Does Japan need tighter money?

Once again, we are hearing calls for a more contractionary monetary policy in Japan. Here is a FT headline:

“Bank of Japan must respond to increasingly sticky inflation

Accommodative monetary policy stance no longer makes sense“

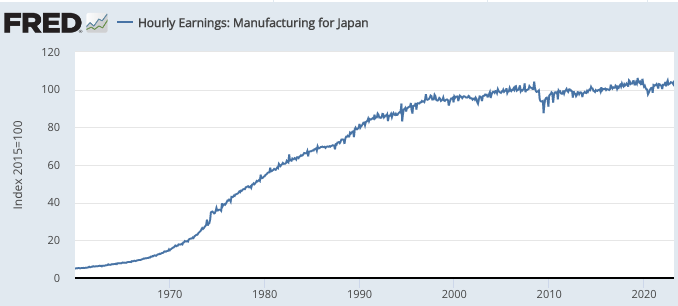

But when I look at nominal wages in Japan, I have trouble seeing any evidence of persistent inflation. (Inflation not associated with wage increases is transitory.)

I am open to arguments that I’ve missed something. Thoughts?

Tags:

1. August 2023 at 23:48

Everyday I am puzzled by media reports (even better financial pubs) which routinely describe BoJ as “ultra-easy.” And have decades, btw.

So Japan fleetingly got to 4% inflation in early 2023, and now around 3%. Usual C19 problems, supply-chain snags. BoJ says next year back to under 2%.

As pointed out by SS, Japan wages are lagging behind inflation.

Housing costs are flat, even nominally.

BoJ’s “ultra-easy” policies resulted in years and years of mild inflation or deflation.

Interesting to ponder that the BoJ owns half the national debt of Japan. So…is it truly debt?

Can you owe money to yourself?

2. August 2023 at 06:42

I don’t think you’re missing anything here, although I can anticipate the people who will say “But what about energy prices?!” or something similar. There’s also the critique that relatively stagnant demographics translate directly into stagnation of GDP and a zero inflation rate condition–which is wrong as well. Something went wrong with policy–both monetary and fiscal–in the mid 90’s. I attribute it to an overreaction to some minor investment bubbles during that period.

I wonder if China will have a similar looking graph a few decades from now.

2. August 2023 at 07:57

David, It’s very possible that China will have the same problem. East Asian central bankers seem to have a hawkish bias.

2. August 2023 at 09:22

Yeah inflation seems low and their idea of capping 10 year yield via Yield Curve Control cements in low growth (despite BOJ thinking it will increase NGDP)

I realize this is far from an ideal policy (and i’m not advocating for it) but as a thought experiment: if Japan really wanted higher NGDP growth they could say something like “we will continue to buy 10 year bonds until yields *rise* to 3%”

3. August 2023 at 02:37

Jim B–

The other way around. The BoJ would have to say they plan on heavy selling of bonds until yields struck 3%.

I think the BoJ is doing roughly the right thing.

The Japan taxpayer is not getting over-leveraged.

An interesting question is whether what the BoJ is doing is essentially money-financed fiscal policy.

3. August 2023 at 05:19

Japan’s nominal GDP growth (% Q/Q sea. adjusted annualized)

Q4 2022 4.7%

Q1 2023 8.3%

Q2 2023 to be released on 15 August, but likely 8.0% since booming auto exports and solid service sector will generate RGDP around 4% and CPI + terms of trade boost to operating surplus will generate GDP deflator around 4%

vs.

Pre-pandemic Abenomics average (Q1/13 ~ Q4/19): 1.5% Q/Q SAAR

Labour cash earnings

May 2023 2.9% Y/Y

12 month average (Jun 22 ~ May 23) 1.8% Y/Y

vs.

Pre-pandemic Abenomics average (Jan 13 ~ Dec 19): 0.22% Y/Y

BOJ surveyed inflation outlook for households and businesses close to their historical highs

Agree with you that they can push a bit harder just to be sure, but it does seem that the underlying inflation is higher. But maybe NGDP and wage growth will prove fleeting.

3. August 2023 at 07:57

Solon-

I realize what i’m saying was unorthodox, but thats my point. Buying bonds long term should increase NGDP over time which increases nominal yields.

Selling bonds, would tend to lower NGDP growth and put downward pressure on yields.

IF buying bonds always pushed yields down then why don’t we just have the Fed buy all govt bonds and we’ll stop collecting taxes. Would yields really continue downwards forever in such a case?

3. August 2023 at 07:58

Solon-

I realize what i’m saying was unorthodox, but thats my point. Buying bonds long term should increase NGDP over time which increases nominal yields.

Selling bonds, would tend to lower NGDP growth and put downward pressure on yields.

IF buying bonds always pushed yields down then why don’t we just have the Fed buy all govt bonds and we’ll stop collecting taxes. Would yields really continue downwards forever in such a case?

3. August 2023 at 08:06

Jim, You don’t want to target interest rates, as that leaves prices indeterminate. A less bad approach would be pegging the yen to the dollar, which would equalize inflation with America in the very long run.

HL, Those are interesting data points, but I’m still a bit skeptical about how durable all this is. I hope I’m wrong.

3. August 2023 at 09:09

Scott, Yup certainly agree that we dont want to target interest rates and thats why i prefaced everything with “this is just a thought experiment”. I’m fully on board with NGDP level targeting

That said, I still stand by fact that YCC is actually putting downward pressure on Japan NGPD growth and not many seem to appreciate that. For example, if YCC target was -3% on the 10 year JGB, surely that would result in pretty low Japan NGDP growth, no? And of course, if buying bonds also reduces yields, i still don’t understand why we collect taxes at all. Thats kinda my main point, which I got from you Scott, that bond buying tends to increase yield