…not many are discussing the rates rising due to out of control deficits in a peacetime, non-recessionary economy.

5. October 2023 at 14:01

Sean,

Yes, empirically periods of high NGDP growth are also periods of large rate-dividend spreads, and the current spreads are modest in terms of associated NGDP growth. They are not consistent with particularly high expected NGDP growth.

5. October 2023 at 15:11

The spreads have no relation to ngdp. It’s a market interest rate largely set by the fed.

You can have high ngdp growth (like 2021) and 0% short term rates. Back then monthly ES spreads was front month above next contract.

5. October 2023 at 15:57

Sean,

You have to go deeper into the analysis than just that equation. Your claim is similar to the one that says that low real interest rates cause higher stock prices. It simply isn’t true, despite what the Gordon Growth model says.

Yes, the Fed sets interest rates, but not in a vacuum.

5. October 2023 at 17:16

When people say “but TIPs are only pricing 2.x% inflation for 5-30 years” (low inflation) and at the same time people say “ain’t much chance of getting productivity” (low real growth), then everybody scratches their head b/c two low numbers (low inflation and low growth) don’t add up to high rates.

In other words, using the projected inflation and projected real growth to deconstruct the rise in long rates doesn’t “add up”.

That’s when you start seeing biz news headlines reminding everyone of that thing called “term premium” 🙂

6. October 2023 at 03:30

I had a more detailed comment with some back-of-envelope calculations that seemingly supported the hypothesis that oil prices were raising inflation enough to spur expectations of the Fed raising rates, but given the sharp decline in oil prices this week, it seems that idea has been blown up. Treasury yields certainly haven’t declined proportionally. That comment was held for moderation.

6. October 2023 at 07:26

The blowout jobs report today would seem to support the notion that the economy is running hot, even if inflation continues to moderate. NGDP growth may simply be too high right now.

That said, jobs numbers, like GDP numbers, have been less reliable during the pandemic recovery and subject to large revisions.

6. October 2023 at 09:54

10/6/23 Lawrence Summers: “The so-called neutral level for the Fed’s benchmark rate, where it neither stokes nor slows growth, is now being revised higher, he said.”

Interest rates, as the monetary transmission mechanism, is a moving target.

6. October 2023 at 10:21

https://files.stlouisfed.org/files/htdocs/publications/review/2023/06/02/fiscal-dominance-and-the-return-of-zero-interest-bank-reserve-requirements.pdf

“Taxing banks with reserve requirements and zero-interest reserves is convenient for two reasons.”

Banks aren’t intermediaries.

6. October 2023 at 13:27

sd0000, Why would the federal government default, when they could more easily inflate away the debt?

Sean, You need to look at both the level and the growth rate of NGDP. In 2021, we were coming out of a deep slump.

6. October 2023 at 15:01

It seems to me like the Fed has lost control. As you often mention, interest rates don’t tell you the stance of monetary policy.

It seems like they can’t get ngdp down to target

7. October 2023 at 07:32

re: “It seems to me like the Fed has lost control.”

The FED thinks banks lend deposits. But it’s nonbanks, MMMFs, that lend deposits. MMMFs deposits are double counted (just like MSBs deposits were from 1913 to 1980).

Monetary savings flowing through the MMMFs increase the supply of loan funds (activates bank-held savings), but not the supply of money (a velocity relationship).

Large CDs are excluded from the tabulations in the money supply, but large CDs is money that is created by the banks. There is just a shift in deposit classifications in the system (loans = deposits).

As Dr. Philip George says:

“The velocity of money is a function of interest rates” and

“Changes in velocity have nothing to do with the speed at which money moves from hand to hand but are entirely the result of movements between demand deposits and other kinds of deposits.”

The increase in the transaction’s velocity of funds was driven by the above reasons and the shift in the composition of the money stock, the increase in transaction deposits relative to gated deposits (the fluctuation in the demand for money).

Atlanta gdpnow’s 4.9% latest estimate is no happenstance.

7. October 2023 at 17:41

Financial markets are concerned about left-wing thugs like Scott Sumner, canceling their business licenses over their political views, and under the pretex of inflating asset values as if it wasn’t common.

That’s why the CME group is preparing to ditch Chicago.

And the sooner the better, because when the democrats rack up the credit card and can’t foot the bill, they begin to raid the coffers of job creators.

Always remember that the four biggest losers of the last one hundred years: Mussolini, Mao, Stalin, Hitler, were all self described socialists or communists. Mussolini was a syndicalist for years.

Go back another 100 years before those four bums and you’ve got slave owners who were democrats; jim crow was orchestrated by democrats. WW1 entered into by a democrat. First income tax on Americans, supported by Democrats. WW2 entered into by another democrat. Most of the 60’s, and vietnam were democrats.

Socialism is a mental disease that has caused more deaths than any other disease known to man.