How not to think about monetary policy

This Bloomberg piece caught my eye:

Faced with only limited signs of a slowdown in US demand despite more than five percentage points of interest-rate hikes, logic would say the Federal Reserve needs to do more.

But policymakers and Fed watchers are now giving more attention to a new line of argument, that central banks need to take account of what their actions mean for the supply side of the economy. The implication: Too-high rates could actually undermine the inflation fight, by squelching the benefits of increasing supply — which are just now coming on stream.

It’s true that bad monetary policy can affect the level of investment. But this is not a useful way of thinking about monetary policy. The primary cost of tight money is high unemployment. The fact that investment might also be impacted doesn’t really change the bigger picture.

The question is not whether tight money can be harmful; the question is what sort of regime makes overly tight money less likely to occur? What’s the appropriate policy rule?

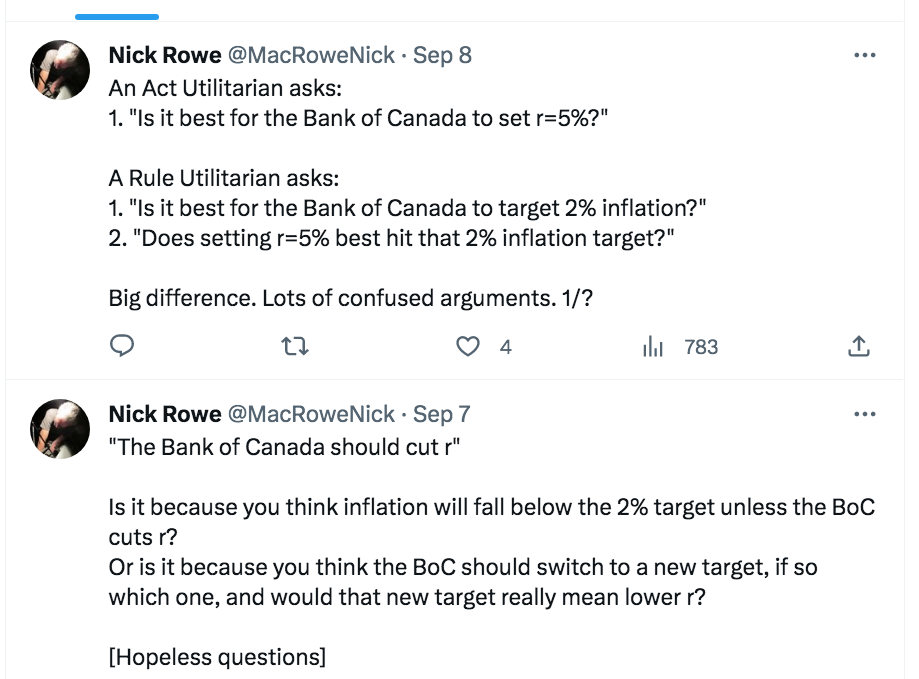

Here’s Nick Rowe:

Take a look at the Bloomberg headline and two subheads:

Fed’s Policy Paradox: Too-Slow Growth Threatens Inflation Fight

- Too-high rates can hurt supply, lift price pressures: paper

- Theory in past focused on throttling demand to stem inflation

Yes, tight money can reduce supply. But the effect on demand is an order of magnitude larger.

Tags:

17. September 2023 at 18:23

Well, yes, Rowe and Sumner are right.

On the other hand, large swaths of Canadians are now experiencing substantial declines in living standards due to the restricted supply of housing (coupled with large scale immigration. High taxes too,

Canadians are facing the West Coast-i-fication, or perhaps the Hong Kong-i-fication of housing markets, which leads to lower living standards, straitened circumstances, glum outlooks.

Some economists are devoted to monetary policy, and there is nothing wrong with that.

And, control over housing density usually is a local issue, making it “unsexy” in some regards. Olympian national solutions are unlikely (federal bounties for un-zoning are one possible solution).

Still, we have a situation in which America’s and Canada’s best economists are pontificating about fiscal and monetary policies, and the glories of globalization, while living standards go downhill Hong Kong- or Los Angeles-style in much of the US and Canada.

18. September 2023 at 06:17

The correct approach to stagflation is to drain reserves (restrict money growth), while cutting interest rates. The 1966 Interest Rate Adjustment Act is the antecedent and precedent. Interest is the price of credit. And lending by the nonbanks (back then the thrifts) is noninflationary (results in the turnover of existing money).

Non-inflationary savings should be activated by driving the banks out of the savings business. That’s what capping Reg. Q ceilings did. I.e., the NBFIs, nonbanks, are not in competition with the DFIs, banks.

Waller, Williams, and Logan seem to agree. They “believe the Fed can keep unloading bonds even when officials cut interest rates at some future date.”

“The Federal Reserve Board shall from time-to-time limit by regulation the rate of interest which may be paid by member banks on time deposits, and may prescribe different rates for such payment on time and savings deposits having different maturities or subject to different conditions respecting withdrawal or repayment or subject to different conditions by reason of different locations.” – Section 11(b) of the Banking Act of 1933

19. September 2023 at 07:14

Why isn’t the correct approach to stagflation to do nothing at all?

Was stagflation ever an issue before 1913? When it occurred, if at all, did it cripple the United State economy?

Did it occur to you that monetary economists are charlatans masquerading as stewards of a healthy economy.

There is no such thing as a lender of last resort. What that term really means is that the citizens of this country must lower their standard of living (through deevaluation of currency) whenever the Fed decides its necessary to increase the money supply.

That’s not capitalism.

J.P. Morgan actually had to keep good books. He was revered, because he was prudent and cautious, and conservative when investing. That’s how a bank ought to be operated. It wasn’t his fault that other banks couldn’t keep their books right.

If you end the Fed it will also make extremely difficult for the United States to engage in endless wars.

19. September 2023 at 08:06

Scott, you say, “Yes, tight money can reduce supply. But the effect on demand is an order of magnitude larger.” What unit is this “effect”? NGDP? What model do you have in mind?

Pondering your statement, I built the following mental model. Due to sticky wages and excessive demand, people work more hours (or more people are employed) and increase NGDP by 0.5% more than NGDP would be under appropriate demand. And at the same time, NGDP is 5% more than the target due to excessive demand. Is that how you get the order of magnitude larger?

20. September 2023 at 07:10

I think the FED’s accounting is wrong. It’s virtually impossible for the Central Bank or the DFIs to engage in any type of activity involving non-bank customers without an alteration in the money stock.

Most of the uptake in the O/N RRP facility is from the nonbanks. And O/N RRPs have fallen by $872.155b since 4/28/23.

That, and any increase in the supply of loan funds originating from the transfer of bank-held savings through the MMMFs increases the transaction’s velocity of funds, but not the supply of money. MMMFs have increased by $580.1b since 1/1/22 (most of their growth stems from 11/1/22).

And the shifting of bank deposits into large time deposits, $596.0185 since 10/1/22, offsets the decline in m2, as large CDs are part of the money stock.

I.e., Powell is just letting the economy burn itself out.

20. September 2023 at 08:48

Travis, I was thinking that the tight money would shift AD to the left by an order of magnitude more than it shifted AS to the left. So the net effect would be lower prices.

21. September 2023 at 06:48

Wouldn’t this effect be dwarfed by the effect that unpredictably loose monetary policy has on killing the supply of non-renewable goods? If I am sensitized to the possibility of tremendous QE and very negative real interest rates for a prolonged period of time, then I am going to demand a dramatically higher price before parting once and for all with, say, oil I have in the ground. Right?

21. September 2023 at 08:18

Jeff, Loose monetary policy will shift AD to the right and SRAS to the left (as you say.) Both factors will drive up prices.

But there’s little effect on long run AS, so I call that a demand shock.

21. September 2023 at 13:43

If you want housing prices to fall, then you drain reserves. That’s how Greenspan caused “Black Monday”.

22. September 2023 at 05:14

Powell: “But we cannot identify with certainty the neutral rate of interest, and thus there is always uncertainty about the precise level of monetary policy restraint.”

https://www.federalreserve.gov/newsevents/speech/powell20230825a.htm

That’s why you target N-gDp.

23. September 2023 at 08:20

re: “But we are attentive to signs that the economy may not be cooling as expected.”

https://www.federalreserve.gov/newsevents/speech/powell20230825a.htm

Contrary to the FED’s spurious accounting, the draining of O/N RRPs increases the money supply. Retail MMMFs shouldn’t be included in the measure of the money stock in the first place. The Austrian economists get this right. So, the FED and Steve Hanke call it a liability swap.

That’s subterfuge. Case in point, the O/N RRP facility. Aug, 9 WSJ:

“In their Aug 6. letter in response to our op-ed “How the Fed Is Hedging Its Inflation Bet” (Aug. 2), John Greenwood and Steve Hanke argue that the Fed’s sale of a trillion dollars of reverse repos does not in and of itself reduce the deposit liabilities of banks and money-market mutual funds, and that the money supply is unaffected. By that logic, none of the monetary tools of the Federal Reserve Bank would affect the money supply.”

24. September 2023 at 04:48

The FED’s accounting is wrong. Just like Mutual Savings Bank deposits were included in the money stock from 1913 to 1980.

See: Toward a More Meaningful Statistical Concept of the Money Supply

Leland J. Pritchard

The Journal of Finance

Vol. 9, No. 1 (Mar., 1954), pp. 41-48 (8 pages)

The banksters and the FED make the rules and “science” up as they go along.

25. September 2023 at 02:10

Should the Fed plan for a “back swan” collapse of the Sino economy?

—-

Some finance execs in China are spending nearly a third of their working time studying ‘Xi Thought,’ report says

Polly Thompson Sep 17, 2023, 8:30 PM GMT+7

Insider

“The CCP is seeking to ensure ideological loyalty in the face of economic headwinds.

Employees of foreign firms are apparently being pulled into the ‘study sessions’ as well.

Employees of the global finance firm BlackRock, together with other bankers and business leaders in China, are said to be spending up to a third of their working time engaging in materials related to “Xi Jinping Thought,” per Bloomberg.”

—30—

China seems to chug ahead, with 5% GDP growth this year.

But will a re-Mao-fication of China suffocate the economy?